Report Overview

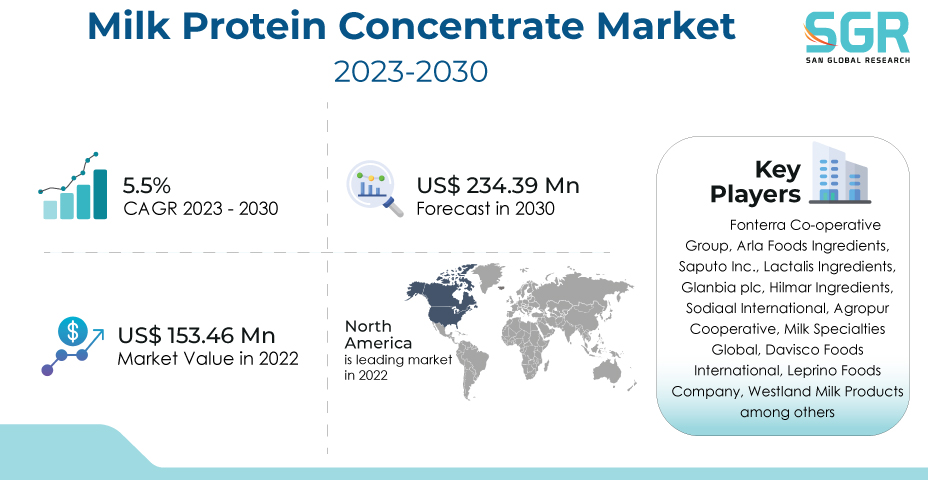

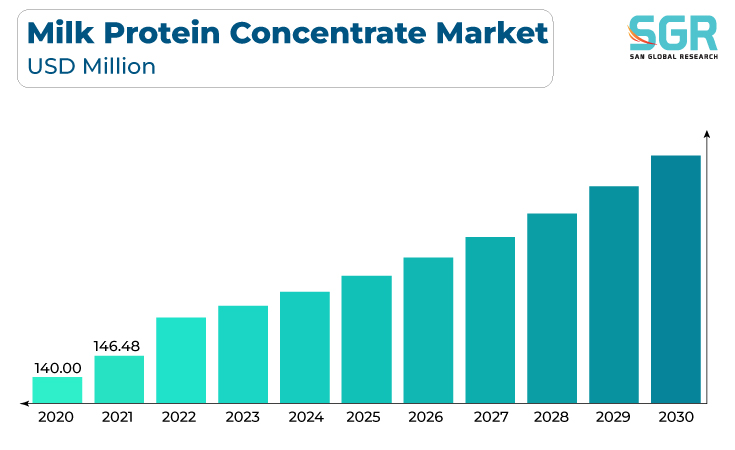

The milk protein concentrate market was valued at 153.46 million in 2022 and expected to grow at CAGR of 5.5% over forecast period.

Increasing awareness of the importance of protein in a balanced diet has led to a rising demand for high-protein products, including milk protein concentrates.Milk protein concentrates offer functional properties such as emulsification and texturization, making them valuable ingredients in food processing, especially in the production of dairy and non-dairy products.

The emphasis on health and fitness, along with the demand for sports nutrition products, has contributed to the increased use of milk protein concentrates in protein supplements and sports beverages.The versatility of milk protein concentrates allows their incorporation into a wide range of food and beverage products, including bakery items, dairy products, and nutritional supplements.

Moreover, consumer preferences for nutrient-rich and functional foods drive the use of milk protein concentrates as ingredients that enhance the nutritional profile of various products.The growth of the plant-based and alternative dairy market has led to the development of plant-based products that utilize milk protein concentrates to enhance texture and nutritional content.

