Report Overview

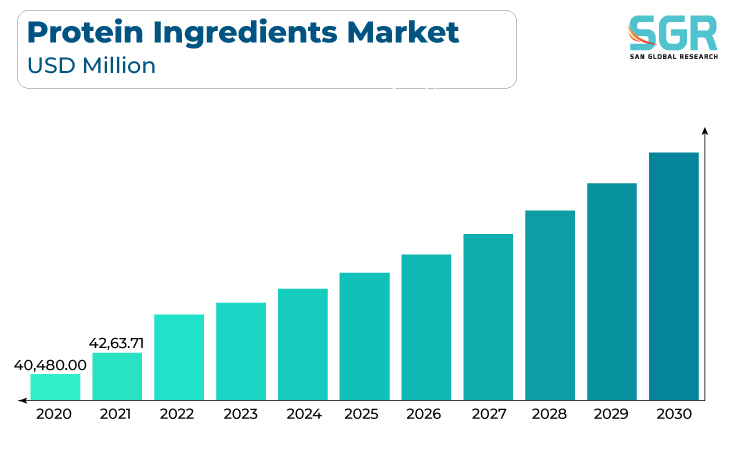

The protein ingredients market was valued at 44,973.83 million in 2022 and expected to grow at CAGR of 6.3% over forecast period.

Growing awareness of the importance of a healthy diet and the role of protein in maintaining overall health is driving consumer demand for protein-rich foods and supplements. The increasing popularity of plant-based diets and the rise of flexitarianism have led to a surge in demand for plant-based protein ingredients, such as soy, pea, and rice protein.

The emphasis on health and fitness, coupled with the popularity of sports nutrition, has increased the demand for protein ingredients to support muscle development and recovery. The incorporation of protein ingredients into a wide range of functional foods and beverages, including protein bars, shakes, and snacks, is driving market growth. Advances in food processing technologies have enabled the extraction and incorporation of protein from various sources, contributing to the diversification of protein ingredient offerings.

Advances in food processing technologies have enabled the extraction and incorporation of protein from various sources, contributing to the diversification of protein ingredient offerings.

Form Outlook

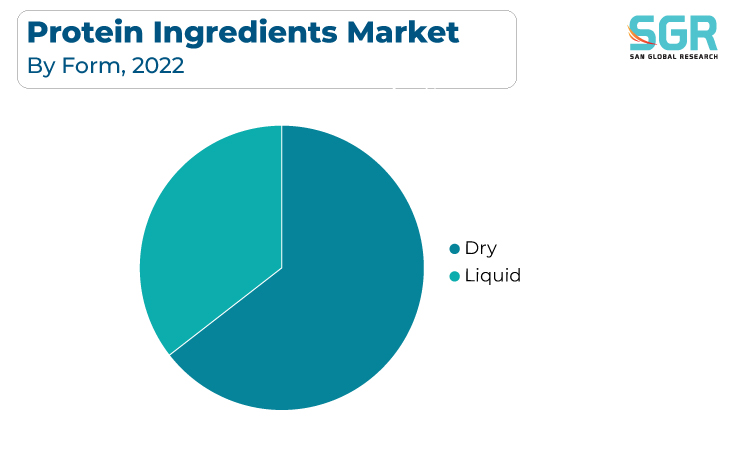

Based on form, the Protein Ingredients market is segmented into dry and liquid. Dry segment accounted for largest share in 2022. Dry forms, such as protein powders and concentrates, offer convenience and extended shelf life. Consumers appreciate the ease of storage, handling, and longer product durability, making dry forms a preferred choice.

Dry protein ingredients are highly versatile and can be easily incorporated into various food and beverage applications. This versatility extends to the formulation of protein bars, shakes, snacks, and other dry and semi-dry products. The demand for protein supplements in the form of powders and dry mixes is driven by the global fitness and sports nutrition trends. Dry forms are convenient for preparing protein-rich shakes and smoothies, favored by athletes and fitness enthusiasts.

Dry protein ingredients are more cost-effective to transport and store compared to liquid or frozen forms. The reduced weight and volume contribute to lower shipping costs and storage requirements. The dry form allows for easy customization of protein content in food formulations. Food manufacturers have the flexibility to precisely control the protein content in the final product without altering the product's texture or consistency.

Regional Outlook

North America has emerged as leading market for Protein Ingredients market in 2022. North America has witnessed a significant trend towards high-protein diets driven by the increasing awareness of the role of protein in supporting overall health, muscle development, and weight management.

Furthermore, the increasing focus on health and wellness in North America has led to a higher demand for protein-rich foods and beverages. Consumers are actively seeking products that align with their health and nutrition goals. The demand for functional foods and beverages with added health benefits, including protein fortification, is on the rise. Protein ingredients are being incorporated into a variety of functional food products.

The robust sports nutrition and fitness industry in North America has fueled the demand for protein supplements. Protein powders, bars, and shakes are commonly used by athletes and fitness enthusiasts, driving market growth.

Protein Ingredients Market Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 44,973.83 Million |

| Forecast in 2030 | USD 73,001.46 Million |

| CAGR | CAGR of 6.3% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product, By Form, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Archer Daniels Midland (ADM), Cargill, Kerry Group, Fonterra, Glanbia Nutritionals, Arla Foods Ingredients, Ingredion, Roquette, Kerry Group, Tate & Lyle among others |

Protein Ingredients Market, Report Segmentation

Protein Ingredients Market, By Product

- Plant Proteins

- Animal/Dairy Proteins

- Microbe-based Protein

- Insect Protein

Protein Ingredients Market, By Form

- Dry

- Liquid

Protein Ingredients Market, By Application

- Foods & Beverages

- Animal Feed

- Cosmetics

- Personal Care

Protein Ingredients Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355