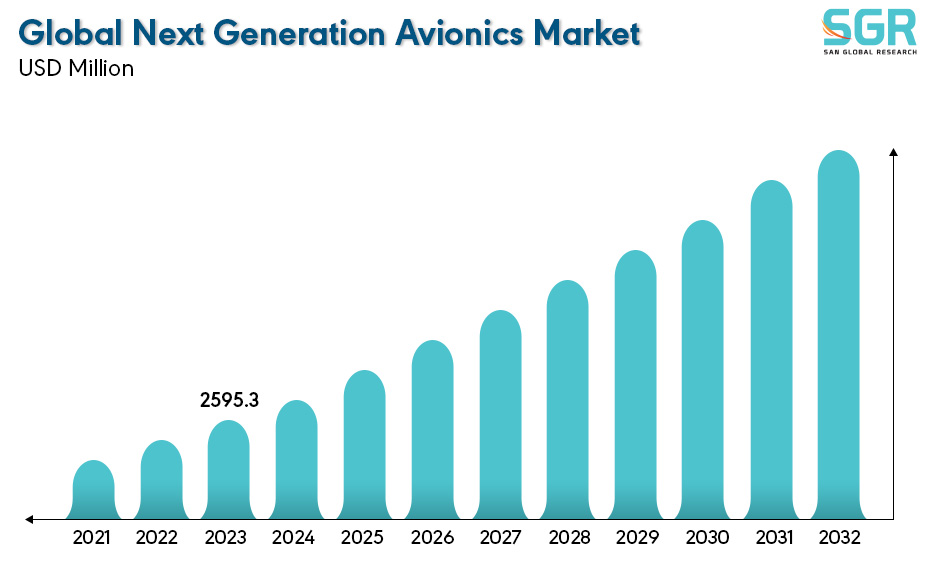

Next Generation Avionics Market is estimated to be worth USD 2595.3 Million in 2023 and is projected to grow at a CAGR of 6.47% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Million), for the market. The report segments the market and forecasts it by type, by application and by region/country.

Next Generation Avionics Market refers to the market segment associated with the development and adoption of advanced avionics systems in the aviation industry. Avionics, a portmanteau of aviation and electronics, encompasses the electronic systems used in aircraft for communication, navigation, surveillance, and other critical functions.

The next generation avionics market involves the evolution and integration of cutting-edge technologies to enhance the capabilities, efficiency, and safety of aircraft. Key components of next-generation avionics may include advanced radar systems, communication technologies, navigation systems, flight control systems, sensors, and displays. Next-generation avionics often involve increased automation and artificial intelligence in flight control systems, leading to improved safety and operational efficiency. Advanced navigation systems, such as Global Navigation Satellite Systems (GNSS) and inertial navigation systems, contribute to more accurate and reliable aircraft positioning.

.jpg)

Region wise Comparison:

North America has traditionally been a major hub for the aviation industry, with numerous aerospace companies, airlines, and defense contractors headquartered in the region. The aerospace and defense sectors in North America often engage in modernization programs to upgrade the avionics systems of existing fleets. Governments and private entities invest in advanced technologies to enhance the capabilities, safety, and efficiency of their aircraft. The demand for air travel, both domestic and international, contributes to the need for advanced avionics in commercial aircraft. Airlines seek to improve fuel efficiency, reduce operational costs, and enhance passenger safety, driving the adoption of modern avionic systems.

The European region has a significant presence in the commercial aviation sector. Airlines and aircraft manufacturers in Europe may invest in advanced avionics systems to enhance the safety, efficiency, and capabilities of their fleets. European aviation authorities, such as the European Union Aviation Safety Agency (EASA), set regulatory standards for avionics systems. Compliance with these standards often drives the adoption of new technologies to meet safety and performance requirements.

