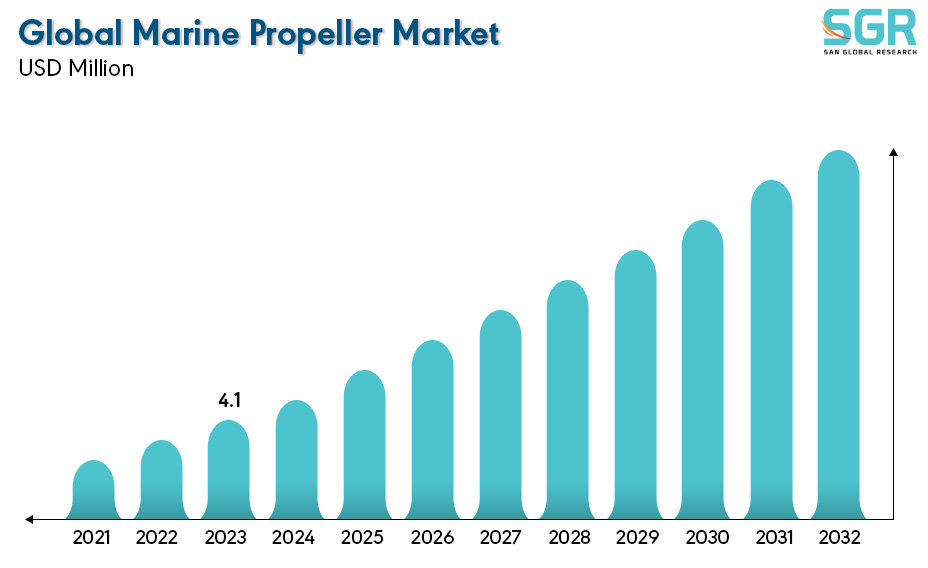

Global Marine Propeller Market is estimated to be worth USD 4.1 Billion in 2022 and is projected to grow at a CAGR of 5.1% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Propeller Type, by, by Number of Blades, by Application, by Sales Channel and by region/country.

The global marine propeller market serves as a crucial segment within the maritime industry, providing propulsion systems essential for various types of vessels, including cargo ships, container ships, cruise liners, tankers, and naval vessels. Marine propellers are vital components that convert engine power into thrust, propelling ships through water. The market encompasses a diverse range of propeller types, including fixed-pitch propellers, controllable-pitch propellers (CPP), and azimuth thrusters, each catering to specific vessel requirements and operational needs. Factors such as the burgeoning global trade, the expansion of the shipping industry, and the growing demand for energy-efficient propulsion systems drive the market. Moreover, technological advancements, such as the integration of computational fluid dynamics (CFD) and advanced materials in propeller designs, aim to enhance fuel efficiency, reduce emissions, and improve maneuverability for vessels, fostering continuous innovation within the global marine propeller market. Geographically, regions with significant maritime activity, such as Asia-Pacific, Europe, and North America, contribute significantly to the growth and evolution of this market, driven by evolving regulations and the need for enhanced vessel performance and sustainability. Overall, the global marine propeller market plays a pivotal role in shaping the efficiency and capabilities of marine transportation systems worldwide.

.jpg)

Region wise Comparison:

Europe, with countries like Germany, Norway, and the Netherlands, boasts a strong presence in the marine industry and technological innovation. The region focuses on developing advanced and energy-efficient propulsion systems, including controllable-pitch propellers and innovative thruster technologies. Stricter environmental regulations drive the market towards more eco-friendly and fuel-efficient propeller designs.

North America, particularly the United States and Canada, plays a significant role in the marine propeller market, primarily driven by the shipping industry, naval fleets, and offshore activities. The region emphasizes the development of advanced propulsion systems for military vessels, commercial shipping, and offshore operations, focusing on efficiency and sustainability.

_Map.jpg)

The Asia-Pacific region, particularly countries like China, South Korea, and Japan, stands out as a significant contributor to the global marine propeller market. These countries are major shipbuilding hubs, driving the demand for various types of marine propellers. Rapid industrialization, increased seaborne trade, and the expansion of the shipping industry in this region contribute to the growth of the market.

