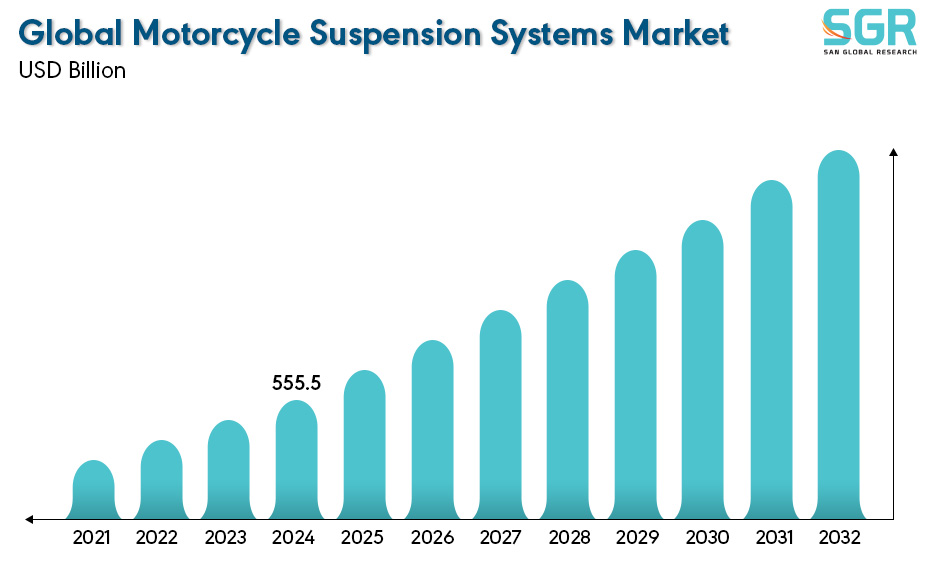

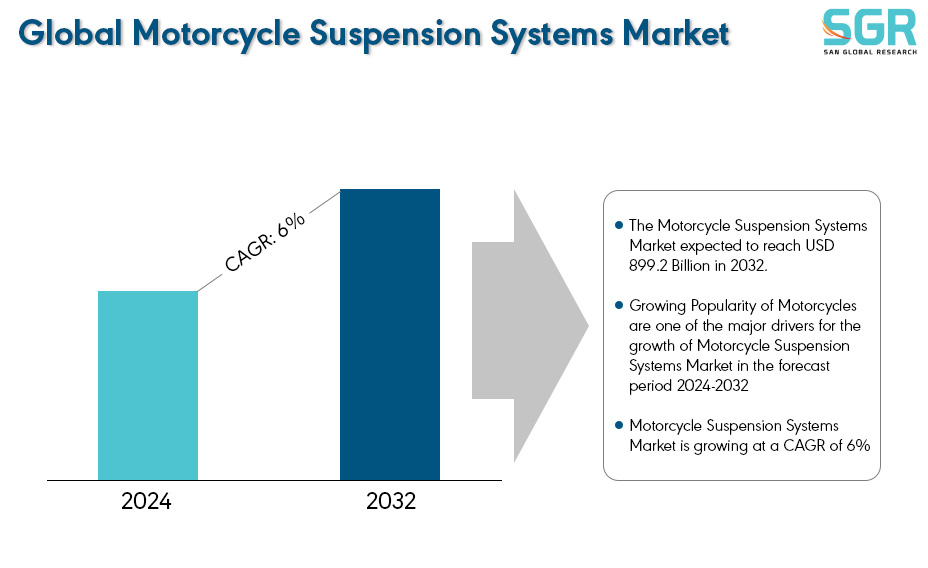

Motorcycle Suspension Systems Market is estimated to be worth USD 555.5 Billion in 2024 and is projected to grow at a CAGR of 6% between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of the market, and the forecast period is 2024 to 2032. The report analyses and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Suspension Type, by Technology Type, by Motorcycle Type and by region/country.

Suspension systems being the main part of the vehicle, where the shock absorbers are designed mechanically to withstand shock impulse and disperse kinetic energy. The shock absorbers reduce the effect of riding over rough ground, which leads to improved ride quality and vehicle handling. The primary purpose of shock absorbers is to damp spring oscillations while also serving the purpose of limiting excessive suspension movements. The purpose of motorcycle suspensions is to keep vehicle tires in contact with ground. The vehicles tires would lose their traction when encountering bumps, dips and other ground imperfections without the proper suspension.

And considering the features such as braking, cornering and acceleration by the vehicle is firmly supported by the suspension by optimally maintain the tractions. The motorcycle suspension usually uses a spring and damper combination to isolate the chassis and rider for imperfect roads. And suspensions within the off-road motorcycles are used to handle roots, rocks, jumps, ledges etc.

After reviewing the data shown below, it can be determined that the Asia Pacific region dominates the Motorcycle Suspension Systems Market for the following reasons.

Asia Pacific region is significantly dominating the Motorcycle Suspension Systems market because, of being a dominant player within the automobile industry and also leading manufacturer of EVs. And Asia Pacific region being the largest user of motorcycles accounting for about more than 50% makes the region dominating in the Motorcycle Suspensions Systems Market.

Second to Asia Pacific, Europe is also gaining traction within the Motorcycle Suspension System Market. Europe being one of the largest users of Mopeds has gained substantial growth within the market. For instance, according to the data provided by ACEM, on January 2023, the new motorcycle registration within the region were around 950,400 units in 2022.

