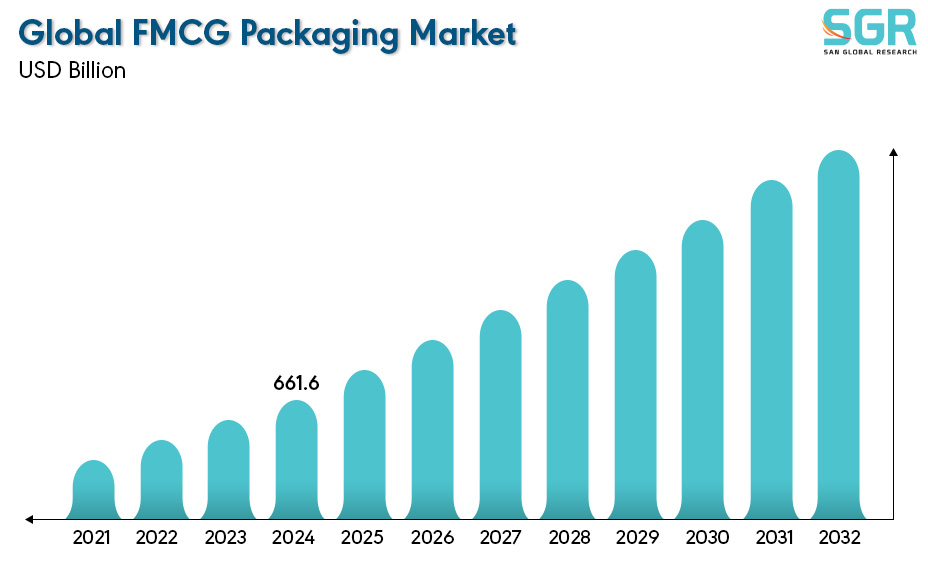

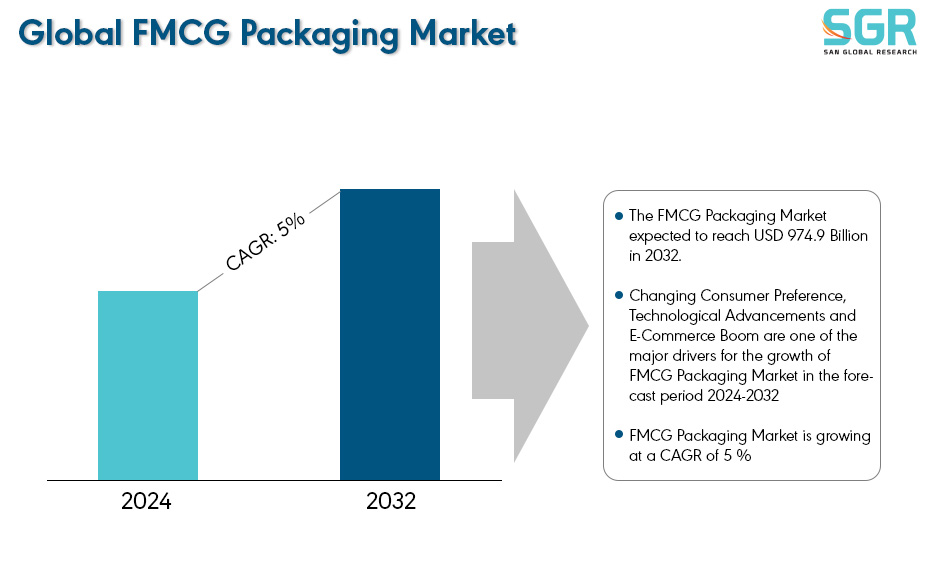

FMCG Packaging Market is estimated to be worth USD 661.6 Billion in 2024 and is projected to grow at a CAGR of 5 % between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of market and the forecast period is 2024 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Material Type, by Product Type, by End User and by region/country.

Fast-moving consumer goods (FMCGs) are a large category of lower-priced products that sell quickly and leave store shelves rapidly, commonly found in supermarkets, hypermarkets, convenience stores, and other retail outlets. FMCG companies in the personal care category leverage packaging to attract and persuade customers.

Trends show consumers are drawn to packaging that emphasizes affordability, convenience, storage ease, differentiation from competitors, style, and attractiveness. However, the rising consumption of FMCGs also significantly increases packaging waste. Fortunately, many sustainable alternatives are emerging as potential packaging sources.

