Report Overview

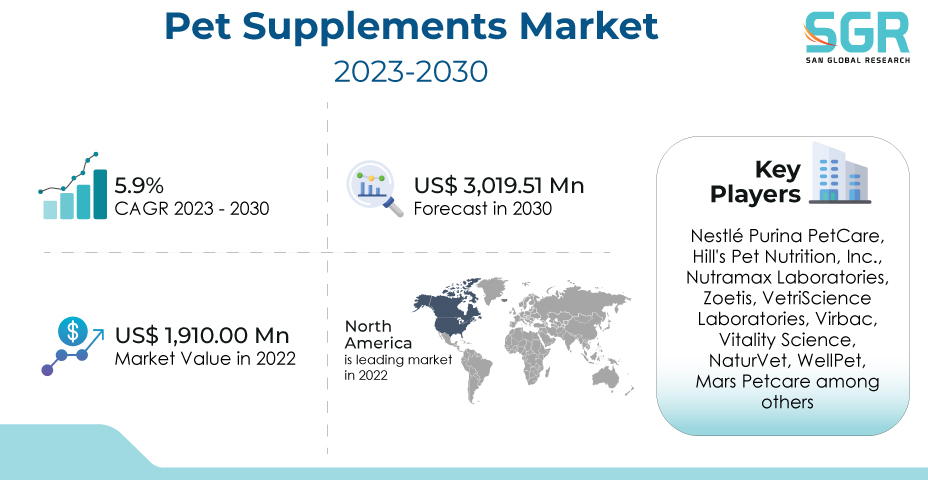

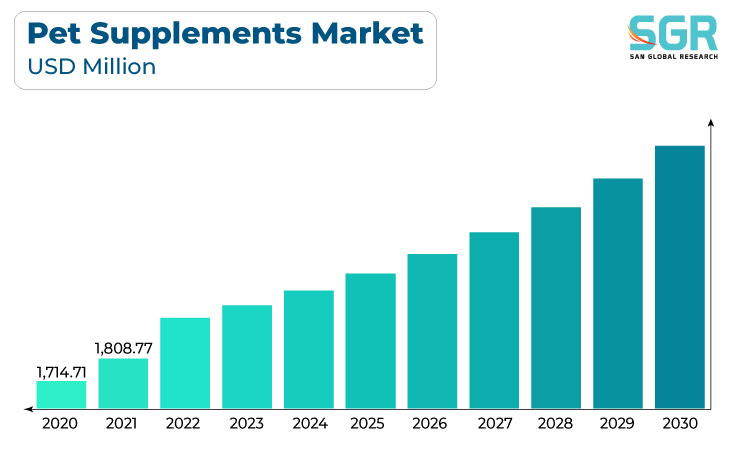

The pet supplements market was valued at 1,910.00 million in 2022 and expected to grow at CAGR of 5.9% over forecast period.

The trend of treating pets as family members has led to a greater focus on their health and well-being. Pet owners are more willing to invest in supplements to ensure their pets lead healthier and longer lives. As more people choose to have pets as companions, the overall pet population rises, leading to increased demand for pet-related products, including supplements. Moreover, Pet owners are becoming more conscious of the importance of preventive healthcare for their pets. This awareness has driven the demand for supplements that address specific health concerns or conditions in pets.

In addition, Developments in veterinary science and medicine have led to a better understanding of pet nutrition and health. This has resulted in the creation of more specialized and effective pet supplements.

The pet supplements industry has benefited from regulatory support and standards that ensure the safety and efficacy of products. Clear regulations provide consumers with confidence in the products they purchase for their pets.