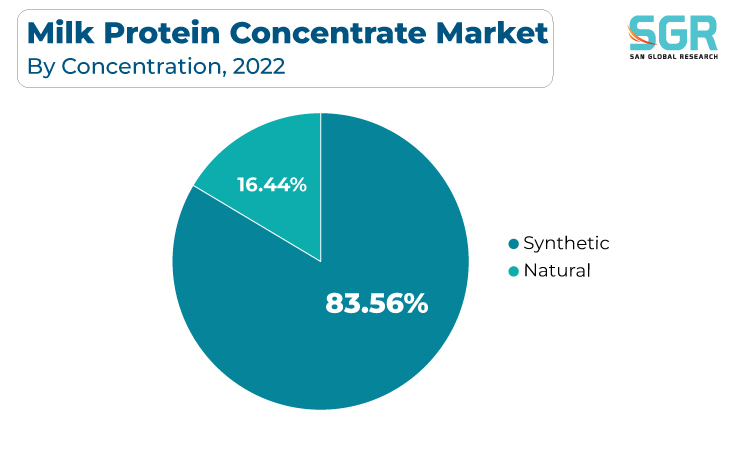

Concentration Outlook

Based on concentration, the milk protein concentratemarketis segmented intolow, medium and high.lowsegmentaccounted for largest share in 2022.As health-conscious consumers seek low-fat and reduced-calorie options, low protein milk concentrates align with these preferences. They offer a source of dairy protein with lower fat content.

In addition, low protein milk concentrates are often used in products designed for weight management and fitness. The emphasis on protein intake for muscle building and weight loss supports their inclusion in dietary plans.Low protein milk concentrates find applications in various functional food products such as protein bars, shakes, and baked goods, contributing to their versatility and market demand.

Consumers seeking clean label and minimally processed products appreciate low protein milk concentrates for their simplicity and natural origin, contributing to their use in natural and organic products.Low protein milk concentrates are sometimes used in plant-based dairy alternatives to enhance texture and nutritional content, catering to the growing market of consumers seeking non-dairy options.

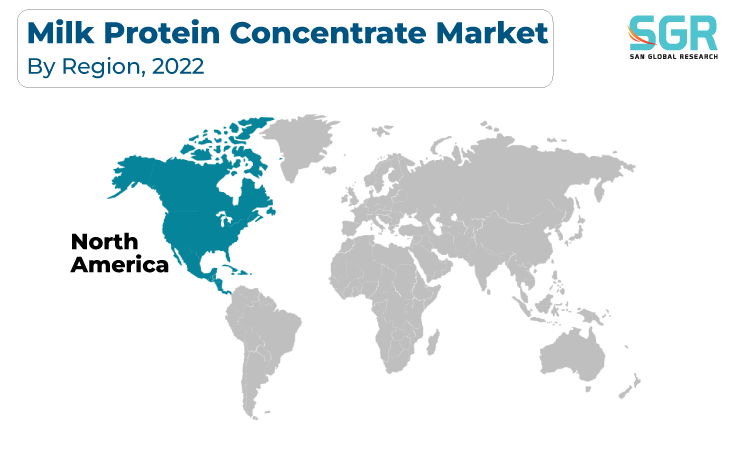

Regional Outlook

North America has emerged as leading market for milk protein concentrate market in 2022. North American consumers exhibit a high demand for milk concentrates due to their diverse applications in the food and beverage industry, including dairy products, bakery items, and confectionery.With a growing emphasis on health and wellness, there is an increased demand for protein-fortified products. Milk concentrates, being a rich source of proteins, align with these consumer preferences.

Furthermore,the prevalence of fitness culture in North America contributes to the demand for milk concentrates in sports nutrition products, including protein shakes and bars, catering to the needs of athletes and fitness enthusiasts.

The well-established and growing processed food industry in North America utilizes milk concentrates for their convenience in formulation, improving the texture, taste, and nutritional content of a wide range of products.The robust dairy industry in North America plays a significant role in driving the market for milk concentrates. These concentrates are used to create value-added dairy products, contributing to the overall growth of the sector.

Milk Protein Concentrate Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD153.46Million |

| Forecast in 2030 | USD234.39Million |

| CAGR | CAGR of 5.5% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Application, By Concentration |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Fonterra Co-operative Group, Arla Foods Ingredients, Saputo Inc., Lactalis Ingredients, Glanbia plc, Hilmar Ingredients, Sodiaal International, Agropur Cooperative, Milk Specialties Global, Davisco Foods International, Leprino Foods Company, Westland Milk Products among others |

Milk Protein Concentrate Market, Report Segmentation

Milk Protein Concentrate Market, By Application

- Packaged Products

- Nutritional Products

- nfant Formula

- Others

Milk Protein Concentrate Market, By Concentration

- Low

- Medium

- High

Milk Protein Concentrate Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355