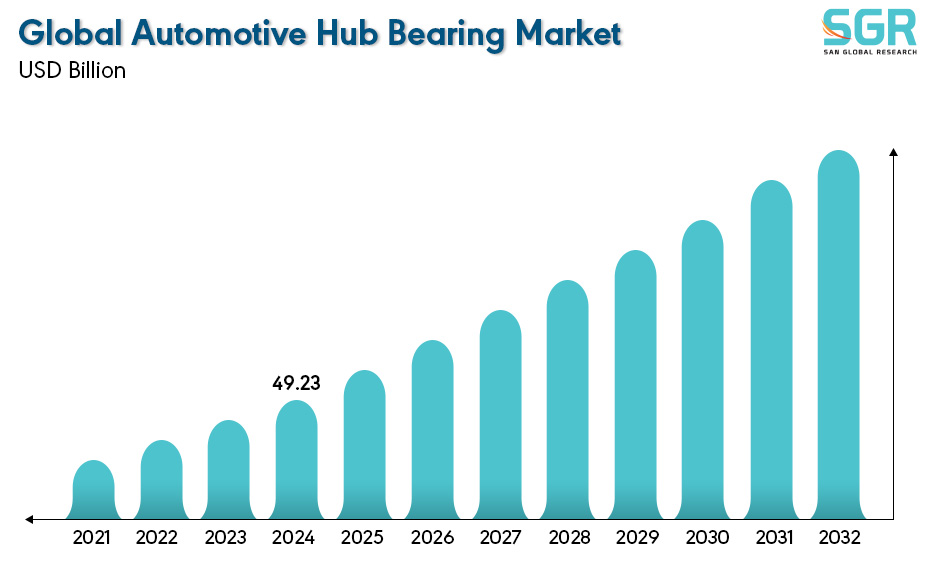

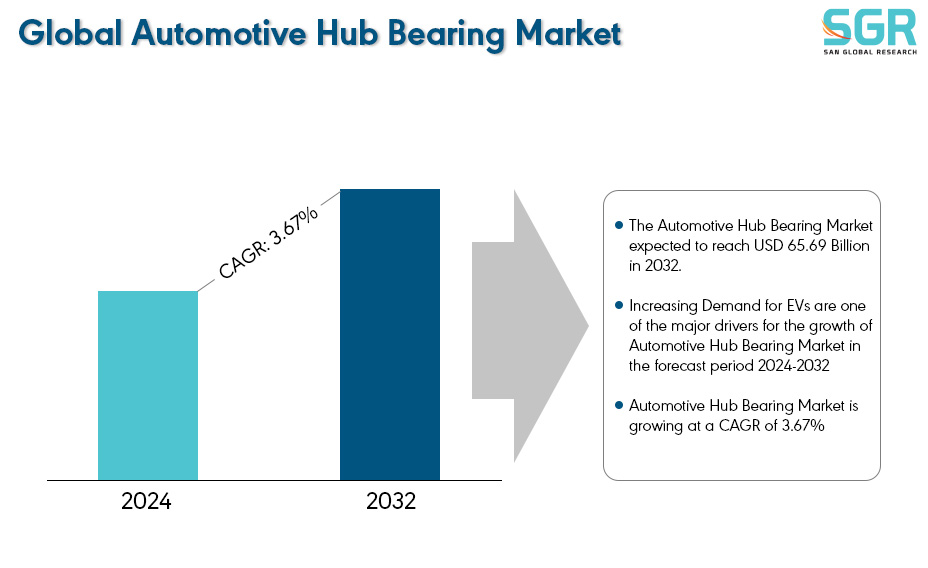

Automotive Hub Bearing Market is estimated to be worth USD 49.23 Billion in 2024 and is projected to grow at a CAGR of 3.67% between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of the market, and the forecast period is 2024 to 2032. The report analyses and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Type, by Application, and by region/country.

Automotive wheel bearings are essential for a car's smooth operation. They connect the driveshaft to the wheel, handling weight and transmitting power for movement. Ball bearings, ideal for lighter vehicles, provide low-friction rotation, while taper roller bearings handle heavier loads in trucks and SUVs. Wheel bearing design has continuously improved to meet these demands. Early, bulkier designs have given way to compact, efficient units with fewer parts. Today's third-generation bearings prioritize weight reduction, easier assembly, and increased durability, keeping your wheels rolling smoothly for miles to come.

Wheel hub bearings help reduce the friction and wear caused by the high rotational speeds of the wheels, which can reach over 800 revolutions per minute at highway speeds. This helps improve drivability, fuel efficiency, and overall vehicle performance. Proper installation and maintenance of wheel hub bearings is crucial, as failure can lead to issues like noise, reduced control, and in extreme cases, the wheel becoming detached from the vehicle. Automotive technicians must ensure hub bearings are torqued to the manufacturer's specifications during replacement.

After reviewing the data shown below, it can be determined that the Asia Pacific region dominates the Automotive Hub Bearing Market for the following reasons.

The Asia Pacific region is significantly dominating the Automotive Hub Bearing Market due to the booming automotive industry within the region. The Asia Pacific region home to some of the largest vehicle manufactures including China, Japan and India. And due to these rapid developments within the automotive industry has fueled the demand for the various automotive component, such as the hub bearing. And due to the growing government initiative to increase the adoption of the EVs within the public transport to reduce the GHG emissions has also played a significant role to boost the automotive hub bearing market. The combustion based vehicle usually requires the traditional hub bearing and due to the increasing adoption of the EVs has demanded specialized hub bearing creating a new market segment.