.jpg)

Many countries in the Asia Pacific region allocate significant budgets for defense modernization, including the upgrade of military aircraft with advanced avionics systems. This is driven by strategic considerations and the need to maintain a technological edge in the defense sector. Emerging economies in the region, such as China and India, are investing heavily in their aerospace industries. The growth of domestic aircraft manufacturing and the expansion of aviation infrastructure contribute to the demand for modern avionics technologies.

Some countries in the Middle East, such as the UAE, Qatar, and Turkey, have been investing in developing their aerospace industries. This includes the establishment of aircraft manufacturing facilities and research and development centers, which can contribute to the demand for advanced avionics. Several countries in the Middle East, including Saudi Arabia and the United Arab Emirates (UAE), have substantial defense budgets. Investments in defense modernization often include upgrading military aircraft with advanced avionics systems to maintain a technological edge.

.jpg)

Segmentation:

The Next Generation Avionics Market is segmented by type, by application and by region/country.

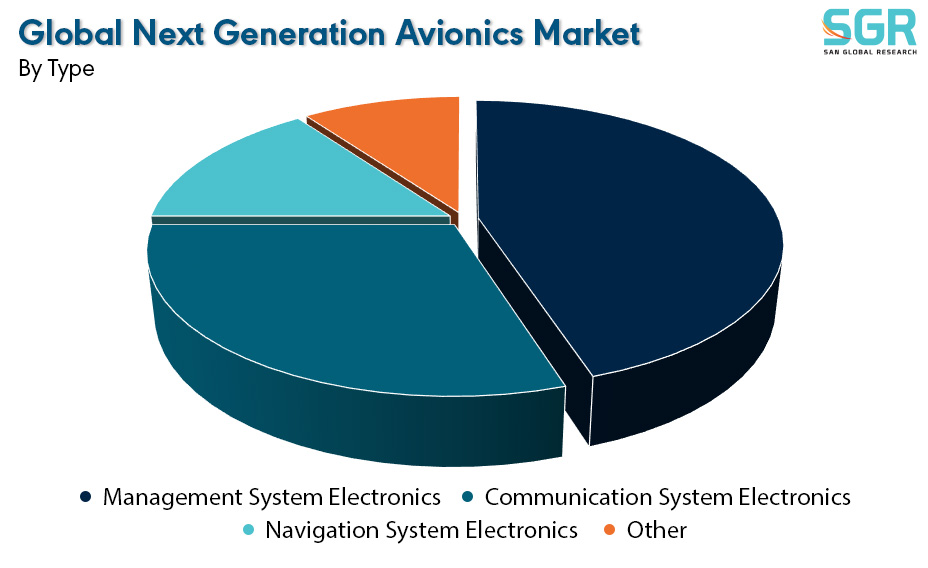

By Type:

Based on the type, the Next Generation Avionics Market is bifurcated into Management System Electronics, Communication System Electronics, Navigation System Electronics and Other Electronics – where Management System Electronics is dominating and ahead in terms of share.

Management System Electronics in Next generation avionics is crucial as it offers safety is paramount in aviation, and next-generation avionics aim to incorporate advanced features for risk mitigation and accident prevention. Management systems play a crucial role in monitoring various parameters and ensuring safe operation. Next-generation avionics are likely to leverage the Internet of Things (IoT) and data analytics for real-time monitoring and predictive maintenance. Management systems will be essential for processing vast amounts of data and extracting actionable insights to optimize performance and reliability. The proliferation of advanced sensors, such as LiDAR, radar, and infrared sensors, in next-generation aircraft necessitates robust management systems for data fusion, interpretation, and decision-making.

