Report Overview

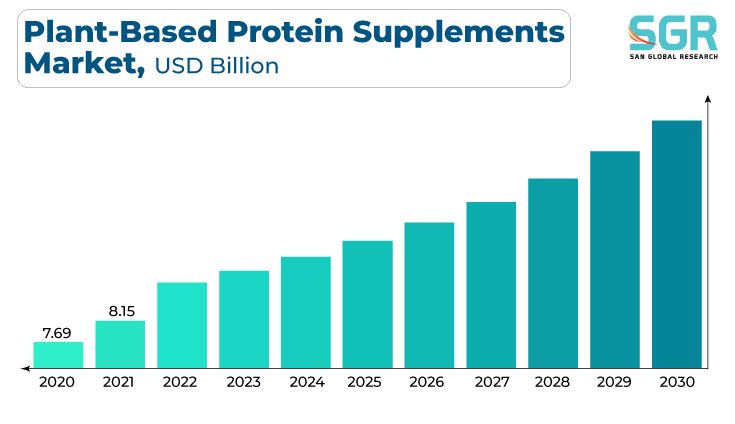

The plant-based protein supplements market was valued at 8.64billion in 2022 and expected to grow at CAGR of 6.2% over forecast period.

The rise in vegan and vegetarian lifestyles is a primary driver. Consumers adopting plant-based diets seek protein supplements to meet their nutritional needs without relying on animal-derived sources. Growing awareness of the health benefits associated with plant-based diets drives the demand for plant-based protein supplements. Consumers are increasingly conscious of their nutritional choices and their impact on overall well-being.

The fitness and sports nutrition industry are witnessing a surge in interest in plant-based protein supplements. Athletes and fitness enthusiasts are incorporating these supplements to support muscle recovery, endurance, and overall performance.

Plant-based protein supplements are often allergen-free, addressing concerns related to common allergens like dairy and soy. Additionally, plant-based proteins are perceived as easily digestible, appealing to a broader consumer base.

Sustainability concerns are driving the shift towards plant-based diets. Plant-based protein supplements have a lower environmental footprint compared to animal-derived proteins, attracting environmentally conscious consumers.

Form Outlook

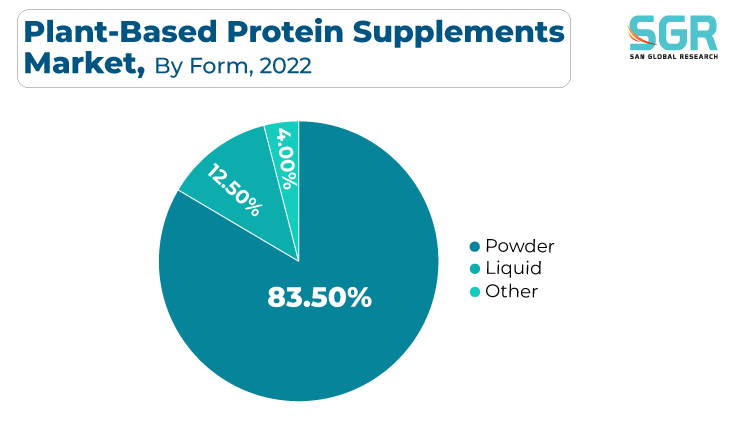

Based on form, the plant-based protein supplements marketis segmented intopowder, liquid and other. Powder segment accounted for largest share in 2022. Plant-based protein powders offer versatility in usage, making them convenient for consumers. They can be easily mixed into various beverages and foods, providing flexibility in incorporating them into daily diets.

The powder form allows for easy integration into daily routines. Consumers can add plant-based protein powder to smoothies, shakes, yogurt, or even use them in cooking and baking, making it a seamless part of their daily nutrition. In addition, powders allow for customizable dosage, enabling consumers to control the amount of protein they want to intake. This flexibility is appealing to individuals with specific dietary goals or those following personalized nutrition plans.

Powders are popular choices for pre-workout and post-workout supplementation. The quick and easy preparation of protein shakes makes them convenient for individuals looking to support muscle performance and recovery.

Regional Outlook

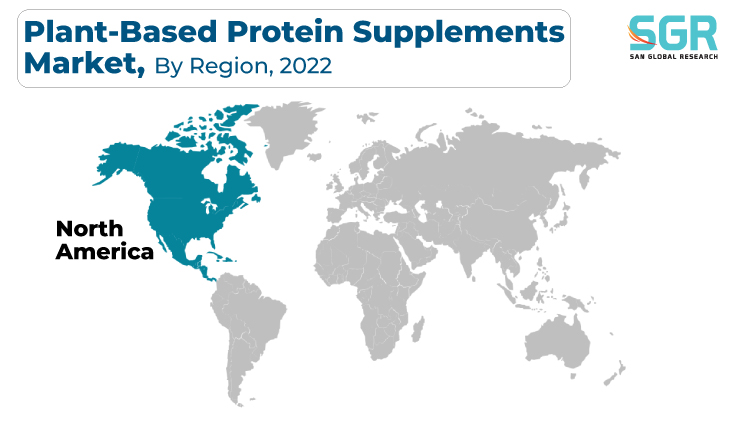

North Americahas emerged as leading market for plant-based protein supplements market in 2022. North America has witnessed a significant rise in the adoption of plant-based diets. Consumers are increasingly choosing plant-based protein supplements as part of their dietary shift towards more sustainable and plant-centric eating habits.

Furthermore,the prevalent health and wellness trends in North America contribute to the growth of the plant-based protein supplements market. Consumers are seeking products that align with their desire for healthier lifestyles, including protein supplements derived from plant sources. Also, The region places a strong emphasis on fitness and sports nutrition. Athletes, fitness enthusiasts, and the general population are incorporating plant-based protein supplements to support muscle recovery, enhance endurance, and meet their protein needs.

North America has a growing population of vegans and vegetarians. The demand for plant-based protein supplements is particularly strong among these groups as they seek convenient and effective ways to meet their protein requirements without relying on animal products.

Plant-Based Protein Supplements Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD8.64Billion |

| Forecast in 2030 | USD13.91Billion |

| CAGR | CAGR of 6.2% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Source, By Form, By Distribution Channel |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Vega (formerly Vega One), Orgain, Garden of Life, Sunwarrior, Nutiva, PlantFusion, Nuzest, Amazing Grass, Aloha, Sprout Living, OWYN (Only What You Need), Truvaniamong others |

Plant-Based Protein Supplements Market, Report Segmentation

Plant-Based protein supplements Market, By Source

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

Plant-Based Protein Supplements Market, By Form

- Powder

- Liquid

- Other

Plant-Based Protein Supplements Market, By Distribution Channel

- Direct

- Indirect

Plant-Based Protein Supplements Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355