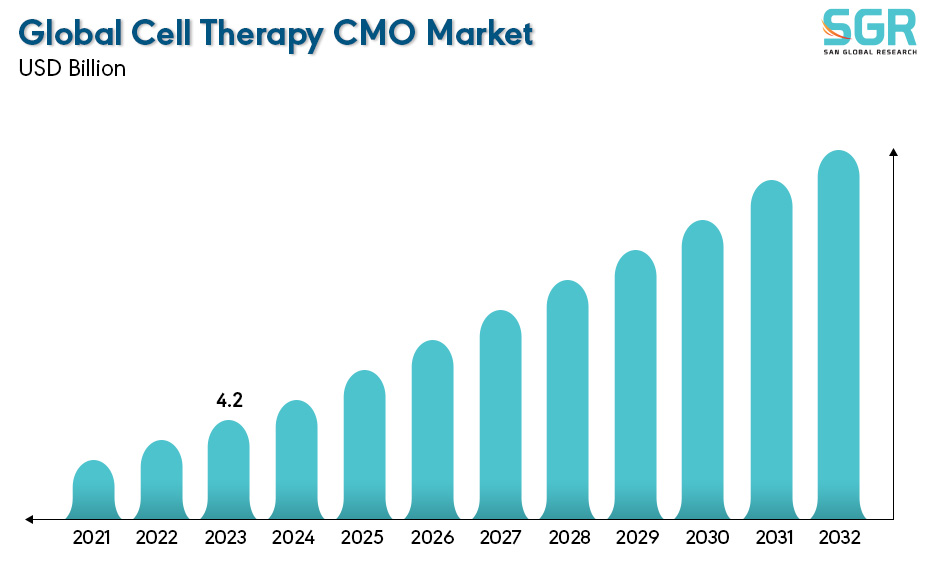

Global Cell Therapy CMO Market is estimated to be worth USD 4.2 Billion in 2022 and is projected to grow at a CAGR of 11.3% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Type, by Application and by region/country.

The global Cell Therapy Contract Manufacturing Organization (CMO) market plays a pivotal role in the rapidly advancing field of regenerative medicine and cell therapy. Cell therapy CMOs are specialized organizations that provide manufacturing services to biopharmaceutical companies engaged in the development of cell-based therapies. These therapies involve the use of living cells, often genetically modified, to treat or prevent diseases. The cell therapy CMO market offers crucial expertise in the production, processing, and scale-up of these complex cellular products. As the demand for innovative cell therapies continues to grow, outsourcing manufacturing to specialized CMOs becomes an attractive option for biotech and pharmaceutical companies. The market is characterized by collaborations, strategic partnerships, and investments in state-of-the-art manufacturing facilities. Regulatory compliance, scalability, and the ability to adapt to diverse cell therapy modalities are key considerations within this dynamic and evolving market.

.jpg)

Region wise Comparison:

The North American Cell Therapy CMO market is a dynamic and mature sector, reflecting the region's leadership in biopharmaceutical innovation. With a robust ecosystem of biotech and pharmaceutical companies engaged in cell therapy development, the demand for specialized manufacturing services is substantial. North American CMOs excel in offering scalable solutions, regulatory compliance, and advanced manufacturing technologies.

Europe's Cell Therapy CMO market is marked by a growing emphasis on regenerative medicine and a supportive regulatory environment. European CMOs are at the forefront of providing manufacturing services for diverse cell therapy applications. The region's strong research infrastructure and collaborations between academia and industry contribute to the market's growth.

.jpg)

The Asia Pacific Cell Therapy CMO market is witnessing notable expansion, driven by the region's increasing prominence in the global biopharmaceutical landscape. Countries like China, Japan, and South Korea are emerging as key players, leveraging their scientific expertise and investment in biotechnology. The market benefits from a growing number of clinical trials and partnerships between global pharmaceutical companies and Asian CMOs.

