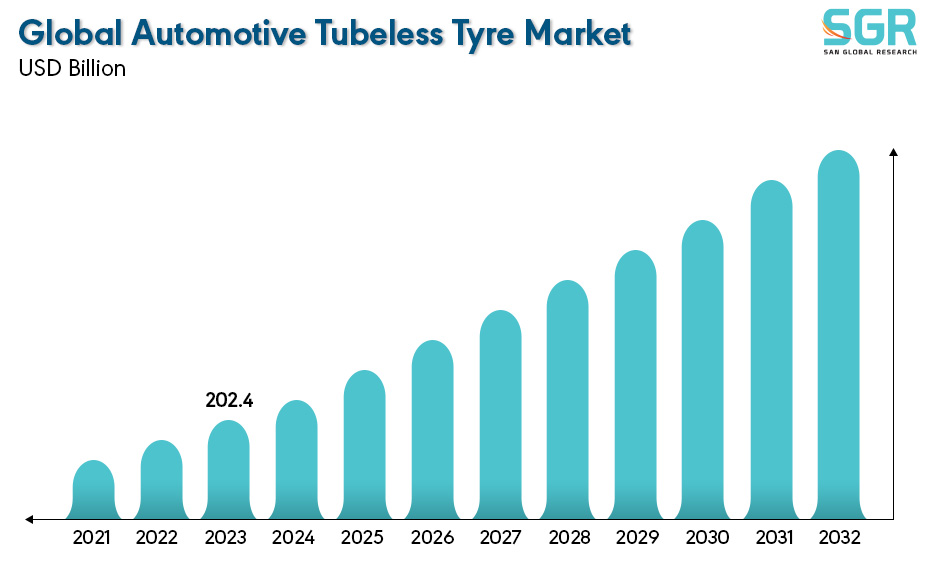

Global Automotive Tubeless Tyre Market is estimated to be worth USD 202.4 Billion in 2022 and is projected to grow at a CAGR of 5.6% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Type, by, by vehicle type, by distribution channel and by region/country.

The global automotive tubeless tire market represents a pivotal segment within the automotive industry, characterized by a significant shift from traditional tubed tires to tubeless ones. These tubeless tires have gained substantial traction due to their numerous advantages, including improved safety, better fuel efficiency, reduced weight, and enhanced driving comfort. The market continues to grow steadily, driven by several factors such as increasing vehicle production, rising consumer preference for high-performance and durable tires, and stringent safety regulations mandating the use of advanced tire technologies. Tubeless tires offer reduced chances of sudden blowouts, improved heat dissipation, and better stability due to their construction, eliminating the need for inner tubes and relying on airtight seals between the tire and wheel rim. Geographically, regions such as Asia-Pacific, Europe, and North America are significant contributors to this market, witnessing high adoption rates due to technological advancements, increased automotive sales, and a focus on vehicle safety and performance. Overall, the global automotive tubeless tire market continues to thrive, driven by innovation, safety standards, and consumer demands for better driving experiences and vehicle efficiency.

.jpg)

Region wise Comparison:

Europe stands as a prominent market for automotive tubeless tires, characterized by stringent safety regulations and a focus on high-quality, performance-oriented vehicles. The region's emphasis on vehicle safety and eco-friendliness contributes to the growing adoption of tubeless tires in the automotive sector.

North America, including the United States and Canada, is a significant contributor to the global tubeless tire market. Consumer preferences for better fuel efficiency and safety features in vehicles have led to the widespread adoption of tubeless tires across various vehicle segments.

_Map.jpg)

The Asia-Pacific region, encompassing countries like China, India, Japan, and South Korea, is a dominant market for automotive tubeless tires. The region experiences significant automotive production and sales, driving the demand for tubeless tires due to increased vehicle ownership and a shift toward safer and more fuel-efficient vehicles.

Latin America contributes to the tubeless tire market, with varying growth rates across different countries due to economic fluctuations and consumer preferences. However, the market sees growth driven by increased vehicle sales and a gradual shift towards tubeless tire technology.

Africa and the Middle East regions are emerging markets for tubeless tires, influenced by economic conditions, vehicle sales, and consumer preferences. While the adoption rates may vary, the market is gradually growing due to the rising automotive industry and safety considerations.

.jpg)

Segmentation:

The Global Automotive Tubeless Tyre Market is segmented by Type, by, by vehicle type, by distribution channel and by region/country.

