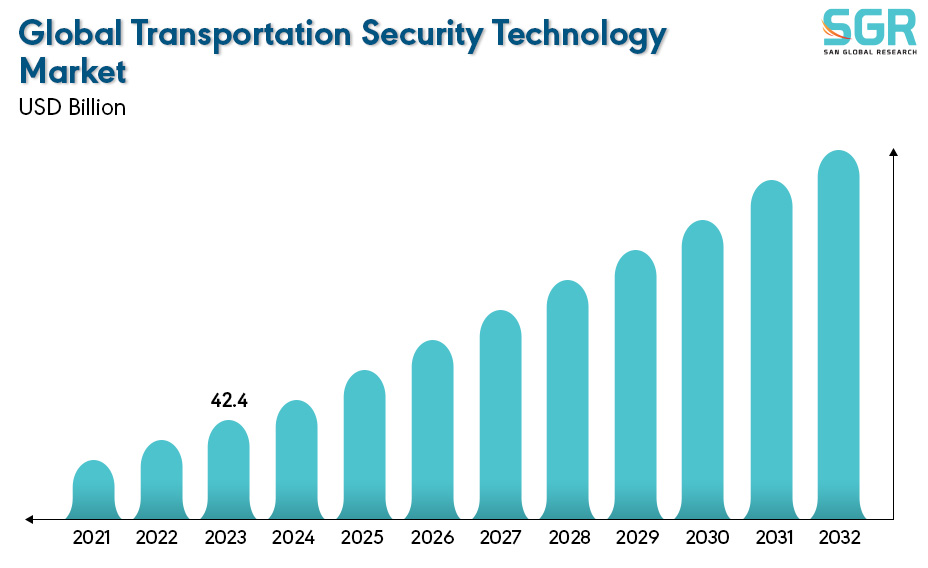

Global Transportation Security Technology Market is estimated to be worth USD 42.4 Billion in 2022 and is projected to grow at a CAGR of 7.4% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Transportation mode, By application and by region/country.

The Global Transportation Security Technology Market encompasses a diverse range of technologies and solutions aimed at safeguarding various modes of transportation, including aviation, maritime, road, and rail sectors. The market addresses the pressing need for security measures to protect against evolving threats such as terrorism, smuggling, and illegal activities that pose risks to travelers, cargo, and infrastructure. This market covers a wide array of security solutions, including passenger and baggage screening systems, video surveillance, access control systems, biometric identification, cyber security solutions, and perimeter security technologies. Factors driving this market include increasing security concerns, stringent government regulations, rising instances of cross-border terrorism, and the need to secure critical transportation infrastructure worldwide. Geographically, regions with significant transportation hubs and high passenger traffic contribute significantly to market growth. Continuous technological advancements and innovations in security systems and collaboration between public and private sectors further drive the evolution of the Global Transportation Security Technology Market to ensure safer and more secure transportation networks globally.

.jpg)

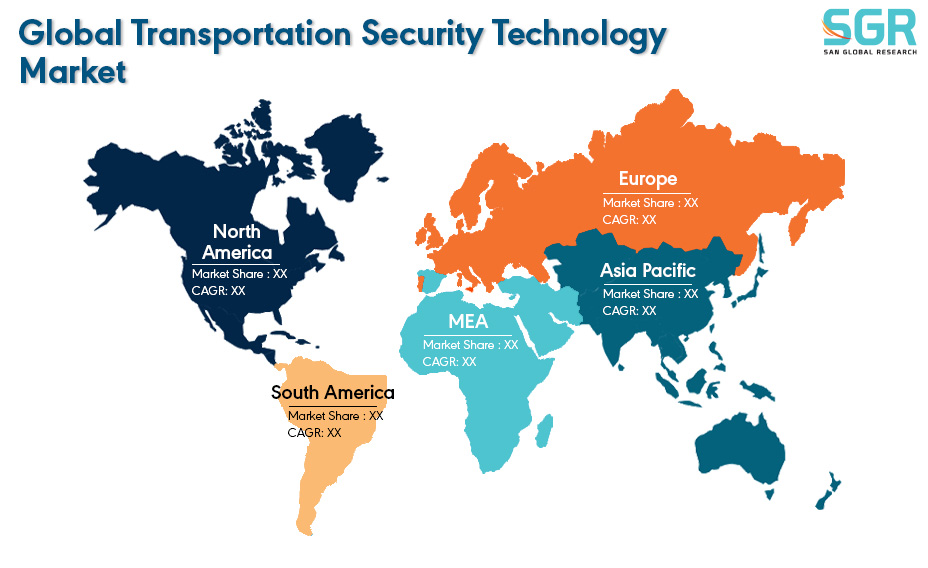

Region wise Comparison:

North America, comprising the United States and Canada, holds a substantial share in the global transportation security technology market. The region's focus on aviation security, stringent regulations, and the presence of major transportation hubs drives investments in advanced security technologies for airports, seaports, and land transportation systems.

