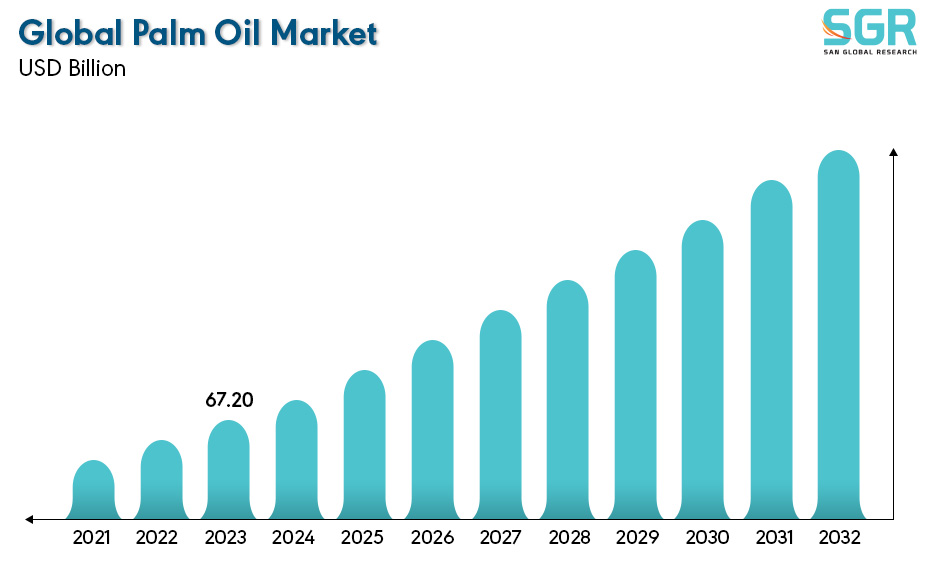

Palm Oil Market is estimated to be worth USD 63.58 Billion in 2022 and is projected to grow at a CAGR of 5.70% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it By Nature, By Product, By End-User and By Region/Country.

The palm oil market is a significant global commodity market centered around the production, trade, and consumption of palm oil, a versatile vegetable oil derived from the fruit of oil palm trees, primarily the African oil palm (Elaeis guineensis) and to a lesser extent the American oil palm (Elaeis oleifera). Palm oil is widely used in various industries, including food processing, cosmetics, pharmaceuticals, and biofuels, due to its unique properties such as high oxidative stability and versatility in different applications. The largest producers of palm oil are Indonesia and Malaysia, which together account for the majority of global palm oil production. Other countries in Southeast Asia, Africa, and Latin America also contribute to the production, albeit to a lesser extent. Palm oil is one of the most widely consumed vegetable oils globally, primarily due to its cost-effectiveness and versatility. It is used in a wide range of products, including cooking oil, processed foods, baked goods, margarine, chocolate, ice cream, and personal care products.

.jpg)

Region wise Comparison:

Palm oil is widely used in the food industry for various purposes, including cooking oil, margarine, baked goods, processed foods, snacks, and confectionery. The growing population and changing dietary habits in North America have led to increased consumption of processed and convenience foods, where palm oil is often an ingredient.

Palm oil and its derivatives are commonly found in cosmetics, personal care products, and toiletries in Europe due to their emollient properties. As consumers become more conscious of the ingredients in their skincare and beauty products, the demand for sustainably sourced palm oil or alternatives has increased.

Palm oil is extensively used in industrial applications across various sectors in the Asia-Pacific region. These include the production of soaps, detergents, cosmetics, personal care products, pharmaceuticals, candles, lubricants, and oleochemicals. The region's expanding industrial base and manufacturing activities contribute to the demand for palm oil in these sectors.

Palm oil is used in various industrial applications in Latin American countries, including the production of soaps, detergents, cosmetics, and biofuels. There is increasing awareness of the environmental and social impacts of palm oil production in Latin America, leading to calls for sustainable sourcing practices and certification schemes.

Most countries in the Middle East region heavily rely on palm oil imports to meet their domestic demand. This demand is primarily driven by the widespread use of palm oil in cooking oil, margarine, and processed foods.

.jpg)

Segmentation:

The Palm Oil Market is segmented by Nature, by product, by End-User and by region/country.

