Report Overview

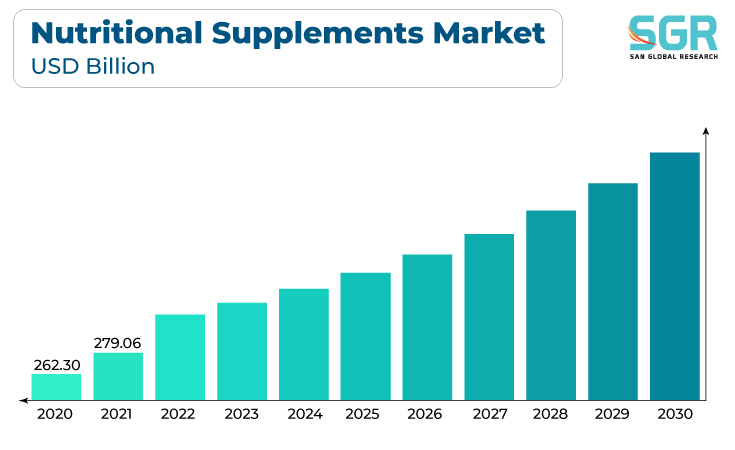

The nutritional supplements market was valued at 297.48 billion in 2022 and expected to grow at CAGR of 7.7% over forecast period.

Growing awareness about the importance of a healthy lifestyle and preventive healthcare encourages people to seek nutritional supplements. Easy access to information through the internet allows consumers to educate themselves about the benefits of specific nutrients and supplements.

Moreover, as the global population ages, there is an increased focus on products that support aging-related health issues, such as bone health, joint health, and cognitive function. Consumers are increasingly adopting a preventive approach to healthcare, seeking supplements to address nutritional gaps and reduce the risk of chronic diseases. The rise in fitness culture and sports participation contributes to the demand for supplements that enhance physical performance, muscle recovery, and overall fitness.

Consumers are looking for personalized nutrition plans, leading to the development of supplements tailored to specific needs, age groups, or health conditions. The growth of online retail platforms makes it convenient for consumers to access a wide variety of nutritional supplements, contributing to market expansion.

Product Type Outlook

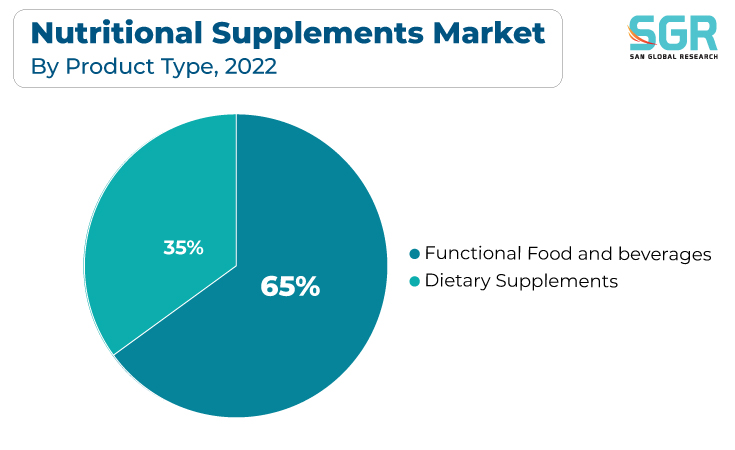

Based on product type, the nutritional supplements market is segmented into dietary supplements, and functional food and beverages. Functional food and beverages segment accounted for largest share in 2022. The growth of the nutritional supplement market is significantly influenced by the rise in demand for functional foods and beverages. This trend is driven by several factors that contribute to consumer preferences for products that offer health benefits beyond basic nutrition.

In addition, there is a growing awareness of the link between diet and health. Consumers are increasingly seeking products that not only provide basic nutrition but also offer additional health benefits. Functional foods and beverages often come in convenient formats suitable for on-the-go consumption. This aligns with the busy lifestyles of consumers, making it easier to incorporate supplements into their daily routines.

Functional foods and beverages are perceived as a part of a proactive approach to healthcare. Consumers are interested in products that can help prevent or manage health issues, contributing to the demand for nutritional supplements.

Regional Outlook

North America has emerged as leading market for nutritional supplements market in 2022. North America plays a pivotal role in driving the growth of the nutritional supplement market, and several factors contribute to its prominence in this industry. North America has witnessed a significant cultural shift towards health and wellness. Consumers in the region are increasingly health-conscious, leading to a heightened demand for nutritional supplements.

Furthermore, the population in North America has easy access to information through various channels, including the internet and social media. This facilitates informed decision-making, contributing to the rising awareness of the benefits of nutritional supplements.

With a growing emphasis on preventive healthcare, North American consumers are proactively seeking nutritional supplements to support overall well-being and address specific health concerns. The region has a large population of fitness enthusiasts and athletes who contribute significantly to the demand for sports nutrition supplements, including protein powders, amino acids, and other performance-enhancing products.

Nutritional supplements Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 297.48 Billion |

| Forecast in 2030 | USD 535.57 Billion |

| CAGR | CAGR of 7.7% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product Type, By Consumer Group, By Distribution channel |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Abbott Nutrition, Amway, Bayer HealthCare, Herbalife Nutrition, Glanbia Nutritionals, Nestlé Health Science, Nature's Bounty, NOW Foods, Nutraceutical Corporation, Otsuka Pharmaceutical Co., Ltd., Pfizer Consumer Healthcare, GNC (General Nutrition Centers), Vitabiotics among others |

Nutritional Supplements Market, Report Segmentation

Nutritional supplements Market, By Product Type

- Dietary Supplements

- Functional food and beverages

Nutritional supplements Market, By Consumer Group

- Infants

- Adults

Nutritional supplements Market, By Distribution Channel

- Direct

- Indirect

Nutritional Supplements Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355