Report Overview

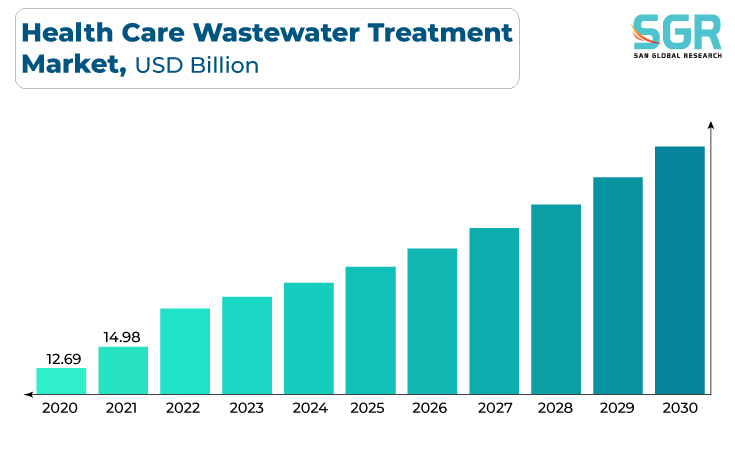

The Healthcare Wastewater Treatment Market was valued at 15.7 billion in 2022 and expected to grow at CAGR of 6.3% over forecast period.

The Health Care Wastewater Treatment Market is primarily driven by rising environmental regulations and stringent discharge standards, which require healthcare facilities to implement advanced wastewater treatment technologies to ensure compliance. Furthermore, rising awareness of the environmental impact of healthcare wastewater, the need to reduce pharmaceutical pollution, and a growing emphasis on sustainable and responsible healthcare practices all contribute to the market's expansion.

Furthermore, the growing healthcare sector, the proliferation of healthcare facilities, and the need to manage and treat a wide range of contaminants and pathogens in wastewater generated by hospitals and clinics are major drivers of the healthcare wastewater treatment market, fostering innovation and investment in this sector.

Type Outlook

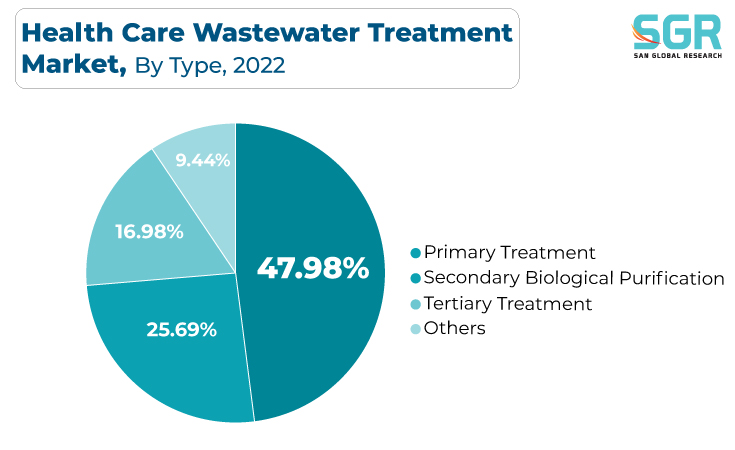

Based on Type, the Health Care Wastewater Treatment Market is segmented in Primary Treatment, Secondary Biological Purification, Tertiary Treatment, Others. Primary treatment segment accounted for largest share in 2022. Primary treatment in the Healthcare Wastewater Treatment Market is being driven by the increasing volume of wastewater generated by healthcare facilities, such as hospitals and clinics, as a result of the world's growing population and disease burden. A primary driver for primary treatment technologies in this market is the need to effectively remove solids, contaminants, and pathogens from wastewater in order to prevent environmental pollution and protect public health.

Secondary biological treatment technologies, such as activated sludge and biological nutrient removal processes, are critical in the removal of organic matter and nutrients from healthcare wastewater, which frequently contains complex contaminants. Stringent environmental regulations, increased scrutiny on pharmaceutical and pathogen removal, and a growing awareness of the environmental impact of healthcare wastewater all contribute to the market's demand for secondary biological purification solutions.

End-Users Outlook

Based on End-Users, Health Care Wastewater Treatment Market is segmented into Hospitals, Clinics, Ambulatory Surgical Centers, Others. Hospitals accounted for largest share in 2022. The Hospitals Wastewater Treatment Market is primarily driven by the growing number of hospitals worldwide, which is fueled by population growth and disease prevalence. Hospitals produce large amounts of complex wastewater containing pathogens, pharmaceuticals, and other contaminants, necessitating effective treatment methods in order to meet strict environmental regulations and prevent pollution. Environmental awareness, stringent regulatory requirements, and the need to reduce the ecological footprint of healthcare facilities are all driving factors in the adoption of wastewater treatment solutions in hospitals.

