Report Overview

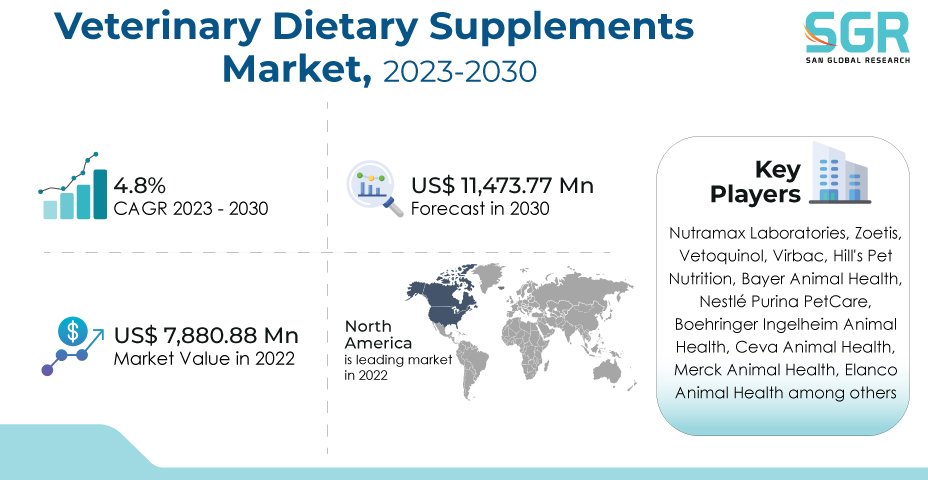

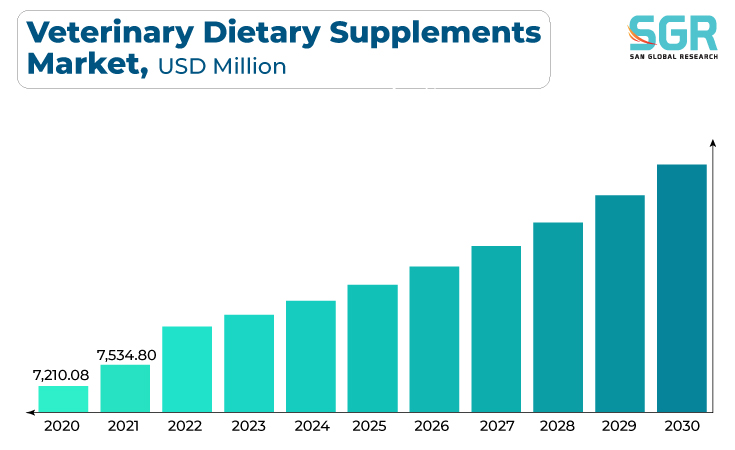

The Veterinary Dietary Supplements market was valued at 7,880.88 million in 2022 and expected to grow at CAGR of 4.8% over forecast period.

The rising trend of pet ownership globally, coupled with the growing perception of pets as family members, has led to increased spending on pet healthcare, including dietary supplements. The "humanization" of pets, where owners seek to provide the best possible care and nutrition for their animals, has driven the demand for high-quality and specialized dietary supplements for pets.

There is a growing awareness among pet owners about preventive healthcare for pets. Dietary supplements are often seen as a proactive approach to maintaining the health and well-being of pets, preventing potential health issues. Moreover, Pet owners are becoming more conscious of the nutritional needs of their animals. The emphasis on providing balanced and nutritious diets, supplemented with specific nutrients, has driven the demand for veterinary dietary supplements.

Veterinarians play a crucial role in influencing pet owners' choices. The growing awareness among veterinarians about the benefits of dietary supplements has resulted in increased recommendations, boosting market growth.

Animal Type Outlook

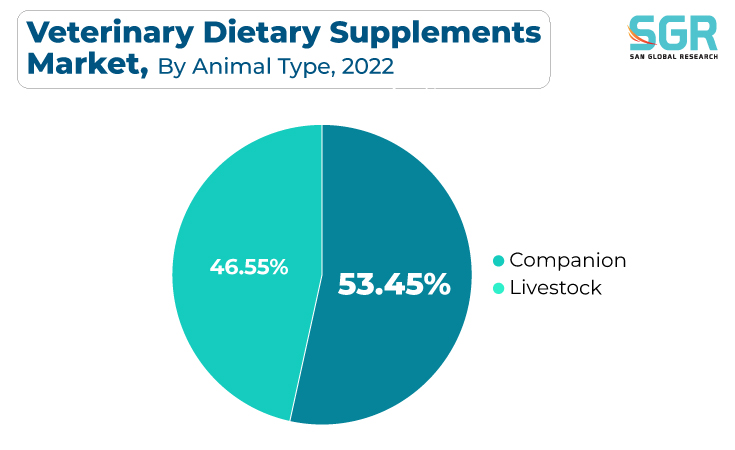

Based on animal type, the Veterinary Dietary Supplements market is segmented into companion and Livestock. Companion segment accounted for largest share in 2022. The surge in pet ownership worldwide, particularly of dogs and cats, is a primary driver of the veterinary dietary supplements market. More households consider pets as family members, leading to increased spending on their health and wellness.

Pet owners are more aware of the significance of maintaining their pets' health. This awareness has led to a proactive approach, with pet owners incorporating dietary supplements into their pets' daily routines to address specific health needs. Thus, they are adopting preventive healthcare practices, using dietary supplements as a proactive measure to ensure their pets lead healthy lives. This has led to an increased demand for supplements that address specific nutritional deficiencies.

The evolving dynamics of the Veterinary Dietary Supplements Market are intricately linked to the evolving role of companion animals in households. These trends are expected to continue shaping the market's growth in the coming years.

Regional Outlook

North America has emerged as leading market for Veterinary Dietary Supplements market in 2022. North America exhibits a high rate of pet ownership, with a significant number of households having companion animals. This elevated pet ownership contributes directly to the demand for veterinary dietary supplements. There is a notable cultural shift in North America towards considering pets as family members. This has led to increased spending on pet care, including healthcare products such as dietary supplements.

Furthermore, the trend of humanizing pets, where owners treat pets as family members, is prominent in North America. Pet owners are inclined to invest in high-quality products, including dietary supplements, to ensure the well-being of their animals.

Pet owners in North America increasingly adopt preventive healthcare measures for their animals. Dietary supplements are seen as a proactive approach to maintaining pet health, preventing potential issues, and enhancing overall well-being. The region has well-established distribution channels, including veterinary clinics, pet specialty stores, and e-commerce platforms. This facilitates easy accessibility for pet owners to purchase veterinary dietary supplements.

Veterinary Dietary Supplements Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 7,880.88 Million |

| Forecast in 2030 | USD 11,473.77 Million |

| CAGR | CAGR of 4.8% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Animal Type, By Specialty Type |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled |

Nutramax Laboratories, Zoetis, Vetoquinol, Virbac, Hill's Pet Nutrition, Bayer Animal Health, Nestlé Purina PetCare, Boehringer Ingelheim Animal Health, Ceva Animal Health, Merck Animal Health, Elanco Animal Health among others |

Veterinary Dietary Supplements Market, Report Segmentation

Veterinary Dietary Supplements Market, By Animal Type

- Companion

- Livestock

Veterinary Dietary Supplements Market, By Specialty Type

- Urinary Tract Diseases

- Diabetes

- Digestive Sensitivity

- Oral Care

- Renal

- Other Specialty Types

Veterinary Dietary Supplements Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355