Latin America contributes to the marine propeller market, albeit with varying growth rates across different countries. Countries like Brazil and Chile have active maritime industries, influencing the demand for marine propulsion systems, primarily in fishing, transportation, and offshore sectors.

Africa and the Middle East regions have smaller shares in the global marine propeller market. However, countries with substantial maritime activities and ports, such as South Africa and the UAE, play roles in the demand for marine propulsion systems, particularly in commercial shipping and offshore industries.

.jpg)

Segmentation:

The Global Marine Propeller Market is segmented by Propeller Type, by, by Number of Blades, by Application, by Sales Channel and by region/country.

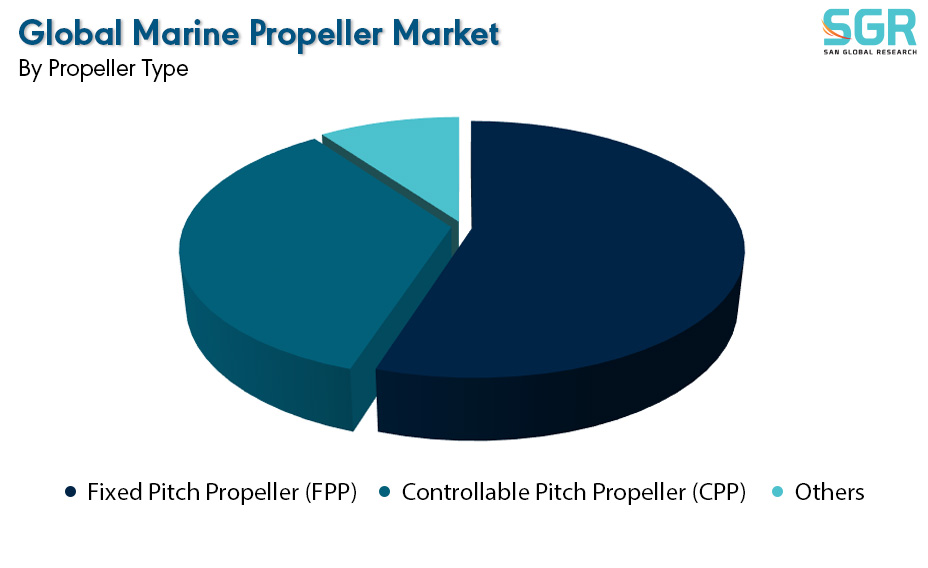

By Propeller Type:

Based on Propeller Type, the Global Marine Propeller Market is bifurcated into Fixed Pitch Propeller (FPP) and Controllable Pitch Propeller (CPP), and Others – where FPP are dominating and ahead in terms of share.

Fixed Pitch Propellers (FPPs) represent a fundamental and traditional type of marine propeller widely used in various vessels across the global maritime industry. FPPs feature a fixed blade angle that remains constant during operation, providing simple and reliable propulsion. These propellers are commonly found in smaller vessels, such as pleasure crafts, fishing boats, and some commercial vessels. They are relatively cost-effective and straightforward in design, comprising a hub and a set of fixed blades that generate forward thrust when rotated by the ship's engine. While offering simplicity and ease of maintenance, FPPs might lack the efficiency and maneuverability compared to more advanced propeller systems.

