Report Overview

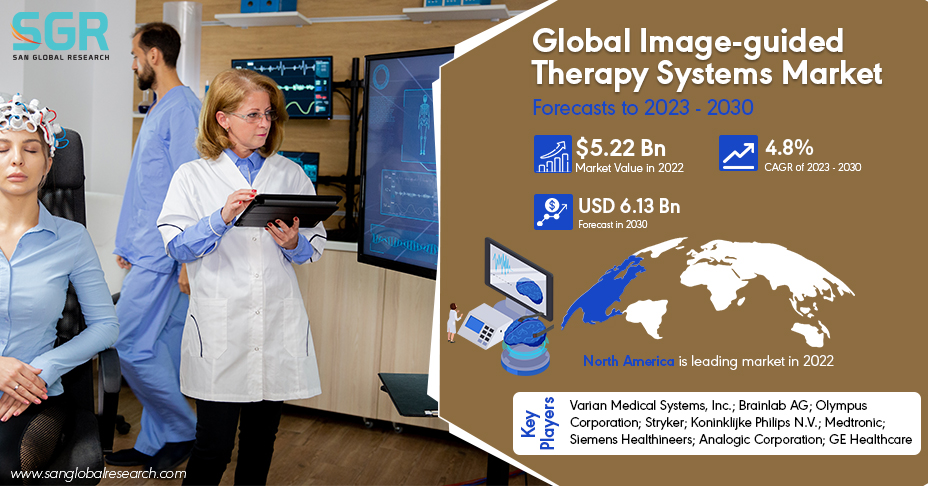

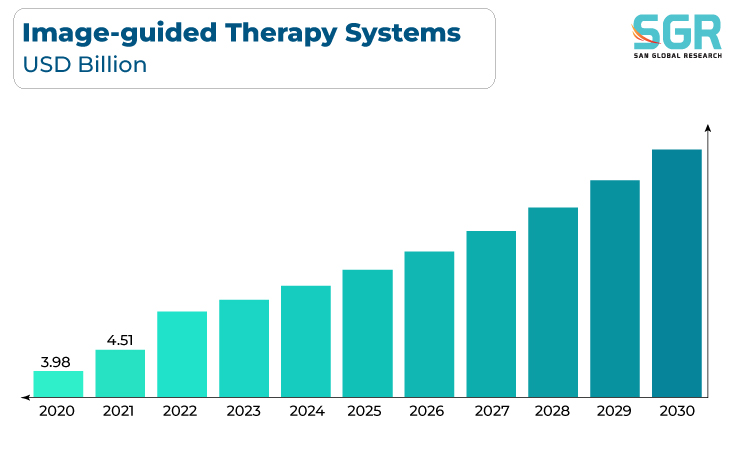

The Image-guided Therapy Systems Market was valued at 5.22 Billion in 2022 and expected to grow at CAGR of 4.8% over forecast period.

The growing demand for minimally invasive medical procedures and precision in medical interventions is driving the Image-guided Therapy Systems Market. These systems, which combine real-time imaging technologies such as MRI, CT scans, and ultrasound with therapeutic tools, allow physicians to visualize and target treatment with extreme precision, resulting in less patient trauma, shorter recovery times, and better clinical outcomes. Furthermore, the rising prevalence of chronic diseases, an aging population, and the need for less invasive treatment options all contribute to the market's growth.

The ongoing technological advancements in imaging and surgical tools, combined with rising healthcare expenditure and investments in healthcare infrastructure, drive image-guided therapy system adoption, making it a key driver in this market.

