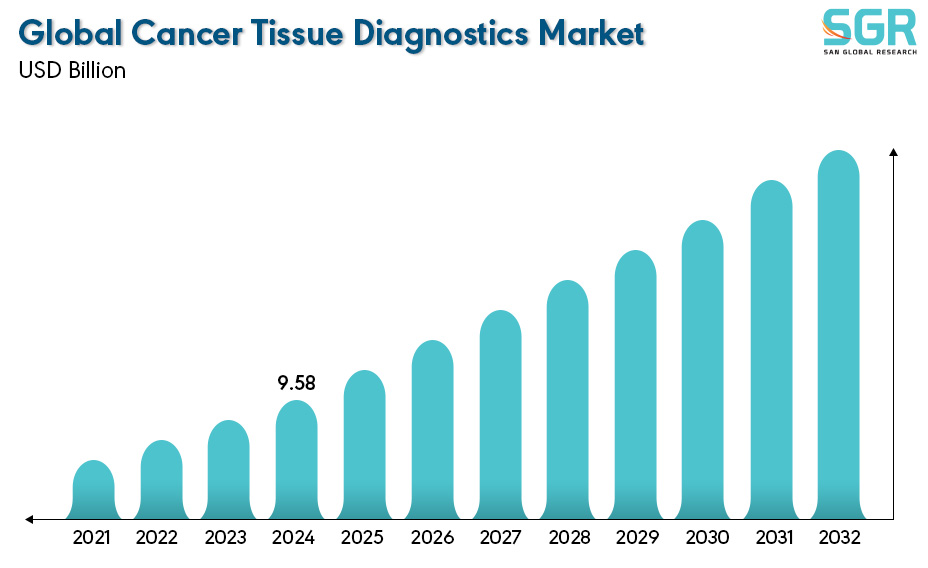

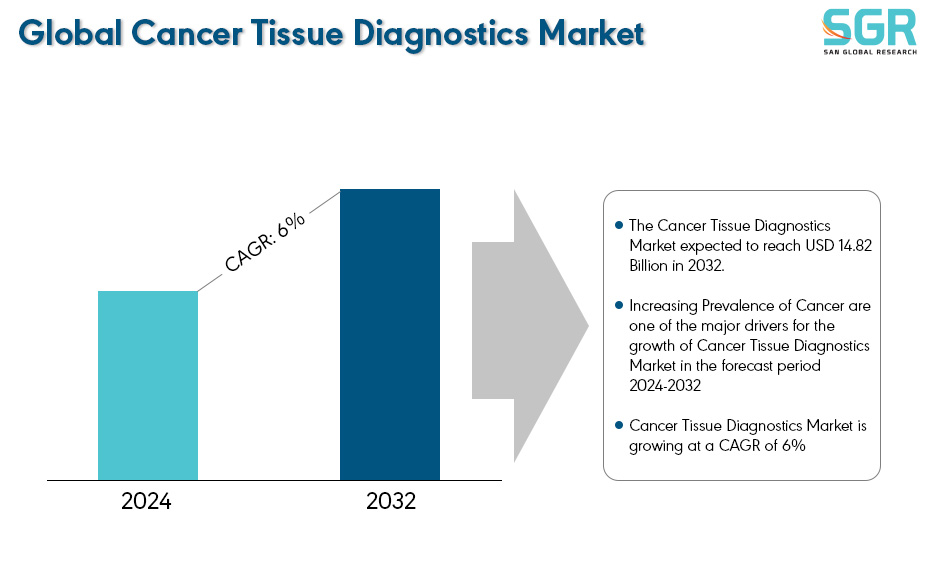

Cancer Tissue Diagnostics Market is estimated to be worth USD 9.58 Billion in 2024 and is projected to grow at a CAGR of 6% between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of the market, and the forecast period is 2024 to 2032. The report analyses and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Product, by Technology, by Application, by End User and by region/country.