Segmentations

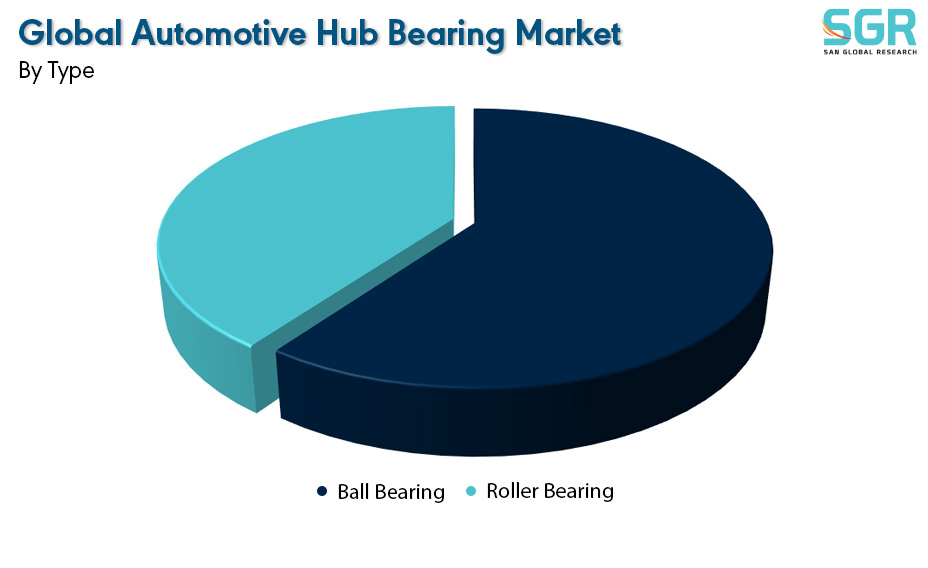

By Type

Based on Type, the Automotive Hub Bearing Market is bifurcated into Ball Bearing and Roller Bearing– where Ball Bearings segment is dominating and ahead in terms of share. The Ball Bearing segment is dominating the Type segment within the Automotive Hub Bearing Market. Ball bearings offer low friction, which helps improve fuel efficiency in vehicles. The simple and compact design of ball bearings makes them a perfect choice for space-constrained environments like vehicle wheel hubs. Ball bearings are easy to maintain and versatile, allowing their use in a range of load capacities through design and material choices.

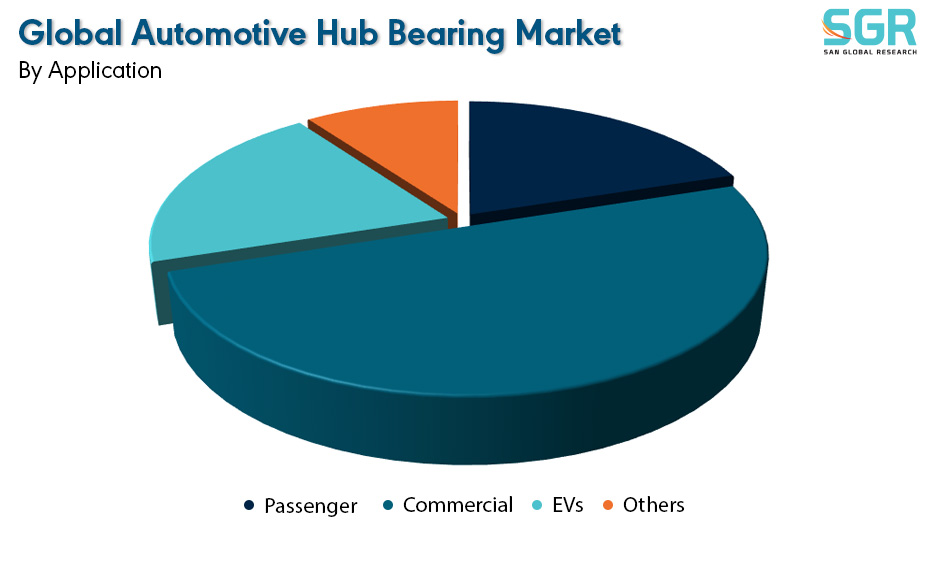

By Application

Based on Application, the Automotive Hub Bearing Market is bifurcated into Passenger, Commercial, EVs and Others– where Commercial segment is dominating and ahead in terms of share.

Key Players

• SKF Group

• Schaeffler AG

• NSK Ltd.

• NTN Corporation

• JTEKT Corporation

Drivers

Increasing Demand for EVs

The surge in electric vehicles (EVs) is a major boon for the automotive hub bearing market. Despite global challenges, data from the International Energy Agency (February 2023) shows strong growth in SUVs, a category increasingly dominated by EVs. Global SUV sales grew 3% between 2021 and 2022, accounting for a whopping 46% of all car sales. This trend is particularly evident in the US, India, and Europe. Notably, electric SUVs captured over 16% of the total SUV market in 2022, exceeding the average EV market share. Even more significantly, electric SUVs now represent over half of all global electric car sales. This growing preference is reflected in the rising number of electric car models available globally, with SUVs making up a staggering 55% in 2022, compared to 40% just four years ago.

Opportunity

Technological Advancements

Researchers have made a significant breakthrough in automotive hub bearing technology by developing a new ABS hub bearing with a hall sensor integrated into a third-generation hub bearing design. This innovation is accompanied by an optimization method using a genetic algorithm, aiming to create future-proof hub bearings that meet the evolving demands of the automotive industry. This development offers valuable guidance for designing next-generation hub bearings and presents exciting growth opportunities within the global automotive hub bearing market.

| Report Attribute | Details |

| Market Value in 2024 | 49.23 Billion |

| Forecast in 2032 | 65.69 Billion |

| CAGR | CAGR of 3.67% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | By Type, By Application |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • SKF Group • Schaeffler AG • NSK Ltd. • NTN Corporation • JTEKT Corporation |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355