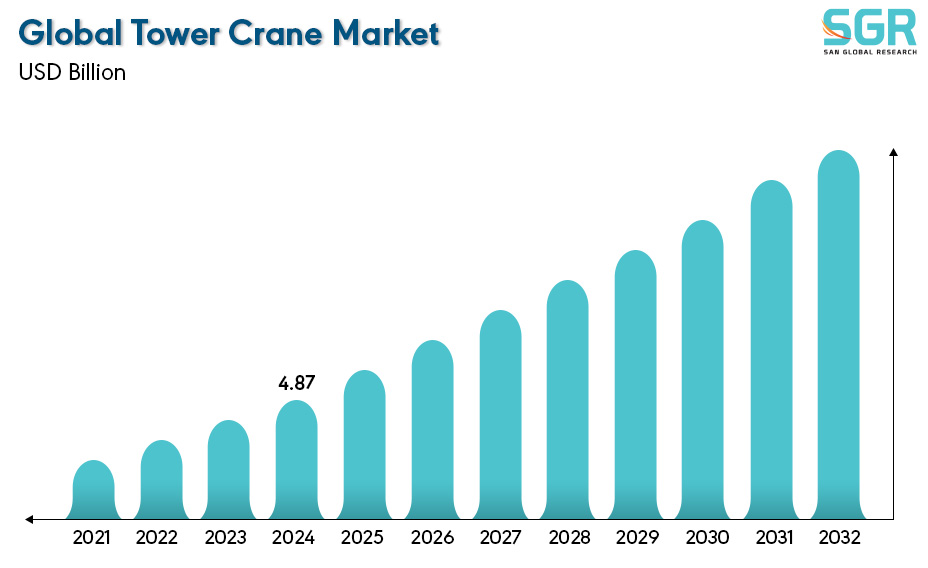

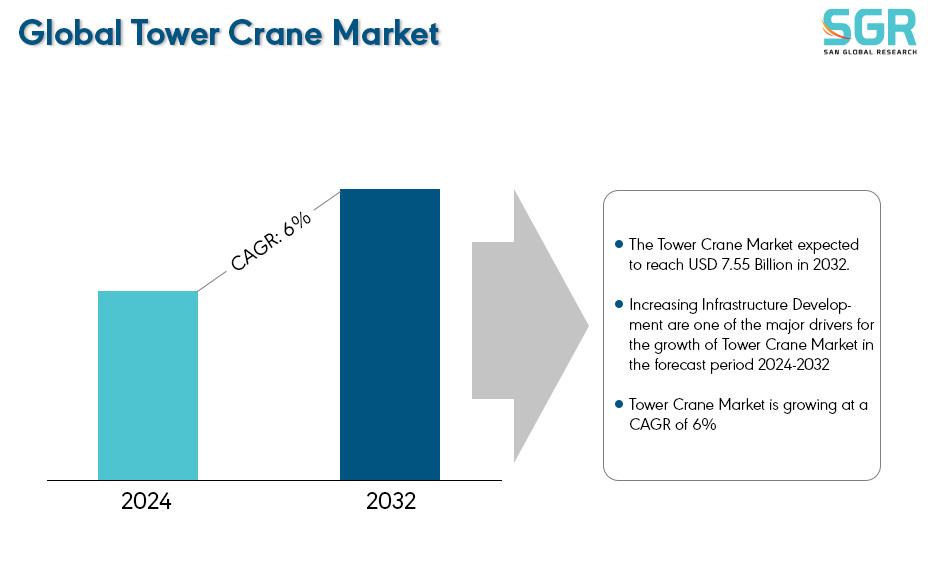

Tower Crane Market is estimated to be worth USD 4.87 Billion in 2024 and is projected to grow at a CAGR of 6% between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of the market, and the forecast period is 2024 to 2032. The report analyses and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Type, by Application, By Lifting Capacity and by region/country.

Recently, due to the rapid urbanization the construction industry is experiencing a significant boom. For the construction colossal building and infrastructure, the use of cranes is necessary, especially tower cranes. Tower cranes are primarily designed to lift the heavy materials such as concrete, steel beams and pre-fabricated components to a different level of a construction site. The capacity to transport substantial loads helps accelerate the building process. With the help of these tower cranes, it allows for the controlled and precise placements of materials, enabling the assembly of complex structure with accuracy. This is particularly important in high rise building and large infrastructure projects.

The utilization of tower cranes significantly reduces manual labor and expedites material movement, leading to improved project timelines. These versatile machines are adopted for various tasks, from laying foundations to assembling structural elements and installing exterior components.

