Report Overview

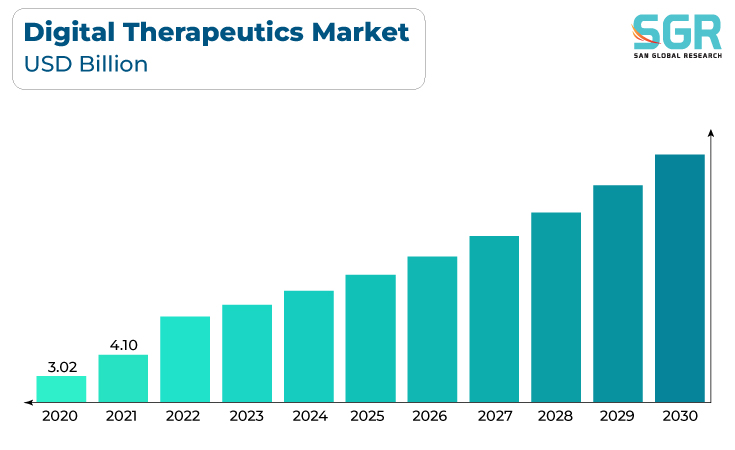

The Digital Therapeutics Market was valued at 4.69 billion in 2022 and expected to grow at CAGR of 25.7% over forecast period.

Several key factors are driving the digital therapeutics market, including the rising prevalence of chronic diseases such as diabetes, hypertension, and mental health conditions, which has created a growing need for innovative and cost-effective treatment solutions. Furthermore, the proliferation of smartphones and wearable devices has increased patient engagement and data collection, allowing for the development of personalized and data-driven digital therapeutic interventions.

Regulatory approvals and reimbursement policies are improving, boosting investor confidence and industry growth. Furthermore, the ongoing COVID-19 pandemic has accelerated the adoption of telehealth and digital solutions, providing a significant impetus to the expansion of the digital therapeutics market with the potential for scalable and accessible healthcare solutions.

Application Outlook

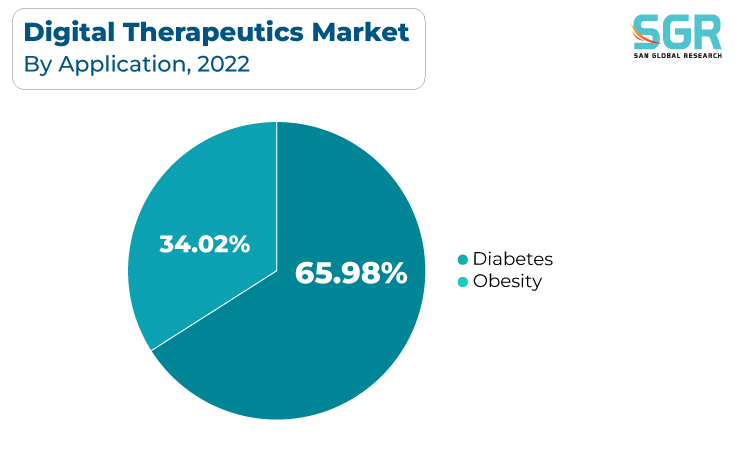

Based on Application, the Digital Therapeutics Market is segmented in Diabetes, Obesity. Diabetes segment accounted for largest share in 2022. The rising global prevalence of diabetes, particularly type 2 diabetes, and the associated burden of managing the condition are driving the diabetes digital therapeutics market. Digital therapeutics provides novel solutions for self-management, real-time monitoring, and personalized treatment plans, all of which improve patient outcomes. The increased adoption of digital health technologies, such as mobile apps and continuous glucose monitoring devices, has enabled diabetics and healthcare providers to better manage the disease.

Obesity is a serious issue. The global obesity epidemic, which poses a significant public health challenge, is driving the digital therapeutics market. Through evidence-based interventions, digital therapeutics provide a promising solution for weight management and lifestyle modification, assisting individuals in achieving sustainable weight loss and overall health improvements. Individuals and healthcare providers are looking for effective digital tools and interventions as they become more aware of the health risks associated with obesity, such as diabetes, cardiovascular disease, and metabolic disorders.

End Use Outlook

Based on End Use, Digital Therapeutics Market is segmented into Patients, Providers, Payers, and Employers. Patient accounted for largest share in 2022. Patients are driving the digital therapeutics market as they seek more accessible and personalized healthcare solutions. Patient adoption is driven by a desire for convenient self-management tools and a shift toward proactive healthcare, particularly in the context of chronic diseases. The increasing prevalence of chronic conditions such as diabetes, hypertension, and mental health disorders encourages people to look into digital therapeutic options for more effective and convenient treatment. Furthermore, the COVID-19 pandemic has hastened the adoption of telehealth and digital interventions, reinforcing the need for patient-centered solutions that can be accessed remotely.