After reviewing the data shown below, it can be determined that the North America region dominates the FMCG Packaging Market for the following reasons. North America holds a significant lead in the FMCG packaging market, driven by the rising demand for convenient food options. This includes beverages, canned goods, dairy products like milk and yogurt, ready-to-eat snacks, and ready-to-serve meals. This trend significantly boosts market growth. Major packaging companies are also active in the region due to its well-developed e-commerce infrastructure. For example, Walmart's efficient home delivery system for these convenience products further fuels market growth for FMCG packaging.

The Asia Pacific region is experiencing steady market growth in FMCG packaging due to rapid urbanization and evolving consumer preferences, particularly among Gen Z. Additionally, the region's large population fuels a significant rise in e-commerce activity for FMCG products. This growing demand necessitates robust and efficient packaging solutions, further driving the FMCG packaging market.

Segmentations

By Material Type

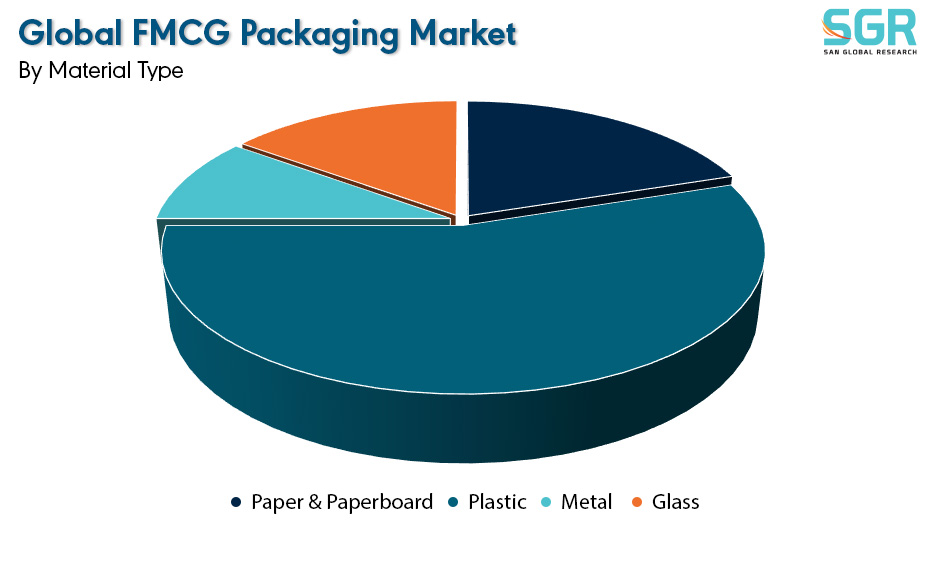

Based on the Material Type, the FMCG Packaging Market is bifurcated by Paper & Paperboard, Plastic, Metal and Glass– where Plastic is dominating and ahead in terms of share. Plastics dominate the FMCG Packaging Market due to various properties that make them ideally suited for food packaging. These properties offer a unique combination of benefits compared to traditional materials. Paper, for example, is lightweight but lacks sufficient moisture resistance for many food applications unless combined with plastic for reinforcement. The lightweight nature of plastic enhances consumer convenience and significantly reduces shipping costs, a key driver behind plastic's penetration into the market for food containers, once dominated by metal and glass. Additionally, plastic's ability to create strong hermetic seals at low temperatures (100-250 degrees Celsius) is unmatched by other packaging materials, making it crucial for manufacturers. This property further solidifies the dominance of the Plastic segment within the FMCG Packaging Market.