Fuelled by its role in personalized cancer care, the cancer tissue diagnostics market is experiencing significant growth. Analysis of tissue samples allows for not just cancer diagnosis, but pinpointing the exact type for tailored treatment plans. This precise identification directly impacts patient outcomes. Several factors are fuelling this market growth. First, the rising global cancer burden translates to a surge in demand for accurate and timely diagnoses. Second, advancements like digital pathology and companion diagnostics are revolutionizing the field.

Digital pathology streamlines analysis with digital scans, while companion diagnostics ensure patients receive the most effective treatments based on their unique cancer profile. Finally, the growing emphasis on personalized medicine creates a strong demand for detailed tissue diagnostics, further propelling the market forward. As a result, the cancer tissue diagnostics market is anticipated to reach new heights in the coming years.

After reviewing the data shown below, it can be determined that the North America region dominates the Cancer Tissue Diagnostics Market for the following reasons.

North America currently dominates the cancer tissue diagnostics market due to several factors. Firstly, the region boasts established healthcare infrastructure with well-equipped hospitals and laboratories, fostering the adoption of advanced diagnostic tools. Secondly, countries in North America dedicate a larger portion of their GDP to healthcare. For instance, according to the data published by the Centres for Medicare & Medicaid Services, by an estimation by the National Health Expenditure Accounts, in 2022, the United States spent a record $4.5 trillion on healthcare, a 4.1% increase from the previous year. This translates to an average cost of $13,493 per person. Despite the growth, the healthcare sector's share of the national economy (GDP) actually dipped slightly to 17.3%, compared to a peak of 19.5% in 2020. Finally, the rising burden of cancer in North America necessitates a robust infrastructure for accurate and timely diagnoses, further propelling market growth. These factors collectively position North America as the leader in the cancer tissue diagnostics market.

Segmentations

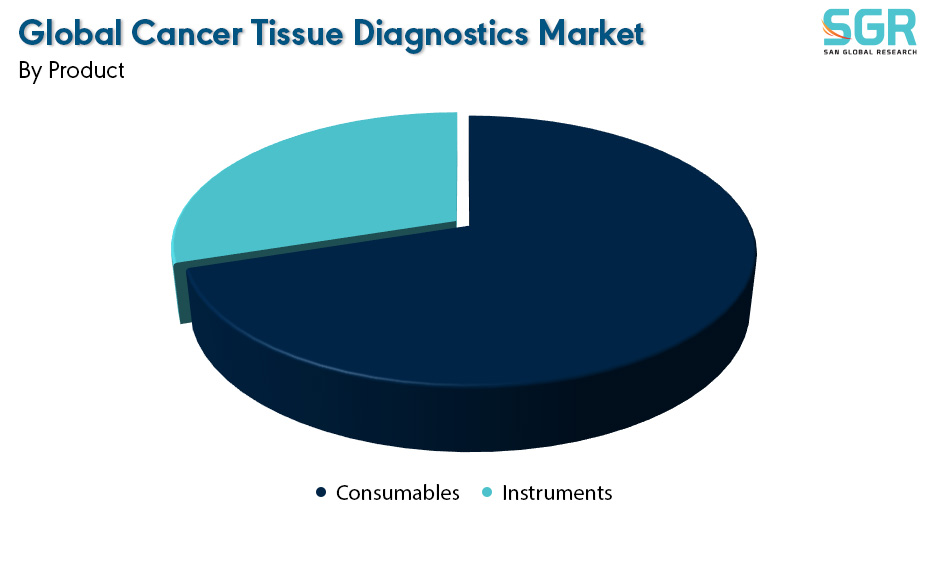

By Product

Based on Product, the Cancer Tissue Diagnostics Market is bifurcated into Consumables and Instruments– where Consumables segment is dominating and ahead in terms of share.

