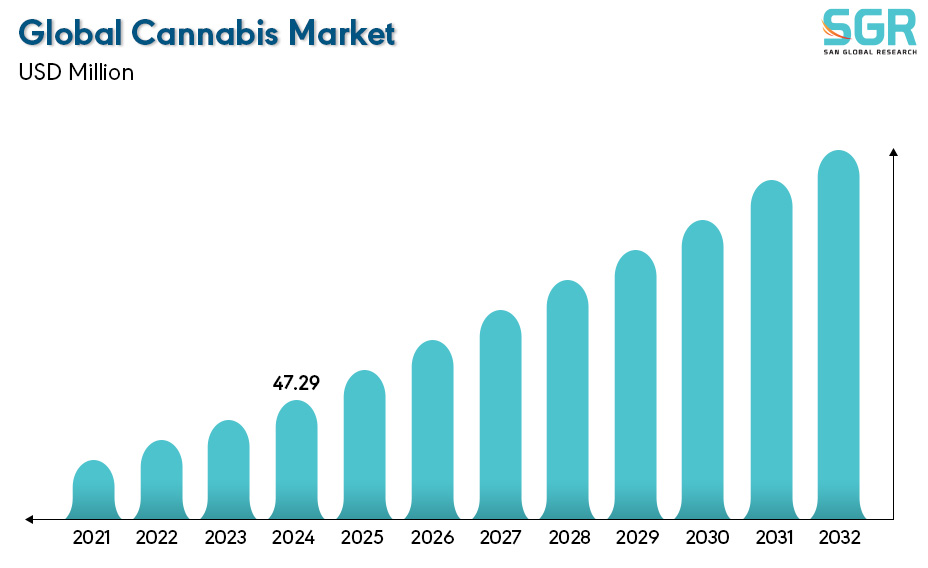

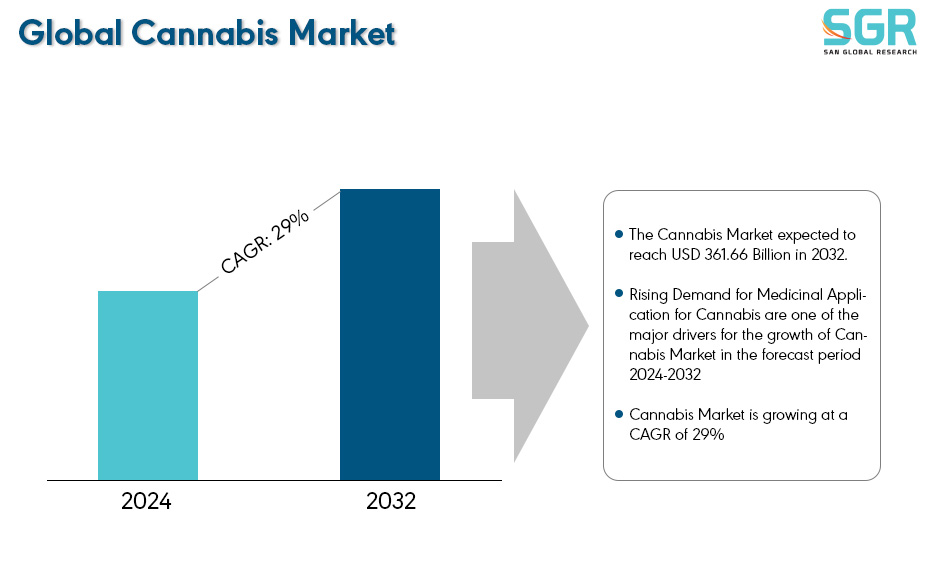

Cannabis Market is estimated to be worth USD 47.29 Billion in 2024 and is projected to grow at a CAGR of 29% between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of the market, and the forecast period is 2024 to 2032. The report analyses and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Product Type, by Application, by Component, and by region/country.

Considering recreational drugs today cannabis is one of the most widely used drugs today. It comes from the genus of the flowering plant, which includes three species: indica, sativa and rudralis. It’s basically native to the Indian subcontinent and Central Asia. Apart from recreational use, it’s also used in religious ceremonies and, more recently, has been used to treat various illnesses, from chronic pain to epilepsy.

