Report Overview

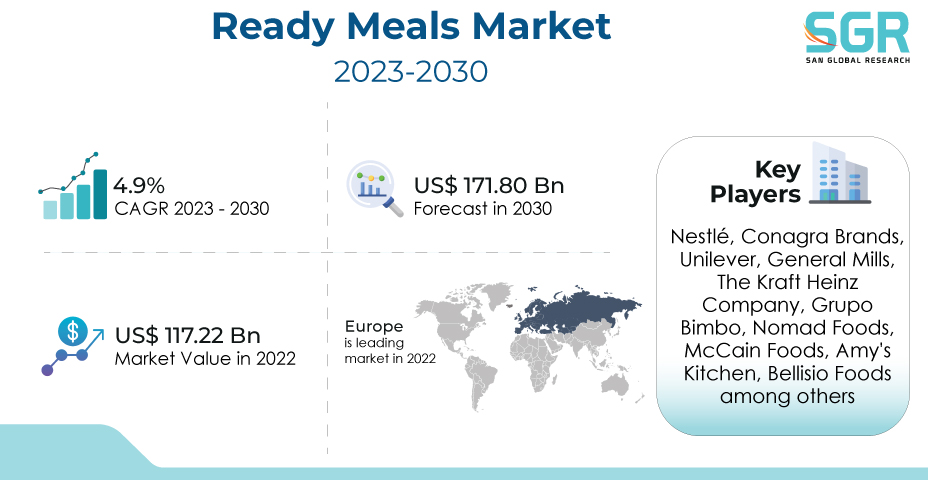

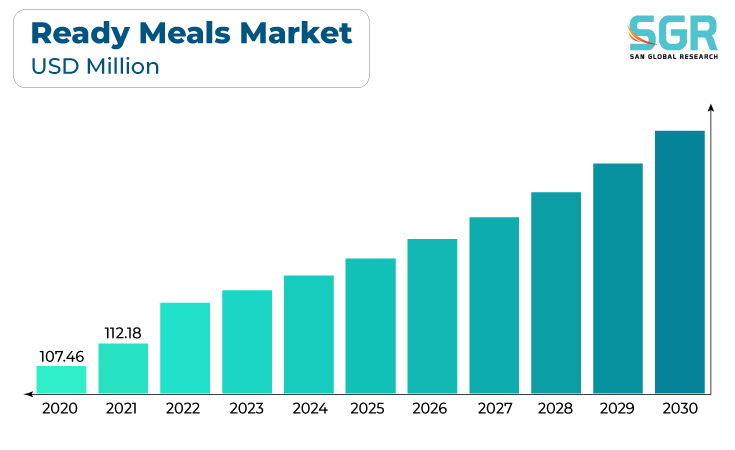

The ready meals market was valued at 117.22 billion in 2022 and expected to grow at CAGR of 4.9% over forecast period.

The primary driver for ready meals is the convenience they offer. In our fast-paced lives, consumers seek quick and easy meal solutions, and ready meals provide a time-saving option for those with busy schedules. The growth of urban areas is associated with hectic schedules and limited time for meal preparation. Ready meals cater to urban consumers who may prefer convenient options due to time constraints. With more people working from home or having irregular work hours, the demand for quick and easily prepared meals has increased. Ready meals provide a convenient solution for individuals who want a hassle-free cooking experience.

Moreover, innovations in packaging, such as microwaveable containers and vacuum-sealing, enhance the convenience of ready meals. Packaging that preserves freshness and allows for easy heating contributes to consumer satisfaction. In addition, the rise of e-commerce and online grocery shopping platforms has made it easier for consumers to access and order ready meals. This convenience has contributed to the growth of the ready meals market.

The combination of these factors has fueled the growth of the ready meals market, making it a popular choice for consumers seeking quick, convenient, and diverse meal options. As consumer preferences continue to evolve, the market is likely to see further innovations and expansions.