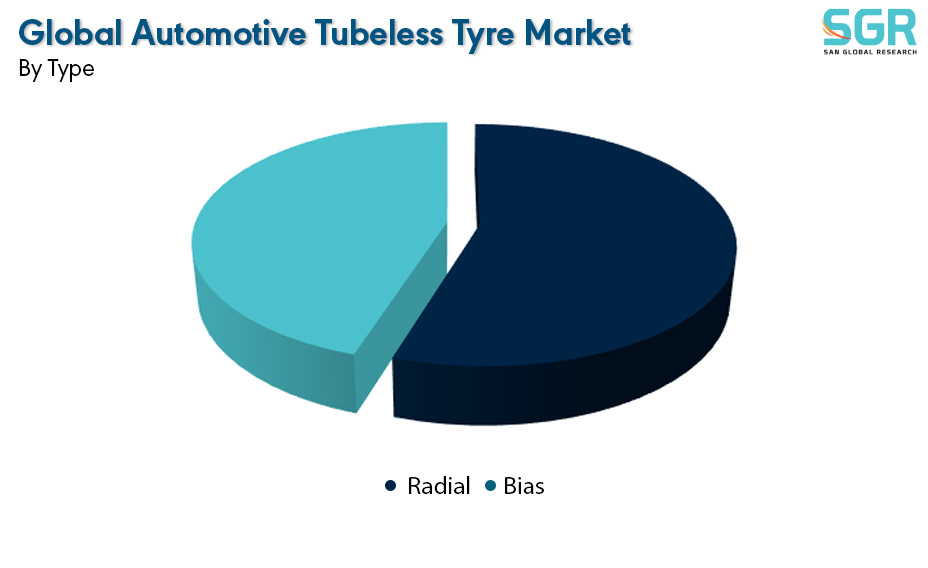

By Type:

Based on Type, the Global Automotive Tubeless Tyre Market is bifurcated into Radial & Bias– where Radial is dominating and ahead in terms of share.

Radial tires represent a significant segment within the global automotive tubeless tire market, characterized by their construction using radial ply layers running perpendicular to the tire's direction. This design offers distinct advantages over traditional bias-ply tires, including better traction, improved fuel efficiency, enhanced ride comfort, and longer tread life. Radial tires are known for their flexible sidewalls, which reduce rolling resistance and heat generation while providing a smoother ride quality. They have gained widespread acceptance across various vehicle types, from passenger cars to commercial trucks, due to their superior performance characteristics.

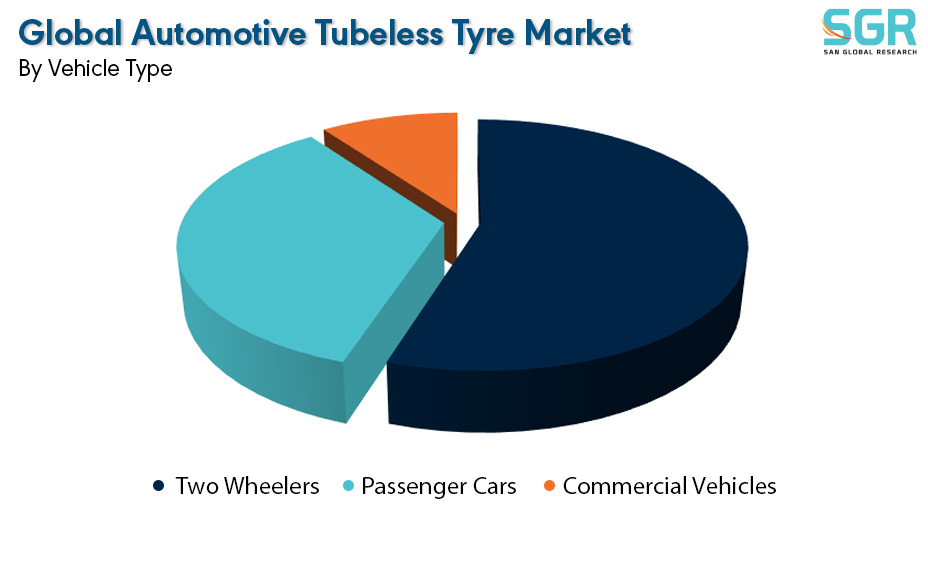

By Vehicle Type:

Based on the Vehicle Type, the Global Automotive Tubeless Tyre Market is bifurcated into Two Wheelers, Passenger Cars, and Commercial Vehicles – where 2 wheelers are dominating and ahead in terms of share.