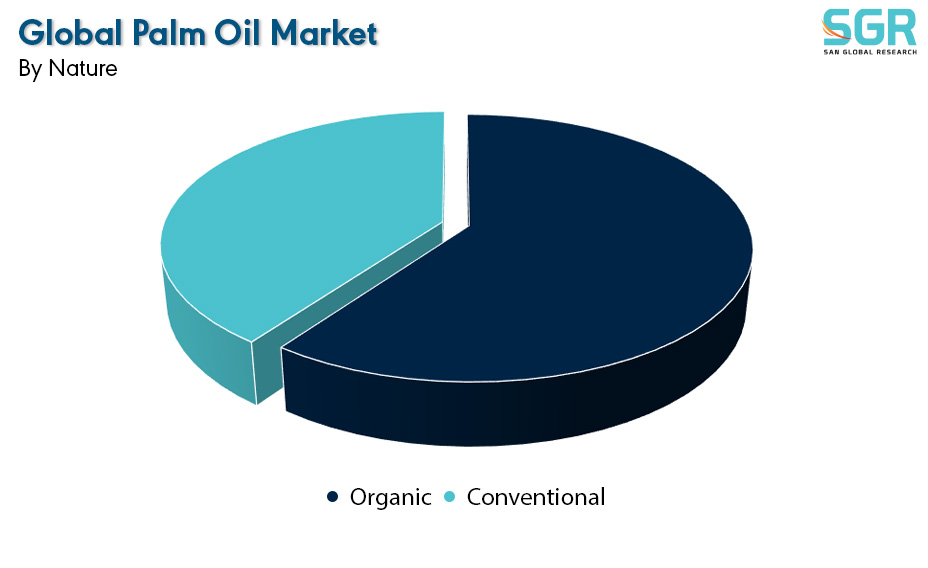

By Nature:

Based on by Nature, the Palm Oil Market is bifurcated into Organic and Conventional – where Organic is dominating and ahead in terms of share.

"Organic" refers to palm oil that is produced using organic farming methods. This means that the palm oil is derived from oil palm trees that are grown without the use of synthetic pesticides, herbicides, fertilizers, or genetically modified organisms (GMOs). Organic palm oil production typically emphasizes environmental sustainability and biodiversity conservation, as well as the well-being of workers and local communities. Organic certification for palm oil usually involves stringent standards set by certification bodies such as the USDA Organic, European Union Organic (EU Organic), or other international organic certification organizations. These standards ensure that the production process follows specific guidelines for organic agriculture, including soil management, pest control, and the prohibition of certain synthetic inputs.

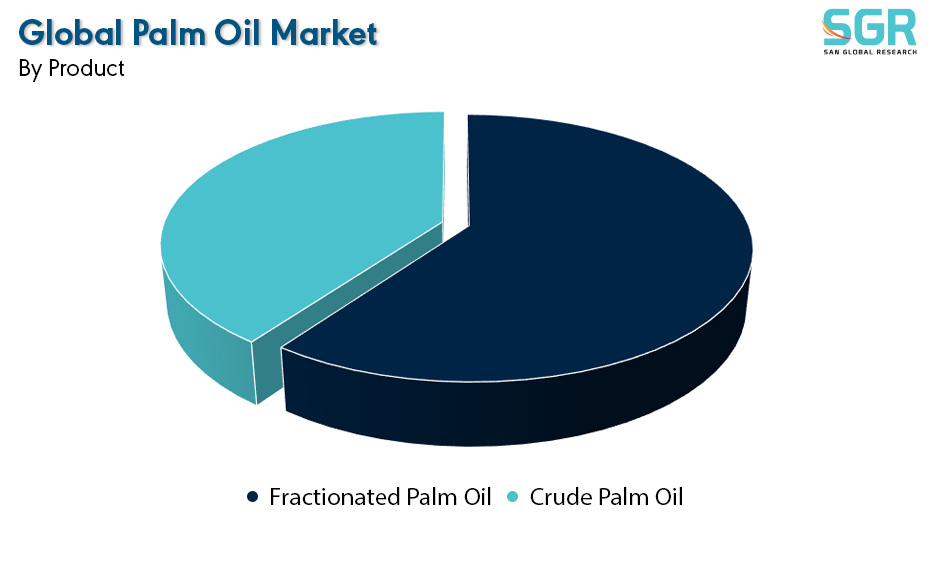

By Product:

Based on by Product, the Palm Oil Market is bifurcated into Fractionated Palm Oil and Crude Palm Oil – where Fractionated Palm Oil is dominating and ahead in terms of share.