Latin America's Cell Therapy CMO market is evolving as the region actively participates in the global biopharmaceutical landscape. While not as mature as some other regions, Latin American CMOs are gaining traction by offering cost-effective manufacturing solutions and strategic partnerships.

The Cell Therapy CMO market in Africa and the Middle East is nascent but holds potential for growth. With increasing investments in healthcare infrastructure and a focus on biotechnology, the region is slowly gaining attention in the cell therapy landscape. Regulatory developments and collaborative initiatives may shape the trajectory of CMOs in these regions as they become more integrated into the global cell therapy ecosystem.

.jpg)

Segmentation:

The Global Cell Therapy CMO Market is segmented by Type, by Application and by region/country.

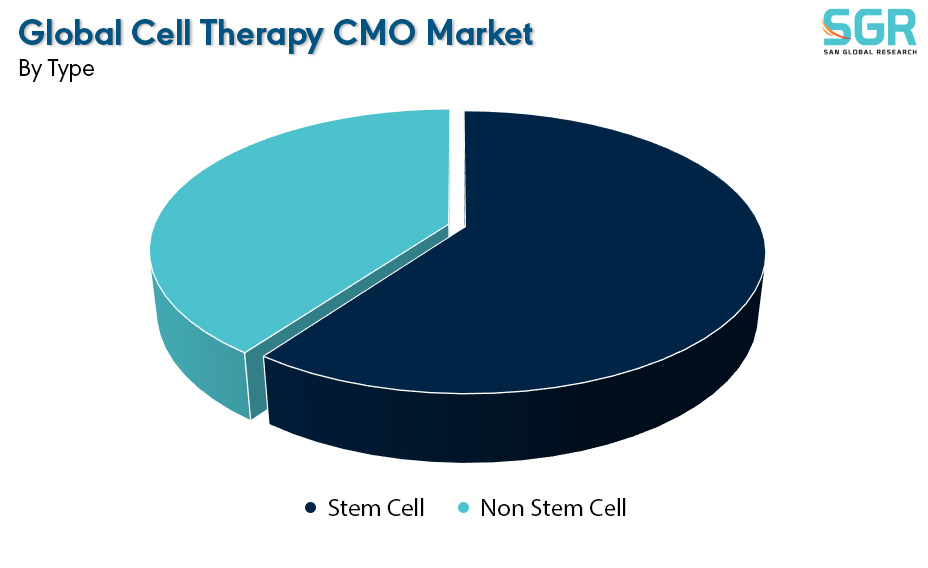

By Type:

Based on the type, the Global Cell Therapy CMO Market is bifurcated into Stem Cell & Non Stem Cell – where Single Phase is dominating and ahead in terms of share.

Stem cells play a central role in the global Cell Therapy Contract Manufacturing Organization (CMO) market, contributing significantly to the development of advanced therapeutic interventions. Stem cell-based therapies hold immense promise for regenerative medicine, and CMOs specializing in stem cell manufacturing are crucial enablers for biopharmaceutical companies engaged in these innovative treatments. These CMOs provide expertise in the cultivation, expansion, and processing of various types of stem cells, including mesenchymal stem cells (MSCs), induced pluripotent stem cells (iPSCs), and hematopoietic stem cells (HSCs).

