Report Overview

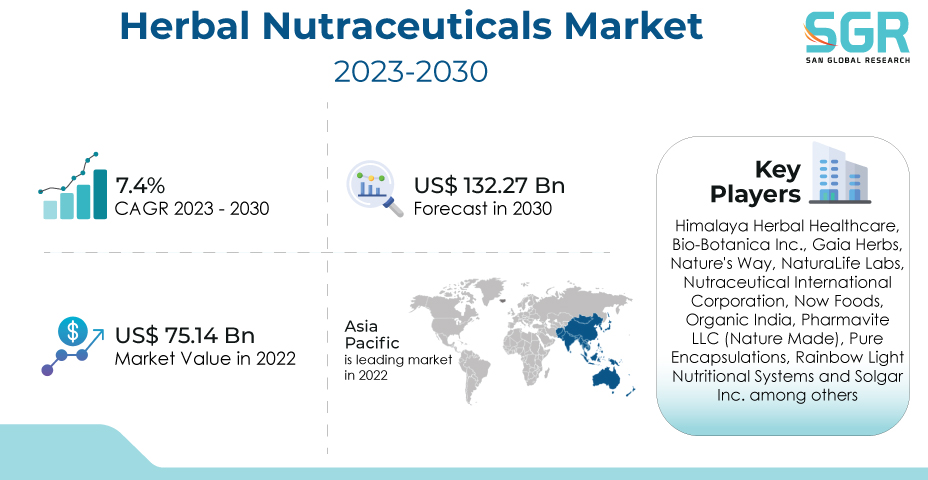

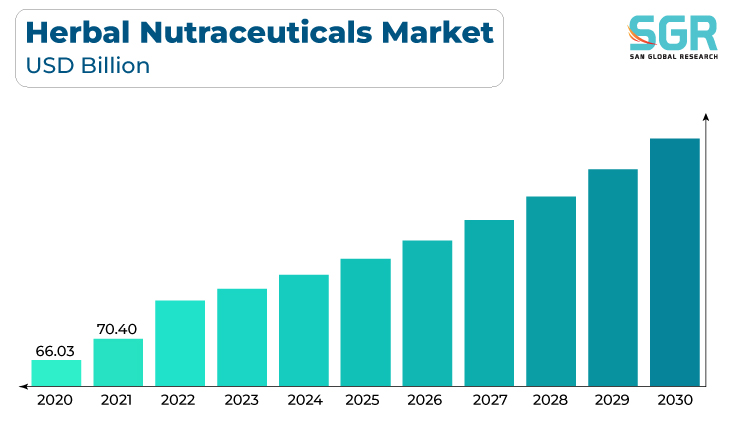

The herbal nutraceuticals market was valued at 75.14 billion in 2022 and expected to grow at CAGR of 7.4 % over forecast period.

Growing awareness of the importance of health and wellness is a major driver for herbal nutraceuticals. Consumers are seeking natural alternatives to support their overall well-being, driving the demand for herbal supplements.A rising preference for natural and plant-based products fuels the demand for herbal nutraceuticals. Consumers are drawn to these products due to perceptions of safety, minimal side effects, and alignment with natural lifestyles.

The utilization of herbs and botanicals in traditional medicine practices worldwide contributes to the popularity of herbal nutraceuticals. Consumers often trust formulations rooted in historical usage for health and healing.Herbal nutraceuticals align with the broader trend towards holistic wellness. Consumers are increasingly adopting a comprehensive approach to health, seeking products that address both nutritional needs and preventive healthcare.

Furthermore, the shift towards preventive healthcare fosters the demand for herbal nutraceuticals. Consumers are proactively incorporating these supplements into their routines to prevent health issues and maintain optimal wellness.

The integration of herbal ingredients into functional foods and beverages adds to the appeal of herbal nutraceuticals. Consumers seek convenient ways to incorporate herbs into their daily diets for added health benefits.