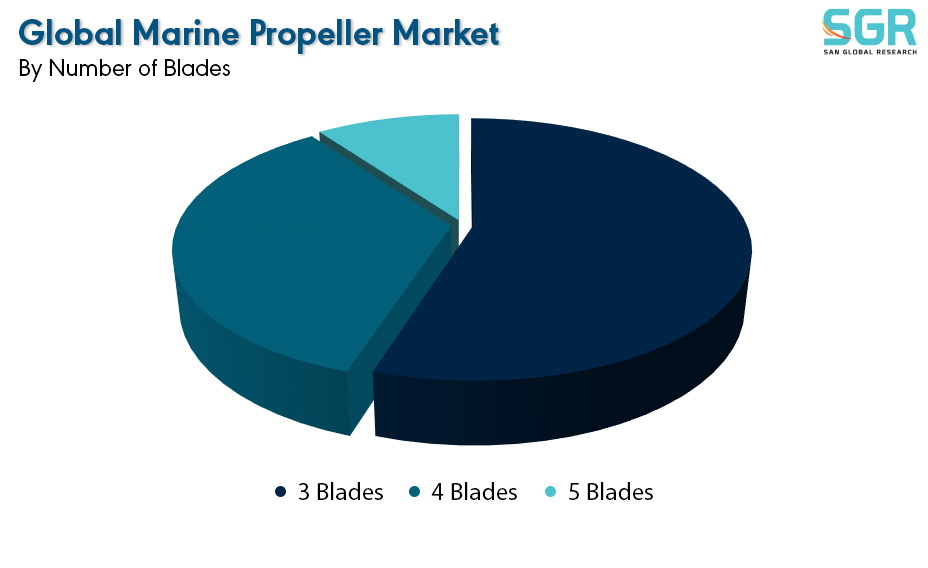

By Number of Blades:

Based on the Blades, the Global Marine Propeller Market is bifurcated into 3 Blades, 4 Blades & 5 Blades – where 3 Blades is dominating and ahead in terms of share.

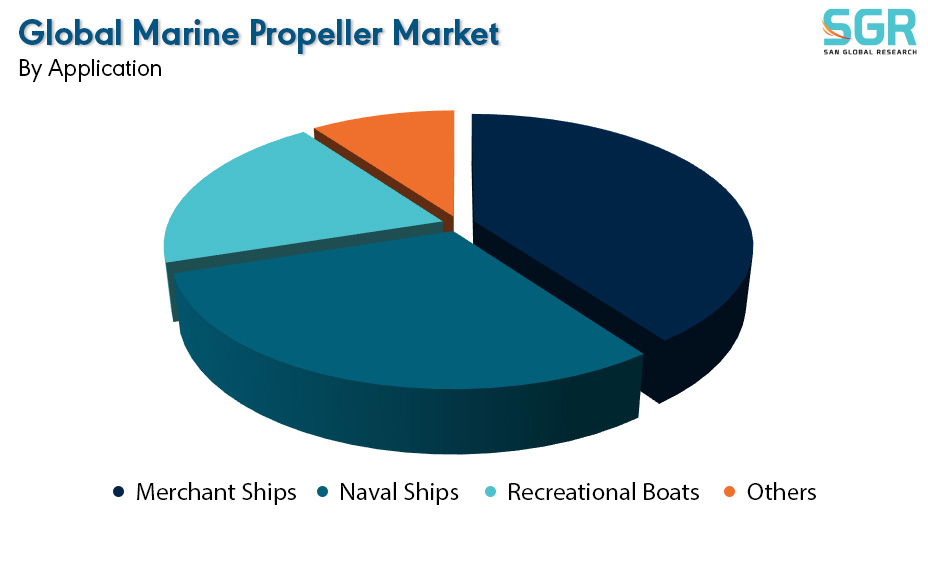

By Application:

Based on the Application Type, the Global Marine Propeller Market is bifurcated into Merchant Ships, Naval Ships, Recreational Boats, and Others – where Merchant Ships is dominating and ahead in terms of share.

