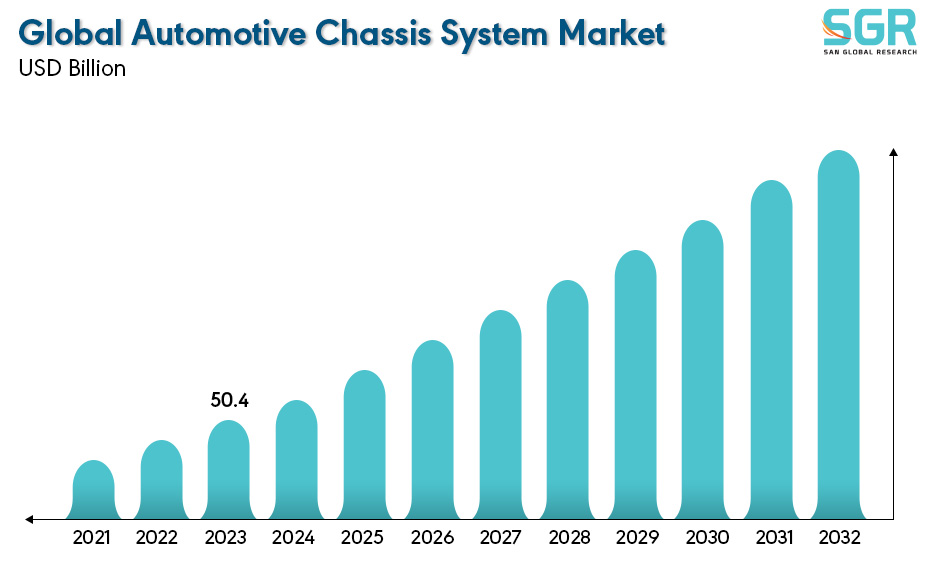

Global Automotive Chassis System Market is estimated to be worth USD 50.4 Billion in 2022 and is projected to grow at a CAGR of 4.3% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by component, by chassis system, by vehicle type and by region/country.

The global automotive chassis system market represents a crucial segment within the automotive industry, encompassing the foundational framework that supports and integrates various vehicle components. Comprising elements like the frame, suspension systems, steering systems, brakes, and other structural components, the chassis system plays a fundamental role in ensuring vehicle stability, handling, and overall safety. The market is driven by a continuous quest for lightweight, durable, and high-performance chassis systems that can accommodate diverse vehicle types, including passenger cars, commercial vehicles, and off-road vehicles. Automakers and chassis system manufacturers focus on innovations to enhance ride comfort, maneuverability, fuel efficiency, and safety features through advancements in materials, design, and technology. Moreover, stringent regulations emphasizing vehicle safety and emissions reduction further propel research and development efforts in the market. Geographically, regions like Asia-Pacific, Europe, North America, and emerging markets contribute significantly to the growth of the global automotive chassis system market, each influenced by unique consumer preferences, regulatory standards, and technological advancements. Overall, the market continues to evolve, driven by the pursuit of superior performance, efficiency, and safety across a wide spectrum of vehicles.

.jpg)

Region wise Comparison:

North America boasts a sizable share in the automotive chassis system market owing to a well-established automotive industry and a strong focus on vehicle performance and safety. Consumers in this region value sturdy chassis systems that offer stability, excellent handling, and safety features.

Europe represents a significant market for automotive chassis systems, characterized by a penchant for sophisticated engineering and performance-oriented vehicles. Stringent regulations regarding vehicle emissions and safety drive innovation, resulting in advanced chassis systems focused on fuel efficiency, handling, and reduced environmental impact.

_Map.jpg)

This region displays robust growth potential due to the burgeoning automotive industry in countries like China, Japan, India, and South Korea. The market here is influenced by a diverse range of vehicles, including compact cars, commercial vehicles, and two-wheelers, each with distinct chassis system requirements.

Latin America contributes to the automotive chassis system market, albeit with variations in growth rates across different countries. Economic fluctuations impact vehicle sales, but there's a growing emphasis on chassis systems that offer durability and adaptability to different road conditions.

These regions are evolving markets for automotive chassis systems, with preferences influenced by economic conditions and terrain variability. Durability and reliability in chassis systems are significant considerations, especially for vehicles used in off-road or rugged conditions.

.jpg)

Segmentation:

The Global Automotive Chassis System Market is segmented by component, by chassis system, by vehicle type and by region/country.

