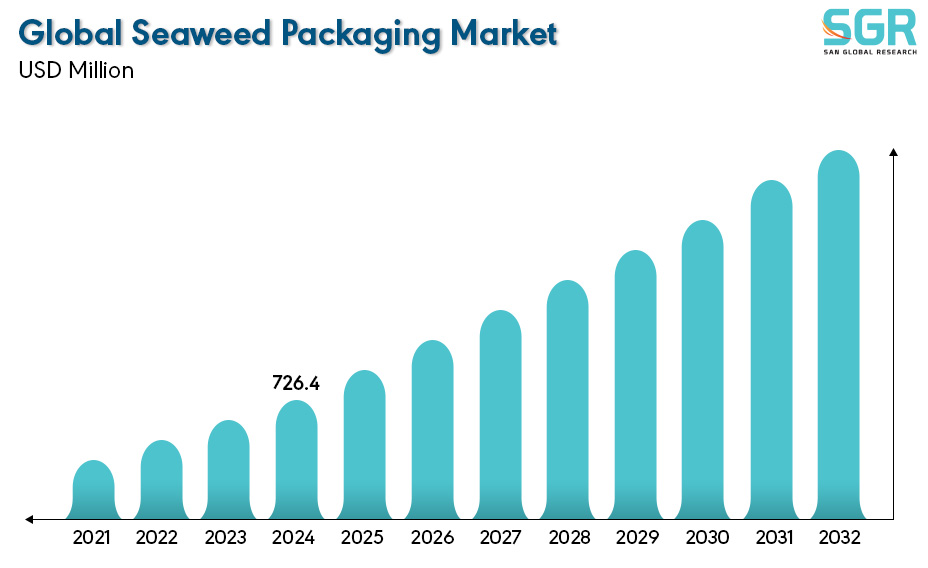

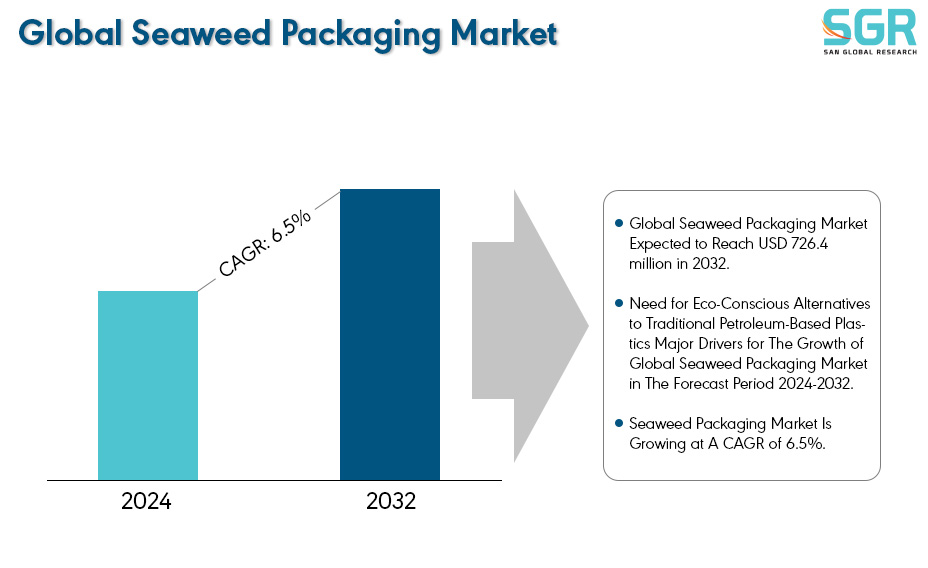

Global Seaweed packaging Market is estimated to be worth USD 726.4 million in 2024 and is projected to grow at a CAGR of 6.5 % market size of market and the forecast period is 2024 to 2032. The report analyses and forecasts the market size, in terms of value (USD million), for the market. The report segments the market and forecasts it by Product Format, by Packaging Type, By End-Use and by region/country.

Seaweed extract contains a variety of compounds derived from red, brown, and green algae. Seaweeds are fast-growing marine plants that can be cultivated without arable land, freshwater, or pesticides. They have a high growth rate, allowing for sustainable harvesting without depleting natural resources. This makes seaweed an attractive alternative to traditional packaging materials derived from fossil fuels or limited resources, the seaweed packaging market has emerged as a dynamic and promising segment in the global packaging industry. As Seaweed-based packaging is environmentally friendly and has sustainable properties like renewable sourcing, biodegradability, and functional properties.

The advantages of seaweed-based packaging include their renewable and abundant source, biodegradability, and favourable barrier properties. this resulted into initiation of attraction from companies, consumers, also from environmentalists. This market segment has seen steady growth in recent years, driven by increasing awareness of environmental issues, stringent regulations on the use of single-use plastics, and growing demand for eco-friendly packaging solutions across industries. According to EPA united states environmental protection Agency, Containers and packaging Material make largest portion of municipal solid waste (MSW), totalling to 82.2 million tons of generation back in 2018 (28.1 percent of total generation).

Region Wise Comparison

By Region Europe Has Dominate the Seaweed Packaging Market

Europe was the market leader in seaweed packaging usage and accounted for the largest market share in 2024. This dominant position can be attributed to a variety of factors, including a strong commitment to sustainability, a strong regulatory framework, and growing consumer preference for environmentally friendly products and Friendly packaging solutions. European companies have shown remarkable foresight in recognizing the potential of seaweed-based packaging and adapting their strategies to the global shift towards more sustainable practices.

