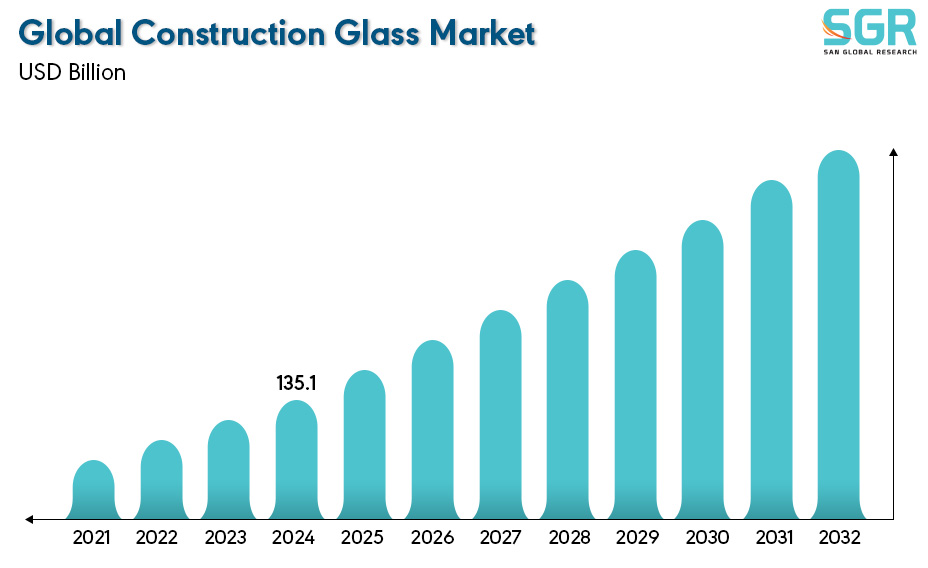

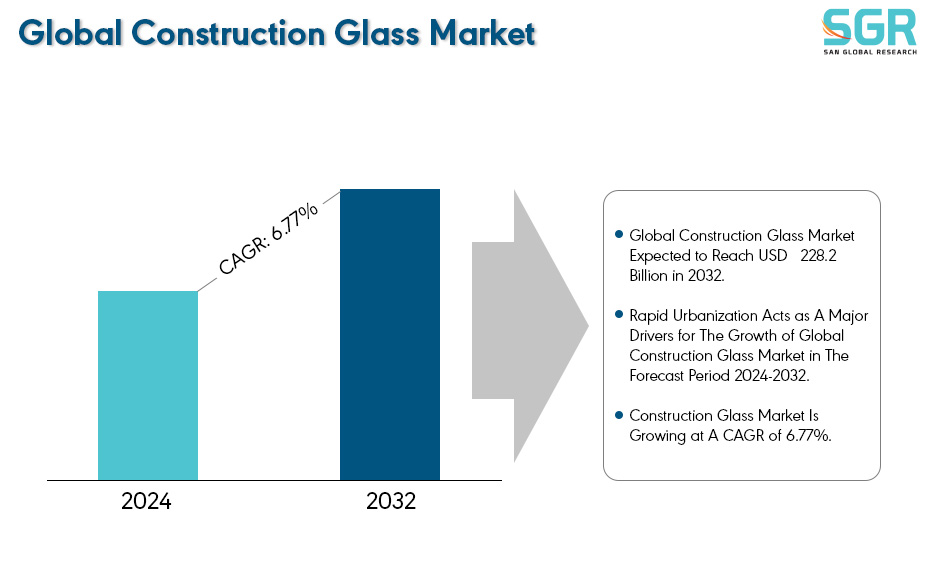

Global Construction Glass Market Is Estimated to Be Worth USD 135.1 Billion in 2024 And Is Projected to Grow at A CAGR of 6.77% Market Size of Market and The Forecast Period Is 2024 To 2032. The Report Analyses And Forecasts The Market Size, In Terms of Value (USD Million), For The Market. The Report Segments the Market and Forecasts It by Product by Application and by Region/Country.

Construction glass is a fundamental material used extensively in modern building design. It is manufactured through a process that involves melting various raw materials such as silica sand, soda ash, and limestone at high temperatures, followed by rapid cooling to create a solid and transparent product. This production technique results in its unique properties, including transparency, strength, and durability. The advantages of construction glass are manifold, such as its transparency allows natural light to permeate indoor spaces, reducing the need for artificial lighting and thereby promoting energy efficiency. Furthermore, it contributes to aesthetic appeal, creating an open and spacious feel within structures. Different types of construction glass are available, such as tempered glass and laminated glass.

