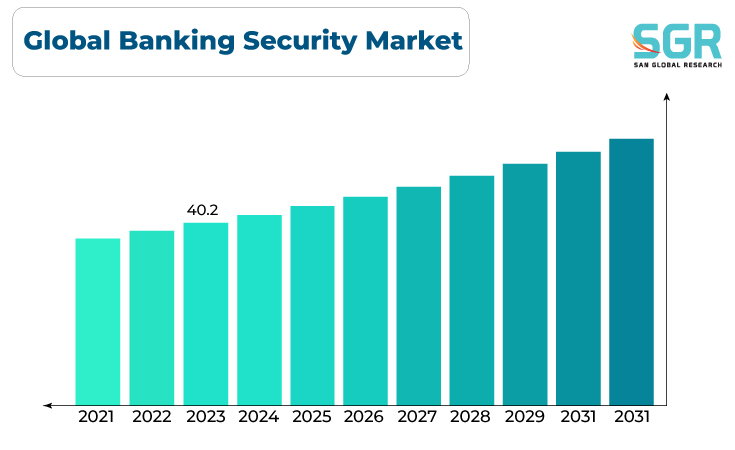

Global Banking Security Market is estimated to be worth USD 40.2 Billion in 2022 and is projected to grow at a CAGR of 5.4% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by component, by software type, by service type, by application, by end user and region/country.

The global banking security market revolves around the implementation of security solutions and measures to protect financial institutions, banking systems, and customer data from cyber threats, fraud, and other security risks. The increasing frequency and sophistication of cyber attacks in the financial sector have led to a growing emphasis on robust security measures within the banking industry. Focuses on protecting banking networks, systems, and data from cyber threats. This includes measures like firewalls, antivirus software, intrusion detection systems, and encryption. Secures end-user devices (computers, smart phones, tablets) to prevent unauthorized access and protect against malware and other threats. Involves services provided by cyber security experts and consultants to assess vulnerabilities, develop security strategies, and implement effective security measures.

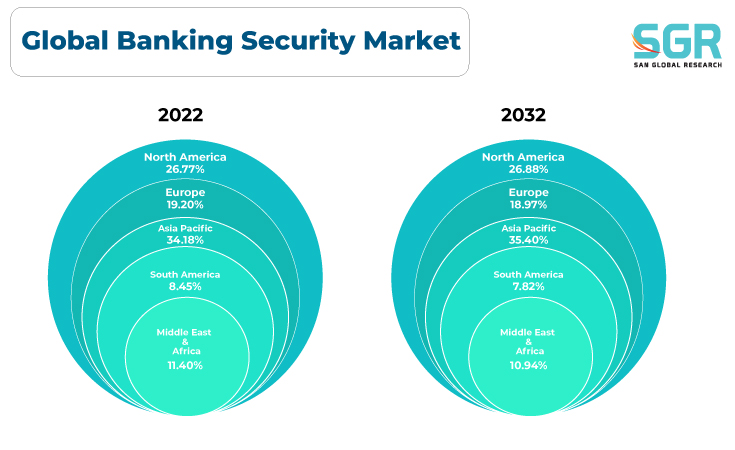

Region wise Comparison:

North America, particularly the United States, is a significant market for banking security. The region is home to major financial institutions that heavily invest in cyber security solutions due to the prevalence of cyber threats and stringent regulatory requirements.

European countries, including the United Kingdom, Germany, and France, also have a strong focus on banking security. The European banking sector is subject to regulatory frameworks such as GDPR, which influence cyber security practices.

The Asia-Pacific region, with countries like China, Japan, and India, is witnessing substantial growth in banking security investments. The increasing digitalization of financial services and the rise of fintech contribute to the demand for advanced security solutions.

Latin American countries are recognizing the importance of robust banking security measures, particularly as digital banking adoption increases. Cyber security initiatives are becoming more prevalent in the region.

The level of investment in banking security in Africa varies by country, but there is a growing awareness of the need for cyber security measures in the financial sector. Some countries are enhancing their cyber security capabilities to address evolving threats.

Countries in the Middle East, such as the United Arab Emirates and Saudi Arabia, are also investing in banking security to protect against cyber threats. The region's financial hubs are adopting advanced security measures.

Segmentation:

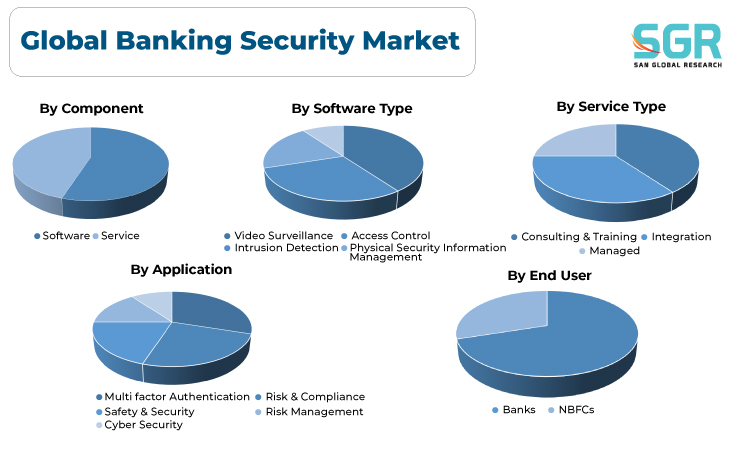

The Global Banking Security Market is segmented by component, by software type, by service type, by application, by end user and region/country.