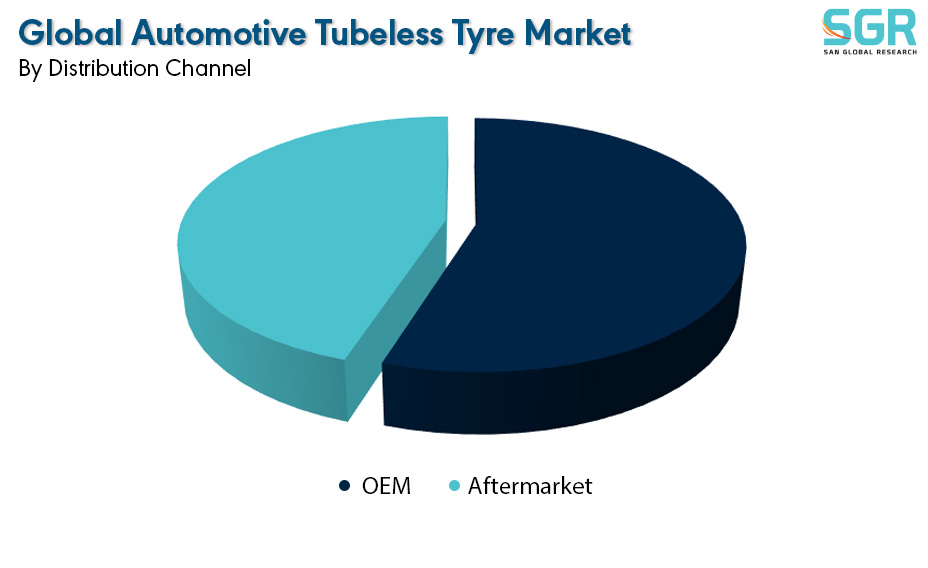

By Distribution Channel:

Based on the Distribution Channel, the Global Automotive Tubeless Tyre Market is bifurcated into OEM & Aftermarket – where OEM is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the Global Automotive Tubeless Tyre Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Global Automotive Tubeless Tyre Market include

• AB Volvo

• MICHELIN, Bridgestone Corporation

• Toyo Tire & Rubber Co. Ltd

• Pirelli Tyre S.p.A

• Continental AG

• CST, Sumitomo Rubber Industries, Ltd

• The Goodyear Tyre & Rubber Company

• Hankook Tire Co. Ltd

• Yokohama Tire Corporation

Drivers:

Growing sector across the globe

The global automotive tubeless tire market is propelled by several key drivers shaping its growth and evolution. One of the primary drivers is the increasing emphasis on vehicle safety standards worldwide. Stricter regulations mandating advanced safety features in vehicles, including tubeless tires, have significantly influenced their adoption. Moreover, the continuous expansion of the automotive industry across emerging economies coupled with rising disposable incomes has spurred vehicle ownership, consequently boosting the demand for tubeless tires. Additionally, the growing focus on fuel efficiency and environmental concerns encourages the use of tubeless tires due to their ability to offer reduced rolling resistance, improved mileage, and lower carbon emissions. Furthermore, technological advancements in tire manufacturing, such as innovative rubber compounds and tread designs, enhance tire durability and performance, further fueling the demand for tubeless tires globally. Overall, these drivers collectively contribute to the robust growth and increasing preference for automotive tubeless tires across diverse vehicle segments.

Opportunity:

Evolving Market

The global automotive tubeless tire market presents numerous opportunities driven by evolving trends and technological advancements within the automotive industry. One significant opportunity arises from the burgeoning electric and hybrid vehicle segment, where the demand for specialized tubeless tires designed for these vehicles continues to grow. Additionally, the rising interest in autonomous vehicles offers prospects for tire manufacturers to develop advanced sensors or smart technologies embedded within tubeless tires to support these vehicles' unique needs for safety and performance. Moreover, the increasing adoption of innovative materials, such as silica compounds and nanotechnology, provides avenues for tire manufacturers to enhance tire performance, durability, and fuel efficiency. The focus on sustainability and eco-friendly solutions further encourages the development of recyclable materials and tire designs that reduce environmental impact, presenting a niche opportunity in the market. Furthermore, the continuous evolution of tire manufacturing techniques and 3D printing technologies enables customization and offers scope for tailored solutions, catering to specific vehicle models or driving conditions.

| Report Attribute | Details |

| Market Value in 2022 | 202.4 Billion |

| Forecast in 2032 | 349.0 Billion |

| CAGR | CAGR of 5.6% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By vehicle type, By distribution channel |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • AB Volvo • MICHELIN, Bridgestone Corporation • Toyo Tire & Rubber Co. Ltd • Pirelli Tyre S.p.A • Continental AG • CST, Sumitomo Rubber Industries, Ltd • The Goodyear Tyre & Rubber Company • Hankook Tire Co. Ltd • Yokohama Tire Corporation |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355