Asia pacific has the largest market of construction Glass by region

Asia Pacific is currently leading the global Construction glass market and has emerged as the largest market region by 2022. The region's dominant characteristics are fueled by rapid urbanization, infrastructure development and a growing construction industry. Countries such as India, China, Japan and South Korea are playing a key role in driving demand, with a surge in residential and commercial construction projects. Asia Pacific region holds the upper hand in the global Construction glass market due to economic growth in the region and increasing focus on sustainable development of buildings and infrastructure. On the other hand, North America continues to strengthen its dominant position in the Construction glass market, becoming the fastest growing region in the market.

The region's dominant position in the global Construction glass market is driven by strong emphasis on energy efficiency and evolving construction trends. Demand for Construction glass in North America has grown with the focus on green building initiatives and growing awareness of sustainable building practices. Technological innovations and preference for innovative glass ideas and solutions in residential and commercial construction have made this region a key growth hub for the global Construction glass market.

Segmentation

By Type

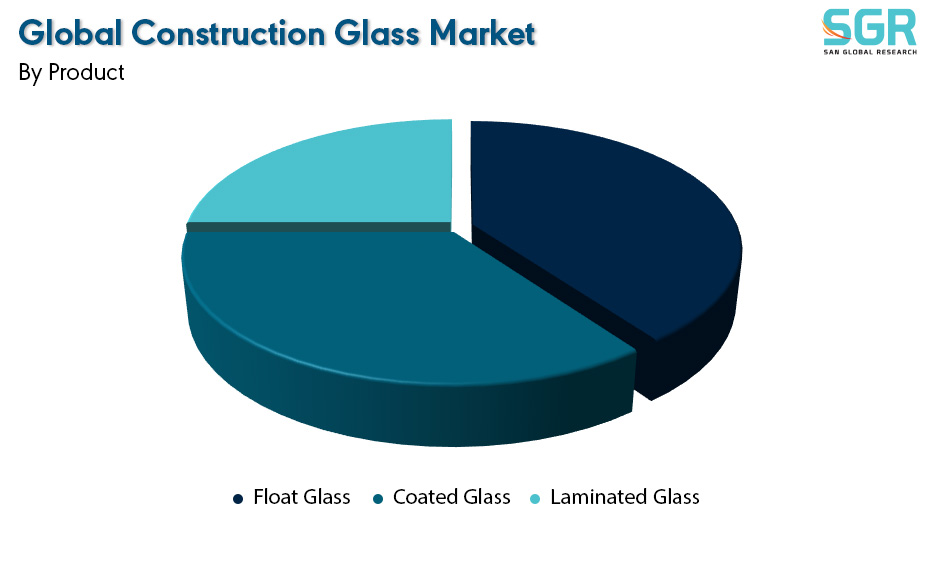

By type, the Float glass segment has become the largest segment in the global Construction glass industry. It dominates many applications such as windows and interiors. The popularity of float glass is attributed to its demand in many industries due to its cost effectiveness and ease of use compared to other areas of glass. Float glass is widely used in residential, commercial and industrial buildings and forms the basis of the Construction glass industry, meeting the needs of the industry. Currently, the coated glass field has become the largest Construction glass field in the world Construction glass market. The popularity of coated glass in the industry is due to its advanced properties, including better thermal and solar control. Additionally, the construction industry is increasingly focusing on energy-efficient building construction, which is increasing the demand for coated glass. Coated glass's ability to contribute to sustainability goals and meet stringent energy efficiency standards makes it the fastest growing glass industry.