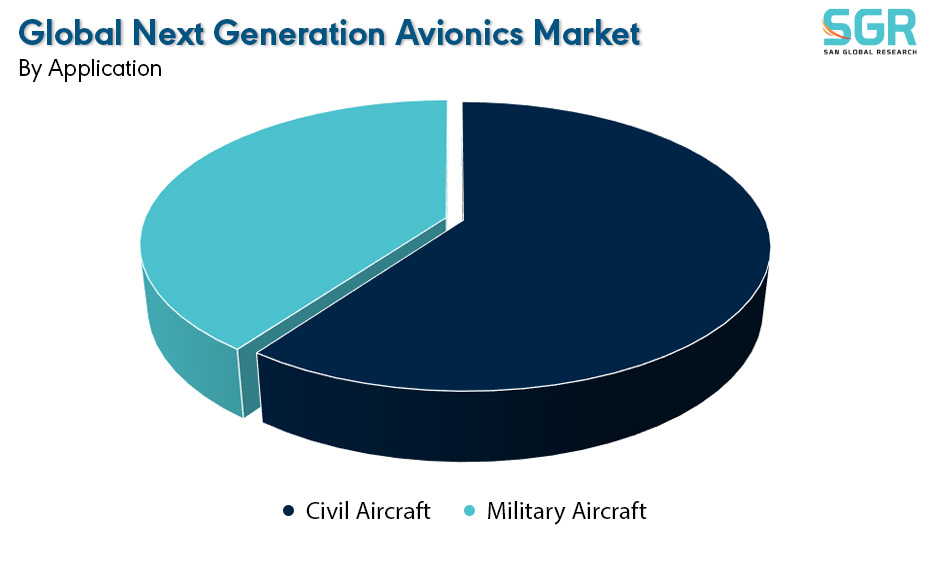

By Application:

Based on the application, the Next Generation Avionics Market is bifurcated into Civil Aircraft and Military Aircraft – where Civil Aircraft is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the Next Generation Avionics Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Next Generation Avionics Market include

• Collins Aerospace

• Thales

• GE Aviation

• L3Harris Technologies

• Universal Avionics

• Curtiss-Wright

• Safran

• Cobham

• Scioteq

• Garmin

Drivers:

Improved Safety and Reliability

The focus on improved safety and reliability is a central aspect of advancements in the Next Generation Avionics Market. Avionics, encompassing communication, navigation, surveillance, and other electronic systems in aircraft, continually evolves to enhance overall safety levels and operational reliability. Next-generation avionics incorporate advanced safety features and redundancy systems, enhancing overall safety levels in aviation. Modern avionics systems are designed with high reliability, reducing the likelihood of system failures and improving the overall safety of air travel. Avionics advancements include improved navigation systems such as GPS, Inertial Navigation Systems (INS), and Multi-Mode Receivers (MMR). These technologies provide accurate positioning and navigation information, reducing the risk of navigational errors. Avionics systems are equipped with sophisticated collision avoidance technologies, including Traffic Collision Avoidance System (TCAS) and Automatic Dependent Surveillance-Broadcast (ADS-B). These systems enhance situational awareness and help prevent mid-air collisions.

Opportunity:

Modernization and Fleet Upgrades

Modernization and fleet upgrades in the Next Generation Avionics Market involve the incorporation of advanced electronic systems and technologies into existing aircraft or the integration of state-of-the-art avionics into new fleets. Airlines and operators worldwide are investing in the modernization of their fleets, creating opportunities for avionics manufacturers to supply advanced systems for existing and new aircraft models. Upgrading older aircraft with next-generation avionics improves overall efficiency, safety, and compliance with evolving aviation standards. Modern avionics support advanced communication technologies, including satellite-based communication and high-speed data connectivity. This is crucial for improving air-to-ground communication and ensuring seamless connectivity for passengers and crew. Fleet upgrades often involve the installation of advanced cockpit displays with high-resolution screens and intuitive interfaces. This improves the overall human-machine interaction, reduces pilot workload, and enhances situational awareness.

| Report Attribute | Details |

| Market Value in 2022 | 2437.6 Million |

| Forecast in 2032 | 4562.8 Million |

| CAGR | CAGR of 6.47% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Application |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Collins Aerospace • Thales • GE Aviation • L3Harris Technologies • Universal Avionics • Curtiss-Wright • Safran • Cobham • Scioteq • Garmin |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355