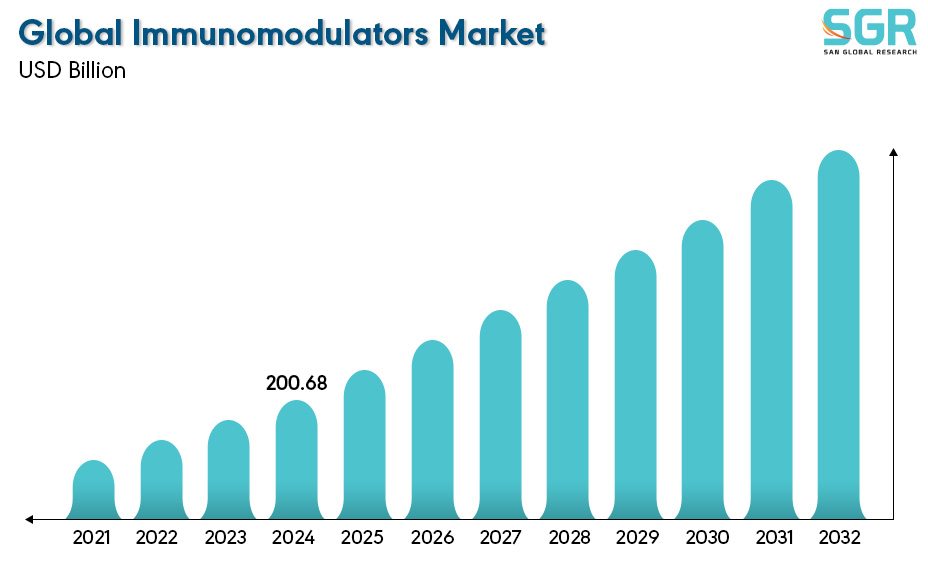

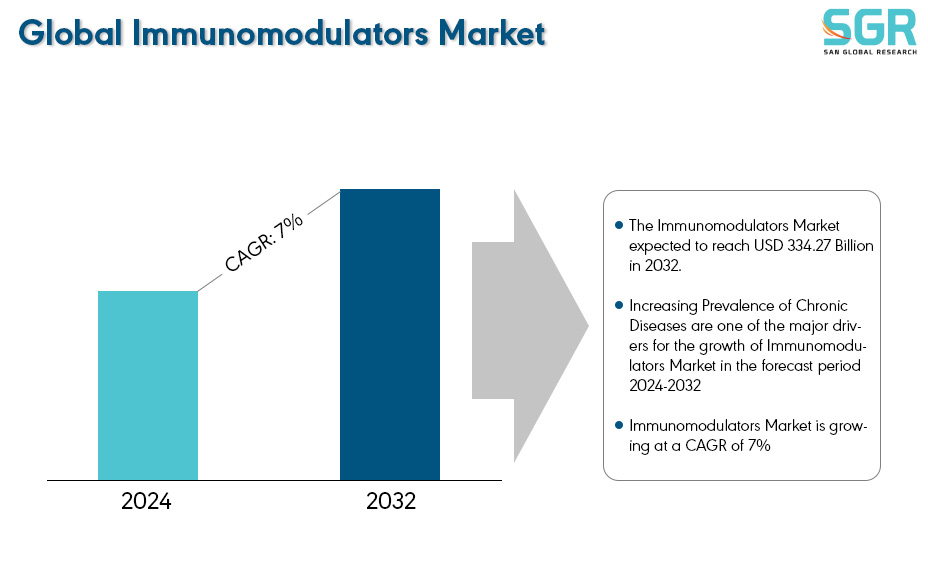

Immunomodulators Market is estimated to be worth USD 200.68 Billion in 2024 and is projected to grow at a CAGR of 7% between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of the market, and the forecast period is 2024 to 2032. The report analyses and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Product, by Application and by region/country.

Recent advances within the molecular biology have provided insights to into complex network of interaction that occurs within the immune system. Immunomodulators offer a unique therapeutic strategy by strengthening a deficient immune system or boosting a healthy one. This approach holds promise for treating a variety of disorders, potentially impacting the practice of clinical medicine for years to come. A major difficulty in limiting the use of immunomodulators in clinical medicine has been the complexity of the immunoregulatory network. Because modulating one component often perturbs the entire system, the approach suffers from diminished specificity.

Immunomodulators can modulate the activity of the immune system, either weakening it or strengthening it, which can in turn influence the inflammatory response. The immunosuppressants can be basically defined as the drugs which are used to suppress the immunity is called immunosuppressants and immunostimulants are the drugs used to boost the immune system in the body.

After reviewing the data shown below, it can be determined that the North America region dominates the Immunomodulators Market for the following reasons.

The North American region is significantly dominating the Immunomodulators Market due to the growing geriatric population and increase in the prevalence of chronic disease such as multiple sclerosis etc. For instance, according to the data provided based on research paper published by JAMA Neurology Journal on May 2023, the prevalence rate of multiple sclerosis within United States is estimated to be 309.2 per 1,00,000 adults. This represents 7,27,344 cases in U.S. adult population. And the study also found that the prevalence of MS was highest in 55 – 64-year age group which makes the North American region dominates the Immunomodulators Market significantly.