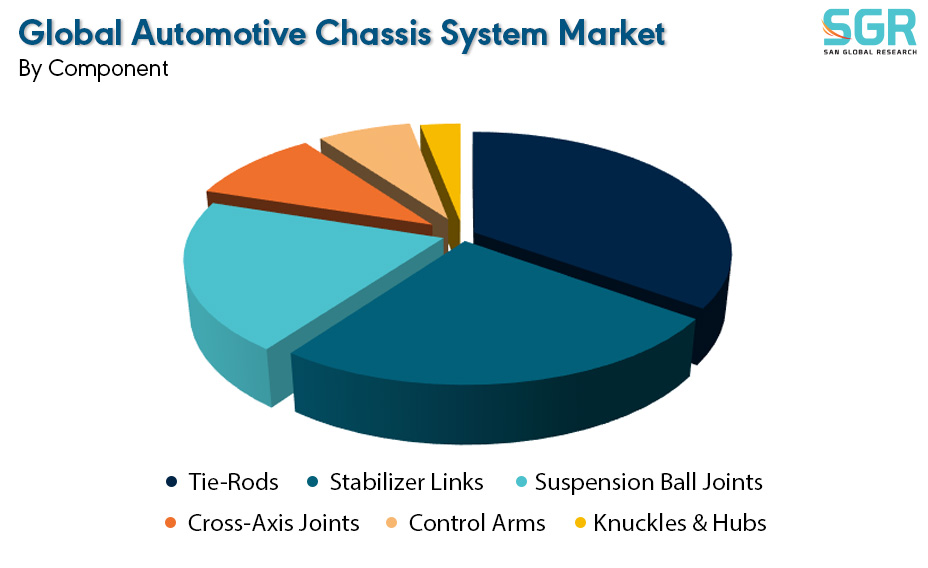

By Component:

Based on the Component, the Global Automotive Chassis System Market is bifurcated into Tie-Rods, Stabilizer Links, Suspension Ball Joints, Cross-Axis Joints, Control Arms, and Knuckles & Hubs – where Tie Rods are dominating and ahead in terms of share.

In the global automotive chassis system market, tie rods play a critical role in ensuring proper steering functionality and vehicle control. Tie rods are essential components that connect the steering knuckles to the steering rack or steering gear, allowing for the transmission of steering input from the driver to the wheels. These crucial linkages come in various types, including inner tie rods and outer tie rods. Inner tie rods connect to the steering rack, while outer tie rods connect to the steering knuckle. The design and quality of tie rods significantly impact steering precision, responsiveness, and overall vehicle handling. The market offers various tie rod types, ranging from traditional to advanced designs, incorporating materials and engineering techniques to enhance durability, reduce weight, and improve steering performance.

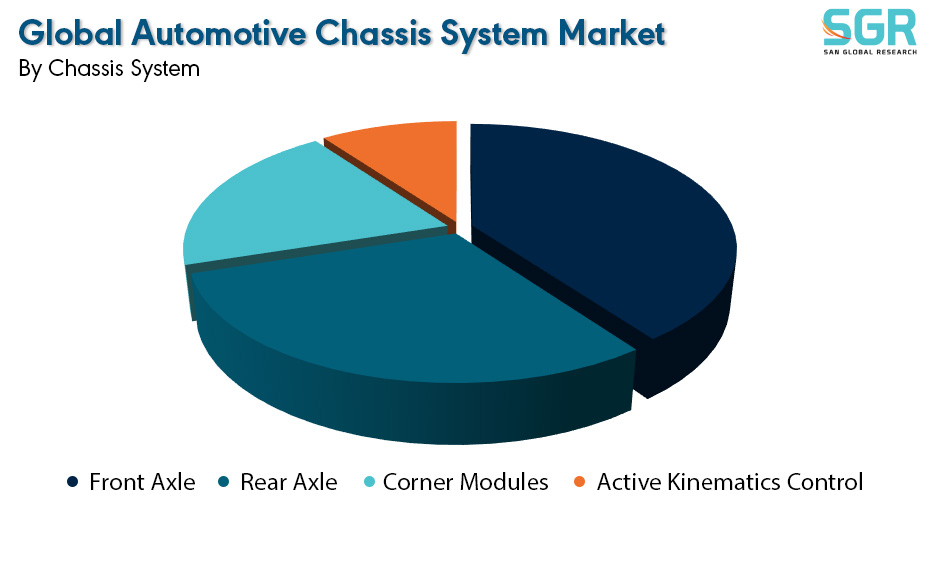

By Chassis System:

Based on the Chassis System, the Global Automotive Chassis System Market is bifurcated into Front Axle, Rear Axle, Corner Modules, and Active Kinematics Control– where Front Axle is dominating and ahead in terms of share.