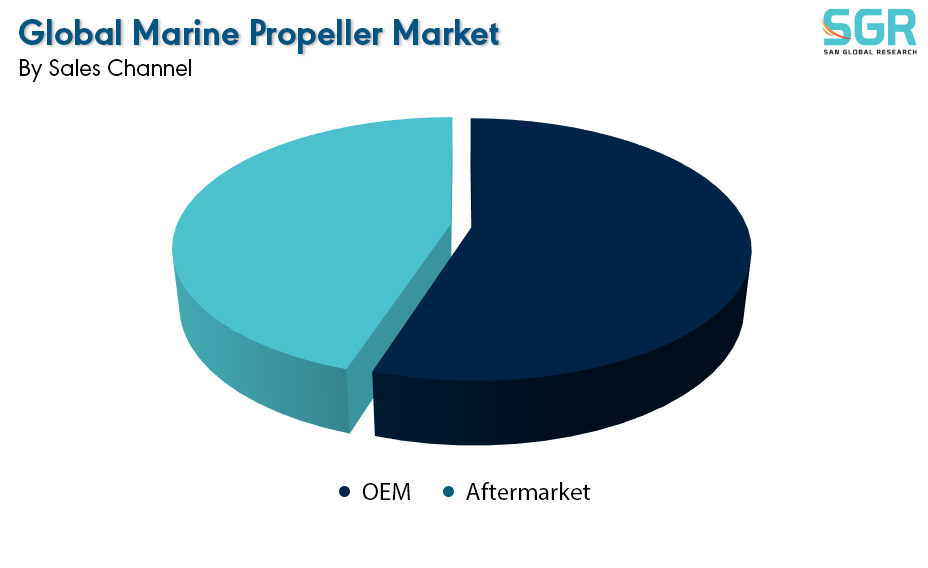

By Sales Channel:

Based on the Sales Channel, the Global Marine Propeller Market is bifurcated into OEM & Aftermarket – where OEM is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the Global Marine Propeller Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Global Marine Propeller Market include

• AB Volvo

• Brunswick Corporation

• Kawasaki Heavy Industries, Ltd.

• KSOE (Hyundai Heavy Industries Co., Ltd.)

• MAN Energy Solutions

• Nakashima Propeller Co., Ltd.

• Rolls-Royce Plc

• Schottel Group

• VEEM Ltd.

• Wartsila Oyj Abp

Drivers:

Growing sector across the globe

The global marine propeller market is primarily driven by several key factors that influence the demand for propulsion systems across the maritime industry. One of the primary drivers is the constant growth in global seaborne trade and shipping activities, which necessitates efficient and reliable propulsion systems for various vessels, including cargo ships, tankers, and container vessels. Additionally, the surge in maritime tourism and the increasing demand for cruise ships contribute to the market growth, requiring propulsion systems that offer not only efficiency but also reduced noise and vibration for passenger comfort. Moreover, stringent environmental regulations aimed at reducing emissions drive the need for more fuel-efficient and eco-friendly propulsion systems, encouraging the development of innovative marine propeller technologies. Furthermore, ongoing technological advancements in materials, hydrodynamics, and propulsion systems contribute to improved efficiency, reduced fuel consumption, and enhanced vessel maneuverability, further stimulating the marine propeller market globally.

Opportunity:

Evolving Market

The global marine propeller market presents several opportunities arising from evolving trends and technological advancements within the maritime industry. One significant opportunity lies in the development of more efficient and environmentally friendly propulsion systems. The growing focus on reducing emissions and enhancing fuel efficiency offers avenues for innovative propeller designs, materials, and propulsion technologies. Additionally, the increasing adoption of renewable energy sources, such as hybrid or electric propulsion systems in vessels, creates opportunities for marine propeller manufacturers to design systems that integrate seamlessly with these alternative power sources, aiming for cleaner and more sustainable maritime transportation. Furthermore, the expanding market for naval vessels and offshore platforms, driven by security concerns and oil exploration activities, presents prospects for specialized propulsion systems designed for high-performance and reliability in harsh marine environments. Moreover, the need for advanced propulsion systems that enhance vessel maneuverability and reduce noise and vibration levels in passenger ships or luxury yachts offers another niche opportunity in the marine propeller market. Overall, these opportunities signal a promising landscape for technological advancements and innovation within the global marine propeller market, catering to diverse needs and driving sustainable growth within the maritime industry.

| Report Attribute | Details |

| Market Value in 2022 | 4.1 Billion |

| Forecast in 2032 | 6.8 Billion |

| CAGR | CAGR of 5.1% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Propeller Type, By Number of Blades, By Application, By Sales Channel |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • AB Volvo • Brunswick Corporation • Kawasaki Heavy Industries, Ltd. • KSOE (Hyundai Heavy Industries Co., Ltd.) • MAN Energy Solutions • Nakashima Propeller Co., Ltd. • Rolls-Royce Plc • Schottel Group • VEEM Ltd. • Wartsila Oyj Abp |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355