Segmentations

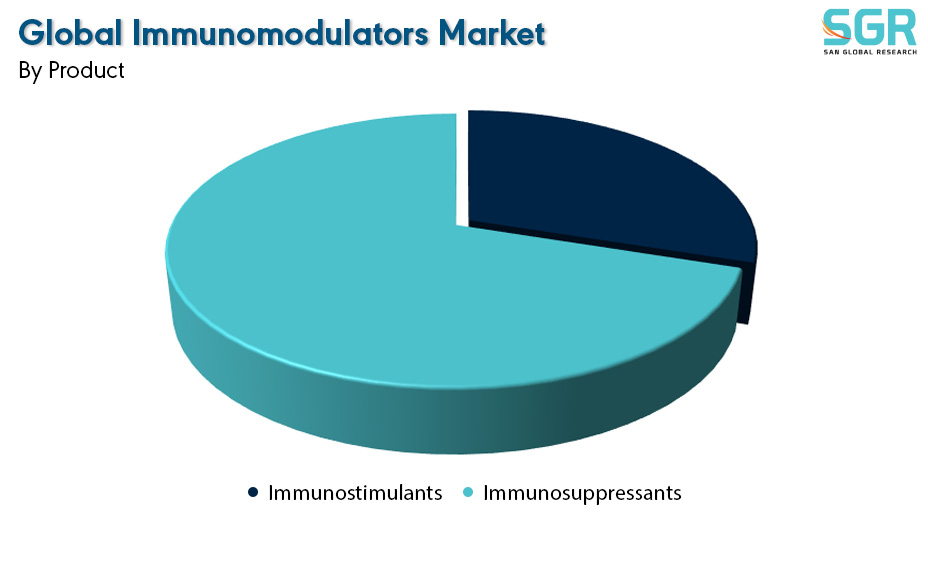

By Product

Based on Product, the Immunomodulators Market is bifurcated into Immunostimulants and Immunosuppressants– where Immunosuppressants segment is dominating and ahead in terms of share. The immunosuppressant segment reigns supreme within the product segment of the immunomodulator market. These medications, by inhibiting or decreasing the body's immune response, play a crucial role in preventing organ rejection. In solid organ transplantation, immunosuppressive agents are essential for three key stages: inducing early-stage immunosuppression, managing late-stage immunosuppression, and maintaining control over potential organ rejection.

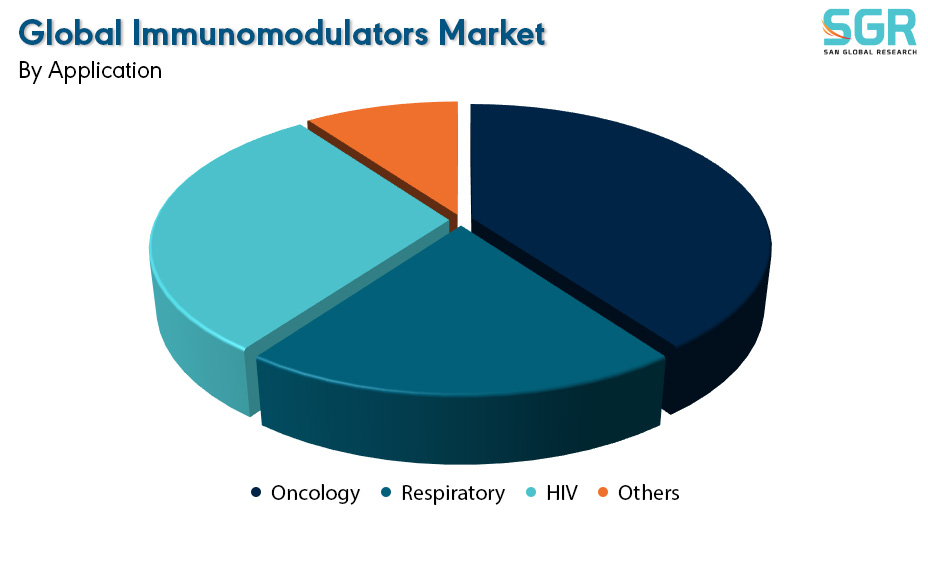

By Application

Based on Application, the Immunomodulators Market is bifurcated into Oncology, Respiratory, HIV and Others– where Oncology segment is dominating and ahead in terms of share.

Key Players

• Biocon

• Avidea Technologies

• Petrovax

• InDex Pharmaceuticals Holding AB

• Pfizer Inc

Drivers

Increasing Prevalence of Chronic Diseases

The increase in the prevalence of the chronic disease such as HIV, multiple sclerosis and cancer has been a significant market growth driver for the Immunomodulators Market. For instance, according the data published on the World Health Organization on February 2022, there were a total 10 million deaths in 2020. In term of new cancer cases in 2022 were as follows, Breast cancer 2.26 million cases, Lung cancer 2.21 million cases, Colon and Rectum cancer 1.93 million cases, Prostate cancer 1.41 million cases, Skin cancer million cases and Stomach cancer 1.09 million cases. This increasing prevalence of diseases are the major market growth drivers for the Immunomodulators Market.

Opportunity

Innovations

The introduction of the Phyto immunomodulators within immunomodulators have hold a great promise. The Phyto immunomodulators are not only known for their immunomodulator activities but their application also includes wide range of benefits such as the anti-tumour, anti-protozoal, antiviral etc. And Phyto immunomodulators being natural extracts the patients opting for natural remedies this option will be certainly appealing opening new market growth opportunities.

| Report Attribute | Details |

| Market Value in 2024 | 200.68 Billion |

| Forecast in 2032 | 334.27 Billion |

| CAGR | CAGR of 7% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | By Product, By Application |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Biocon • Avidea Technologies • Petrovax • InDex Pharmaceuticals Holding AB • Pfizer Inc |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355