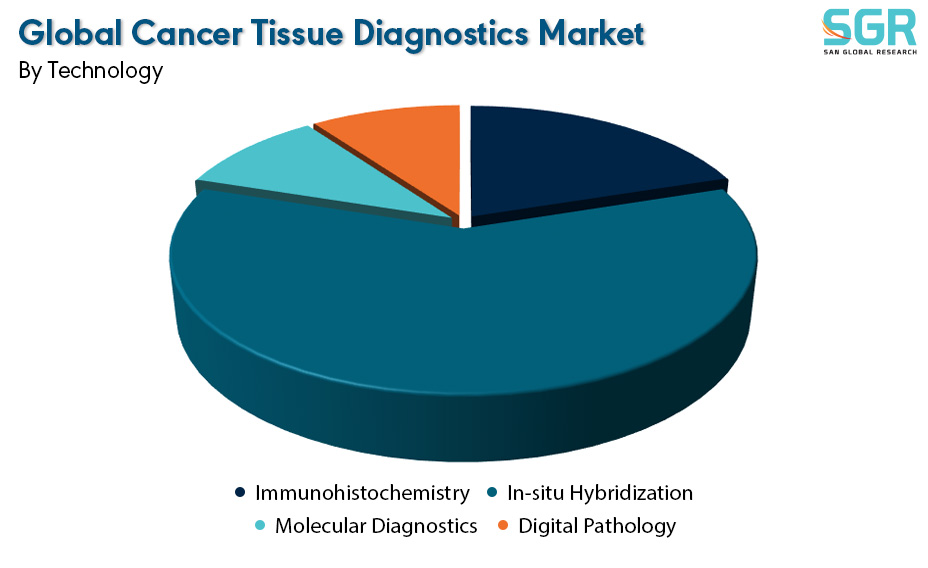

By Technology

Based on Technology, the Cancer Tissue Diagnostics is bifurcated into Immunohistochemistry, In-situ Hybridization, Molecular Diagnostics and Digital Pathology– where In-situ Hybridization segment is dominating and ahead in terms of share. In- Situ Hybridization is dominating the technology segment within the Cancer Tissue Diagnostics market. In-Situ Hybridization targets specific DNA or RNA sequences within cells. They can help determine if a patient’s tumour is likely to respond to specific targeted therapies.

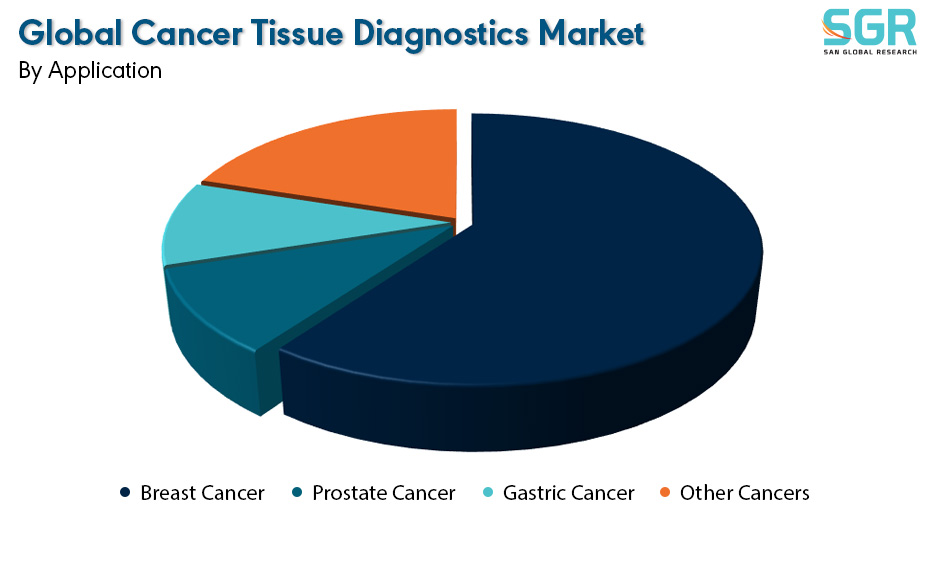

By Application

Based on Application, the Cancer Tissue Diagnostics is bifurcated into Breast Cancer, Prostate Cancer, Gastric Cancer and Other Cancers– where In-situ Breast Cancer segment is dominating and ahead in terms of share.