The increasing adoption of ASCs as a preferred option for outpatient surgical procedures, owing to their efficiency, cost-effectiveness, and patient convenience, is driving the Ambulatory Surgical Centers (ASCs) Wastewater Treatment Market. As the number of ASCs increases, so does the generation of wastewater containing various contaminants such as medical chemicals and infectious agents, necessitating the implementation of effective wastewater treatment solutions in order to comply with stringent environmental regulations.

Regional Outlook

North America is emerged as leading market for Health Care Wastewater Treatment Market in 2022. The North America Health Care Wastewater Treatment Market is driven primarily by a combination of factors, including stringent environmental regulations and standards governing the discharge of healthcare wastewater, which necessitate advanced treatment solutions to ensure compliance. Furthermore, the region's aging population and expanding healthcare infrastructure contribute to the increasing volume of wastewater generated by healthcare facilities, increasing demand for effective treatment technologies. Concerns about the environmental impact of pharmaceuticals and pathogens in healthcare wastewater, combined with a renewed emphasis on sustainability and responsible wastewater management, drive additional innovation and investment in this sector.

As the number of healthcare facilities increases, so does the volume of wastewater generated, necessitating efficient wastewater treatment solutions to meet stringent environmental regulations and prevent pollution. Furthermore, increased awareness of the environmental impact of healthcare wastewater, as well as the need for responsible wastewater management practices, contribute to the growth of this market. Furthermore, as Asia Pacific strives to balance healthcare accessibility with environmental sustainability, the region's focus on economic development and healthcare modernization fosters the adoption of advanced wastewater treatment technologies in the healthcare sector, making it a prominent driver in the Asia Pacific Health Care Wastewater Treatment Market.

Recent Key Developments in Health Care Wastewater Treatment Market

- In June 2023, British Standards Institute (BSI) and AMR Industry Alliance announced new certification scheme to promote responsible antibiotics manufacturing. To obtain this certification, manufacturers must provide effective environmental management and wastewater treatment systems.

- In January 2022, The LAU School of Pharmacy (SOP) has collaborated with a consortium of local and European institutions on a three-year capacity-building project to promote safe hospital wastewater management in Lebanon.

Driver

Rising Environmental Regulations and Stringent Discharge Standards

Healthcare facilities produce wastewater containing a unique mixture of contaminants, including pathogens, pharmaceuticals, and hazardous chemicals. These pollutants pose a serious threat to human health and the environment if not properly managed. As a result, governments around the world are introducing more stringent environmental and medical wastewater discharge standards. for instance, “Safe Management of Wastes from Health-Care Activities” to manage HWW was made available by WHO in 1999 [29], updated in 2013. Stated that safe management of wastes from health care by WHO direct discharge of hazardous liquids and chemical wastes (photochemicals, aldehydes, colorants, and pharmaceuticals) to sewer is strictly prohibited. Separate collection and pretreatment are required for wastewater from medical laboratories. These regulations require healthcare facilities to implement advanced wastewater treatment technologies to ensure wastewater meets established standards. The focus on compliance with increasingly stringent regulations is the key driver for the growth of the medical wastewater treatment market.

For instance, In Denmark, the first full scale wastewater treatment plant (WWTP) for treatment of healthcare waste water (HWW) was constructed in 2013. The hospital WWTP was designed to treat wastewater originated from Herlev hospital which discharged approximately 150,000 m3/year of wastewater and expected to discharge 200,000 m3 of wastewater by 2020

Opportunity

Decentralized Wastewater Treatment Systems

In the healthcare industry, there is a growing trend toward decentralization of healthcare facilities, including ambulatory surgery centers, emergency clinics, and dialysis centers. These facilities typically generate less wastewater than larger hospitals. Traditional centralized wastewater treatment plants may not be the most efficient and cost-effective solution for these smaller plants due to a number of factors. High installation costs. Installing and maintaining a connection to a central treatment plant can be expensive. Infrastructure limitations. Some places, especially rural areas, may not have the necessary infrastructure to connect to a central power plant. Inefficient use of resources: Treating less wastewater and treating more wastewater in hospitals may not be the most efficient use of resources. Decentralized wastewater treatment systems provide significant opportunities for the medical wastewater treatment market.

Health Care Wastewater Treatment Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 15.7 Billion |

| Forecast in 2030 | USD 40.78 Billion |

| CAGR | CAGR of 6.3% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By End-User |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled |

Toshiba Water Solutions Private Limited; Xylem, Inc.; Veolia Group; Ecolab Inc; Evoqua Water Technologies LLC; Pentair plc; DuPont; Aquatech International LLC; Calgon Carbon Corporation

|

Health Care Wastewater Treatment Market Segmentation

Type Outlook (Revenue, USD Billion, 2018 – 2030)

- Primary Treatment

- Secondary Biological Purification

- Tertiary Treatment

- Others

End-User Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

Health Care Wastewater Treatment Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355