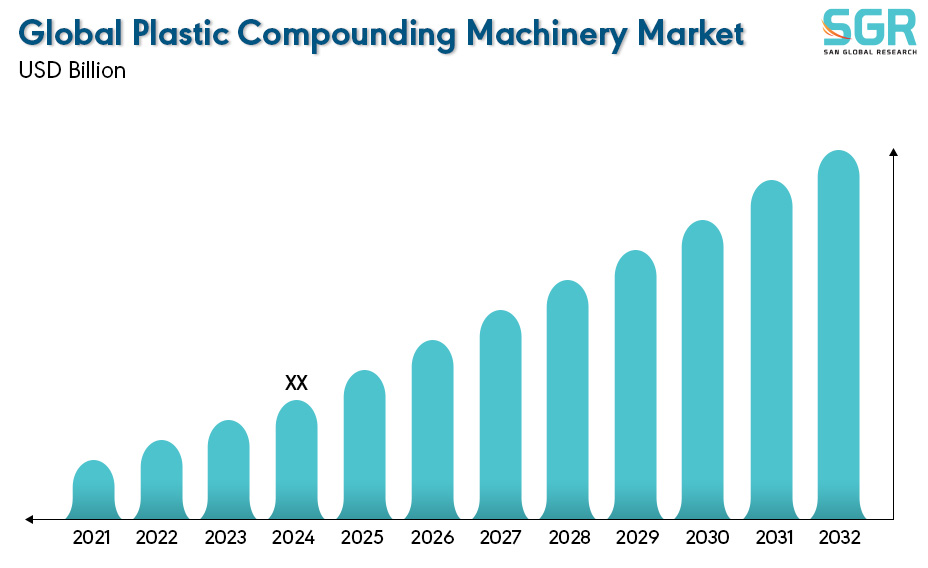

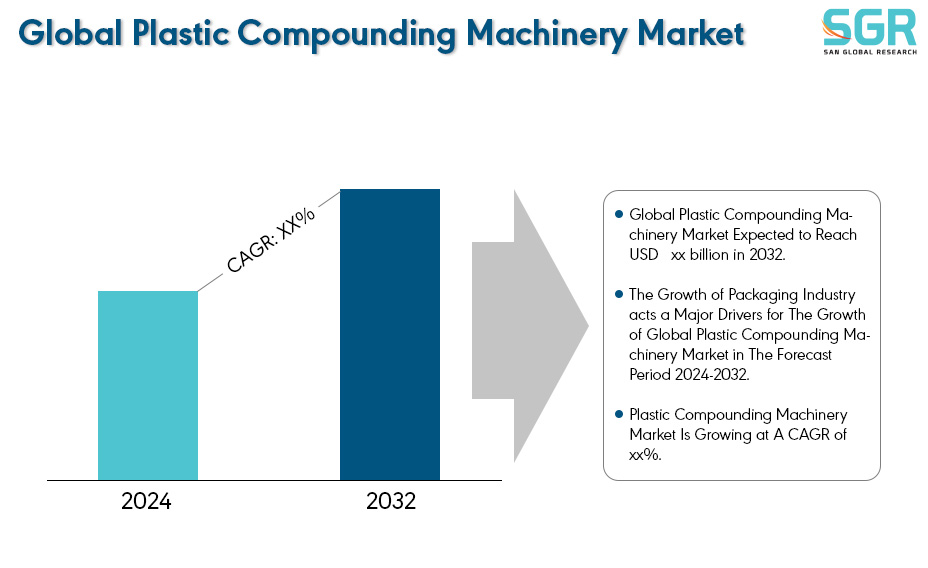

Global Plastic Compounding Machinery Market is estimated to be worth USD XX billion in 2024 and is projected to grow at a CAGR of XX% market size of market and the forecast period is 2024 to 2032. The report analyses and forecasts the market size, in terms of value (USD million), for the market. The report segments the market and forecasts it by Type, By Application, By End user industry and by region/country.

Plastic compounding machine is an important part of plastic production and provides ideal conditions for polymer blending, compound additives, upgraded polymer properties, as well as glass fiber reinforcement and other compound additives. Plastic mixing machines are generally twin-screw extruders with isodirectional or reverse design. Other types of construction include single screw extruders, kneaders and mixers. Thermoplastic forming process (D-LFT) and supercritical carbon dioxide mixing process are widely used. The world's plastic laminating machine supplier aiming to provide customized engineering plastic laminating machine suitable for applications that produce materials at the lowest operating cost and handle a variety of temperatures and save materials. More and more international products are being offered at competitive prices, with an increase in orders taking time to characterize the new business environment facing manufacturers. The key to overcoming these challenges is that plastic laminators are flexible; That's why companies are developing designs that combine different materials to complete the installation, providing the best fluid mix for specific applications and reducing operating and maintenance costs. Recently, manufacturers have begun to offer various advanced equipment and solutions for plastic laminators.