Segmentations

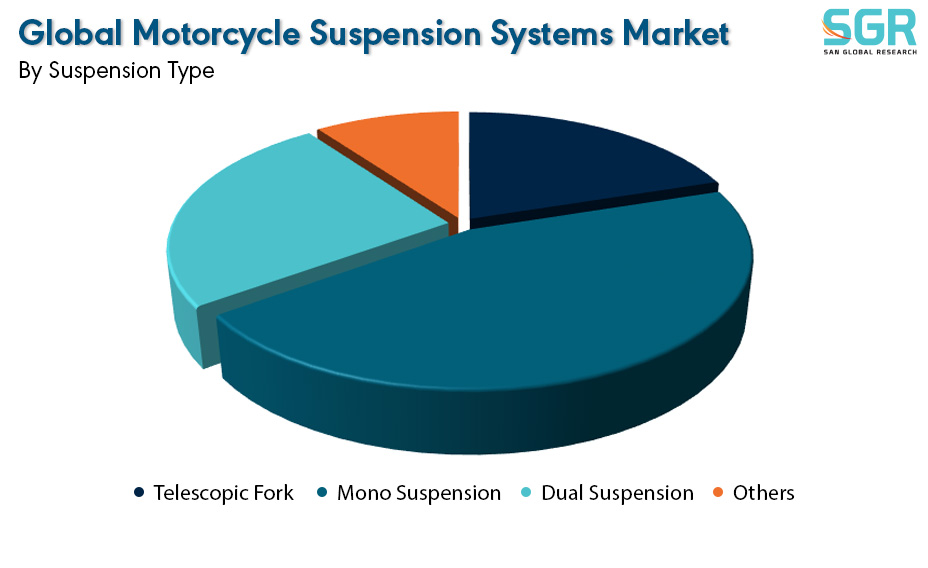

By Suspension Type

Based on Suspension Type, the Motorcycle Suspension Systems Market is bifurcated into Telescopic Fork Suspension, Mono Suspension, Dual Suspension and Others– where Mono Suspension segment is dominating and ahead in terms of share. The Mono Suspension segment is dominating the suspension type segment within the Motorcycle Suspension System Market. The Mono Suspension eliminate torque to the swing arm and improve braking and handling of vehicle. And it gets easier to adjust on the vehicle due to only one shock to adjust. The Mono suspensions also have better cornering ability. And due to Mono Suspension, the vehicle is lighter than the dual suspension-based vehicle.

By Technology Type

Based on Technology Type, the Motorcycle Suspension Systems Market is bifurcated into Analog and Digital– where Analog segment is dominating and ahead in terms of share.

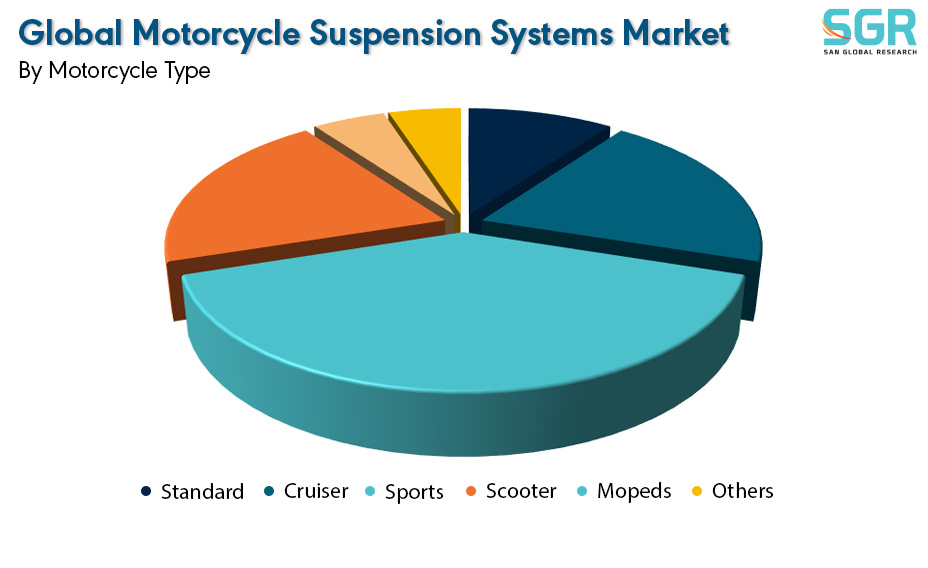

By Motorcycle Type

Based on Motorcycle Type, the Motorcycle Suspension Systems Market is bifurcated into Standard, Cruiser, Sports, Scooter, Mopeds and Others– where Sports segment is dominating and ahead in terms of share.

Key Players

• SHOWA CORPORATION

• KYB Corporation

• Duro Shox Pvt Ltd

• BMW Group

• WP AG

Drivers

Growing Popularity of Motorcycles

The growing popularity of motorcycles among the youngsters has significantly contributed as the market growth driver for the Motorcycle Suspension Systems Market. Due to the introduction of new motorcycle models which are affordable and are extremely comfortable due to the advances suspension systems installed within the Sports bikes has attracted significant attention among the youngsters. And due to the growing population motorcycles being an affordable option has shown a surge in the market’s growth.

Opportunity

Technological Advancements – Controlled Algorithm Design

The motorcycle suspension system market is poised for a breakthrough with the development of the Hybrid Control Algorithm based on Frequency Division (HCFD). This technology tackles a major rider concern: the inability of traditional systems to balance comfort and handling on various terrains. Current control algorithms struggle to optimize both aspects simultaneously. HCFD offers a promising solution by effectively absorbing vibrations for a smoother ride without compromising stability. This improved rider experience can drive demand for motorcycles equipped with HCFD suspension systems, creating a significant growth opportunity within the market.

| Report Attribute | Details |

| Market Value in 2024 | 555.5 Billion |

| Forecast in 2032 | 899.2 Billion |

| CAGR | CAGR of 6% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | by Suspension Type, by Technology Type, by Motorcycle Type |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • SHOWA CORPORATION • KYB Corporation • Duro Shox Pvt Ltd • BMW Group • WP AG |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355