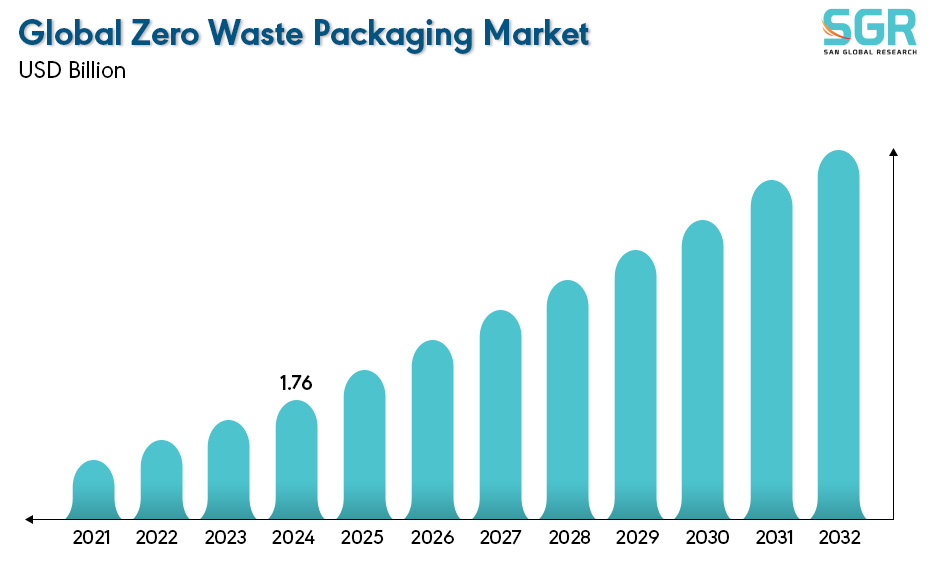

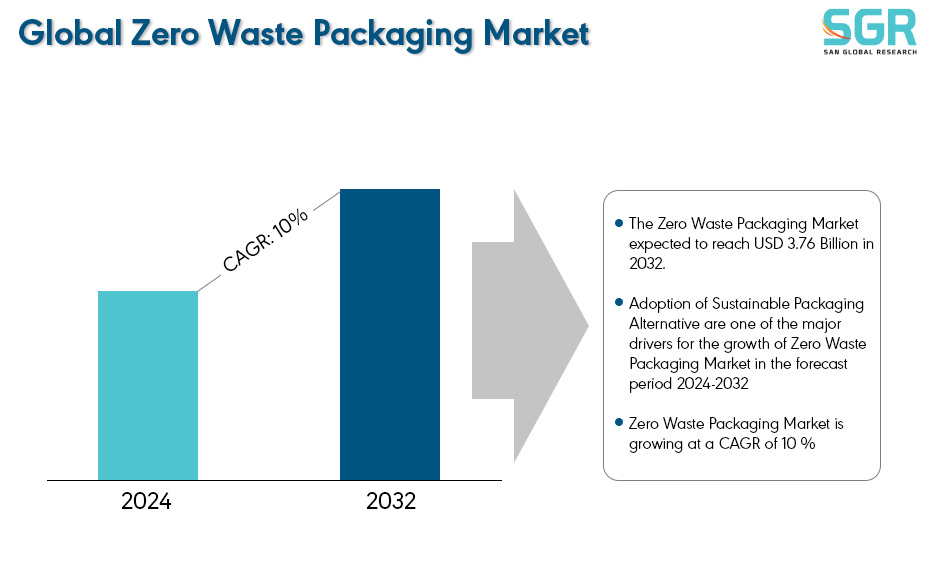

Zero Waste Packaging Market is estimated to be worth USD 1.76 Billion in 2024 and is projected to grow at a CAGR of 10 % between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of market and the forecast period is 2024 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Type, by End User and by region/country.

Zero-waste packaging is a system where all used materials are reused or recycled, eliminating waste. This approach significantly reduces global waste generation, addressing the pressing issue of waste accumulation. Managing such huge amounts of waste often involves burying it in landfills or disposing of it in oceans, causing a serious threat to aquatic life. Due to the increasing accumulation of plastics, with over 5 trillion pieces of plastic floating in the oceans being at risk.