Cannabis is composed of remarkably intricate chemical compositions such as delta-9-tetrahydrocannabinol and cannabidiol, which have significantly opposing effects. The discovery of these components has led to the further discovery of a significant neurotransmitter system known as endocannabinoid systems. The system is widely bifurcated in the brain and within the body and is considered to be responsible for various important functions.

After reviewing the data shown below, it can be determined that the North America region dominates the Cannabis Market for the following reasons.

The North American region is significantly dominating the cannabis market due to the increasing demand and legalization within the 30 states in the U.S., which have pushed the market to significant growth. The legalization of cannabis production has helped the revenue grow significantly. For instance, according to research by TAX FOUNDATION it is estimated that the legalized states will have collected nearly $3 billion in marijuana revenues in 2022, and according to an estimation, nationwide legalization could generate $8.5 billion annually for all the states, which is driving substantially the market growth of the Cannabis Market within the region.

Segmentations

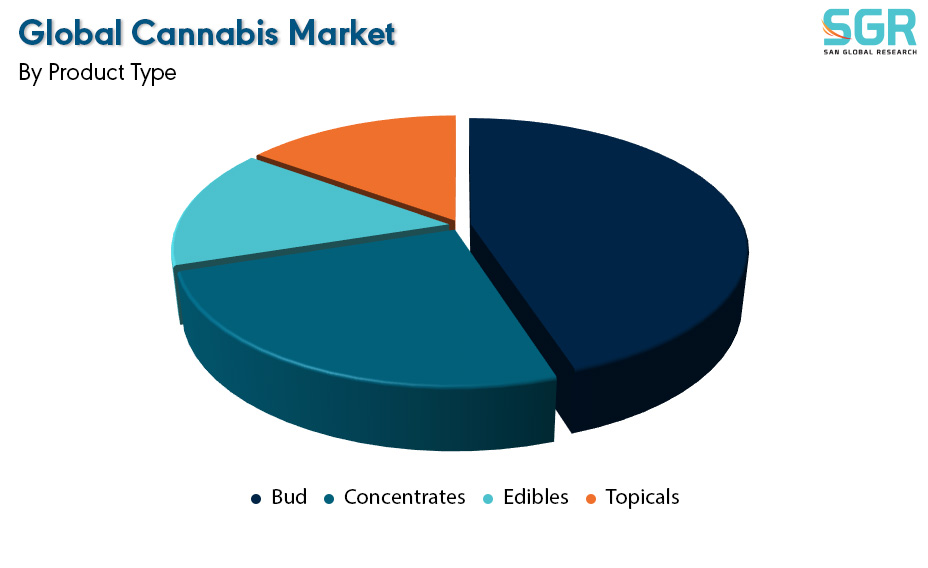

By Product Type

Based on Product Type, the Cannabis Market is bifurcated into Flower, Concentrates, Edibles and Topicals– where Buds segment is dominating and ahead in terms of share. The Bud segment within the product type is dominating the Cannabis Market due to the increasing demand for buds used for smoking purposes within the population due to the recent legalization all around the globe. Consuming the buds allows for a more direct and immediate experience of the plant effect compared to other forms such as concentrates and edibles due to the high THC content within the bud compared to the others, which makes the bud segment dominate within the product segment in the Cannabis Market.