Nature Outlook

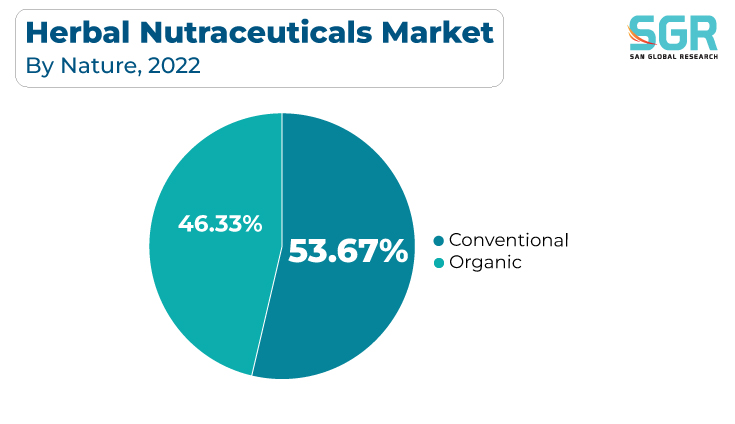

Based on nature, the herbal nutraceuticals marketis segmented intoconventional and organic.Convectional segmentaccounted for largest share in 2022.Established and conventional brands with a long-standing presence in the market contribute significantly to the growth. Consumers often trust recognized brands for their quality, safety, and efficacy, driving the overall market expansion.

The conventional segment of herbal nutraceuticals is witnessing growth due to increased adoption by mainstream consumers. As awareness of herbal products expands, a broader consumer base seeks these supplements for general health and wellness. Also, Conventional channels, including brick-and-mortar retail outlets, pharmacies, and supermarkets, play a vital role in making herbal nutraceuticals accessible to a wider audience. The convenience of purchasing from traditional retail locations fosters market growth.

Conventional herbal nutraceuticals often adhere to stringent regulatory standards. Compliance with regulations and quality standards contributes to consumer trust and confidence in the safety and efficacy of these products.

Regional Outlook

Asia-Pacifichas emerged as leading market for herbal nutraceuticals market in 2022. Growing health and wellness consciousness among European consumers drive the demand for herbal nutraceuticals. The emphasis on preventive healthcare and a holistic approach to well-being fuels the growth of the market.European consumers have a strong preference for natural and plant-based solutions. Herbal nutraceuticals align with this preference, as they are perceived as minimally processed and derived from natural sources.

Furthermore,the scientific validation of herbal ingredients contributes to the growth of herbal nutraceuticals in Europe. Research studies and clinical trials on the efficacy and safety of specific herbs enhance consumer confidence in these products.

Integration of herbal nutraceuticals into pharmaceutical practices and endorsements from healthcare professionals contribute to market growth. Physicians and healthcare practitioners increasingly recognize the value of herbal supplements in supporting health.Europe benefits from well-established distribution channels, including pharmacies, health food stores, and online platforms. This accessibility enhances the reach of herbal nutraceuticals, supporting market expansion.

Herbal Nutraceuticals Market Scope Report

| Report Attribute | Details |

| Market Value in 2022 | USD75.14 Billion |

| Forecast in 2030 | USD132.27 Billion |

| CAGR | CAGR of 7.4 % from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Nature, By Form, By Distribution Channel |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Himalaya Herbal Healthcare, Bio-Botanica Inc., Gaia Herbs, Nature's Way, NaturaLife Labs, Nutraceutical International Corporation, Now Foods, Organic India, Pharmavite LLC (Nature Made), Pure Encapsulations, Rainbow Light Nutritional Systems and Solgar Inc. among others |

Herbal Nutraceuticals Market, Report Segmentation

Herbal Nutraceuticals Market, By Product Type

- Ginger

- Garlic

- Turmeric

- Aloe Vera

- Green Tea

- Others

Herbal Nutraceuticals Market, By Nature

- Conventional

- Organic

Herbal Nutraceuticals Market, By Form

- Capsules & Tablets

- Powder,

- Liquid,

- Others

Herbal Nutraceuticals Market, By Distribution Channel

- Pharmacy

- Online Store

- Supermarket/Hypermarket

- Others

Herbal Nutraceuticals Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355