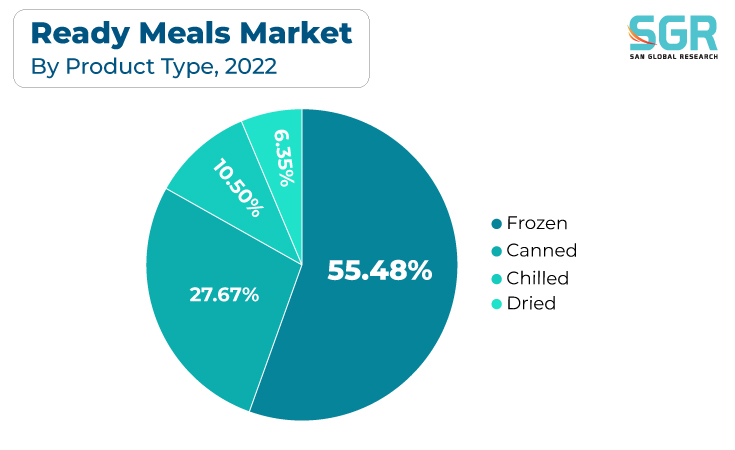

Type Outlook

Based on type, the ready meals market is segmented into frozen, chilled, canned, dried. Frozen segment accounted for largest share in 2022. Frozen ready meals have a longer shelf life compared to fresh alternatives. This makes them convenient for consumers who want to stock up on meals and have them readily available without the concern of spoilage. Frozen ready meals offer unmatched convenience. Consumers can easily store them in their freezers and prepare a meal quickly without the need for extensive meal planning, ingredient preparation, or cooking from scratch.

The freezing process helps to preserve the nutritional content of ingredients. This appeals to health-conscious consumers who seek a balance between convenience and nutrient-rich meals. In addition, Frozen ready meals contribute to the reduction of food waste. With precisely portioned and frozen ingredients, consumers can use only what they need, minimizing the risk of perishable items going unused.

The combination of these factors has made frozen ready meals a popular choice for consumers seeking convenient, time-saving, and diverse meal solutions. As the market continues to evolve, innovations in product offerings and improvements in freezing and packaging technologies are likely to drive further growth in the frozen ready meals segment.

Regional Outlook

Europe has emerged as leading market for ready meals market in 2022. Europe has experienced significant urbanization trends, with more people living in urban areas. Urban dwellers often have hectic schedules and may prefer ready meals for their ease of preparation. Europe has a culturally diverse population with varying culinary preferences. The ready meals market offers a broad range of options, including international cuisines, to cater to the diverse tastes of European consumers.

Furthermore, the growing emphasis on health and wellness has influenced the ready meals market in Europe. Consumers are increasingly seeking options with better nutritional profiles, fewer additives, and cleaner labels. In addition, The European market has seen a trend towards premiumization, where consumers are willing to pay more for higher quality and gourmet-style ready meals. This trend has driven the introduction of upscale and specialty options.

Europe's contribution to the growth of the ready meals market is a result of its alignment with the evolving lifestyles, diverse preferences, and demands of its consumer base. The market's adaptability to changing trends, coupled with a focus on innovation, health, and quality, positions it as a dynamic force in the global ready meals landscape.

Ready Meals Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 117.22 Billion |

| Forecast in 2030 | USD 171.80 Billion |

| CAGR | CAGR of 4.9% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Meal Type, By Distribution Channel |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | Nestlé, Conagra Brands, Unilever, General Mills, The Kraft Heinz Company, Grupo Bimbo, Nomad Foods, McCain Foods, Amy's Kitchen, Bellisio Foods among others |

Global Ready Meals Market, Report Segmentation

Ready Meals Market, By Type

- Frozen

- Chilled

- Canned

- Dried

Ready Meals Market, By Meal Type

- Vegetarian

- Non-vegetarian

Ready Meals Market, By Distribution Channel

- Online

- Offline

Ready Meals Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355