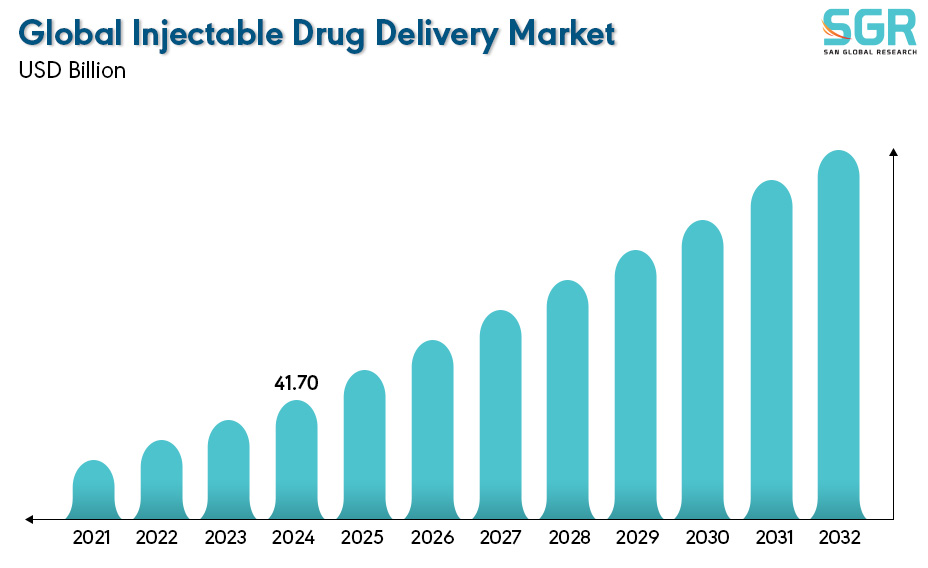

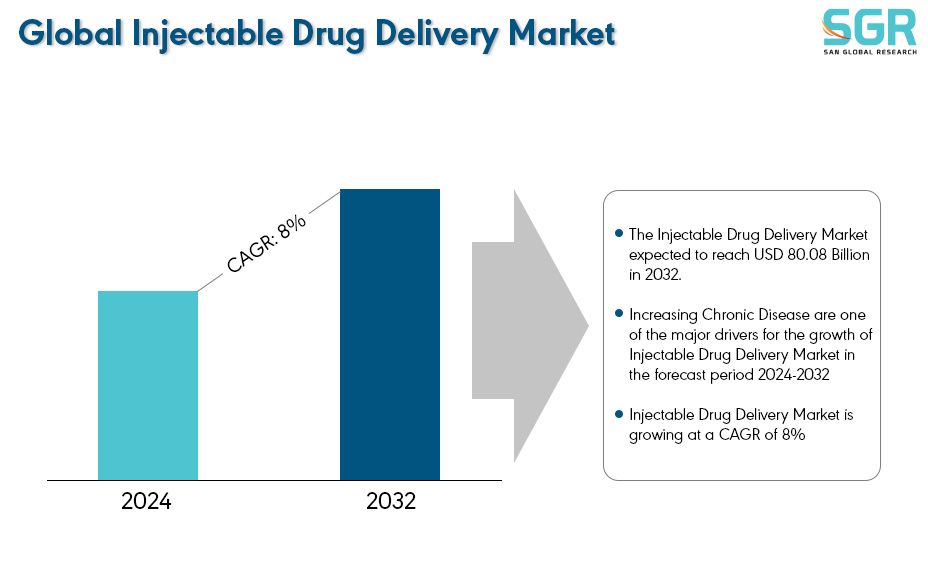

Global Injectable Drug Delivery Market is estimated to be worth USD 41.70 Billion in 2024 and is projected to grow at a CAGR of 8% between 2024 to 2032.

The study has considered the base year as 2023, which estimates the market size of the market, and the forecast period is 2024 to 2032. The report analyses and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Product, by Application, by End User, and by region/country.

The injectable drug delivery system market is a rapidly growing sector within the healthcare industry. It encompasses the development, manufacturing, and distribution of devices and formulations used to administer medications directly into the body through injections. Considering the key characteristics regarding the injectable drug delivery systems are as follows; they are very reliable and accurate the medication delivered are precise to the target site.

Which is fast acting and can deliver medication directly into the blood stream for rapid action, which is very versatile which are suitable for administering a wide range of drugs including biologics, vaccines and small molecules. After reviewing the data shown below, it can be determined that the North America region dominates the Injectable Drug Delivery Market for the following reasons.

