Report Overview

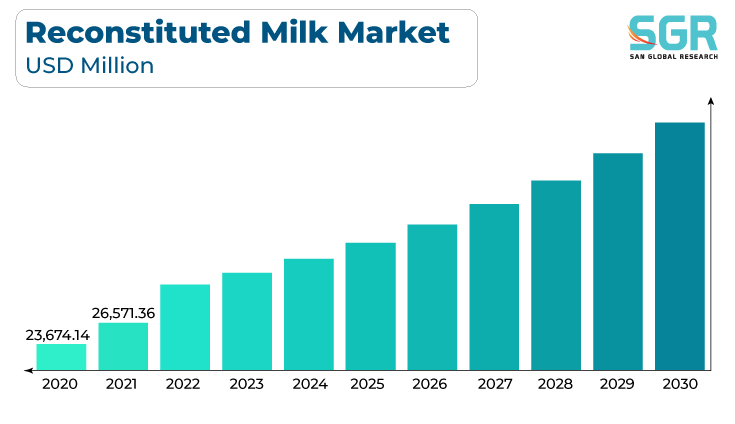

The reconstituted milk market was valued at 29,855.21 million in 2022 and expected to grow at CAGR of 13.1% over forecast period.

Reconstituted milk, also known as recombined or reconstituted milk, refers to milk that is made by recombining milk constituents such as milk solids and water after the removal of water from milk.One of the primary drivers for the use of reconstituted milk is its cost-effectiveness. The process of reconstitution allows for the removal of water from milk, reducing transportation costs as the weight of the final product is lower. This can be particularly important in regions where transportation costs are a significant factor.

Reconstituted milk can have a longer shelf life compared to fresh milk. The removal of water helps in reducing the microbial activity and slows down the spoilage process. This extended shelf life can be advantageous for both producers and consumers, especially in areas with limited access to refrigeration.

The production of reconstituted milk allows for better supply chain management. It provides flexibility in storage and distribution, enabling a more efficient supply chain, which is crucial in regions with challenging logistics.

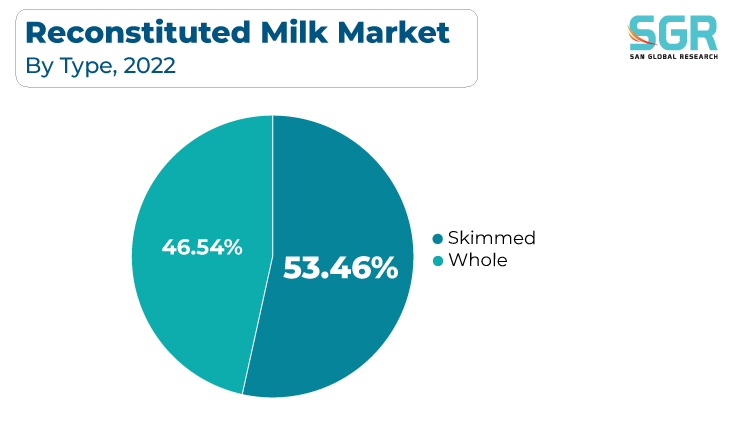

Type Outlook

Based on type, the reconstituted milk marketis segmented into skimmed and whole.Skimmed segment accounted for largest share in 2022.Skimmed milk is processed to remove most or all of its fat content. This makes it a preferred choice for health-conscious consumers who seek lower-fat alternatives. The availability of skimmed milk as a starting ingredient for reconstituted milk meets the demand for healthier dairy options.

Skimmed milk retains the nutritional benefits of milk, such as protein, vitamins, and minerals, while significantly reducing the fat content. The nutritional profile makes skimmed milk a valuable component in the production of reconstituted milk, offering a balance between health-conscious choices and essential nutrients.

Thus, the preference for skimmed milk as a healthier and versatile dairy option has been a key driver in the growth of reconstituted milk. The ability of skimmed milk to meet both nutritional and dietary preferences contributes to its role as a foundational ingredient in the expanding market for reconstituted milk.

Regional Outlook

Asia-Pacifichas emerged as leading market for reconstituted milk market in 2022. The Asia-Pacific region has experienced rapid population growth and urbanization. As urban populations increase, there is a higher demand for processed and convenient food products, including reconstituted milk. The convenience and longer shelf life of reconstituted milk make it appealing in urban settings.

Furthermore,changing lifestyles, with an increasing number of people leading busier lives, have led to a greater demand for convenient and ready-to-use food products. Reconstituted milk fits well into this trend, providing a convenient dairy option for consumers with hectic schedules.

With an increasing focus on health and nutrition, consumers in the Asia-Pacific region are seeking dairy products that align with their health goals. Reconstituted milk, particularly formulations with reduced fat content or fortified with additional nutrients, appeals to health-conscious consumers.

Milk Reconstituted Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD29,855.21 Million |

| Forecast in 2030 | USD78,917.72 Million |

| CAGR | CAGR of 13.1% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Application, By Distribution Channel |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Nestlé, Fonterra Co-operative Group, Danone, Arla Foods, Amul, Lactalis, Saputo Inc, FrieslandCampina, Glanbia plc among others |

Milk Reconstituted Market, Report Segmentation

Milk Reconstituted Market, By Type

- Skimmed

- Whole

Milk Reconstituted Market, By Application

- Milk

- Yogurt

- Cheese

- Other

Milk Reconstituted Market, By Distribution Channel

- B2B

- B2C

Milk Reconstituted Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355