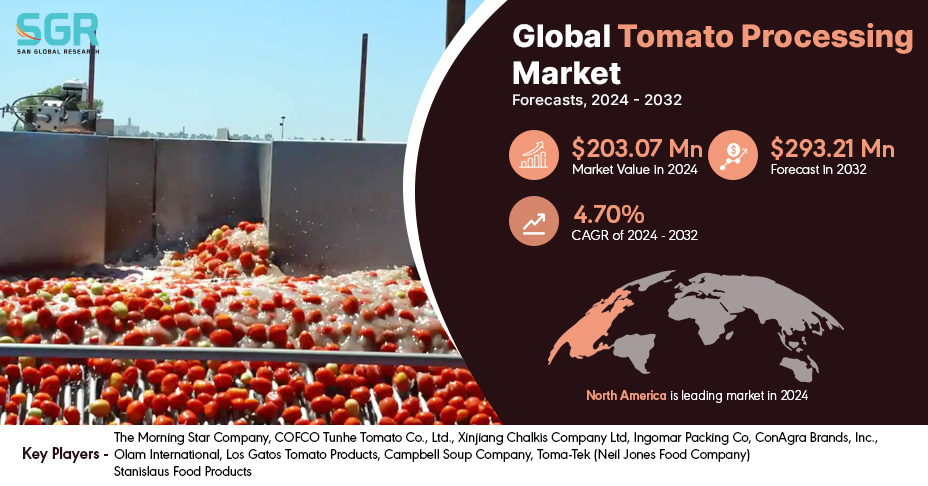

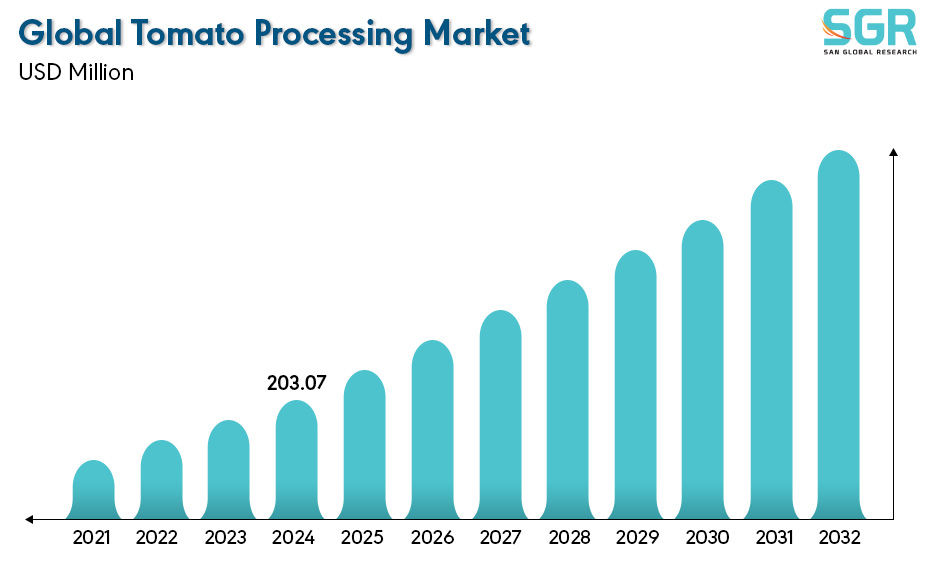

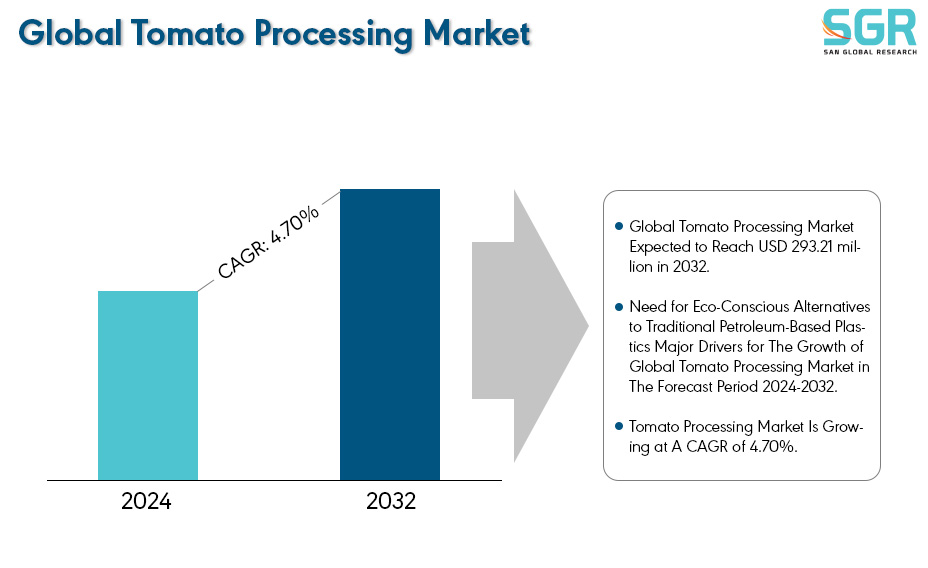

Global Tomato Processing Market is estimated to be worth USD 203.07 million in 2024 and is projected to grow at a CAGR of 4.70 % market size of market and the forecast period is 2024 to 2032.

The report analyses and forecasts the market size, in terms of value (USD million), for the market. The report segments the market and forecasts it by Product Type, by process, by Distribution Channel, by End-Use and by region/country.

Tomatoes are used in countless food products, involving many different types of processing. Tomato processing is the series of steps taken to transform raw tomatoes into various forms that are easier to store, transport, and use in different recipes. The main aim of this process is to extend the shelf life of tomatoes while preserving their nutritional value, taste, and texture. Preservation of tomato by processing it into various high-value products with extended shelf-life can help the country to address the problem of tomato spoilage to a great extent. It can also help address the problem of sudden drop in the tomato price during glut season because of which farmers fail to get the right price for their commodity The most common products resulting from tomato processing are canned tomatoes, tomato sauce, ketchup, and tomato paste. For instance, on a global scale, the