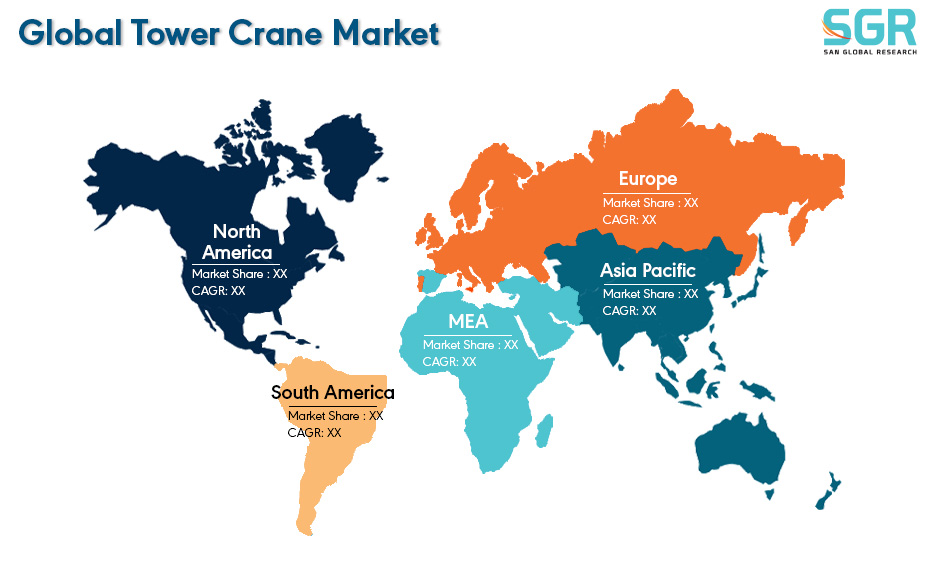

After reviewing the data shown below, it can be determined that the Asia Pacific region dominates the Tower Crane Market for the following reasons.

The Asia Pacific region is experiencing a significant domination within the Tower Crane Market due to the emerging construction segment within the region. For instance, according to investindia the construction industry within India is expected to reach $1.4 trillion by 2025. As the construction market within India works across 250 sub sectors with linkage across sector. Even considering the Residential sector an estimate of 600 million people is likely to be living in urban centres by 2030, creating an additional demand for 25 million additional mid end and affordable units. Due to which the Asia Pacific region is dominating the Tower Crane market significantly.

Segmentations

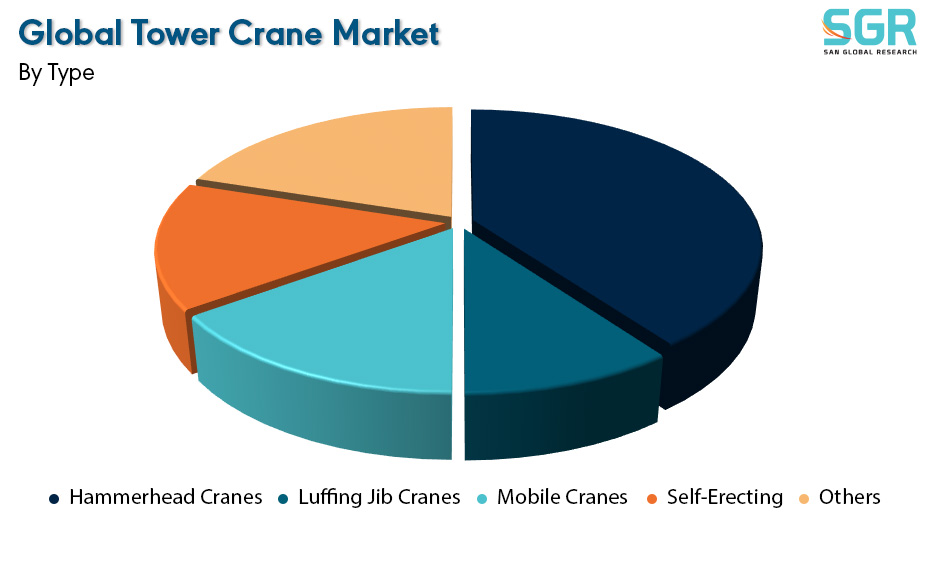

By Type

Based on Type, the Tower Crane Market is bifurcated into Hammerhead Cranes, Luffing Jib Cranes, Mobile Cranes, Self-Erecting and Others– where Hammerhead Cranes segment is dominating and ahead in terms of share. Hammerhead crane being used as one of the most common type of cranes used all around the world. For precise and accurate handling of even the most diverse heavy materials, tower cranes offer unmatched reliability. The versatile way the hammerhead crane can adopt to work for any job site and any type or volume of material being transported is what makes a hammerhead tower crane such a unique workhorse, due to which the hammerhead tower crane segment is dominated with the Tower crane market.