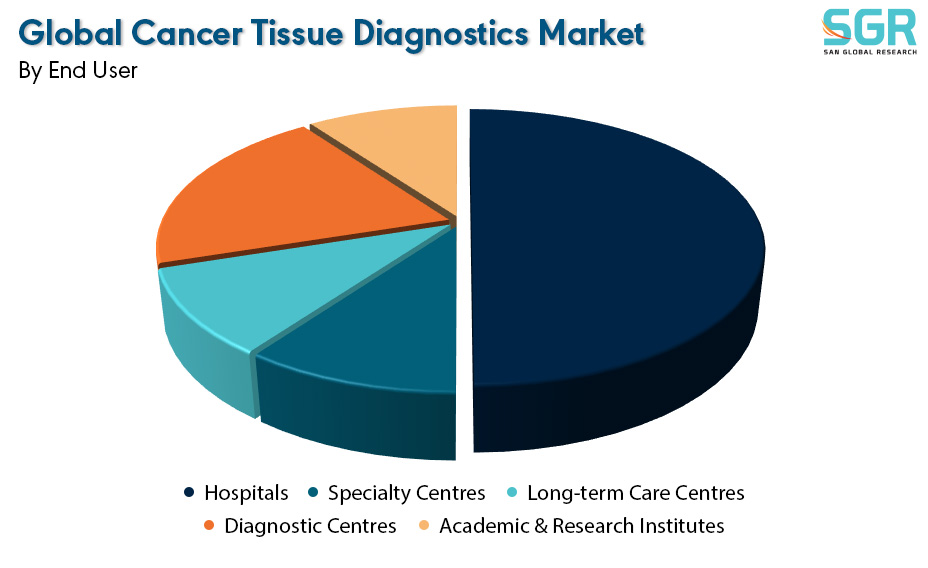

By End User

Based on End User, the Cancer Tissue Diagnostics is bifurcated into Hospitals, Specialty Centres, Long-term Care Centres, Diagnostic Centres and Academic & Research Institutes– where Hospitals segment is dominating and ahead in terms of share.

Key Players

• Abbott Laboratories

• F.Hoffmann-La Roche Ltd.

• Thermo Fisher Scientific Inc.

• QIAGEN

• Illumina, Inc.

Drivers

Increasing Cancer Prevalence

Increasing prevalence of cancer worldwide is a significant market growth driver for the Cancer Tissue Diagnostic market. For instance, according to the article published on National Library of Medicine on April 2024, Lung cancer stands out as the most commonly diagnosed cancer, accounting for nearly 2.5 million new cases (12.4% of all cancers globally) in 2022. Following lung cancer are female breast cancer (11.6%), colorectal cancer (9.6%), prostate cancer (7.3%), and stomach cancer (4.9%). Lung cancer remains the top cause of cancer death as well, responsible for an estimated 1.8 million fatalities (18.7% of all cancer deaths). It's followed by colorectal cancer (9.3%), liver cancer (7.8%), female breast cancer (6.9%), and stomach cancer (6.8%).

Opportunity

Technological Advancements

The landscape of cancer tissue diagnostics is rapidly transforming due to a wave of technological breakthroughs. Next-generation sequencing is offering an unprecedented view of tumour genetics, enabling highly targeted diagnoses and personalized treatment plans. Digital pathology is revolutionizing how tissue samples are analysed, allowing for remote collaboration, efficient workflows, and secure data storage. New and specific biomarkers are being discovered to improve cancer detection and prognosis. Artificial intelligence is making inroads, automating tasks and potentially leading to earlier diagnoses. Additionally, the integration of various techniques like IHC, ISH, and NGS is providing a more comprehensive picture of tumours, ultimately leading to better diagnoses and treatment decisions for cancer patients which has opened up new market growth opportunities for the market.

| Report Attribute | Details |

| Market Value in 2024 | 9.58 Billion |

| Forecast in 2032 | 14.82 Billion |

| CAGR | CAGR of 6% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | by Product, by Technology, by Application, by End User |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Abbott Laboratories • F.Hoffmann-La Roche Ltd. • Thermo Fisher Scientific Inc. • QIAGEN • Illumina, Inc. |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355