Report Overview

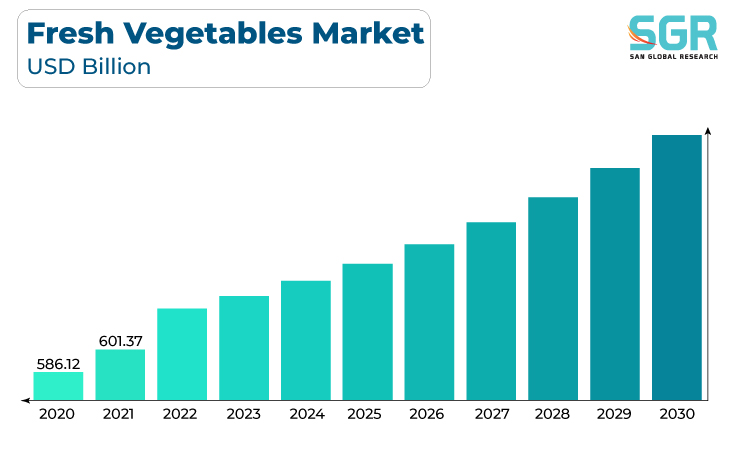

The fresh vegetables market was valued at 618.35 billion in 2022 and expected to grow at CAGR of 4.3% over forecast period.

.jpg)

Increasing awareness of the importance of a healthy diet and the consumption of fresh, natural foods has led to a growing demand for fresh vegetables. Consumers are prioritizing fresh produce as part of their daily meals. In Addition, Health-conscious consumers are seeking nutrient-dense foods that provide essential vitamins, minerals, and fiber. Fresh vegetables are considered a vital component of a balanced and nutritious diet. Moreover, the growing adoption of vegetarian and vegan diets has boosted the demand for fresh vegetables as primary sources of nutrients and protein alternatives. Also, the demand for organic and non-genetically modified (GMO) vegetables is on the rise. These products are perceived as healthier and more environmentally friendly.

The fresh vegetables market continues to evolve as consumer preferences and awareness about health, sustainability, and food sources expand. Meeting these demands requires ongoing innovation and adaptability throughout the supply chain, from growers to retailers are fueling the growth of the fresh vegetables market these days.

Consumers are increasingly interested in purchasing locally grown and sustainably sourced vegetables. This trend supports local farmers and reduces the carbon footprint associated with food transportation.

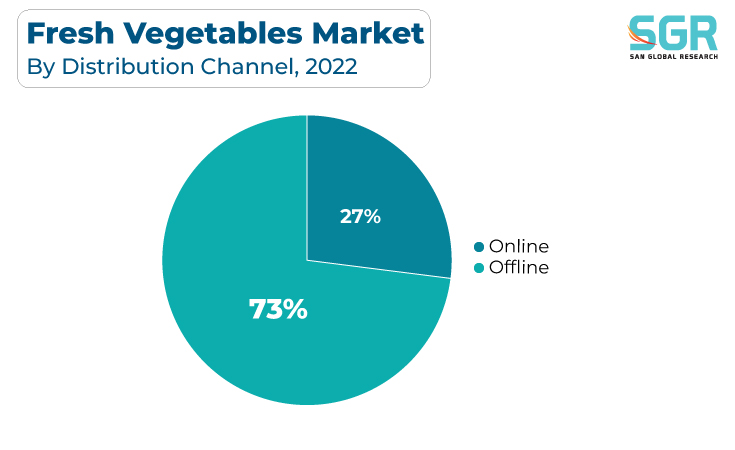

Distribution Channel Outlook

Based on distribution channel, the fresh vegetables market is segmented into online and offline. Offline segment accounted for largest share in 2022. offline distribution channels play a pivotal role in driving the growth of the fresh vegetable market by offering accessibility, variety, trust, and a convenient shopping experience. These channels remain a preferred choice for many consumers, complementing the growth of online distribution options in the evolving retail landscape. Furthermore, offline retailers typically offer a wide variety of fresh vegetables, including seasonal, locally sourced, and exotic options. This variety caters to diverse consumer preferences and encourages exploration of different vegetables.

Thus, offline distribution channels enhance the growth of the fresh vegetables market by providing consumers with accessible, fresh, and diverse options. These channels also offer a personalized shopping experience, community engagement, and immediate access to products, making them integral to the overall success of the fresh vegetables market.

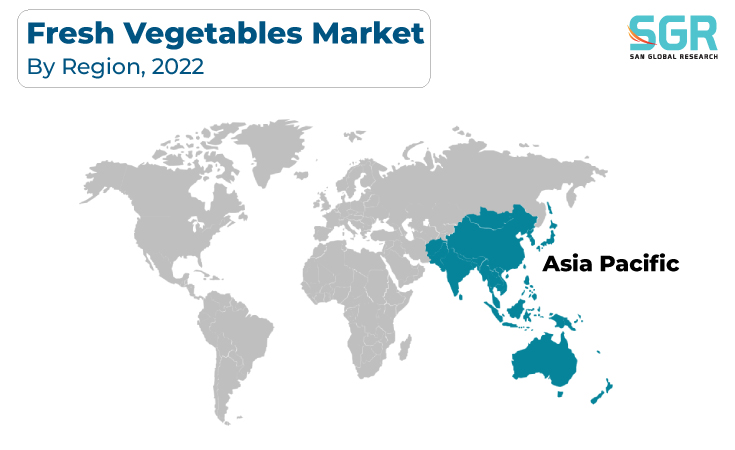

Regional Outlook

Asia-Pacific has emerged as leading market for fresh vegetables market in 2022. Asia-Pacific is the most populous region in the world, with a rapidly growing population. As more people need to be fed, the demand for fresh vegetables, a staple in Asian diets, continues to rise. Asia-Pacific's combination of population size, cultural importance of fresh vegetables, changing consumer preferences, and economic growth positions it as a major driver of the global fresh vegetable market. The region's influence on the market is expected to continue growing in the coming years.

Furthermore, the growth of modern retail formats, such as supermarkets and hypermarkets, has made fresh vegetables more accessible to urban and suburban consumers. These stores often offer a wide variety of fresh produce options. On the other hand, the rise of e-commerce platforms and online grocery shopping in the Asia-Pacific region has made it easier for consumers to purchase fresh vegetables online, contributing to market growth.

Fresh Vegetables Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 618.35 Billion |

| Forecast in 2030 | USD 854.97 Billion |

| CAGR | CAGR of 5.8% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Distribution Channel, By Product |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | Dole Food Company, Fresh Del Monte Produce, Green Giant (B&G Foods), Grimmway Farms, Taylor Farms, Sun World International, NatureSweet, Mastronardi Produce (Sunset), Church Brothers Farms and Houweling's Group among others |

Global Fresh Vegetables Market, Report Segmentation

Fresh Vegetables Market, By Distribution Channel

- Offline

- Online

Fresh Vegetables Market, By Product

- Tomato

- Onion

- Cabbage

- Cucumber

- Eggplant

- Beans

- Carrot

- Other

Fresh Vegetables Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355