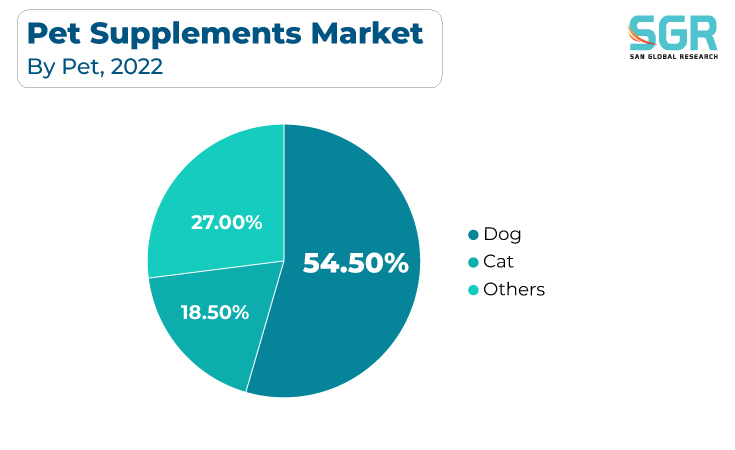

Pet Type Outlook

Based on Pet Type, the pet supplements market is segmented into Cat, Dogs and Others. Dogs segment accounted for largest share in 2022. Dog supplements cater to a wide range of health issues, including joint health, skin and coat care, digestive health, and immune system support. This diversity allows pet owners to choose supplements tailored to their dogs' specific needs. With advancements in veterinary care and nutrition, dogs are living longer. As dogs age, there is an increased demand for supplements that support joint health, cognitive function, and overall vitality.

Furthermore, Veterinarians play a crucial role in influencing pet owners' choices regarding supplements. Recommendations from veterinarians, based on the specific health needs of individual dogs, contribute significantly to the market growth. Additionally, the pet supplements market offers a diverse range of products, allowing pet owners to choose supplements tailored to their dogs' specific needs. This variety contributes to the overall appeal of the market.

The collective impact of these factors reflects the significant role that dogs play in propelling the growth of the pet supplements market. As the bond between humans and their pets continues to strengthen, the demand for high-quality supplements to support the health and well-being of dogs is likely to persist and expand.

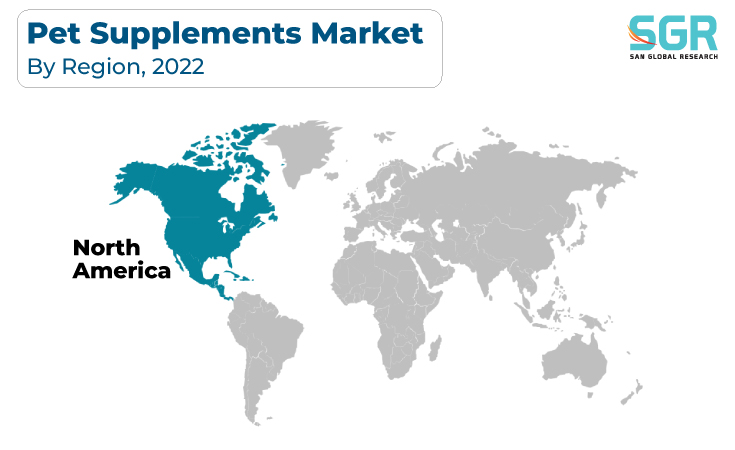

Regional Outlook

North America has emerged as leading market for pet supplements market in 2022. The North America region is a significant driver of growth North America has a large population of pet owners, with a high percentage of households having at least one pet. The sheer number of pets contributes to the demand for various pet-related products, including supplements. Pet owners in North America increasingly adopt a proactive approach to pet healthcare, emphasizing preventive measures. This trend has boosted the demand for supplements as a way to support pets' overall well-being and prevent health issues.

Moreover, North America has a well-developed pet care industry, including veterinary services, pet specialty stores, and online retail platforms. This infrastructure supports the accessibility and distribution of pet supplements. The prevalence of online retail and e-commerce platforms in North America has significantly contributed to the growth of the pet supplements market. Pet owners can easily access a wide range of products and make informed decisions through online channels.

The combination of these factors creates a favorable environment for the growth of the pet supplements market in North America.

Pet Supplements Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 1,910.00 Million |

| Forecast in 2030 | USD 3,019.51 Million |

| CAGR | CAGR of 5.9% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Pet Type, By Form |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | Nestlé Purina PetCare, Hill's Pet Nutrition, Inc., Nutramax Laboratories, Zoetis, VetriScience Laboratories, Virbac, Vitality Science, NaturVet, WellPet, Mars Petcare among others |

Global Pet Supplements Market, Report Segmentation

Pet Supplements Market, By Type

- Over-the-counter (OTC)

- Prescription

Pet Supplements Market, By Pet Type

- Dogs

- Cats

- Others

Pet Supplements Market, By Forms

- Pills/Tablets

- Powder

- Chewable

- Capsules

- Others

Pet Supplements Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355