The North American region is dominating the Injectable Delivery Market due to the significant increasing of the chronic disease within the geographical region. For instance, according to the report published by the National Diabetics Statistics Report 2022, which was documented on 2019, Over 37 million Americans, or 11.3% of the population, have diabetes. Alarmingly, 8.5 million adults with diabetes (a concerning 23%) are unaware of their condition. The prevalence climbs even higher for seniors, with nearly 29.2% of those over 65 living with diabetes. Due to this chronic disease the region is significantly dominating.

Segmentations

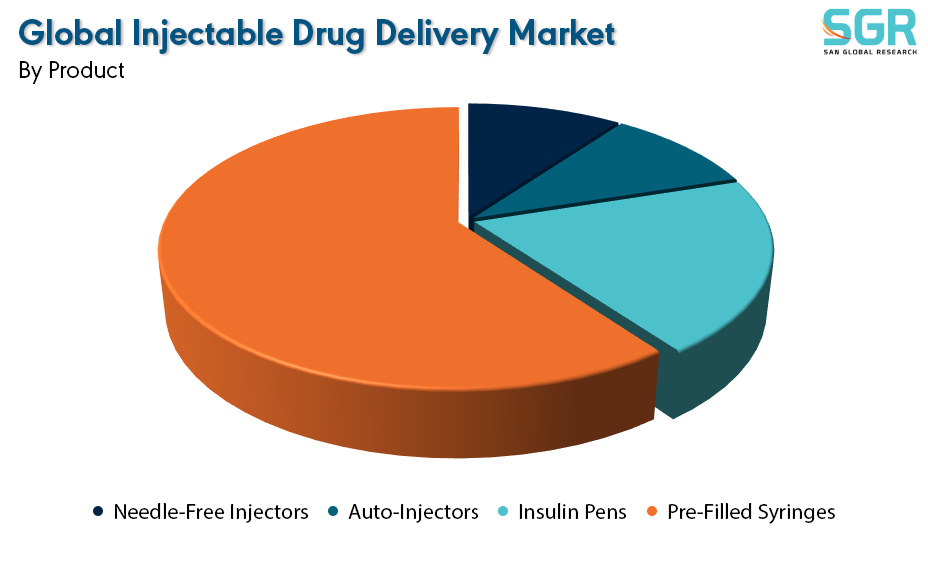

By Product

Based on Product, the Injectable Drug Delivery Market is bifurcated into Needle-Free Injectors, Auto-Injectors, Insulin Pens and Pre-Filled Syringes– where Pre-Filled Syringes segment is dominating and ahead in terms of share. The Pre-Filled Syringes segment is dominating the Product segment within the Injectable Drug Delivery Market significantly. The widespread adoption of prefilled syringes is expected to continue. For pharmaceutical companies, these prefilled options offer several advantages: reduced drug waste, extended product shelf life, and potentially increased market share. Healthcare professionals appreciate their efficiency, reliability, and convenience for administering medications. Moreover, prefilled syringes empower patients to self-administer many injectable drugs at home, shifting treatment settings from hospitals to more comfortable home environments. This trend is supported by research highlighting the numerous benefits of prefilled syringes, including their ease of use, suitability for home settings, minimized medication waste, and precise dosing. Their convenience simplifies the administration process for both patients and healthcare providers, eliminating the need for transferring medication from vials and minimizing wasted doses.