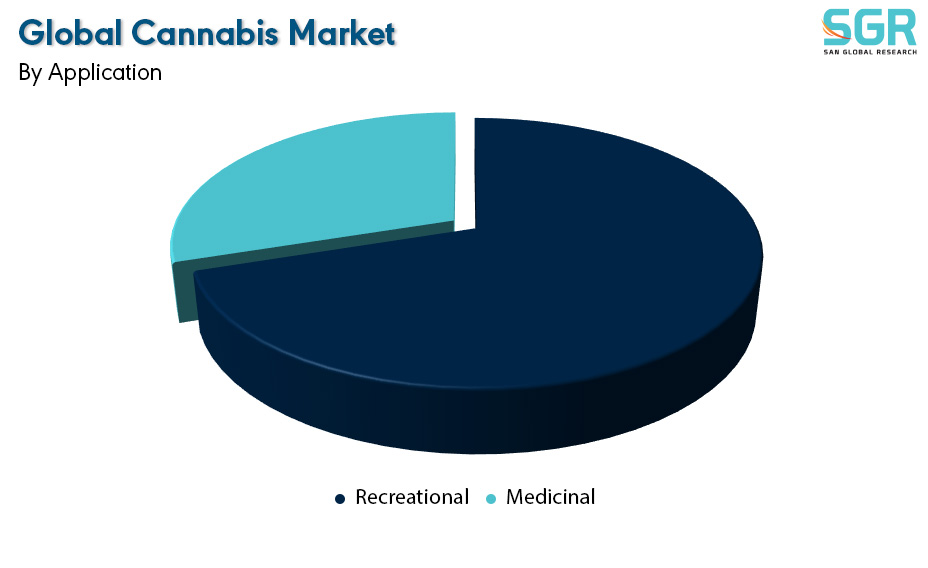

By Application

Based on Application, the Cannabis Market is bifurcated into Recreational and Medicinal– where Recreational segment is dominating and ahead in terms of share.

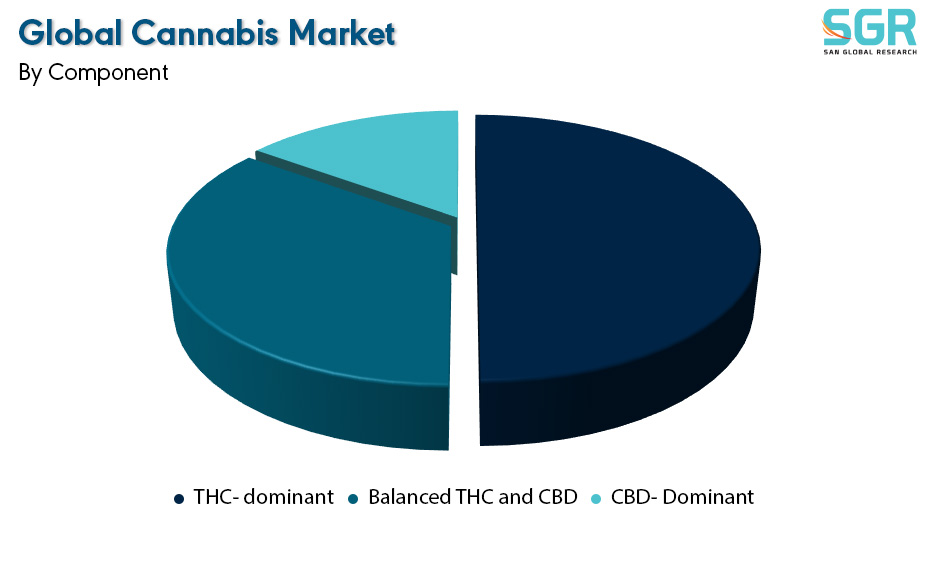

By Component

Based on Component, the Cannabis Market is bifurcated into THC- dominant, Balanced THC and CBD and CBD- Dominant– where THC- dominant segment is dominating and ahead in terms of share.

Key Players

• Aurora Cannabis Inc.

• Tilary Inc.

• Canopy Growth Corporation

• VIVO Cannabis Inc.

• Lexaria Corp.

Drivers

Rising Demand for Medicinal Application

Many countries have acknowledged that the therapeutic capacity of cannabis are immense. For instance, in 2017, a report published by National Academy of Science evaluated 10,700 research articles that have proved with conclusive evidence that cannabis is very effective in the area of chronic pain treatments in adults as antiemetic in the treatment of chemotherapy-induced nausea and vomiting and also for improving the patient's reported multiple sclerosis spasticity symptoms. Oral CBD ingestion caused noticeable reduction in social avoidance and anxiety, as well as improvements in better sleep, feeding, motor co-ordination, sensory processing and language skills, which is significantly driving the market growth of the Cannabis market

Opportunity

Market Expansion through Legalization

The Cannabis Market is significantly experiencing market growth opportunities due to the recent legalization around the globe. For instance, Germany has recently legalized cannabis consumption for adults over 18 to carry and own 25 grams of cannabis for consumption. Also, the United States legalized cannabis in 2021, which has shown immense potential for market growth opportunity for the Cannabis Market.

| Report Attribute | Details |

| Market Value in 2024 | 47.29 Billion |

| Forecast in 2032 | 361.66 Billion |

| CAGR | CAGR of 29% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | By Product Type, By Application, By Component |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Aurora Cannabis Inc. • Tilary Inc. • Canopy Growth Corporation • VIVO Cannabis Inc. • Lexaria Corp. |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355