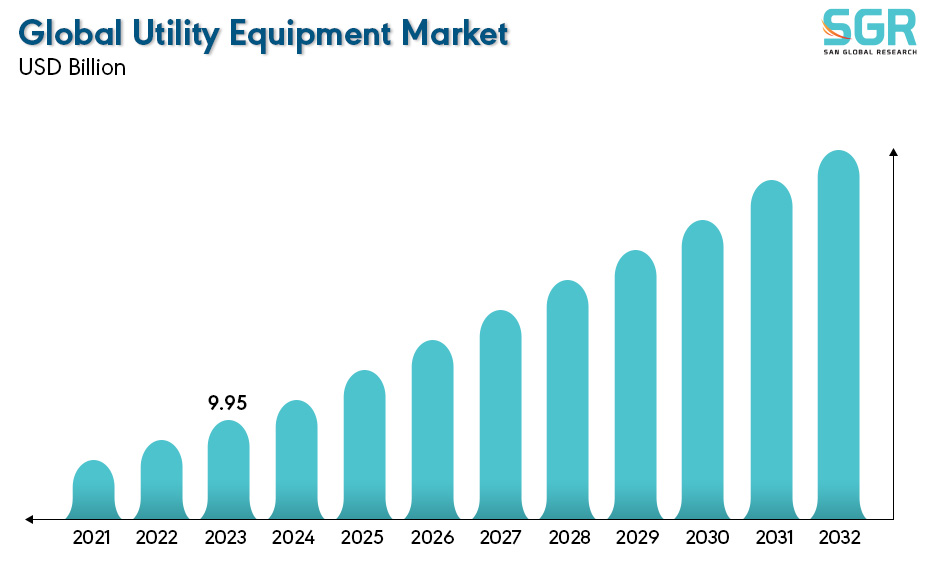

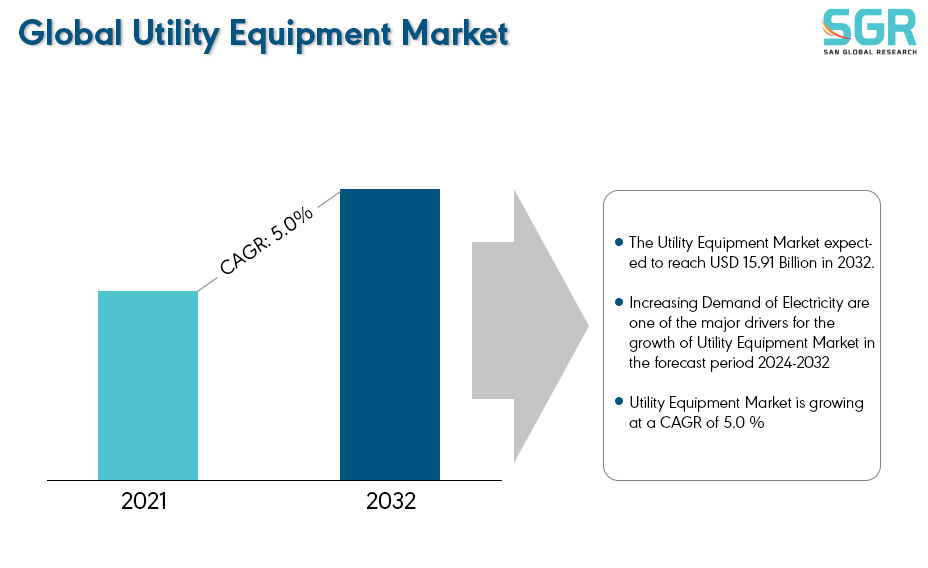

Utility Equipment Market is estimated to be worth USD 9.95 Billion in 2023 and is projected to grow at a CAGR of 5.0 % between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of market and the forecast period is 2024 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Type, by Application, by End User Segmentation and by region/country.