Europe stands as another significant contributor to the global market, characterized by stringent security standards and advanced infrastructure. The region emphasizes security measures across various transportation modes, including air, sea, and rail, leading to the adoption of cutting-edge security technologies and surveillance systems.

The Asia-Pacific region, encompassing countries like China, India, Japan, and South Korea, showcases rapid growth in transportation infrastructure. Growing urbanization, increasing air travel, and expanding maritime trade contribute to the demand for transportation security technologies, particularly in major cities and key transportation hubs.

Latin America contributes to the transportation security technology market, albeit with varying growth rates across different countries due to economic factors. Countries like Brazil and Mexico focus on improving security measures in airports and seaports, leading to investments in advanced security technologies.

Africa and the Middle East regions are gradually expanding their transportation infrastructure, leading to increased investments in security technologies, particularly in major cities and international transportation nodes.

.jpg)

Segmentation:

The Global Transportation Security Technology Market is segmented by Transportation mode, by application and by region/country.

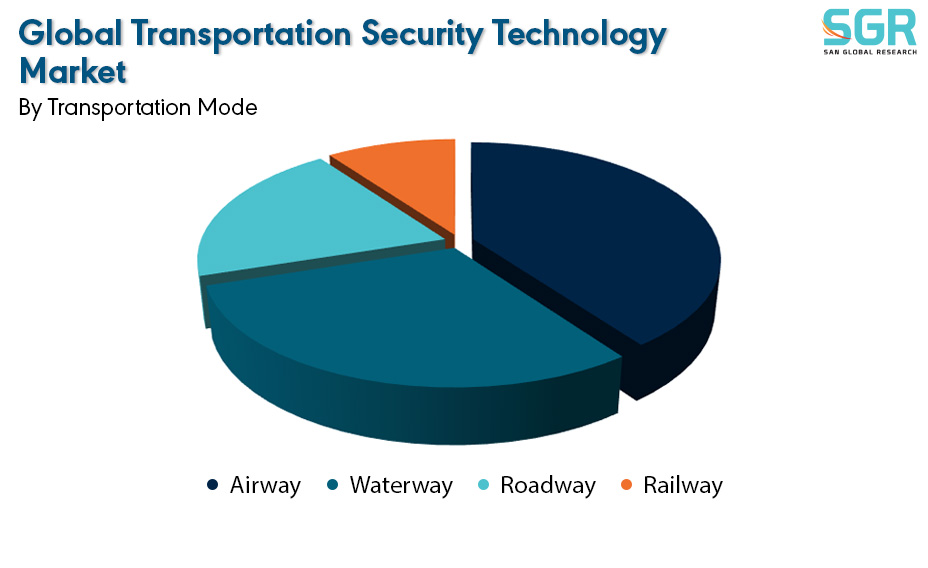

By Transportation Mode:

Based on the Transportation Mode, the Global Transportation Security Technology Market is bifurcated into Airway, Waterway, Roadway, and Railway– where Airway is dominating and ahead in terms of share.

Airway mode within the Global Transportation Security Technology Market pertains to security measures and technologies specifically designed for air transportation systems. This segment encompasses a wide array of security solutions aimed at safeguarding passengers, aircraft, and airport facilities from various threats. It includes advanced passenger and baggage screening systems, explosive detection technologies, biometric identification, cyber security measures, access control systems, and surveillance technologies deployed across airports worldwide.