Product Outlook

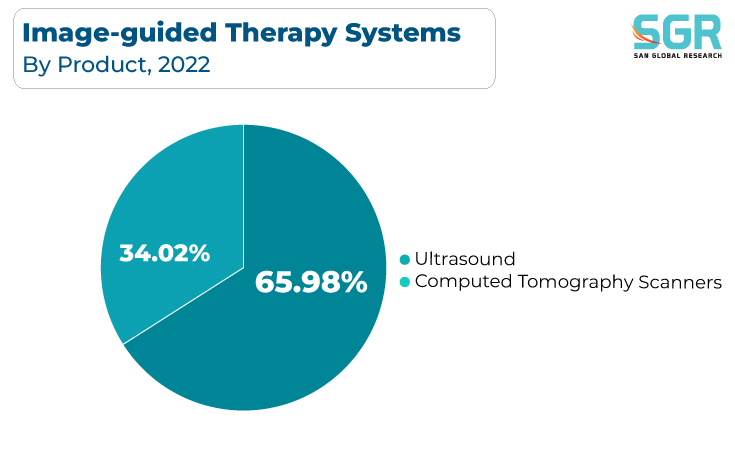

Based on Product, the Image-guided Therapy Systems Market is segmented in Ultrasound, Computed Tomography Scanners. Ultrasound segment accounted for largest share in 2022. The growing demand for non-invasive and real-time treatment procedures that improve patient comfort and clinical outcomes is driving the Ultrasound Image-guided Therapy Systems Market. Because of their versatility and safety, these systems that combine ultrasound imaging with therapeutic interventions are particularly appealing. The market is also being propelled by the rising prevalence of various medical conditions such as cancer, cardiovascular disease, and musculoskeletal disorders, where ultrasound-guided therapies are becoming increasingly popular.

Furthermore, ongoing advances in CT technology, such as faster scanning times and lower radiation exposure, are improving their usability and propelling market growth. The growing demand for minimally invasive procedures, as well as the growing application in fields such as interventional radiology and radiation oncology, all contribute to the continued adoption and development of CT scanners image-guided therapy systems.

End-Use Outlook

Based on End-Use, Image-guided Therapy Systems Market is segmented into Cardiac Surgery, Neurosurgery, Urology, Oncology, Neurology, Gastroenterology, and Orthopedic Surgery. Cardiac Surgery accounted for largest share in 2022. These systems, which combine real-time imaging and precise therapeutic tools, allow cardiac surgeons to perform complex procedures with greater precision, resulting in less patient trauma and faster recovery times. The aging population, combined with an increasing burden of heart-related conditions, fuels the demand for innovative cardiac surgery solutions. Furthermore, advances in imaging and surgical tools, as well as ongoing research and development efforts, are broadening the applications of image-guided therapy in cardiology, improving patient outcomes and stimulating the adoption of these systems in the cardiac surgery domain.

Furthermore, an aging population and increased awareness of minimally invasive urological procedures are driving the adoption of image-guided therapy systems. Continuous technological advancements in imaging and treatment tools, combined with investments in healthcare infrastructure and R&D, drive the market's expansion, improving patient outcomes in urology-related procedures.

Regional Outlook

North America is emerged as leading market for Image-guided Therapy Systems Market in 2022. The market for Image-guided Therapy Systems in North America is primarily driven by the region's well-established healthcare infrastructure, rising demand for advanced medical technologies, and a high prevalence of chronic diseases. The market benefits from high healthcare spending, which encourages the use of cutting-edge image-guided therapy systems with superior diagnostic accuracy and minimally invasive treatment options. The need for precision and real-time guidance during medical procedures is being driven by the aging population and the rising burden of diseases such as cancer and cardiovascular conditions.

The market benefits from a growing population and an increase in chronic diseases, which necessitate accurate diagnostics and less invasive treatment options, which image-guided therapy systems provide. As healthcare modernization and accessibility improve, there is a greater demand for cutting-edge medical devices, particularly in populous countries such as China and India. Furthermore, ongoing healthcare facility development and a growing emphasis on research and development activities in the region support the adoption and innovation of image-guided therapy systems, making Asia Pacific an increasingly important market for these technologies.

Recent Key Developments in Image-guided Therapy Systems Market

- In July 2023, U.S. Food and Drug Administration approved Boston Scientific’s Vercise Neural Navigator 5 Software. This software program used to set and adjust stimulation parameters for the Vercise Deep Brain Stimulation (DBS) Systems, a previously approved therapeutic approach for patients suffering from Parkinson's disease (PD) and essential tremor.