The utility equipment market is a critical sector that supports the utilities industry, providing essential services such as natural gas, electricity, and water to consumers. This market encompasses a diverse range of equipment used by utility companies to generate, distribute, and manage these fundamental amenities. From transformers and switchgears to transmission towers and power cables, utility equipment forms the backbone of the infrastructure necessary for the reliable supply of utilities to homes, businesses, and industries.

The sector's growth is driven by the increasing demand for electricity, grid modernization efforts, and the integration of renewable energy sources like solar and wind power. The utility equipment market plays a vital role in ensuring the efficient delivery of essential services to meet the needs of consumers and industries alike.

After reviewing the data shown below, it can be determined that the Asia Pacific region dominates the Utility Equipment Market for the following reasons.

The North American region plays a dynamic and crucial role in the Utility Equipment Market. In the United States, electricity is indispensable for residential homes, factories, and various commercial establishments, playing a crucial role in sustaining daily operations. Any disruption in the consistent supply of electric power is unwelcome and can lead to significant economic losses. The nation's electric grid is a sophisticated network comprising generation plants, transmission lines, and distribution systems. The North American grid is divided into three major networks (Eastern, Western, and Texas), boasting an extensive infrastructure of 200,000 miles of high-voltage transmission lines ranging from 110 kV to 765 kV, along with millions of miles of distribution lines. Due to the essential nature of electricity and the intricate infrastructure supporting its supply, the utility equipment market is experiencing continuous growth. The increasing demand for a reliable and uninterrupted power supply, coupled with the complexity of the electric grid, has propelled the need for advanced utility equipment. This includes transformers, transmission lines, distribution systems, and other essential components, contributing to the expansion of the utility equipment market to meet the evolving requirements of the nation's electric infrastructure.

As the Utility Equipment Market is surging in the Asia Pacific region. With internet penetration rates exceeding 50 percent in almost all ASEAN member states and the region's digital economy anticipated to achieve US $100 billion in revenue by 2023, there is a growing demand for faster connection speeds and increased bandwidth capacity facilitated by next-generation undersea cables. Countries are making substantial investments in digital transformation policies, strategies, and blueprints to enhance efficiency in public services. Notably, Singapore has achieved 99 percent end-to-end digitalization of government services as part of its Smart Nation initiative, while at least five out of ASEAN's 10 member states have established artificial intelligence frameworks. This presents the potential for an annual growth rate of up to 6%, reaching US $1 trillion. As a result of these trends, the network and transmission segment within the utility equipment market is booming. The surge in demand for faster and more efficient digital connectivity, coupled with the emphasis on digital transformation across nations, is driving the need for advanced utility equipment. This includes infrastructure related to networks and transmission, such as undersea cables, which are critical components in meeting the escalating requirements of the growing digital economy in the ASEAN region.