Regional Analysis

Asia Pacific have a significant share of Plastic Compounding Machinery Market

Asia Pacific is expected to register the highest growth during the forecast period due to various factors such as demographic and social changes such as urbanization, aging population, rise and development of the middle class. Countries like Japan and India. One of the most important drivers of engineering plastics is the increasing purchasing power of consumers in the construction/new industry. to buy. Therefore, car demand and production continues. In addition, as their power increases, the demand for high-tech products and electrical-electronic products will also increase, thus the demand for engineering plastics in the Asia-Pacific region will also increase. Integrating sustainability processes into business to achieve sustainability goals should have a significant impact on the growth of business in education. Some players are encouraged to expand their operations in the region. For Instance, plastic compounding company Celanese plans to expand its compounding and LFT facility in Nanjing, China, adding approximately 52 KT of compounding and long-fiber thermoplastic (LFT) capacity starting in the second half of 2023.

Segment Analysis

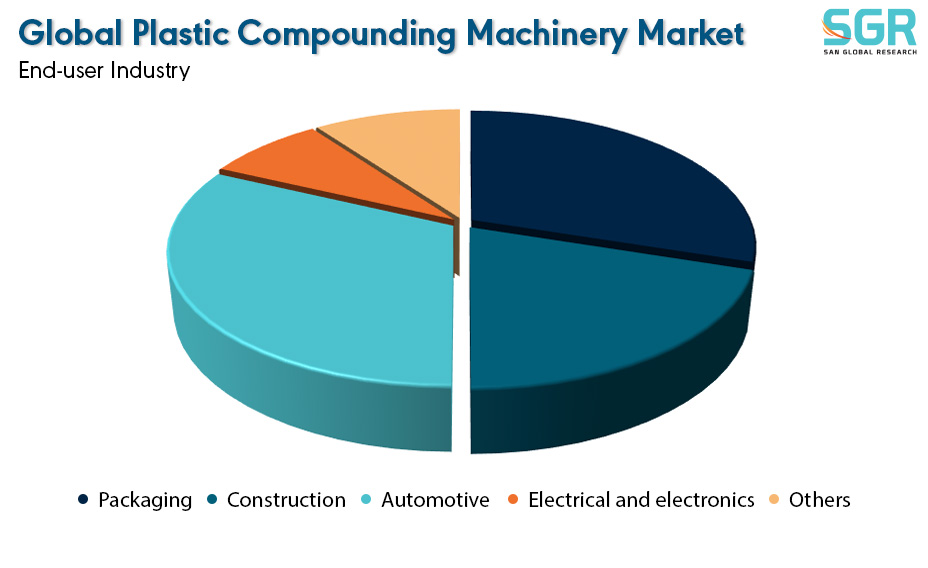

By End User Industry Segment, Automotive industry dominates the Market.

Automotive is the largest application area for Plastic compounds due to their low impact and ease of maintenance. The increase in automobile production in Asia and Latin America has increased economic growth in terms of both automobile sales and domestic production. Due to the continuous growth of the automotive industry and regulatory requirements forcing companies to reduce vehicle weight and increasing energy efficiency, the use of plastics compounding machinery in the automotive industry is expected to increase during the forecast period.

Drivers

The Growth of Packaging Industry

The use of composite plastic in the packaging industry is expected to increase due to the diversity of materials and models, and this will lead to significant changes in the packaging industry. These differences are due to changing consumer behavior and product innovations in the market. In addition, consumers are showing more interest in plastic bags because they are lighter and easier to carry. Currently, the use of plastic composites in these industries will be encouraged. For example, when it comes to the performance of food packaging, the most important thing for customers in any market is hygiene and the packaging of the product, but the packaging itself is also important.

Additionally, environmental concerns have increased the demand for bioplastics in the packaging industry in recent years, which is expected to create growth opportunities for the working sector. For example, according to the data of the European Bioplastics Association, the total bioplastic capacity in the rigid packaging and flexible packaging sectors will be approximately 376,100 tons and 695,600 tons, respectively, in 2022.

Opportunity

Bioplastics and Eco-friendly Compounding

The plastic compounding machinery industry holds a significant opportunity in the rapid growth of the bioplastic industry. Bioplastics are plastics derived from renewable energy sources such as corn or cellulose, providing a better alternative to fossil fuels. The government is increasingly promoting environmentally friendly products. Bioplastics offer a way to meet this need without sacrificing functionality. This requires specialized mixing systems to achieve the desired performance. Companies that can adapt and follow these innovations will do well. Plastic manufacturing machines can command higher prices due to the added value and functionality they offer. By investing in bioplastics technology, manufacturers can position themselves as leaders in the sustainable plastics movement.

Key players

• Coperion GmbH

• CPM EXTRUSION GROUP

• Entek Extruders

• Farrel Corporation

• ICMA San Giorgio SpA

| Report Attribute | Details |

| Market Value in 2024 | xx Billion |

| Forecast in 2032 | XX Billion |

| CAGR | CAGR of xx% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | by Type, by Application By Region./country ,By End User Industry |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | •Coperion GmbH •CPM EXTRUSION GROUP •Entek Extruders •Farrel Corporation •ICMA San Giorgio SpA |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355