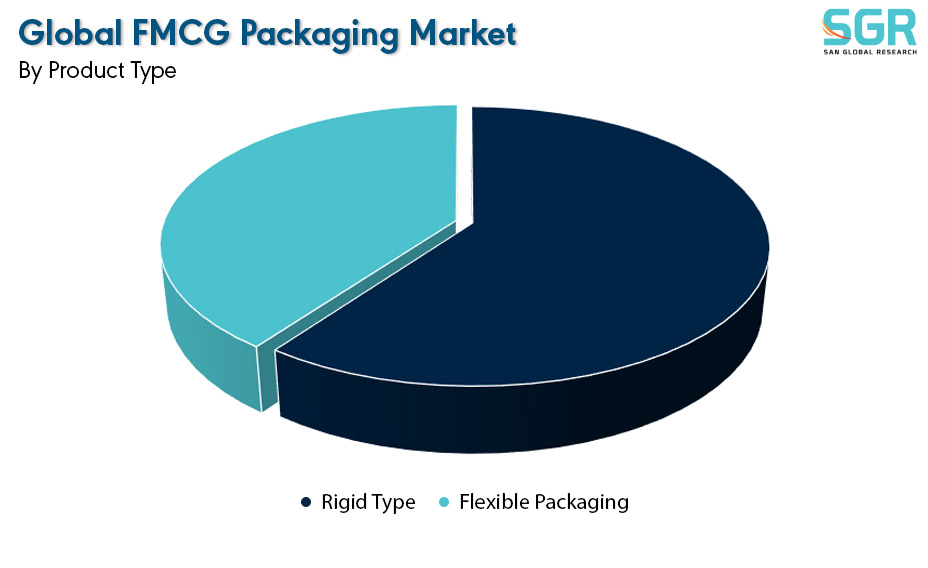

By Product Type

Based on the Product Type, the FMCG Packaging Market is bifurcated by Rigid Type and Flexible Packaging– where Rigid Type is dominating and ahead in terms of share. Many manufacturers are increasingly adopting rigid packaging due to its significant market share growth. This rise is driven by the need for enhanced protection against physical impact and environmental factors like moisture, which is crucial for many FMCG products. Rigid packaging's ability to provide these benefits makes it the dominant segment within the market.

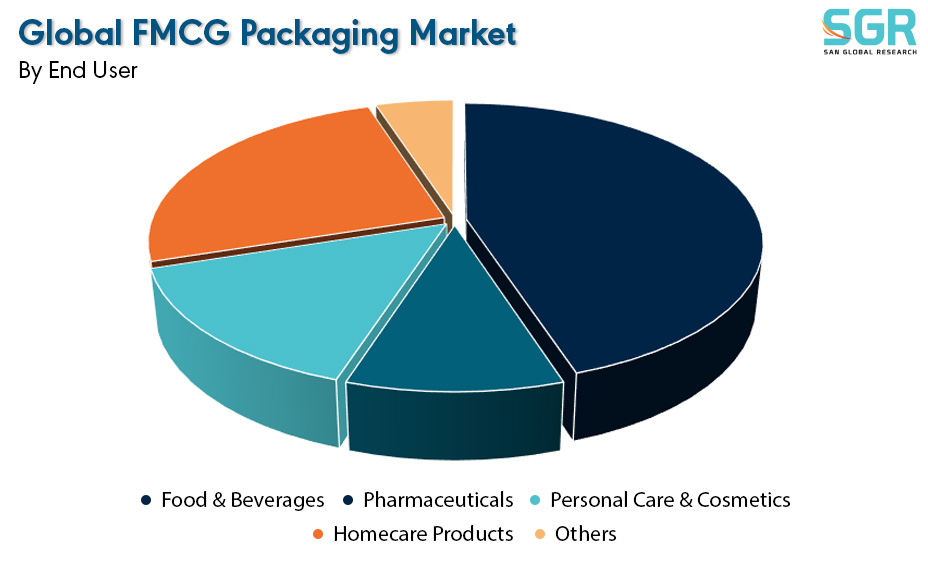

By End User

Based on the End User, the FMCG Packaging Market is bifurcated by Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Homecare Products and Others– where Food & Beverages is dominating and ahead in terms of share.

Key Players

• Amcor Ltd

• Ball Corporation

• DS Smith PLC

• Mondi PLC

• Sonoco Products Company

Drivers

Increasing Consumer Demand and Changing Consumer Preference

Fast-moving consumer goods (FMCG) are high-volume, lower-priced products that turn over quickly on retail shelves in supermarkets, hypermarkets, convenience stores, and other retail outlets. Even the packaging's colour and materials significantly impact consumer behaviour for growing population. This growing consumer demand and evolving preferences are driving the market share of the FMCG Packaging Market.

Opportunity

Technological Advancements and E-Commerce Boom

The combined force of technological advancements and e-commerce growth presents a significant opportunity for the FMCG packaging market. E-commerce demands robust and functional packaging that endures transportation challenges and environmental factors like heat. While packaging's core purpose remains protecting products during shipping, handling, and storage, advancements are adding exciting new dimensions. Innovative materials are being deliberately incorporated to interact with the product, offering additional functionalities. This is particularly beneficial for perishable goods like agricultural products and food items. Recent years have seen advancements in incorporating synthetic or natural agents that provide antimicrobial, antioxidant, and catalytic properties. These innovations extend beyond, even offering features like deodorization, regeneration, and self-sterilization.

| Report Attribute | Details |

| Market Value in 2024 | 661.6 Billion |

| Forecast in 2032 | 974.9 Billion |

| CAGR | CAGR of 5.0% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | By Material Type , By Product Type, By End User |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Amcor Ltd • Ball Corporation • DS Smith PLC • Mondi PLC • Sonoco Products Company |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355