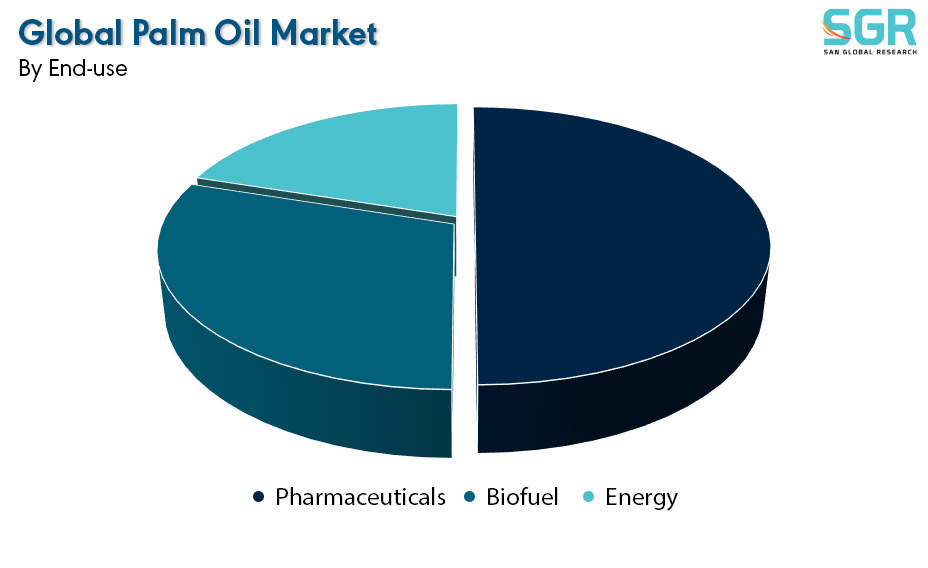

By End-use:

Based on by End-User, the Palm Oil Market is bifurcated into Pharmaceuticals, Biofuel & Energy – where Pharmaceuticals is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the Palm Oil Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Palm Oil Market include

• ADM

• Wilmar International Ltd.

• Sime Darby Plantation Berhad

• IOI Corporation Berhad

• Kuala Lumpur Kepong Berhad

• United Plantations Berhad

• Kulim (Malaysia) Berhad

• IJM Corporation Berhad

• PT Sampoerna Agro, Tbk

• Univanich Palm Oil Public Company Ltd.

• PT. Bakrie Sumatera Plantations tbk

• Asian Agri

Drivers:

Versatility among palm oil

Versatility in palm oil refers to its wide range of applications across various industries, including food, cosmetics, pharmaceuticals, and biofuels. This versatility is due to the unique chemical composition and physical properties of palm oil, which make it suitable for diverse uses. Palm oil is widely used in the food industry due to its neutral flavor, high oxidative stability, and solid consistency at room temperature. It serves as a cooking oil, frying oil, and ingredient in various food products such as margarine, shortening, baked goods, confectionery, snacks, and processed foods. Palm oil and its derivatives are common ingredients in cosmetics, skincare products, soaps, shampoos, lotions, and other personal care items. Its emollient properties help to moisturize and soften the skin, while its stability ensures product longevity. Palm oil derivatives such as palm kernel oil and palm oil fatty acids are also used in the manufacture of cosmetics and toiletries. Palm oil is utilized in pharmaceutical formulations as an excipient, solvent, or carrier oil for active ingredients. Its stability, biocompatibility, and lack of allergenic properties make it suitable for use in various pharmaceutical applications, including capsules, tablets, creams, and ointments.

Opportunity:

Value Addition through Downstream Processing

Value addition through downstream processing in the palm oil market involves refining crude palm oil (CPO) and its derivatives to produce higher-value products. This process adds value to the raw palm oil by creating a range of refined, specialty, and customized products tailored to specific end-uses. Downstream processing of palm oil involves the conversion of palm oil and its fractions into oleochemicals, which are used in the manufacture of a wide range of products. Oleochemicals derived from palm oil include fatty acids, fatty alcohols, glycerol, esters, and surfactants. These oleochemicals serve as raw materials for the production of soaps, detergents, personal care products, lubricants, plastics, and biodiesel, among other industrial applications. Downstream processing enables the production of specialty palm oil products tailored to specific market requirements and consumer preferences. Specialty fats and oils with customized functionalities, such as high stability, low trans-fat content, or specific melting profiles, are developed through advanced processing techniques. These specialty products cater to niche markets and command premium prices, enhancing the overall value proposition of palm oil.

| Report Attribute | Details |

| Market Value in 2022 | 63.58 Billion |

| Forecast in 2032 | 110.71 Billion |

| CAGR | CAGR of 5.70% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Nature, By Product, By End-User |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • ADM • Wilmar International Ltd. • Sime Darby Plantation Berhad • IOI Corporation Berhad • Kuala Lumpur Kepong Berhad • United Plantations Berhad • Kulim (Malaysia) Berhad • IJM Corporation Berhad • PT Sampoerna Agro, Tbk • Univanich Palm Oil Public Company Ltd. • PT. Bakrie Sumatera Plantations tbk • Asian Agri |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355