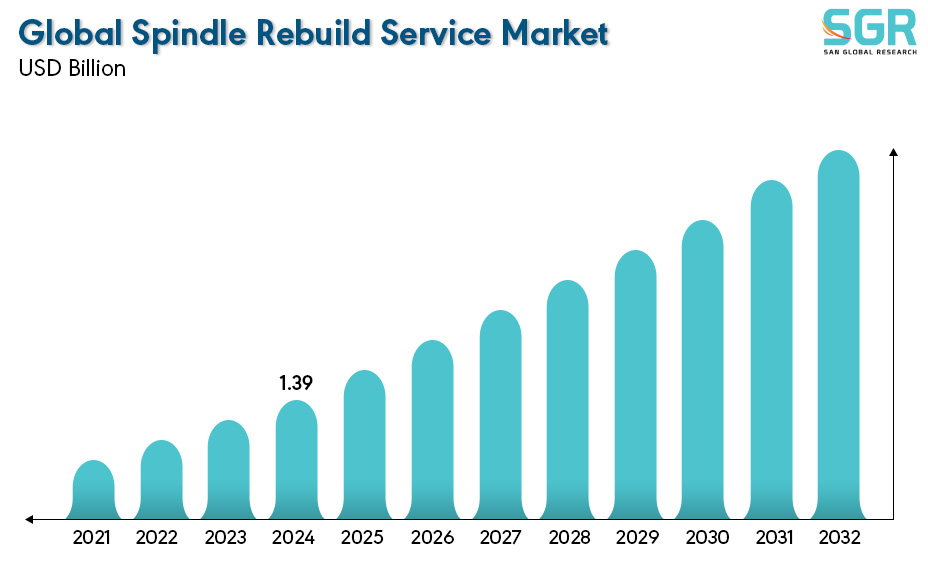

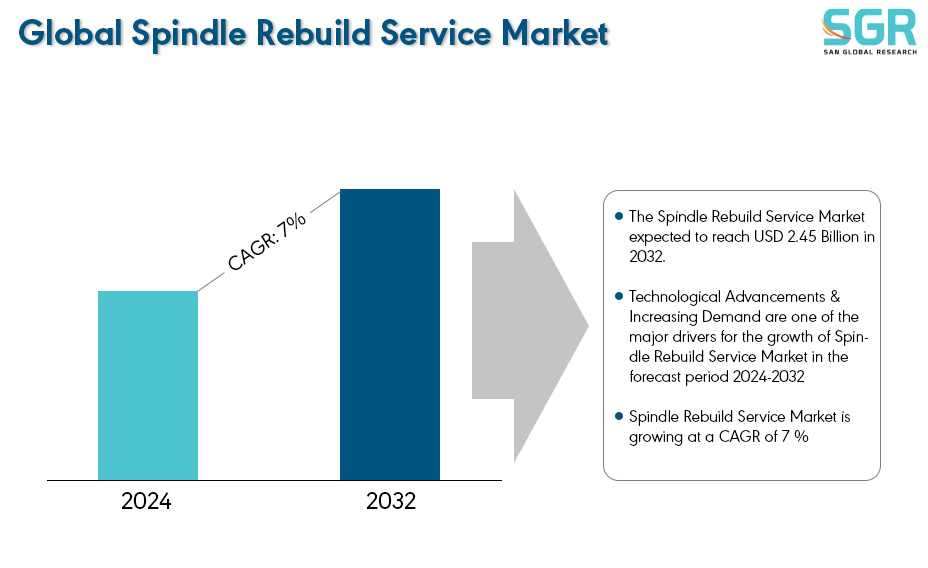

Spindle Rebuild Service Market is estimated to be worth USD 1.39 Billion in 2024 and is projected to grow at a CAGR of 7 % between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of the market, and the forecast period is 2024 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Type, by Application and by region/country.

The increasing adoption of machine tools that are equipped with motorized spindles is significantly increasing. The machines tools which are capable of processing any kind of metal components cutting, milling, drilling, and grinding, are the most important production devices for the machinery and mechanical industry. High-speed spindles are also used excessively and applied in multiple areas of manufacturing, the food industry, aviation, agriculture, automotive industry, and commercial and medical technology such as machine tools, turbo generators, mixers, spin testers and food processors.

Taking into the consideration, the automotive industry is one of major user of the spindles as they are the critical component of the wheel hub spindle assembly in vehicles. As the assembly is majorly supports the wheel, while maintain the stability while driving which enables smooth and efficient rotation. As the spindle is a rod that extends from the connection and then connects the wheel hub assembly, transferring the load from the wheel the suspension systems and to the chassis of the vehicle. The spindle should allow the wheel to rotate smoothly around its axis which makes it an important part within the automotive industry.

After reviewing the data shown below, it can be determined that the North America region dominates the Spindle Rebuild Service Market for the following reasons.

North American region is exponentially growing within the Spindle Rebuild Service market due to various aspects such as the booming manufacturing industry and the development of Industry 4.0 within the region. The U.S. manufacturing output is around $2.4 billion within the manufacturing industry in 2018 and is significantly increasing every year and is a region with the highest rebuild service providers. Considering the automotive industry, the North American region being one of the largest exporters of automobiles also has a strong manufacturing base with advanced infrastructure within the region which helps North America dominate the Spindle Rebuild Service market.