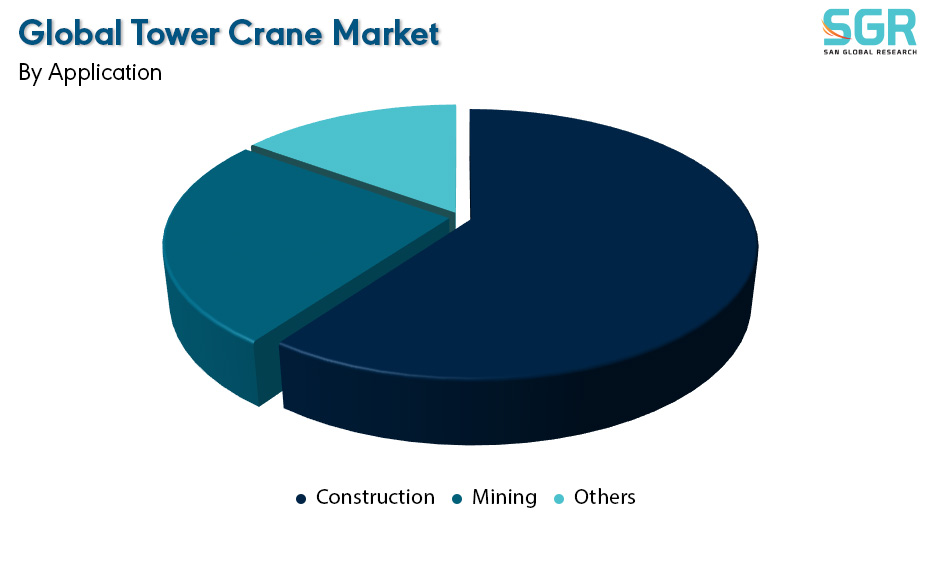

By Application

Based on Application, the Tower Crane Market is bifurcated into Construction, Mining and Others– where Construction segment is dominating and ahead in terms of share.

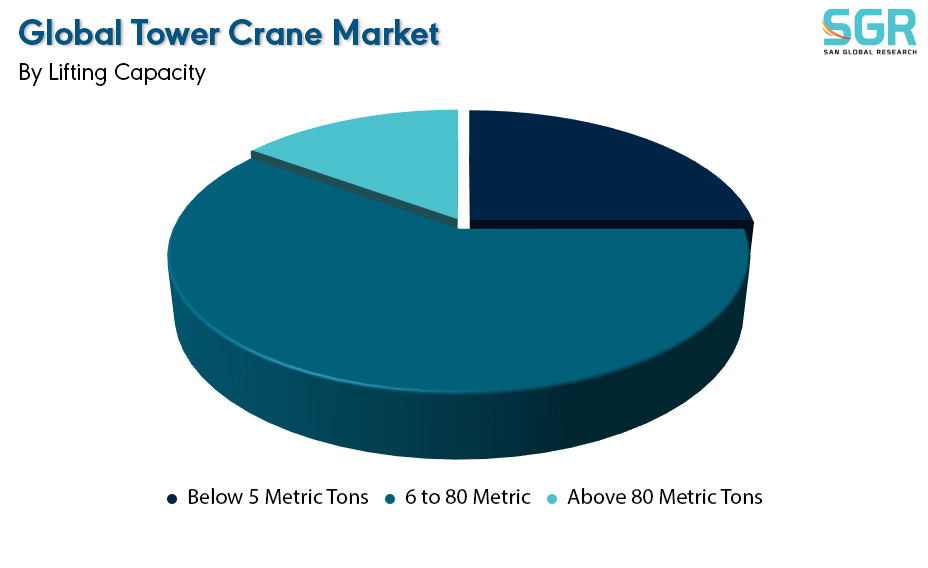

By Lifting Capacity

Based on Lifting Capacity, the Tower Crane Market is bifurcated into Below 5 Metric Tons, 6 to 80 Metric Tons and Above 80 Metric Tons– where 6 to 80 Metric Tons segment is dominating and ahead in terms of share.

Key Players

• Sany Group

• Raimondi

• Terex Corporation

• Liebherr International AG

• The Manitowoc Company, Inc.

Drivers

Increasing Infrastructure Development

The increasing infrastructure development has boosted the Tower Crane market significantly. India, under its National Infrastructure Pipeline (NIP), has allocated a $1.4 trillion investment budget, with a focus on renewable energy (24%), roads and highways (18%), urban infrastructure (17%), and railways (12%). Also, the investment in air transport infrastructure and rail infrastructure in France had increased by 23.4% and 94.0% over the 2010- 2018 period, totalling $1 billion and $10.7 billion, respectively, these huge investments within the sectors has acted as an significant market growth driver for the Tower Crane Market.

Opportunity

Technological Advancements

Tower cranes being one of the major equipment used in the construction of high-rise building. However, the crane operators do not receive sufficient information, such as target space conditions and the materials being lifted, to control the crane. Due to such limitations, it degrades the productivity and safety. In response to concerns, a prototype advanced tower crane (ATC) has been developed. This crane incorporates cutting-edge wireless video control and radio frequency identification (RFID) technology. With these techs, the ATC can provide the operator with an enhanced view of the work-based space and different other functions providing up to date material status. The ATC can also provide faster information flow with greater precision and improved driving efficiency. To evaluate its effectiveness, a case study was conducted using the ATC at a pilot construction site. With this study its confirmed that there is considerable improvement in the operational speed and significantly enhanced performance in workplace safety and communication efficiency.

| Report Attribute | Details |

| Market Value in 2024 | 4.87 Billion |

| Forecast in 2032 | 7.55 Billion |

| CAGR | CAGR of 6% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | By Type, By Application, By Lifting Capacity |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Sany Group • Raimondi • Terex Corporation • Liebherr International AG • The Manitowoc Company, Inc. |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355