By Component:

- Based on the Component, the Global Banking Security Market is bifurcated Software & Service – where the Software is dominating and ahead of Service in terms of share.The global banking security market encompasses various types of software solutions designed to safeguard financial institutions and their customers from cyber threats and security risks.Protects individual devices (computers, smart phones, tablets) from malware, ransom ware, and other cyber threats. It helps ensure that endpoints accessing banking systems are secure.Monitors network and/or system activities for malicious activities or policy violations. It can detect and respond to security threats in real-time.

By Software Type:

- Based on the Software Type, the Global Banking Security Market is bifurcated into Video Surveillance, Access Control, Intrusion Detection & Physical Security Information Management – where the Video Surveillance is dominating and ahead of others in terms of share.

By Service Type:

- Based on the Service Type, the Global Banking Security Market is bifurcated into Consulting & Training, Integration and Managed – where the Consulting & Training is dominating and ahead of others in terms of share.

By Application:

- Based on the Application, the Global Banking Security Market is bifurcated into Multi Factor Authentication, Risk & Compliance, Safety & Security, Risk Management and Cyber Security – where the Multi Factor Authentication is dominating and ahead of others in terms of share.

By End User:

- Based on the End User, the Global Banking Security Market is bifurcated into Banks and NBFCs – where the Banks is dominating and ahead of NBFCs in terms of share.

On the basis of region

- North America

- Europe

- Asia Pacific

- South America and

- Middle East and Africa

In 2022, North America is anticipated to dominate the Global Banking Security Market with market revenue of XX USD Million with a registered CAGR of XX%.

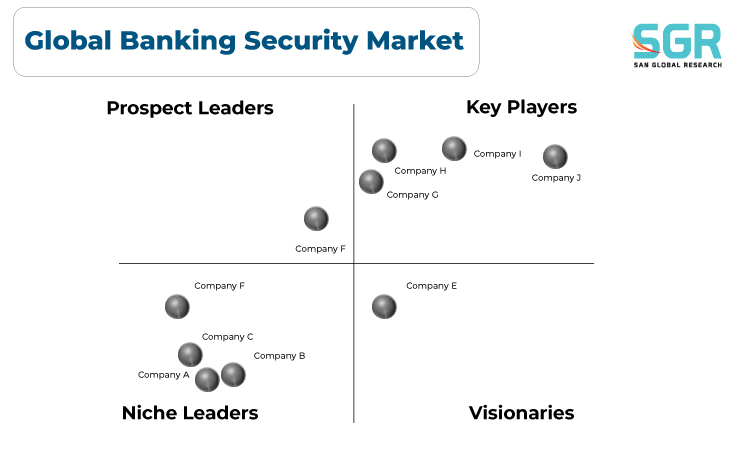

Key Players:

The key market players operating in the Global Banking Security Market include

- McAfee

- CISCO

- EMC Corp.

- Honeywell

- Symantec

- IBM

- Trend Micro Inc.

- Booz Allen Hamilton

- Sophos Group Plc

Drivers:

Growing across the globe

The banking security market is driven by various factors that contribute to the growing demand for robust security solutions within the financial sector. The increasing frequency and sophistication of cyber threats, including malware, ransom ware, and phishing attacks, are compelling banks to invest in advanced security solutions to protect their systems and customer data. The ongoing digital transformation in the banking industry, with the adoption of online and mobile banking services, necessitates enhanced security measures to protect digital channels and prevent unauthorized access. High-profile data breaches and incidents of financial fraud underscore the need for banks to strengthen their security posture. Customer trust is at stake, making security a top priority. The trend of remote work introduces new security challenges, requiring banks to secure endpoints, implement secure access mechanisms, and address the risks associated with remote access to banking systems.

Opportunity:

Evolving Market

The banking security market presents various opportunities driven by technological advancements, evolving threat landscapes, and the increasing need for robust security measures. Opportunities exist for the development and adoption of advanced threat detection solutions using technologies such as artificial intelligence (AI), machine learning (ML), and behavioral analytics to identify and mitigate sophisticated cyber threats. The integration of biometric authentication, including fingerprint recognition, facial recognition, and iris scanning, presents opportunities for enhancing user authentication and access control in banking systems. The demand for advanced security analytics and threat intelligence solutions is rising, providing opportunities for companies to offer tools that analyze large datasets for proactive threat detection and incident response.

Description

Description

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355