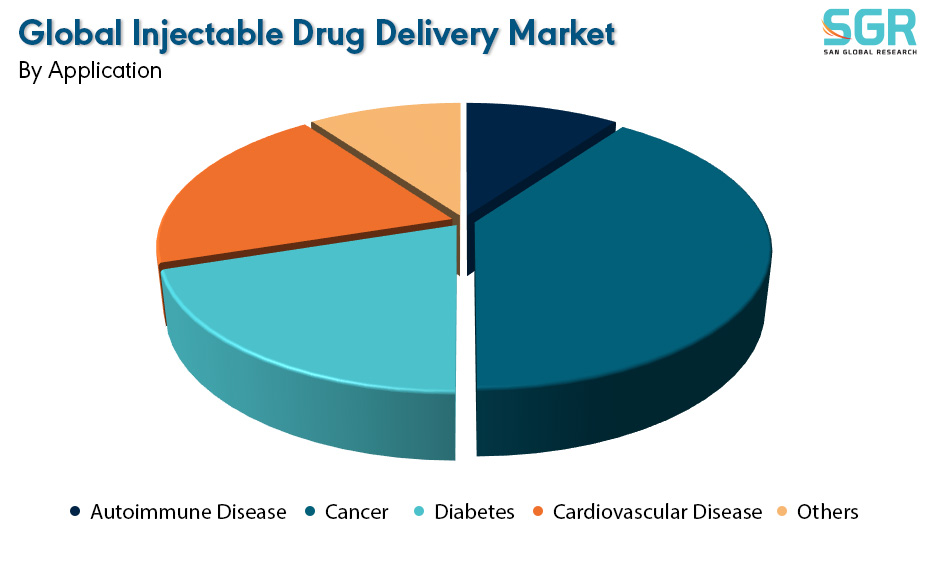

By Application

Based on Application, the Injectable Drug Delivery Market is bifurcated into Autoimmune Disease, Cancer, Diabetes, Cardiovascular Disease and Others– where Cancer segment is dominating and ahead in terms of share.

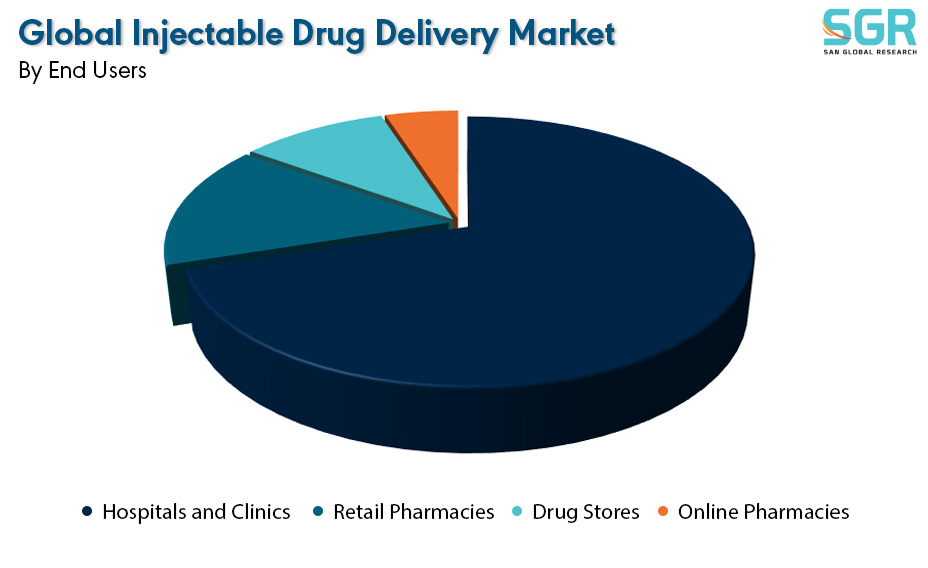

By End Users

Based on End Users, the Injectable Drug Delivery Market is bifurcated into Hospitals and Clinics, Retail Pharmacies, Drug Stores and Online Pharmacies– where Hospitals and Clinics segment is dominating and ahead in terms of share.

Key Players

• Pfizer Inc.

• Novartis AG

• Eli Lilly and Company

• Novo Nordisk A/S

• GlaxoSmithKline plc

Drivers

Increasing Prevalence of Chronic Disease

The increasing prevalence of chronic diseases have been a significant market growth driver for the Injectable Drug Delivery Market. As increasing incidence of the chronic diseases requires frequent medications through the injections. Certain diabetes requires frequent insulin injections as a treatment to the individual. For instance, according to the article published by the PubMed on April 2024, Bladder cancer ranked as the world's seventh most prevalent cancer in 2020, with over 1.7 million cases having a 5-year prevalence.

Opportunity

INNOVATIONS

Injectable medications, delivered via subcutaneous, intramuscular, or intravenous routes, are crucial for administering essential drugs. Advancements in controlled-release formulations, biodegradable polymers, and microneedle technologies have significantly enhanced the accuracy and safety of injectable drug delivery. These innovations contribute to improved patient compliance, reduced side effects, and the ability to customize drug release profiles to fit specific treatment needs. These innovations have opened up new market growth opportunity for the Injectable Drug Delivery Market.

| Report Attribute | Details |

| Market Value in 2024 | 41.70 Billion |

| Forecast in 2032 | 80.08 Billion |

| CAGR | CAGR of 8% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | by Product, by Application, by End User |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Pfizer Inc. • Novartis AG • Eli Lilly and Company • Novo Nordisk A/S • GlaxoSmithKline plc |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355