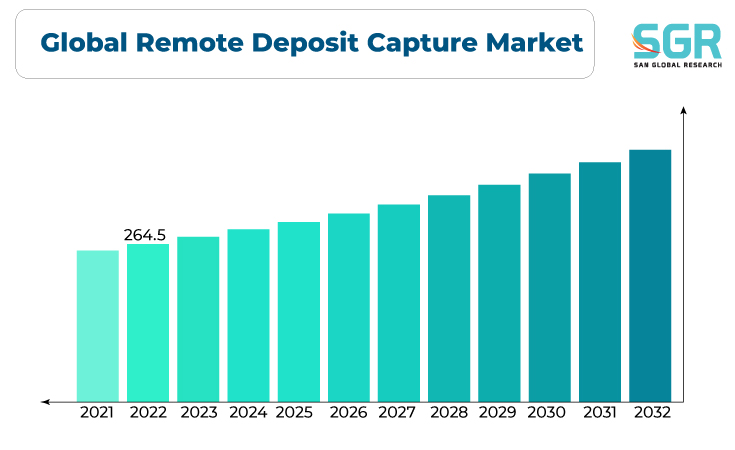

Global Remote Deposit Capture market is estimated to be worth USD 264.5 Billion in 2022 and is projected to grow at a CAGR of 5.8% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Million), for the market. The report segments the market and forecasts it by component, by deployment, by enterprise, and region/country.

The Global Remote Deposit Capture market growing and evolving due to the increasing adoption of digital banking solutions and the demand for convenient and efficient remote deposit services. RDC is a technology that allows users to deposit checks electronically from remote locations, such as their homes or offices, rather than visiting a physical bank branch. The banking industry has been undergoing a digital transformation, with financial institutions investing in digital solutions to enhance customer experiences and streamline operations. The evolution of mobile banking apps and the availability of high-quality image capture technology on smart phones has made it easier for consumers to use RDC services. RDC can lead to cost savings for financial institutions by reducing the need for physical branch infrastructure and teller services.

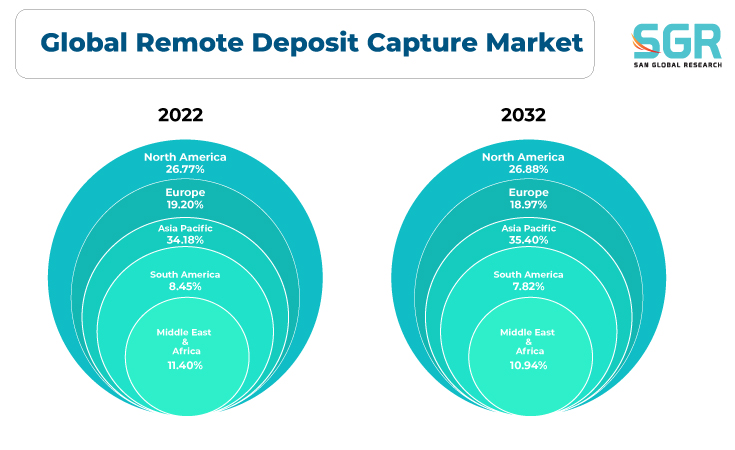

Region Wise Comparison:

North America, particularly the United States, has been a significant driver of RDC adoption. Many banks and financial institutions offer RDC services to consumers and businesses. The technology has gained popularity due to its convenience and efficiency.

Several countries in Western Europe have adopted RDC technology to varying degrees. RDC is more prevalent in countries with advanced digital banking infrastructure.

The Asia-Pacific region has seen increasing adoption of RDC, driven by countries with growing digital banking sectors, such as China and India. The availability of mobile banking apps and increasing smart phone penetration has contributed to the growth.

In Latin America, Brazil has shown interest in RDC technology, primarily driven by banks and financial institutions looking to offer more convenient banking services to their customers.

South Africa is one of the countries in Africa where RDC technology has been adopted, particularly in the banking sector. The growth of digital banking in South Africa has contributed to this adoption.

