Report Overview

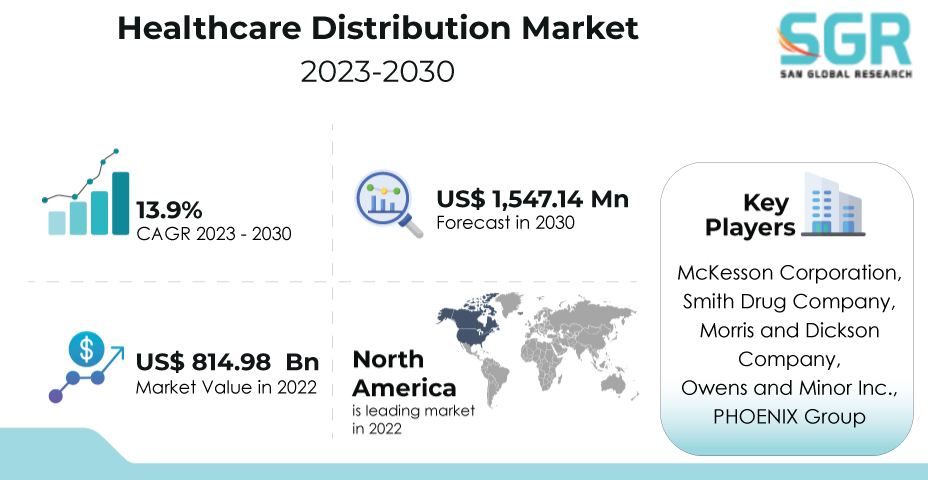

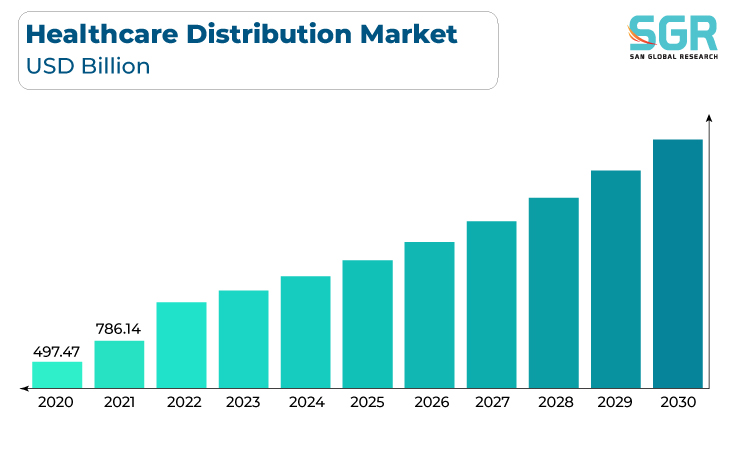

The Health Care Distribution Market was valued at 814.98 Billion in 2022 and expected to grow at CAGR of 13.9% over forecast period.

The Healthcare Distribution market is driven by a confluence of influential factors that highlight its critical role in the healthcare ecosystem. The demand for pharmaceuticals, medical supplies, and devices is being driven by changing patient demographics, such as an aging population and an increasing chronic disease burden. Logistics and supply chain management technological advancements improve distribution efficiency, ensuring timely access to essential healthcare products.

Expanding healthcare access requires a strong distribution network to reach remote and underserved areas, both regionally and globally. Transparent and secure distribution practices are pushed for by regulatory compliance, quality assurance, and patient safety standards. The rise of e-commerce and telehealth emphasizes the importance of healthcare product distribution that is in sync with changing patient preferences and care delivery models. Collaborations among manufacturers, distributors, and healthcare providers promote distribution strategy innovation, ultimately improving patient care and healthcare system efficiency.

Variety Outlook

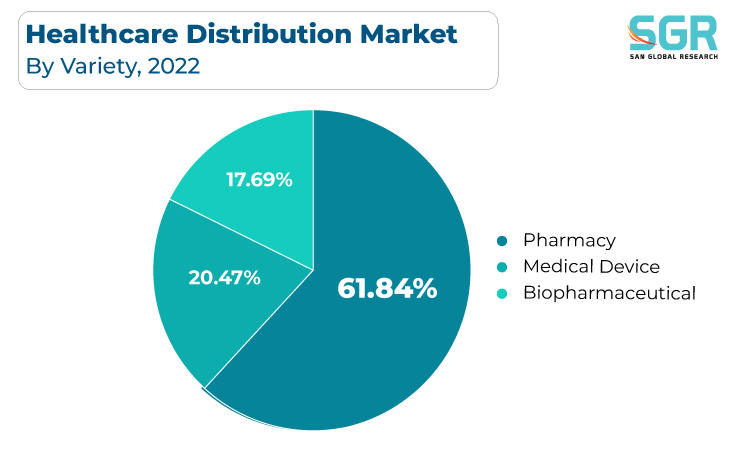

Based on Variety, the Health Care Distribution Market is segmented Pharmacy, Medical Device, and Biopharmaceutical. Pharmacy segment accounted for largest share in 2022. Pharmacies play an important role in the Health Care Distribution market, owing to a number of factors that emphasize their importance in the healthcare ecosystem. Rising patient demand for medications, such as chronic disease management and preventive care, highlights the importance of easily accessible and well-stocked pharmacies.

Biopharmaceutical companies are key drivers of the Health Care Distribution market, driven by a variety of factors that highlight their critical role in the healthcare landscape. Groundbreaking biologics and specialty medication research and innovation result in advanced therapies for complex diseases, increasing the demand for efficient and dependable distribution channels.

Application Outlook

Based on Application, the Health Care Distribution Market is segmented Retail Pharmacies, Hospital Pharmacies. Retail Pharmacies segment accounted for largest share in 2022. The expansion of retail pharmacy networks is being driven by rising patient demand for easy access to prescription medications, over-the-counter drugs, and health products. Customer convenience and engagement are enhanced by technological advancements such as online ordering, prescription refills, and home delivery services. Government policies, insurance coverage, and health initiatives that promote medication adherence and patient well-being drive market growth even faster.

The need to ensure timely drug availability, provide personalized healthcare advice, and aid in the management of chronic diseases drives the adoption of retail pharmacies as critical distribution channels. Collaborations between pharmaceutical manufacturers, healthcare providers, and retail pharmacies spur innovation, allowing them to better meet changing patient needs, improve medication access, and contribute to better public health outcomes.

Regional Outlook

North America is emerged as leading market for Health Care Distribution Market in 2022. The North America Health Care Distribution market is supported by a convergence of critical drivers that highlight its importance in healthcare. The growing prevalence of chronic diseases, as well as an aging population, drive up demand for pharmaceuticals, medical supplies, and devices. Technological advances in distribution and supply chain management improve efficiency, ensuring timely access to critical healthcare products.

The Asia Pacific Health Care Distribution market is propelled by a slew of critical drivers that highlight its importance in the evolving healthcare landscape. Rapid urbanization, population growth, and increased access to healthcare all increase demand for pharmaceuticals, medical equipment, and healthcare products.

Healthcare Distribution Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 814.98 Billion |

| Forecast in 2030 | USD 1,547.14 Million |

| CAGR | CAGR of 13.9% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Variety |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | McKesson Corporation, Smith Drug Company, Morris and Dickson Company, Owens and Minor Inc., PHOENIX Group |

Global Health Care Distribution Market, Report Segmentation

Health Care Distribution Market, By Variety

- Pharmacy

- Medical Device

- Medical Device

- Biopharmaceutical

Health Care Distribution Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355