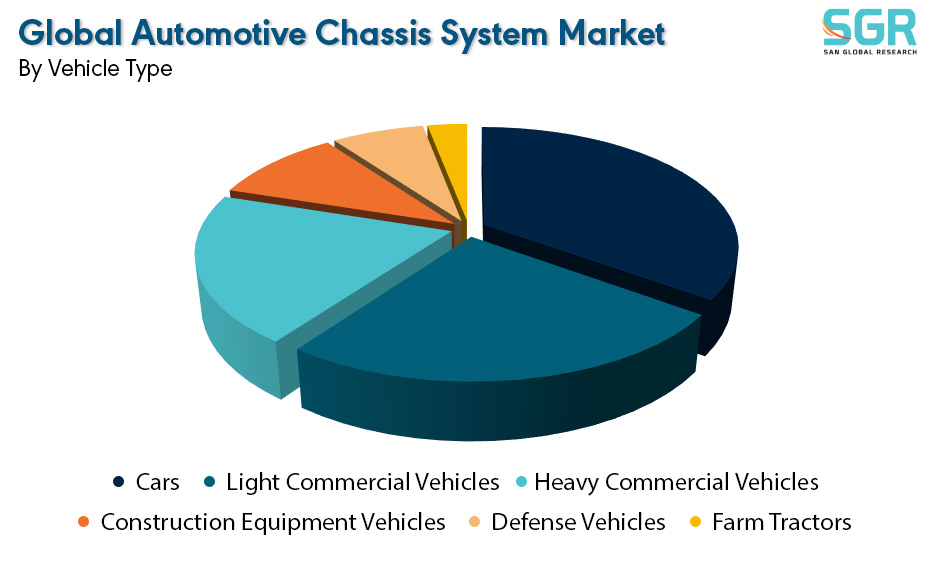

By Vehicle Type:

Based on the Vehicle Type, the Global Automotive Chassis System Market is bifurcated into Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Construction Equipment Vehicles, Defense Vehicles, and Farm Tractors– where Cars is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the Global Automotive Chassis System Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Global Automotive Chassis System Market include

• Aisin Seiki Co., Ltd.,

• Tower International, Inc.

• Hyundai Mobis Co., Ltd

• Continental AG,

• Benteler International AG

• American Axle & Manufacturing Inc.

• Gestamp Automocin S.A.

• Schaeffler AG

• ZF Friedrichshafen AG

• Magna International Inc

Drivers:

Growing sector across the globe

The global automotive chassis system market is driven by several key factors shaping its growth and evolution. One of the primary drivers is the incessant pursuit of enhanced vehicle safety and performance. Stricter safety regulations worldwide demand innovative chassis systems that offer better stability, handling, and crash protection, stimulating advancements in materials and designs. Moreover, the escalating demand for fuel-efficient vehicles drives the development of lightweight chassis systems that optimize fuel economy without compromising structural integrity. The ongoing technological advancements in automotive manufacturing and the rising popularity of electric and hybrid vehicles further propel the market, requiring chassis systems capable of accommodating new power train configurations while maintaining efficiency. Additionally, the increasing preference for enhanced driving experiences and comfort leads to innovations in suspension systems, steering mechanisms, and adaptive chassis technologies. Geographically, diverse market demands and regional preferences influence the market dynamics, shaping the evolution of automotive chassis systems globally. Overall, the market is steered by a combination of safety regulations, technological innovations, environmental concerns, and consumer preferences, driving continual advancements in automotive chassis systems.

Opportunity:

Evolving Market

The global automotive chassis system market presents numerous opportunities propelled by various trends and advancements within the automotive industry. One significant opportunity arises from the rapid evolution of electric and autonomous vehicles, necessitating chassis systems capable of accommodating new propulsion technologies while maintaining structural integrity and safety standards. The increasing demand for lightweight materials and advanced manufacturing processes opens avenues for innovative chassis designs that offer improved fuel efficiency without compromising on performance or safety. Additionally, the growing emphasis on sustainability creates opportunities for the development of eco-friendly chassis materials and manufacturing techniques. Moreover, the rise of connected vehicle technologies and the Internet of Things (IoT) creates prospects for smart chassis systems capable of integrating with vehicle networks for enhanced safety and performance monitoring. Furthermore, the expanding market for commercial vehicles, including trucks and buses, presents opportunities for robust and durable chassis systems designed to withstand heavy loads and varied operating conditions. Overall, the global automotive chassis system market is ripe with opportunities driven by technological advancements, changing consumer preferences, and the evolving landscape of the automotive industry.

| Report Attribute | Details |

| Market Value in 2022 | 50.4 Billion |

| Forecast in 2032 | 76.7 Billion |

| CAGR | CAGR of 4.3% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By component, By chassis system, By vehicle type |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | Aisin Seiki Co., Ltd., Tower International, Inc. Hyundai Mobis Co., Ltd Continental AG, Benteler International AG American Axle & Manufacturing Inc. Gestamp Automocin S.A. Schaeffler AG ZF Friedrichshafen AG Magna International Inc |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355