Annually about 8 million tons of plastic litter and 1.5 million tons of micro plastics enter the oceans, mainly from coastal and riverine areas lacking proper waste management systems. To fight this issue, governments and NGOs worldwide are collaborating to take strict actions to regulate the disposal of packaging waste into water bodies and promote zero-waste packaging practices.

After reviewing the data shown below, it can be determined that the North America region dominates the Zero Waste Packaging Market for the following reasons.

As the single use plastic food packaging trend is a significant contributor for the global waste problem. Consumer awareness plays an important role into the understanding the environmental concerns are more critical than the food safety and showing willingness to switch to a sustainable alternative. For instance, a Canada wise study surveyed 1014 consumer were willing to pay premium for sustainable food packaging alternatives to reduce single-use plastic waste. Around 93.7% respondent were interested and motivated to reduce the consumption of single-use plastic food packaging by significantly boosting the Zero Waste Packaging Market within the North American region.

The Asia-Pacific region is emerging as a frontrunner in the Zero-Waste Packaging Market, fuelled by a confluence of eco-conscious younger generations embracing sustainable alternatives, supportive government policies restricting single-use plastics, and collaborations with waste recycling plants to tackle plastic waste and promote a circular economy. This shift not only benefits the environment by reducing pollution, but also fosters significant energy savings of 20-90% through the use of recycled materials, including plastics which is helping the Zero Waste Packing Market grow steadily.

Segmentations

By Type

Based on the Type, the Zero Waste Packaging Market is bifurcated Reusable Packaging, Compostable Packaging and Recyclable Packaging– where Compostable Packaging is dominating and ahead in terms of share. Due to environmental concerns and awareness within various sectors, we can see various collaborations within industries. For instance, TIPA, a globally dominant giant within compostable packaging solutions for fashion and food, announced their partnership with Wyld, a North American legal edible market leader, to provide an alternative for plastic packaging and fight pollution from single-use flexible plastics that can't be easily recycled.

By End User

Based on the End User, the Zero Waste Packaging Market is bifurcated Food and Beverage, Healthcare, Personal Care, Industrial and Others– where Compostable Packaging is dominating and ahead in terms of share. The food and beverages segment is growing due to the increasing population and rising food demand. The consumption and production cycle of food is highly complex, with food waste management and packaging waste management at the end of the cycle being crucial factors. Annually, the EU generates approximately 100 million tons of food waste, with about 30% of it entering the agri-food supply chain. With the population expected to grow, there will be a significant surge in food demand, consequently promoting higher volumes of packaging waste. Among these, polyethylene emerges as the most commonly used polymer for packaging where there is significant room to adopt the sustainable alternatives, substantially increasing its market share in the Zero Waste Packaging Market, particularly within the Food and Beverage segment.

Key Market Players

• TIPA

• Do Eat

• Evoware

• No Waste Technology

• Origin Materials

Drivers

Adoption of Sustainable Packaging Alternative

Packaging should ensure high product hygiene standards, especially for food and beverages, as it can extend the product shelf life. Even innovative sustainable packaging should meet all these norms. Recently, special attention has been paid to innovative materials in packaging and sustainable waste management solutions. Some existing food packaging is innovative and sustainable due to its resources and bio-based nature, while some are innovative and sustainable due to their end-of-life characteristics, being biodegradable or compostable. Undoubtedly, innovative bio-based packaging can become a great alternative to traditional conventional plastic packaging, driving the Zero Waste Packaging Market significantly.

Opportunity

Improved Recycling Technologies

Recycling packaging materials play an increasingly important role in the packaging industries. Before the development of diverse recycling methods and supporting legislation in the past two decades, a significant portion of post-consumer packaging waste ended up in landfills or was incinerated Currently, a recycling issue is emerging regarding the extensive use of plastic as a packaging material. Among various packaging materials, plastics have been widely utilized due to their lower price, lightweight nature, structural properties, ease of use, and resistance to chemicals and corrosion, among other factors. Technologies like Depolymerisation are primarily employed in addressing this issue, presenting a substantial opportunity for the Zero Waste Packaging Market to grow significantly.

| Report Attribute | Details |

| Market Value in 2024 | 1.76 Billion |

| Forecast in 2032 | 3.76 Billion |

| CAGR | CAGR of 10% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | By Type and By End User |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • TIPA • Do Eat • Evoware • No Waste Technology • Origin Materials |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355