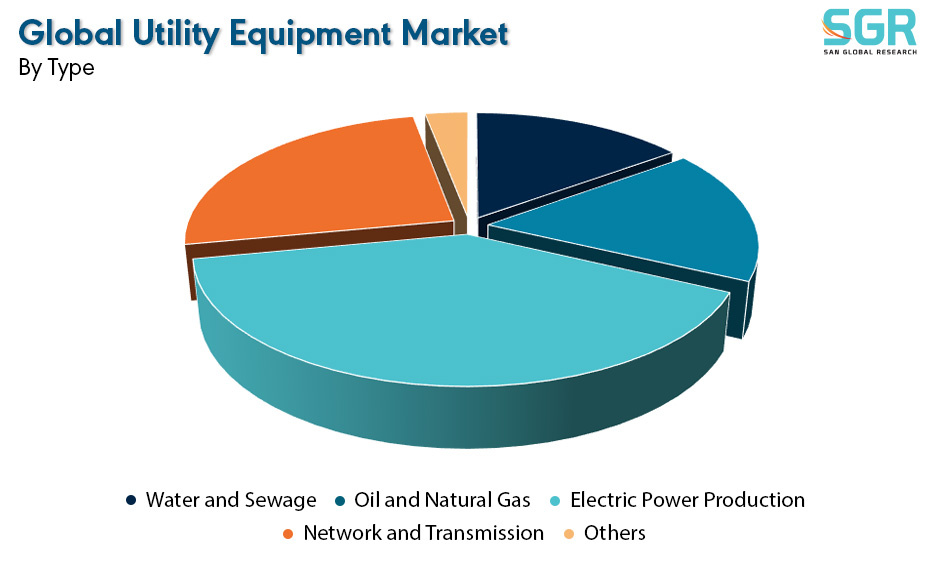

Based on the Technology, the Utility Equipment Market is bifurcated into Water and Sewage, Oil and Natural Gas, Electric Power Production, Network and Transmission and Others– where Electric Power Production based type is dominating and ahead in terms of share.

Due to a substantial 2.6% year-on-year increase in demand in 2022, attributed to heightened economic activity and increased residential usage for both heating and cooling requirements amid extreme weather conditions, the United States experienced a notable surge. This surge was particularly notable with hotter summer weather and a colder-than-normal winter. Globally, the electrification of the transport and heating sectors continued to gain momentum, with record sales of electric vehicles and heat pumps in 2022 contributing to overall growth.

Segmentations

By Type

Based on the End User, the Utility Equipment Market is bifurcated into Municipal Utility, Industrial Utility, Airport Utility and Residential Utility– where Industrial Utility based end user is dominating and ahead in terms of share.

The industrial sector is dominated by the manufacturing sector, which accounts for the largest share of annual industrial energy consumption, followed by mining, construction and agriculture. Mining involves the extraction of coal, oil, and natural gas, as well as non-mineral products such as minerals, stones, and gravel. Agriculture includes farming, fishing, and forestry. Manufacturing, on the other hand, means converting materials or substances physically, mechanically, or chemically into new products. The U.S. Energy Information Administration (EIA) provides energy consumption forecasts for these four major industries. Manufacturing leads the way at 76%, followed by mining at 12%, construction at 7%, and agriculture at 4%. This distribution highlights the dominance of the industrial utilities segment in the utility equipment market, primarily due to the significant energy demand from the manufacturing sector.

By End User

Key Players

• Seimens LLC

• Yorkshire Water

• Power Grid Corporation of India Limited

• Municipal Water and Sewage Company S.A.

• Cadent Gas Ltd

• Korea Gas Corporation

• Abu Dhabi National Oil Company

Drivers

Increasing Electricity Demand

The utility equipment market is experiencing growth owing to the increasing demand for electricity supply. Global electricity demand is rising at a faster rate than renewables, with a 5% increase in 2021 largely satisfied by fossil fuels such as coal. The demand for renewable electricity is propelled by three main drivers: policy, voluntary action, and economics. Policies mandating a percentage of renewable electricity drive growth among electric service providers, while voluntary purchasing by consumers also boosts the demand for renewables due to their environmental and economic benefits. Looking ahead, global electricity demand is projected to grow by an average of 3.4% annually through 2026, with China and India leading in demand growth rates. Overall, the market for utility equipment is on the rise due to escalating global electricity demand, driven by economic recovery, policy mandates for renewables, voluntary consumer actions, and the cost-effectiveness of renewable resources such as wind and solar power.

Opportunity

Technological Advancement

Electricity, gas, and water utilities are encountering the challenge of digital transformation, with the smart grid standing out as a prominent example of this extensive yet promising technological initiative. The smart grid represents an electricity supply network employing digital communications technology to detect and respond to local changes in usage. These advancements in technology also play a crucial role in shaping energy strategies. Consequently, the utility equipment market is witnessing growth as these utilities embrace digital transformation to enhance efficiency and responsiveness in the evolving landscape of energy infrastructure.

| Report Attribute | Details |

| Market Value in 2023 | 9.95 Billion |

| Forecast in 2032 | 15.91 Billion |

| CAGR | CAGR of 5% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By End User |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Seimens LLC • Yorkshire Water • Power Grid Corporation of India Limited • Municipal Water and Sewage Company S.A. • Cadent Gas Ltd • Abu Dhabi National Oil Company |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355