Report Overview

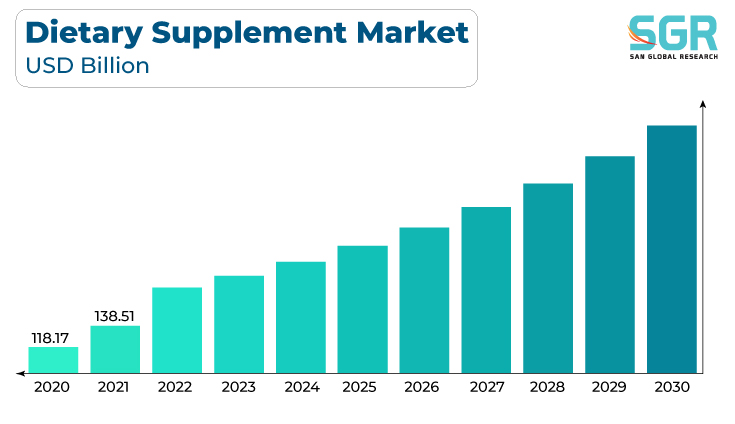

The dietary supplements market was valued at 152.00 billion in 2022 and expected to grow at CAGR of 11.9% over forecast period.

Consumers are increasingly prioritizing health and wellness, leading to a growing awareness of the role of dietary supplements in maintaining optimal health. As the global population ages, there is a rising demand for supplements that address age-related health concerns, such as bone health, joint support, and cognitive function. Furthermore, a shift towards preventive healthcare practices has fueled the demand for dietary supplements, seen as a proactive approach to addressing nutritional deficiencies and promoting overall well-being.

The surge in fitness trends and sports participation has led to a demand for supplements catering to muscle recovery, energy enhancement, and overall physical performance. Also, Busy lifestyles and the need for convenient health solutions drive the popularity of dietary supplements that offer easy consumption and address nutritional gaps in mert

The proliferation of e-commerce platforms has made dietary supplements easily accessible, providing consumers with a wide range of options and the convenience of doorstep delivery.

Type Outlook

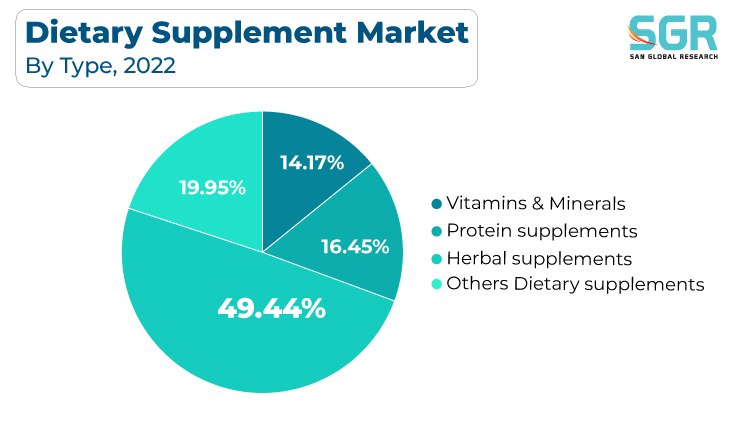

Based on type, the dietary supplements market is segmented into vitamins and minerals, protein supplements, herbal supplements and other dietary supplements. vitamins and minerals segment accounted for largest share in 2022. Dietary supplements, especially those containing vitamins and minerals, serve as a convenient and effective means of addressing nutritional gaps in modern diets. As people become more aware of deficiencies in their diets, the demand for supplements to fulfill these gaps increases.

Growing trends in health and wellness have led consumers to proactively seek ways to improve and maintain their health. Vitamins and minerals are recognized for their crucial roles in supporting immune function, energy metabolism, and various physiological processes, driving their consumption.

Thus, Consumers are increasingly adopting preventive healthcare practices, understanding that a well-balanced intake of vitamins and minerals can contribute to disease prevention and overall health maintenance. This preventive mindset drives the growth of the dietary supplement market.

Regional Outlook

Asia-Pacific has emerged as leading market for dietary supplements market in 2022. Rapid urbanization and changing lifestyles, often characterized by hectic schedules and processed food consumption, contribute to nutritional gaps. Consumers seek dietary supplements to address deficiencies and support their well-being in the face of these lifestyle changes.

Furthermore, The Asia-Pacific region is experiencing demographic shifts with a substantial aging population. This demographic group often requires nutritional support for bone health, joint care, and cognitive function, leading to an increased demand for dietary supplements.

Growing interest in fitness and sports activities in the region is fueling the demand for dietary supplements that support physical performance, muscle recovery, and energy levels among fitness enthusiasts and athletes. In addition, the rich history of herbal and Ayurvedic traditions in countries like India and China has influenced consumer preferences towards natural and traditional remedies. This has led to a surge in the demand for herbal and plant-based dietary supplements.

Dietary supplements Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 152.00 Billion |

| Forecast in 2030 | USD 370.16 Billion |

| CAGR | CAGR of 11.9% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Distribution Channel |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Amway, Nestlé Health Science, Abbott Nutrition, Herbalife Nutrition, Glanbia Nutritionals, GNC Holdings, Inc., Nature's Bounty Co. (formerly NBTY), NOW Foods, The Vitamin Shoppe, USANA Health Sciences, Swisse Wellness among others |

Dietary Supplements Market, Report Segmentation

Dietary supplements Market, By Type

- Vitamins and minerals

- Protein supplements

- Herbal supplements

- Other dietary supplements

Dietary supplements Market, By Distribution Channel

- Direct

- Indirec

Dietary supplements Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355