Report Overview

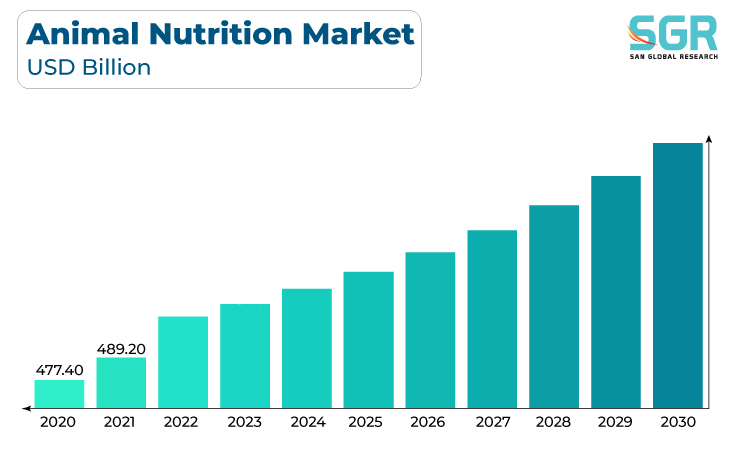

The animal nutrition market was valued at 501.9 billion in 2022 and expected to grow at CAGR of 3.2% over forecast period.

As the global population grows, so does the demand for animal protein products such as meat, milk, and eggs. This drives the need for efficient animal nutrition to support livestock production. Intensive livestock farming is on the rise to meet the growing demand for meat and dairy products. Proper animal nutrition is essential for the health and productivity of animals in these systems. There is a growing awareness of the importance of animal health and welfare. Nutritional strategies can help prevent diseases and ensure the well-being of animals.

Moreover, advances in feed formulation and nutritional science have led to the development of specialized feeds and supplements that enhance animal performance and health.

In addition, Government regulations related to animal nutrition, including the use of additives, antibiotics, and growth-promoting substances, have a significant impact on the industry. Regulatory changes can drive innovation and influence the composition of animal feed. Thus, the animal nutrition industry is driven by a complex interplay of factors, including changing consumer preferences, sustainability concerns, technological advancements, and regulatory developments.

Species Outlook

Based on species, the animal nutrition market is segmented into poultry, ruminant, dairy, aquaculture, swine, and others. Poultry segment accounted for largest share in 2022. The poultry segment is a major driver of growth in the animal nutrition industry due to the increasing global demand for poultry products, the need for efficiency and productivity improvement, health management, and sustainability considerations. Furthermore, Poultry is one of the fastest-growing segments of the global livestock industry. Rising consumer demand for poultry meat and eggs, which are considered affordable sources of high-quality protein, is a significant driver of growth in the poultry industry. To meet this demand, poultry producers seek to optimize production through proper nutrition.

Furthermore, the global trade in poultry products, including meat and eggs, continues to expand. High-quality, nutritionally balanced feed is essential for meeting international quality and safety standards and facilitating poultry product exports. Also, Consumer preferences for leaner and more healthful poultry products drive demand for specialized poultry diets. Nutrition plays a key role in producing poultry products that align with consumer expectations.

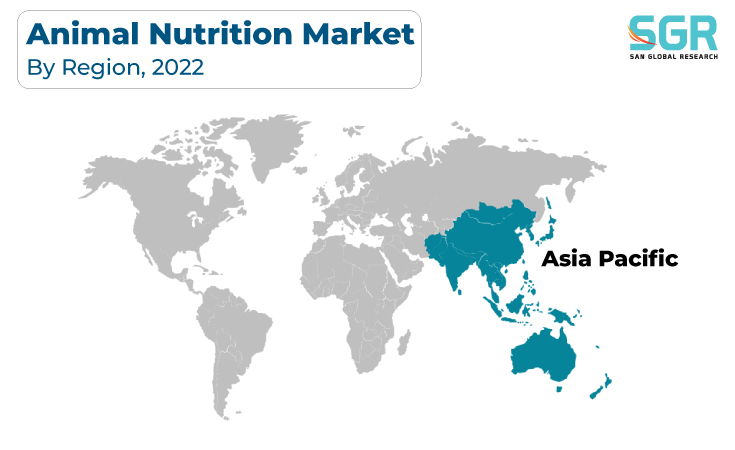

Regional Outlook

Asia-Pacific has emerged as leading market for animal nutrition market in 2022. The Asia-Pacific region is a significant driver of growth in the animal nutrition market due to its large population, rising middle class, changing dietary preferences, expansion of livestock production, and increasing awareness of the importance of animal health and sustainability. The region's influence on the global animal nutrition market is expected to continue to grow as it remains a key player in the global food and agriculture sector.

In addition, The Asia-Pacific region is a major hub for aquaculture, producing a significant portion of the world's farmed fish and seafood. Proper nutrition is critical for the health and growth of aquatic species, and the aquaculture industry's expansion contributes to the demand for specialized aqua feed and nutrition.

Thus, Asia-Pacific region's significant population, changing dietary patterns, expanding livestock sectors, and increasing focus on sustainability collectively drive the growth of the animal nutrition industry. As the region continues to develop and modernize its agriculture and food production systems, the importance of effective animal nutrition will remain paramount to meet the growing demand for animal protein.

Animal Nutrition Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 501.9 Billion |

| Forecast in 2030 | USD 643.28 Billion |

| CAGR | CAGR of 3.2% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Species, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | Cargill, ADM, Nutreco, DSM, Evonik Industries, Novozymes, Alltech, Chr. Hansen, Kemin Industries and Phibro Animal Health among others |

Global Animal Nutrition Market, Report Segmentation

Animal Nutrition Market, By Species

- Poultry

- Ruminant

- Dairy

- Aquaculture

- Swine

- Others

Animal Nutrition Market, By Application

- Veterinarians

- Animal Feed Manufacturers

- Households

- Farms

- Others

Animal Nutrition Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355