annual production of fresh tomatoes amounts to approximately 180 million tonnes. About a quarter of those 160 million tonnes are grown for the processing industry, which makes tomatoes the world’s leading vegetable for processing. On average 39 million tonnes of tomatoes are processed every year in factories belonging to the greatest labels of the global food industry.

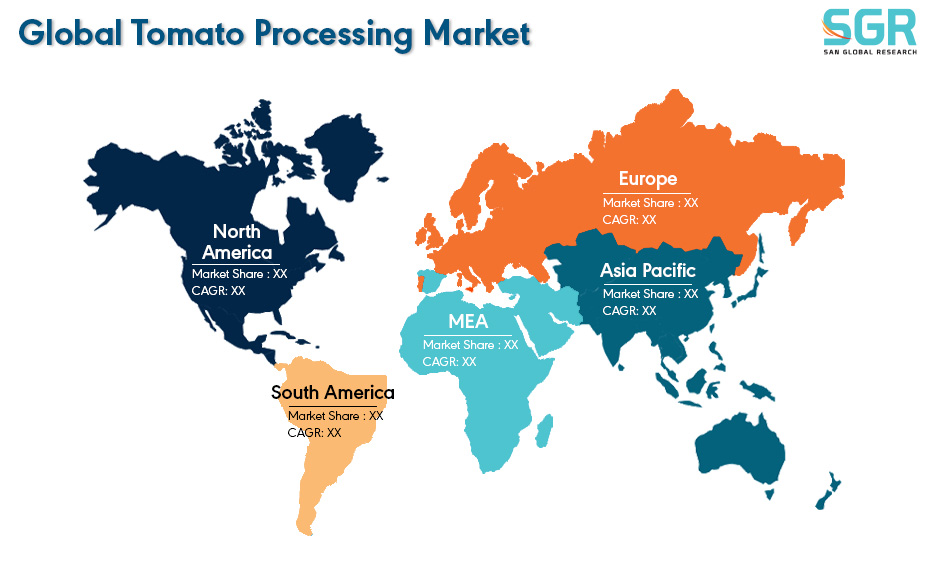

By Region North America Has Dominate the Tomato Processing Market.

Most of this production is based in the Northern hemisphere, where an average of 90% of the world’s crop is processed between the months of July and December. The remaining 10% are processed in the Southern hemisphere between January and June. Owing to the fact that the consumption of the Process tomato is highest in the north America is the highest. Which results into the Largest Market Share of the market

For instance, according to World Processing Tomato Council (WPTC) North America the main consumption region on a global scale (8 million tonnes of raw material equivalent), ahead of the Western European Union (5.9 million tonnes), in a ranking that once again confirms the emergence of regions such as the Middle East (3.9 million tonnes) and Eurasia (3.3 million tonnes), as well as their increasingly important place in the global landscape. The other regions together account for less than half (44%) of estimated global consumption.

