Report Overview

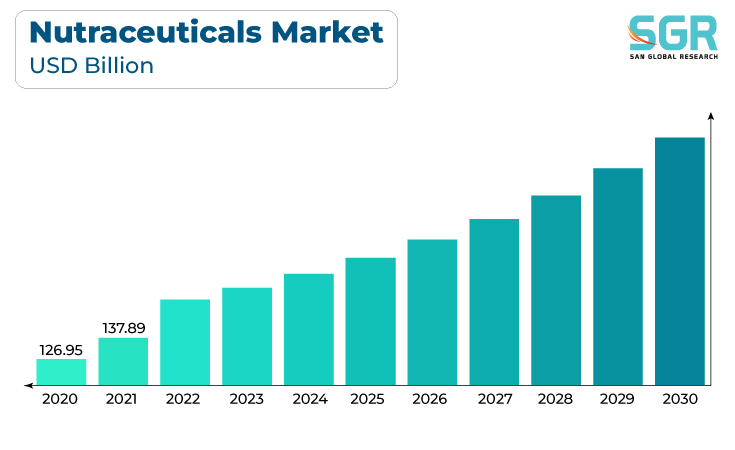

The nutraceuticals market was valued at 149.95 billion in 2022 and expected to grow at CAGR of 9.4% over forecast period.

Increasing consumer awareness of the importance of health and wellness is a major driver. People are becoming more proactive about their health and are seeking products that can help them achieve and maintain their well-being. As the global population ages, there is a growing demand for products that can help manage age-related health issues, such as joint health, cognitive function, and heart health. Nutraceuticals offer solutions to address these concerns.

Moreover, Nutraceuticals are often seen as a preventive measure to maintain health and reduce the risk of chronic diseases. Consumers are looking for products that can help them stay healthy and reduce healthcare costs in the long run.

Consumers are increasingly seeking products made from natural ingredients with minimal additives and preservatives. They are wary of synthetic chemicals and are drawn to clean-label products.

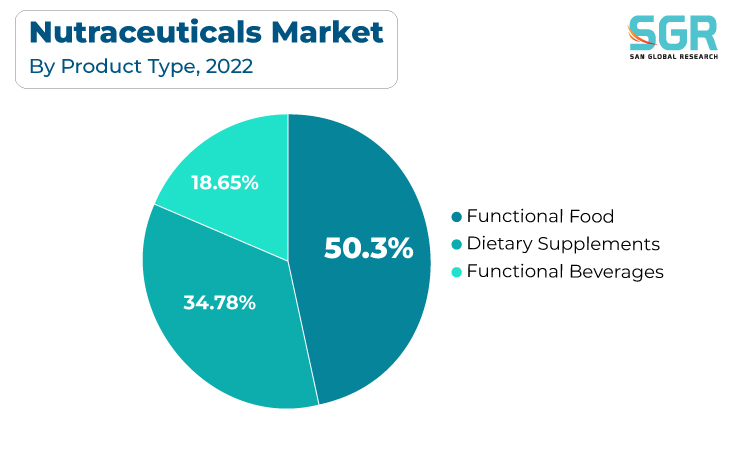

Product Type Outlook

Based on product type, the nutraceuticals market is segmented into Dietary Supplements, Functional Foods, Functional Beverages. Functional Foods segment accounted for largest share in 2022. The growth of the nutraceutical market is closely linked to the popularity of functional foods. These foods cater to consumer demand for health and wellness, offering convenience and a wide range of options to address specific health concerns. As consumer awareness and interest in functional foods continue to grow, the nutraceutical market is likely to expand further. Moreover, Consumers are increasingly seeking foods that offer health benefits. They are more health-conscious and aware of the link between diet and well-being. Functional foods, which are marketed as health-enhancing products, align with this growing consumer trend.

Regional Outlook

North America has emerged as leading market for nutraceuticals market in 2022. the North American market serves as a major driver of growth in the nutraceutical industry due to its large and health-conscious consumer base, supportive regulatory environment, research and innovation efforts, and well-established distribution channels. The region's influence extends beyond its borders, shaping trends and developments in the global nutraceutical market. Also, there is a high level of awareness among North American consumers about the importance of a healthy lifestyle and the role of nutrition in maintaining good health. This awareness drives demand for nutraceutical products.

Nutraceuticals Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 149.95 Billion |

| Forecast in 2030 | USD 306.06 Billion |

| CAGR | CAGR of 9.4% from 2023 to 2030 |

| Base Year of F2022orecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Distribution Channel, By Product Type |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | Nestlé Health Science, Danone Nutricia, Abbott Laboratories, Amway, Herbalife Nutrition, GNC Holdings, Glanbia Nutritionals, ADM, Kerry Group, NOW Foods among others |

Global Nutraceuticals Market, Report Segmentation

Nutraceuticals Market, By Distribution Channel

- Direct

- Indirect

Nutraceuticals Market, By Product Type

- Functional Foods

- Dietary Supplements

- Functional Beverages

Nutraceuticals Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355