By Application

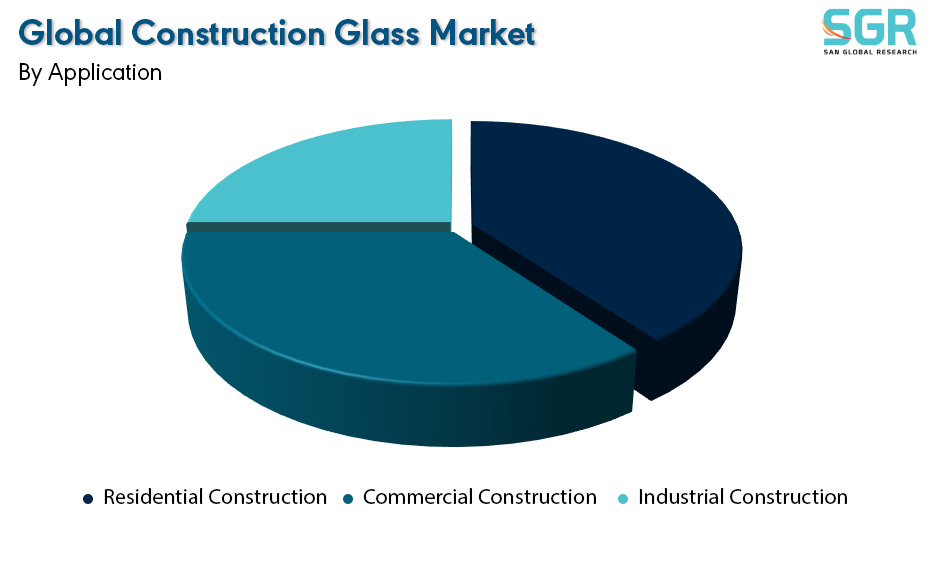

The largest application segment in the global Construction glass market is the residential construction sector. The factors behind its dominant nature are driven by increasing global housing demand and redevelopment activity. Structural glass, primarily in the form of windows and other architectural elements, plays an important role in improving the aesthetic appeal and energy efficiency of residential structural landscapes. However, the residential segment still remains the key driver for the growth and resilience of the Construction glass market, with urbanization playing a significant role in the market. On the other hand, the fastest growing emerging sector by application is commercial construction. In recent years, many developments and innovations have been made in cities, such as smart city concept, etc., which has indirectly contributed to the development of the global Construction glass market. Modernize your city by building office buildings, houses, hospitals, exhibition halls, shopping malls and more with smart building ideas. The expansion of this sector is closely linked to global economic developments and current trends towards innovative and sustainable commercial projects.

Key players

• Compagnie de Saint-Gobain S.A.

• Asahi Glass Co., Ltd.

• PPG Industries, Inc.

• Nippon Sheet Glass Co. Ltd.

• Xinyl Gas Holdings Limited.

• Central Glass Co., Ltd.

• China Glass Holdings Limited

• Guardian Industries Corp.

• Schott AG

• Sisecam Group

Driver

Growing Construction Industry

The global market is driven by the demand from the construction industry. The rising population has encouraged construction of new buildings. Glass is one of the oldest materials utilized in construction. Aside from use in windows, and as transparent glazing material, it has become an increasingly popular exterior building material. High disposable income has enabled end users to spend more on new constructions. Most importantly, the changing mindset of residential consumers has given a boost to the construction glass industry. The development in the construction industry and the inclination of the builders to utilize safe and sustainable building materials to enhance the value of the property are considered the key growth-stimulating factor

Opportunity

Innovation in field of Construction Glass

The construction glass industry is constantly evolving, with new and innovative products being developed all the time. For example, smart glass is a type of glass that can change its properties in response to external stimuli, such as light or temperature. Smart glass can be used to improve energy efficiency, comfort, and privacy in buildings for instance Smart glass is an innovative glass solution that comes with adjustable opacity. The opacity levels of smart glass can easily be controlled by applying appropriate voltage, heat, or light. Smart glass can change its light transmission properties, based on external stimuli. It can easily turn from transparent to opaque, even translucent and vice-versa by the flick of a remote control switch. Due to this unique quality, smart glass is also commonly known as privacy glass, switchable glass, and light control glass

| Report Attribute | Details |

| Market Value in 2024 | 135.1 Billion |

| Forecast in 2032 | 228.2 Billion |

| CAGR | CAGR of 6.77 % from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Application and by region/country |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Compagnie de Saint-Gobain S.A. • Asahi Glass Co., Ltd. • PPG Industries, Inc. • Nippon Sheet Glass Co. Ltd. • Xinyl Gas Holdings Limited. • Central Glass Co., Ltd. • China Glass Holdings Limited • Guardian Industries Corp. • Schott AG • Sisecam Group |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355