- In May 2023, Koninklijke Philips N.V. announced extension of Mobile C-arm portfolio with Zenition 10. Philips Image Guided Therapy now has a new cost-effective addition. The mobile C-arm platform brings flat panel imaging and user-friendliness to routine surgery.

- In March 2023, Koninklijke Philips N.V. developed world’s first spectral detector angio CT solution - Philips Spectral Angio CT suite. Philips intends to provide physicians with immediate access to these two key imaging modalities in a single room, allowing for innovation in minimally invasive procedures in areas such as oncology, stroke, and trauma care.

Driver

Increasing need for minimally invasive procedures

A significant factor driving the global Image-guided Therapy Systems market is the increasing demand for minimally invasive procedures. This new phenomenon is revolutionizing medical procedures in fields as diverse as oncology, cardiology, neurosurgery, and orthopaedics. Unlike traditional open surgery, minimally invasive Procedure uses smaller diameter incisions, which helps reduce physical trauma, relieve post-operative pain, speed recovery, and shorten hospital stay. Image-guided Therapy Systems are paramount to optimizing and increasing the efficiency of these procedures by providing surgeons with real-time visualization, navigation, and guidance throughout the surgery. The main reason for the increasing demand for minimally invasive procedures is patient preference for treatments that require less recovery time and leave less scarring. Additionally, there is growing awareness among healthcare professionals of the benefits these procedures offer, including shorter hospital stays and potential financial savings from complications. Image-guided systems allow surgeons to navigate complex anatomy with great precision, ensuring accurate positioning of surgical instruments and implants. Using sophisticated imaging techniques such as ultrasound, computed tomography, and fluoroscopy, surgeons can view internal structures in real time, increasing their ability to perform complex surgeries with the highest precision. Additionally, the aging of the global population is an important demographic determinant, increasing the need for minimally invasive procedures and consequently driving the use of image-guided systems.

Opportunity

Opportunistic growth of machine learning and artificial intelligence technologies

The global image guidance systems market is driven by opportunistic growth in machine learning (ML) and artificial intelligence (AI) technologies. The above developments offer important prospects for expanding the capabilities of image guidance systems to improve their intelligence, efficiency, and adaptability. Integrating artificial intelligence and machine learning capabilities into these systems can help analyze complex medical imaging data, facilitate real-time decision-making during procedures, and automate many aspects of the surgical process. The potential for collaboration between AI/ML and imaging systems to significantly transform healthcare by improving diagnostic accuracy, optimizing treatment strategies, and improving the overall effectiveness of medical interventions is enormous. Integrating AI/ML into image guidance systems can intelligently automate routine tasks, increasing the accuracy of procedures and reducing the workload of healthcare professionals. For Instance, artificial intelligence algorithms have the ability to quickly analyze large amounts of image data to detect abnormalities and patterns that cannot be seen by the human eye. This can lead to the development of personalized treatment strategies, improved surgical planning, and early detection of disease. Additionally, image guidance systems based on artificial intelligence can provide real-time navigation and decision support during surgical procedures, providing surgeons with valuable information and improving their experience. Combined with the increasing availability of massive training datasets and the ongoing development of artificial intelligence and machine learning algorithms, the integration of these technologies has the potential to significantly accelerate the growth and development of the vision guidance systems market.

Image-guided Therapy Systems Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 5.22 Billion |

| Forecast in 2030 | USD 6.13 Billion |

| CAGR | CAGR of 4.8% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product , By End-Use |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Varian Medical Systems, Inc.; Brainlab AG; Olympus Corporation; Stryker; Koninklijke Philips N.V.; Medtronic; Siemens Healthineers; Analogic Corporation; GE Healthcare |

Image-guided Therapy Systems Market Segmentation

Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Ultrasound

- Computed Tomography Scanners

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Neurosurgery

- Urology

- Oncology

- Neurology

- Gastroenterology

- Orthopedic Surgery

Image-guided Therapy Systems Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355