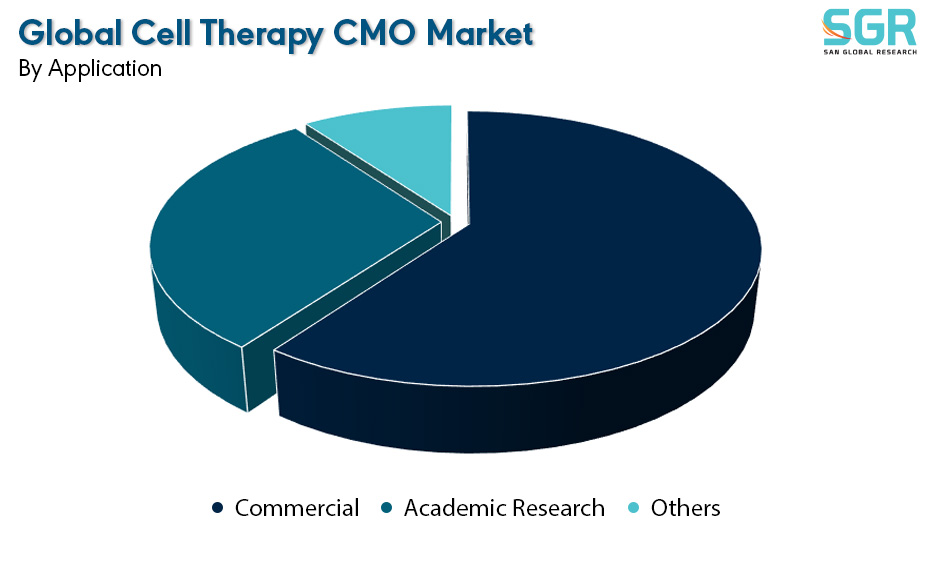

By Application:

Based on the Application, the Global Cell Therapy CMO Market is bifurcated into Commercial, Academic Research & Others – where Commercial is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the Global Cell Therapy CMO Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Global Cell Therapy CMO Market include

• Charles River

• The Discovery Labs

• BIOCENTRIQ

• FUJIFILM Diosynth Biotechnologies

• Exothera

• WuXi AppTec

• Pharmaron

• OBiO

• Cell Therapies

• AGC Biologics

Drivers:

Growing sector across the globe

The global Cell Therapy Contract Manufacturing Organization (CMO) market is driven by several key factors that reflect the dynamic landscape of the biopharmaceutical industry. One of the primary drivers is the increasing interest and investment in cell-based therapies, driven by advancements in regenerative medicine. As the number of cell therapy clinical trials rises globally, biopharmaceutical companies seek the specialized manufacturing expertise offered by CMOs to navigate the complex production processes inherent in cell therapies. The growing awareness of the potential of personalized medicine and the shift towards innovative treatments, including those based on gene and cell therapies, further fuels the demand for CMO services. Collaboration and strategic partnerships between CMOs and therapy developers are also driving the market, providing scalable manufacturing solutions and fostering advancements in manufacturing technologies. Additionally, as regulatory pathways become more defined, the Cell Therapy CMO market benefits from a clearer framework for commercialization. Overall, the increasing focus on cell-based therapies, coupled with the need for specialized manufacturing capabilities, propels the global Cell Therapy CMO market forward.

Opportunity:

Evolving Market

The global Cell Therapy Contract Manufacturing Organization (CMO) market is poised for significant opportunities aligned with the expanding landscape of cell-based therapies. One prominent opportunity lies in the increasing number of cell therapy clinical trials and the subsequent progression of these therapies towards commercialization. As more therapies reach advanced stages of development, the demand for specialized CMO services to scale up manufacturing processes is expected to surge. The rise of personalized medicine and the exploration of novel treatment modalities, including gene therapies, present avenues for CMOs to diversify their service offerings. Furthermore, partnerships and collaborations between CMOs and therapy developers open doors for innovation and the establishment of robust manufacturing platforms. The global nature of the biopharmaceutical industry also presents opportunities for CMOs to cater to a broad spectrum of clients globally. With advancements in manufacturing technologies and process optimization, CMOs can position themselves to meet the evolving needs of the rapidly growing cell therapy market. Overall, the global Cell Therapy CMO market is ripe with opportunities for those attuned to the nuances of this dynamic and evolving sector.

| Report Attribute | Details |

| Market Value in 2022 | 4.2 Billion |

| Forecast in 2032 | 10.36 Billion |

| CAGR | CAGR of 11.3% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Application |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Charles River, • The Discovery Labs, • BIOCENTRIQ, • FUJIFILM, • Diosynth Biotechnologies, • Exothera, • WuXi AppTech, • Pharmaron, • OBiO, • Cell Therapies, • AGC Biologics |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355