Another reason why seaweed packaging is used in Europe is because of the thriving seaweed industry in the region. Many countries in Europe have been harvesting and growing seaweed for many years, and this knowledge has helped develop the seaweed packaging industry. Additionally, the European Union's circular economy strategy to reduce waste and improve resource efficiency has created an enabling environment for the adoption of environmentally friendly packaging solutions such as seaweed-based materials. Europe dominated the market owing to factors such as the availability of raw materials, cost-effective labour, and favourable climatic conditions conducive to seaweed cultivation.

North America has the second largest share of market share.

North America is second largest and fastest growing region owing to the new startups and Market Players, the new emerging players are getting funded which resulting in the growth of the Market for instance, Sway, the California-based startup creating seaweed-based, home compostable replacements for plastic packaging, Close of $5M Seed Round on February 13, 2024. This type of investment in the market Have resulted into the fastest compound annual growth Rate (CAGR)

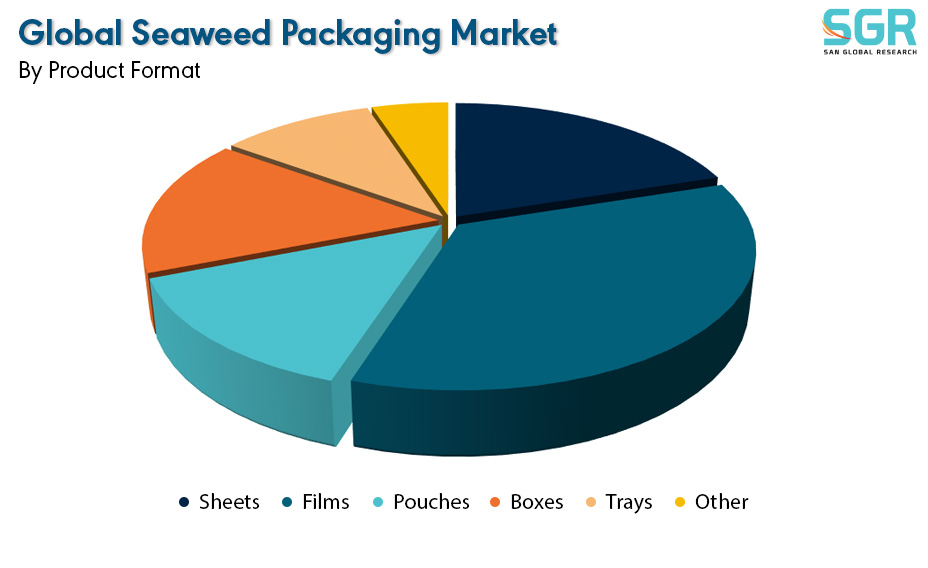

By Product Format

Seaweed-based films have emerged as a promising solution for sustainable food packaging due to their renewable sourcing, biodegradability, and functional properties. This review provides an in-depth analysis of seaweed-based films, focusing on their properties, incorporation of essential oils, applications in food along with that another improved mechanical property, extending shelf life, scaling up production, reducing costs, and innovation in formulation. Overall, seaweed-based films offer a promising and sustainable alternative for food packaging which results into dominance of Seaweed-based films in by product type format

By End Use

Seaweeds wide range of application, benefits and properties resulted into this dominance over food packing industry, Applications of seaweed-based Packaging ranging from fresh produce to dairy products, along with that Seaweed contains natural compounds, such as alginates and polyphenols, which exhibit antimicrobial properties. When incorporated into seaweed-based films, these compounds help to inhibit the growth of bacteria and fungi, making them potentially useful for food packaging where microbial spoilage is a concern due to this added advantage the Seaweeds are widely used for food packing along with this major food companies are moving towards the Seaweeds as their packing

For instances, a The UK’s Notpla sustainable packaging start-up specialised in seaweed burger box receives the royal seal of approval.

Driver:

Urgent demand for environmentally friendly substitutes for conventional polymers made of petroleum.

Algae and seaweed are becoming common raw materials used in the creation of edible packaging items. Seaweed's natural ability to be a nutrient-rich food source makes it a viable option for packaging purposes without the need for extra chemicals. Commercial seaweed farming is seen as a sustainable way to meet industry packaging requirements and has helped supply the industry with enough raw material inputs in the Asia Pacific region. Additionally, seaweed may be processed into a variety of forms and customized for use in a variety of food and beverage applications, giving businesses more flexibility.

Opportunity:

Innovative product development.

Seaweed Based packaging market have the opportunity in edible packaging, as of now Seaweeds Packaging has gained more market for Food Packaging, this new type of product development will result into more acceptance of edible packaging in food for instance, Indonesian start-up aims to ease the waste management of plastic packaging by creating edible packaging from seaweed. Evoware’s edible packaging is environmentally friendly and nutritious as seaweed is rich in flavonoids, fiber, and antioxidants.

| Report Attribute | Details |

| Market Value in 2024 | 726.4 million |

| Forecast in 2032 | 1202.2 million |

| CAGR | CAGR of 6.5% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product Format, By Packaging Type, By End-Use and By region/country |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Tomorrow Machine SE (Sweden), • Regeno (India), • JRF Technology, • LLC (U.S), • Evo &Co. (U.S), • Design Indaba (South Africa), • Monosol LLC (U.S), • Amtrex Nature Care Pvt. Ltd. (India), • Nagase America LLC (U.S), • Notpla Limited (UK), • EnviGreen (India), • Devro (Scotland), • Montrose UK Ltd. (UK) |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355