Segmentations

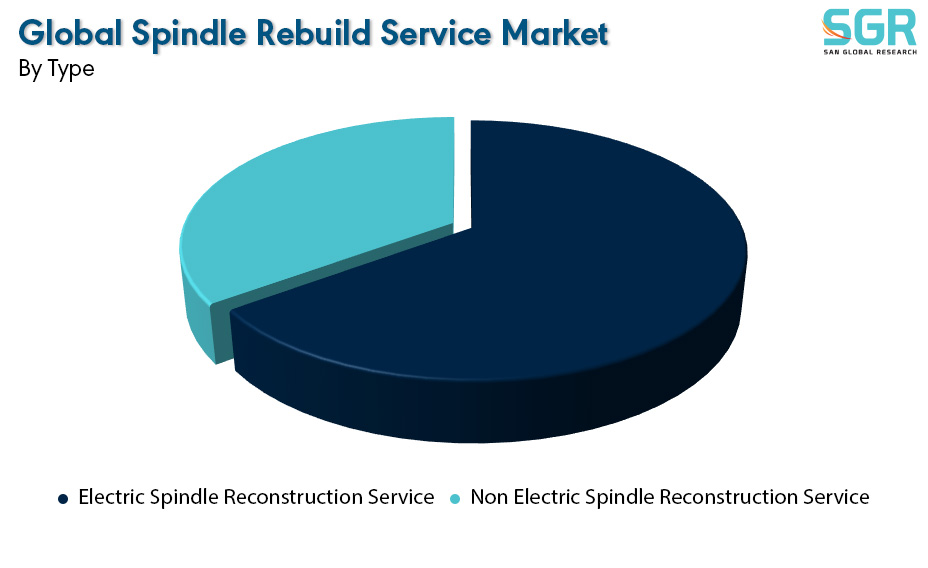

By Type

Based on Type, the Spindle Rebuild Service Market is bifurcated into Electric Spindle Reconstruction Service and Non Electric Spindle Reconstruction Service– where Electric Spindle Reconstruction Service are dominating and ahead in terms of share. Automation is significantly increasing in the manufacturing sector. The growing adoption of CNC machines for precise work has been very efficient for product consistency, where the electric spindle is a key functional component of the CNC machining equipment, including CNC machining tools. Whenever an electric spindle fails, it usually causes a significant production delay for a product. Rebuild services act as a quicker solution compared to buying and installing a new one, which significantly boosts the Electric Spindle Reconstruction market.

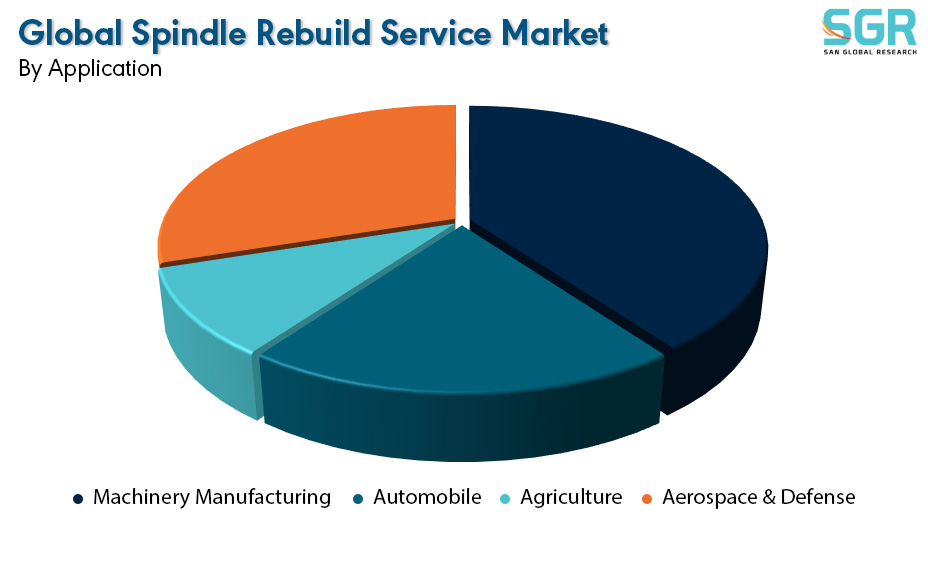

By Application

Based on Application, the Spindle Rebuild Service Market is bifurcated into Machinery Manufacturing, Automobile, Agriculture and Aerospace & Defense – where Machinery Manufacturing are dominating and ahead in terms of share.

Key Players

• SPINTEC

• Mazak Corporation

• Makino

• PDS

• PSI Repair Services

Drivers

Advanced Technologies

Due to latest technological advancement within the spindle rebuild service market has significantly boosted the market growth. The technology such as the laser cladding on spindle remanufactured which presents a remarkable hardness up to 547HV0.1 and has an excellent wear resistance which is 3.7 times of the substrate, and is also the spindle layered with cladding technology is also free of cracks.

Opportunity

Increasing Demand

Due to the increasing cost efficiency & demand within the aerospace, automotive and manufacturing sector is opening up new opportunities within the spindle rebuild service market. The increasing the manufacturing activity within the realm of machinery has significantly boosted the Spindle Rebuild Services market.

| Report Attribute | Detail |

| Market Value in 2024 | 1.39 Billion |

| Forecast in 2032 | 2.45 Billion |

| CAGR | CAGR of 7% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | By Type, By Application |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • SPINTEC • Mazak Corporation • Makino • PDS • PSI Repair Services |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355