Providers are motivated to incorporate digital therapeutics into their practices by the need for more efficient and cost-effective healthcare delivery, as well as the potential for reduced healthcare system burdens. Furthermore, favorable regulatory support and reimbursement policies are encouraging healthcare institutions to invest in and implement these solutions, cementing their role as a driving force in the growth of the digital therapeutics market.

Regional Outlook

North America is emerged as leading market for Digital Therapeutics Market in 2022. Several key factors are driving the North American digital therapeutics market, including a high prevalence of chronic diseases such as diabetes, obesity, and cardiovascular conditions, which has created a significant demand for innovative and cost-effective treatment solutions. North America is an ideal region for digital therapeutics due to its strong healthcare infrastructure, advanced technology adoption, and tech-savvy population. Furthermore, favorable regulatory environments and favorable reimbursement policies are speeding up the adoption of digital therapeutic solutions by both healthcare providers and patients.

The Asia Pacific Digital Therapeutics Market is thriving due to several key factors. The growing use of smartphones and digital technologies, particularly in China and India, has facilitated the deployment of mobile health apps and wearable devices, which improve patient engagement and data collection for personalized healthcare interventions. Favorable government initiatives and healthcare policies aimed at expanding telehealth and digital solutions, as well as the entry of domestic and international players, have fueled innovation and investment.

Recent Key Developments in Digital Therapeutics Market

- In October 2023, US Food and Drug Administration (FDA) launched Digital Health Advisory Committee to bring together external experts from various disciplines to address some of the more pressing issues in digital health, such as product interoperability and the effective use of artificial intelligence/machine learning (AI/ML). Advisory Committee will also discuss AI/ML, augmented reality, virtual reality, digital therapeutics, wearables, remote patient monitoring, and software in medical devices.

- In August 2023, Lupin Digital Health launched E-Clinic in India specialized in digital therapeutics called Digital Heart Failure Clinic. The e-clinic aims to assist cardiologists and caregivers in effectively managing heart failure patients from the comfort of their own homes.

- In August 2023, Mahana Therapeutics partnered with Bayer to commercialize digital therapeutics and also announced marketing partnership with consumer health division of Bayer.

Driver

The importance of preventive healthcare is growing.

Primary prevention measures can help prevent or stop disease in its early stages by promoting a healthy lifestyle or promoting vaccination against communicable diseases. Many of the leading causes of death and disability are preventable with appropriate interventions. There is growing consensus among policymakers, health care providers, and patients that prevention, behaviour, and lifestyle changes are effective drugs or treatments. For instance, In the United States, chronic diseases account for approximately 75% of $3.5 trillion in annual healthcare costs (Source: Chronicdisease.org and CMS, 2019). However, these chronic diseases are largely preventable. Government legislation and initiatives, such as the Patient Protection and Affordable Care Act (PPACA) (2010), aim to provide access to preventive care. Thanks to this law, programs encouraging preventive treatment are gaining popularity.

Opportunity

Large Undiagnosed and Untreated Population.

Despite the availability of highly effective and affordable treatment options for chronic diseases, there are still large numbers of undiagnosed and untreated populations. For instance, according to WHO, many people with chronic diseases do not receive the treatment and care they need. According to WHO, as of 2019, more than 1 billion people with high blood pressure (82% of all people with high blood pressure worldwide) live in low- and middle-income countries. According to BMC Public Health Journal 2022, the overall prevalence of undiagnosed hypertension, untreated hypertension, and poorly treated hypertension among older adults in India was 42.3%, 6%, and 18.7%, respectively. Approximately 90% of deaths from COPD occur in low- and middle-income countries due to lack of access to needed treatment. More than 75% of deaths related to cardiovascular disease occur in low- and middle-income countries, largely due to low or limited access to appropriate health care. Often, treatment for these conditions is not integrated into primary care, which may be the only provider of care in the area. As a result, affected populations do not receive the support they need. Other factors, such as poor health delivery systems, lack of trained personnel, shortage of essential medicines, and proliferation of traditional beliefs and practices, also result in large sections of the population lacking treatment. This population represents a significant opportunity for digital therapeutics implementation. Because digital treatments are delivered online, they are more accessible and can reach more patients than traditional treatments.

Digital Therapeutics Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 4.69 Billion |

| Forecast in 2030 | USD 28.93 Billion |

| CAGR | CAGR of 25.7% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Application, By End Use |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Pear Therapeutics, Inc.; Akili Interactive Labs, Inc.; HYGIEIA; DarioHealth Corp.; BigHealth; GAIA AG; Limbix Health, Inc.; OMADA HEALTH, INC.; Welldoc, Inc.; 2Morrow, Inc; Teladoc Health, Inc.; Propeller Health (ResMed); Fitbit LLC; CANARY HEALTH; Noom, Inc.; |

Digital Therapeutics Market Segmentation

Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Diabetes

- Obesity

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Patients

- Providers

- Payers

- Employers

Digital Therapeutics Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355