Segmentation:

The Global Remote Deposit Capture market is segmented by component, by deployment, by enterprise, and region/country.

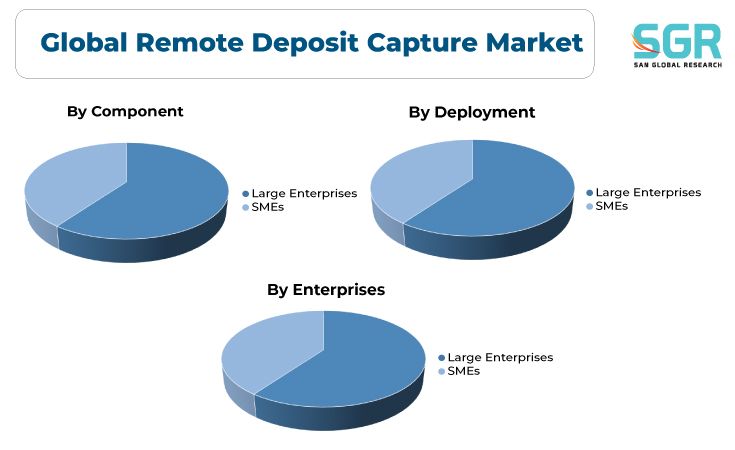

By Component:

- Based on the Components, the Global Remote Deposit Capture market is bifurcated into Solution and Service – where the Service is dominating and ahead of Solution in terms of share.

By Deployment:

- Based on the Deployment, the Global Remote Deposit Capture market is bifurcated into On Premise and Cloud – where the On Premise is dominating and ahead of Cloud in terms of share.

By Enterprises:

- Based on the Enterprises, the Global Remote Deposit Capture market is bifurcated into Large Enterprises and SMEs – where the SME’s is dominating and ahead of Large Enterprises in terms of share.

On the Basis of Region

- North America

- Europe

- Asia Pacific

- South America and

- Middle East and Africa

In 2022, North America is anticipated to dominate the Global Remote Deposit Capture market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Global Remote Deposit Capture market include

- FINASTRA

- ALOGENT

- CHECKALT LLC

- JACK HENRY & ASSOCIATES INC.

- FISERV INC.

- MITEK SYSTEMS INC.

- CSI

- EFT NETWORK INC.

- NCR CORPORATION

- DELUXE ENTERPRISE OPERATIONS

Drivers:

Growing banking sector across the globe

The global Remote Deposit Capture (RDC) market has experienced growth due to several drivers and factors that have facilitated its adoption. RDC technology offers convenience, efficiency, and cost savings, which have contributed to its widespread use. The ongoing digital transformation in the banking and financial services industry has been a significant driver. Financial institutions are investing in digital solutions to improve customer experiences and streamline operations, with RDC being a crucial part of this transformation. RDC technology offers convenience to both consumers and businesses. It eliminates the need for individuals and businesses to visit a physical bank branch to deposit checks, making the process more accessible and efficient. RDC can lead to cost savings for financial institutions. It reduces the need for physical branch infrastructure, as fewer customers need to visit branches for check deposits. Banks can also reduce teller services, contributing to cost efficiency. The availability of high-quality image capture technology on smart phones and mobile devices has made it easier for consumers to use RDC services. Mobile banking apps with RDC functionality have become more user-friendly, encouraging adoption.

Opportunity:

Evolving Market

The global Remote Deposit Capture (RDC) market presents several opportunities for growth and innovation, driven by technological advancements, changing consumer preferences, and evolving business needs. Developing and enhancing mobile RDC solutions is a significant opportunity. Mobile apps with RDC functionality are increasingly popular, and improving the user experience can attract more customers and businesses. Expanding RDC to handle international checks and multiple currencies can open up new opportunities for banks and businesses engaged in global trade. Targeting small and medium-sized businesses (SMBs) with RDC solutions tailored to their needs can be a lucrative opportunity. SMBs often have unique requirements for check processing. Providing solutions that help financial institutions and businesses meet regulatory and compliance requirements related to check processing is an important growth area.

Description

Description

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355