Despite the fact that many countries have a tomato processing industry, this production is strongly concentrated and the ten largest producing countries account for some 83 % of the world’s yearly production. However, in recent years, the quantities processed outside these ten countries are California, China, Italy, Spain, Turkey, Iran, Portugal, Brazil, Chile, Ukraine, Tunisia increasing steadily and the share of in global activity tends to decrease.

Segmentation

By Product Type

The paste condenses large tomatoes into a thick, long-shelf-stable product. This reduces shipping and storage costs compared to processing whole tomatoes. Tomato paste is a very useful food that can be used in many things such as sauces, soups, casseroles, pizza, pasta, and drinks such as Bloody Marys. Tomatoes are seasonal, but Paste allows companies to maintain a consistent supply of tomatoes throughout the year. Making tomato paste intensifies the flavor and makes a better addition to tomato dishes than using fresh tomatoes.

For instances, according to World Processing Tomato Council Paste is the main tomato product, both in production volume and in commercial value. 10 countries export 95% of the total volume which are Spain, Italy, Portugal, Greece, Hunger, Poland, China, Turkey, USA, Iran, Chile, PeruIn. 2021/2022, global exports of tomato paste generated more than USD 3.6 billion of the USD 7.5 billion generated by the global trade of tomato products.

By Process

Two Methods are used Commercially to Produced Tomato Product by Hot Break and Cold Break, “Hot" typically refers to a chopping temperature of 85 to 90 °C, which causes inactivation of enzymes important to aroma and viscosity. “Cold" refers to a temperature below 70 °C to increase enzyme activity. A characteristic of the cold break process is a decrease in viscosity. The main difference between the tomato paste “cold break” and “hot break” processes is the degree of heating of the material before the pulping treatment after the tomato is crushed and the elapsed time at that temperature. In tomato processing the Hot Break is widely used because it is considered to be the healthiest way of consuming tomatoes for Tomatoes that are heated or cooked at high-temperature release an antioxidant and phytochemicals like Lutein and Zeaxanthin, also Heat-processed tomato concentrate is rich in Vitamin B and Potassium. These nutrients are responsible for keeping our cholesterol level within the normal range owing to these Factor the Hot Break processing is widely used in the processing

For instance, according to University of California Agriculture and natural Resources (UCANR)The hot break method is used to produce the majority of tomato products to maintain a high viscosity.

Key Players

• The Morning Star Company

• COFCO Tunhe Tomato Co., Ltd.

• Xinjiang Chalkis Company Ltd

• Ingomar Packing Co

• ConAgra Brands, Inc.

• Olam International

• Los Gatos Tomato Products

• Campbell Soup Company

• Toma-Tek (Neil Jones Food Company)

• Stanislaus Food Products

Driver

Consumers in emerging and developed countries are lured to eat readymade foods.

Busy lifestyles and a growing preference for convenience are fueling the demand for ready-made meals that are quick and easy to prepare. Many popular ready-made meals, such as pizzas, pastas, frozen dinners, and canned soups, heavily rely on tomato-based sauces and ingredients. As people consume more ready-made meals, the demand for the tomato products used in them, like tomato paste, puree, and chopped tomatoes, also increases. market stands to grow rapidly owing to the increasing disposable income of urban consumers. The convenience of fast food means the burgeoning middle class is likely to remain a key consumer demographic for the fast food industry in the coming years, leading to strong growth prospects for the global tomato processing market

Opportunity

Development of health conscious & Nutritious Product

Consumers are increasingly health-conscious and seeking out nutritious and functional foods. Tomatoes are a good source of lycopene, an antioxidant linked to various health benefits. There's a growing demand for products with clean labels, meaning free from artificial ingredients, preservatives, and GMOs. Some companies are already offering HPP-processed tomato products that boast extended shelf life without compromising on nutrition or requiring artificial preservatives. Others are exploring the development of tomato-based functional foods, such as tomato concentrates with added antioxidants or immunity-boosting ingredients.

| Report Attribute | Details |

| Market Value in 2024 | 203.07 Million |

| Forecast in 2032 | 293.21 Million |

| CAGR | CAGR of 4.70% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product Type, By process, By Distribution Channel And By End-Use |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • The Morning Star Company • COFCO Tunhe Tomato Co., Ltd. • Xinjiang Chalkis Company Ltd • Ingomar Packing Co • ConAgra Brands, Inc. • Olam International • Los Gatos Tomato Products • Campbell Soup Company • Toma-Tek (Neil Jones Food Company) • Stanislaus Food Products |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355