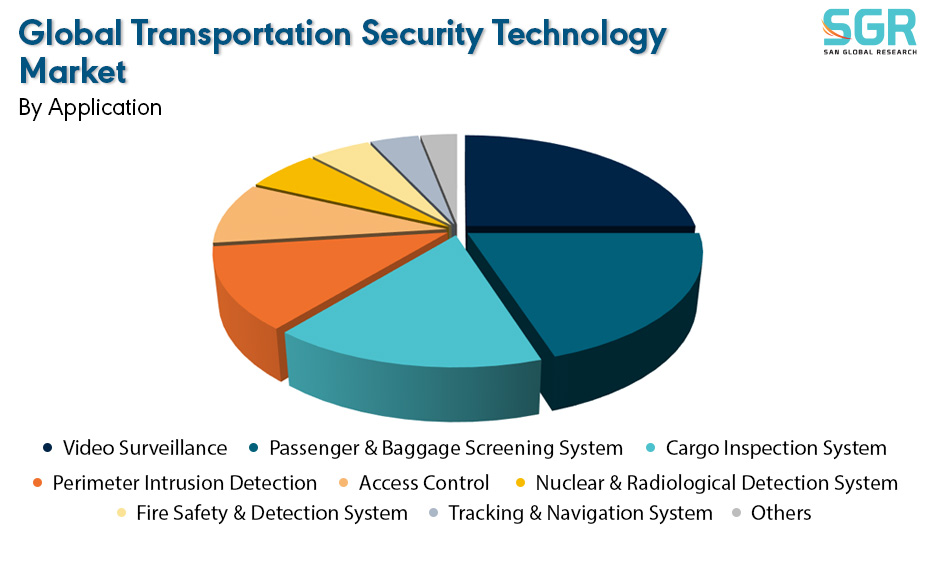

By Application:

Based on the Application, the Global Transportation Security Technology Market is bifurcated into Video Surveillance, Passenger & Baggage Screening System, Cargo Inspection System, Perimeter Intrusion Detection, Access Control, Nuclear & Radiological Detection System, Fire Safety & Detection System, Tracking & Navigation System, and Others – where Video Surveillance is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the Global Transportation Security Technology Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Global Transportation Security Technology Market include

• ALSTOM SA

• OSI SYSTEMS, INC. (RAPISCAN SYSTEMS)

• LOCKHEED MARTIN CORPORATION

• RAYTHEON COMPANY

• KAPSCH AKTIENGESELLSCHAFT

• HONEYWELL INTERNATIONAL INC

• SECURITY ELECTRONIC EQUIPMENT CO.LIMITED

• UNITED TECHNOLOGIES CORPORATION

• SMITHS GROUP PLC (SMITHS DETECTION INC.)

• L3 TECHNOLOGIES, INC

Drivers:

Growing sector across the globe

The Global Transportation Security Technology Market is driven by several key factors that shape its growth trajectory and innovation. One primary driver is the persistent and evolving threat landscape, including terrorism, smuggling, and cyber security risks, prompting the need for advanced security measures across transportation modes. Stringent government regulations and mandates worldwide also play a significant role, compelling transportation authorities to invest in robust security technologies to comply with regulatory standards and ensure passenger and cargo safety. Moreover, the surge in global travel, increasing passenger traffic, and the expansion of transportation infrastructure create a demand for scalable and efficient security solutions to manage the growing volumes effectively. Additionally, technological advancements and innovations in surveillance, biometrics, artificial intelligence, and data analytics contribute to the market's growth by offering more sophisticated and effective security solutions. These drivers collectively fuel the evolution and adoption of transportation security technologies, ensuring safer and more secure global transportation networks.

Opportunity:

Evolving Market

The Global Transportation Security Technology Market presents numerous opportunities driven by evolving trends and technological advancements within the transportation and security sectors. One significant opportunity arises from the growing adoption of smart technologies, including artificial intelligence (AI), machine learning, and the Internet of Things (IoT), to enhance security measures. These technologies offer advanced threat detection, predictive analytics, and real-time monitoring capabilities, providing a proactive approach to security threats across various transportation modes. Additionally, there's an increasing focus on enhancing cyber security in transportation systems, creating opportunities for companies specializing in cyber security solutions tailored to the unique needs of transportation networks. Moreover, the rising demand for integrated and interoperable security systems offers prospects for companies providing comprehensive and scalable security solutions that seamlessly integrate across different transportation segments. Furthermore, the need for more efficient and passenger-friendly security processes, such as biometric identification and contactless screening, presents opportunities for innovative technologies that streamline security procedures while ensuring effectiveness and convenience.

| Report Attribute | Details |

| Market Value in 2022 | 42.4 Billion |

| Forecast in 2032 | 86.5 Billion |

| CAGR | CAGR of 7.4% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Transportation Mode, By Application |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • ALSTOM SA • OSI SYSTEMS, INC. (RAPISCAN SYSTEMS) • LOCKHEED MARTIN CORPORATION • RAYTHEON COMPANY • KAPSCH AKTIENGESELLSCHAFT • HONEYWELL INTERNATIONAL INC • SECURITY ELECTRONIC EQUIPMENT CO.LIMITED • UNITED TECHNOLOGIES CORPORATION • SMITHS GROUP PLC (SMITHS DETECTION INC.) • L3 TECHNOLOGIES, INC |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355