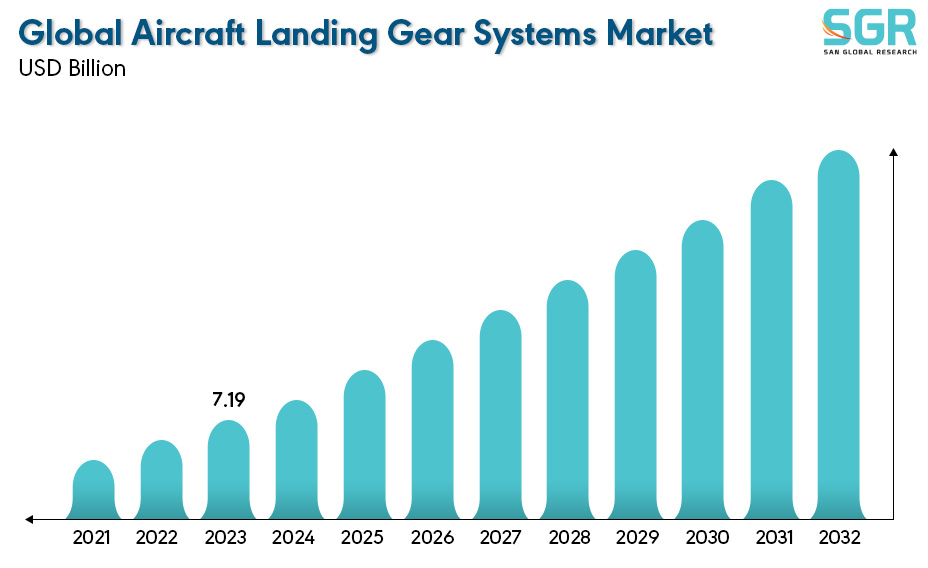

Aircraft Landing Gear Systems Market is estimated to be worth USD 6.72 Billion in 2022 and is projected to grow at a CAGR of 7.10% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Type, by Application and by region/country.

The Aircraft Landing Gear Systems Market refers to the industry involved in the design, manufacturing, and distribution of landing gear systems for aircraft. Landing gear is a crucial component of an aircraft, responsible for supporting the weight of the aircraft during landing and takeoff, as well as providing stability on the ground. It consists of various components such as wheels, brakes, shock absorbers, struts, and other structural elements.

The market for aircraft landing gear systems encompasses a range of products and services related to landing gear technology. This includes both the original equipment manufacturers (OEMs) that produce landing gear systems for new aircraft, as well as aftermarket services for maintenance, repair, and replacement of landing gear components on existing aircraft. The Aircraft Landing Gear Systems Market is a dynamic sector within the broader aerospace industry, playing a crucial role in ensuring the safety and functionality of aircraft during landing and takeoff operations.

.jpg)

Region wise Comparison:

North America is home to some of the largest aerospace manufacturers and companies, including Boeing and Airbus facilities. These companies are constantly innovating and producing new aircraft models, leading to a continuous demand for advanced landing gear systems. The high level of air travel demand in North America, driven by factors such as business travel, tourism, and cargo transportation, contributes to the need for more aircraft. This, in turn, leads to increased demand for landing gear systems.

European airlines and operators are investing in new aircraft or upgrade existing fleets to enhance efficiency, reduce fuel consumption, and comply with environmental standards. This has driven the demand for advanced landing gear systems. Ongoing advancements in landing gear technology, including improvements in materials, design, and control systems, stimulate demand as companies look to incorporate the latest innovations into their aircraft.

.jpg)

Many countries in the Asia-Pacific region are investing in expanding and modernizing their aircraft fleets to meet the growing demand for air travel. This expansion leads to increased demand for landing gear systems. Advances in landing gear technology, such as the development of lightweight materials, more efficient designs, and advanced control systems, may drive the replacement or upgrade of existing landing gear systems.

Some countries in the Middle East have been investing heavily in expanding their airline fleets, supported by the growth of aviation hubs such as Dubai and Doha. As airlines in the region expand their fleets, there may be a corresponding demand for landing gear systems. Some countries in the Middle East are known for significant defense and military investments. This could result in demand for specialized landing gear systems for military aircraft.

Some African countries have experienced economic growth and development, leading to increased air travel demand. As economies grow, there may be a need for more aircraft, contributing to the demand for landing gear systems.

.jpg)

Segmentation:

The Aircraft Landing Gear Systems Market is segmented by Type, by Application and by region/country.

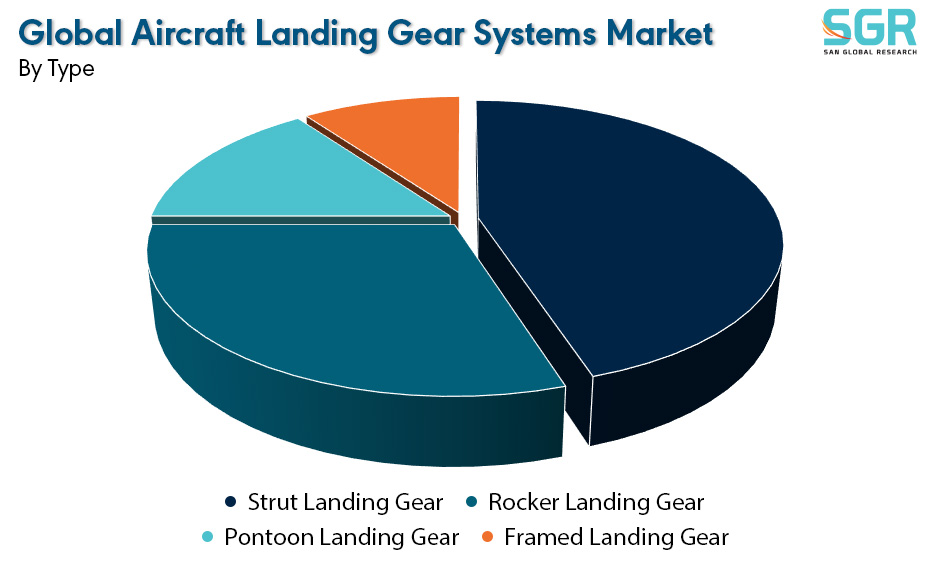

By Type:

Based on the type, the Aircraft Landing Gear Systems Market is bifurcated into Strut Landing Gear, Rocker Landing Gear, Pontoon Landing Gear and Framed Landing Gear – where Strut Landing Gear is dominating and ahead in terms of share.

Strut landing gear refers to a type of landing gear configuration where a structural component known as a strut is used to support the weight of the aircraft during landing and ground operations. The landing gear is a critical component that enables safe takeoff, landing, and taxiing of an aircraft. Strut landing gear configurations are commonly found in a variety of aircraft types, including general aviation airplanes, regional jets, and some military aircraft. The design and characteristics of the strut landing gear can vary based on the specific requirements of the aircraft, such as size, weight, and intended use.

Overall, the choice of landing gear configuration, including the use of a strut, is influenced by factors such as aerodynamics, structural considerations, and the overall design objectives of the aircraft. Different aircraft may utilize various landing gear designs to optimize performance and meet the demands of their respective missions.

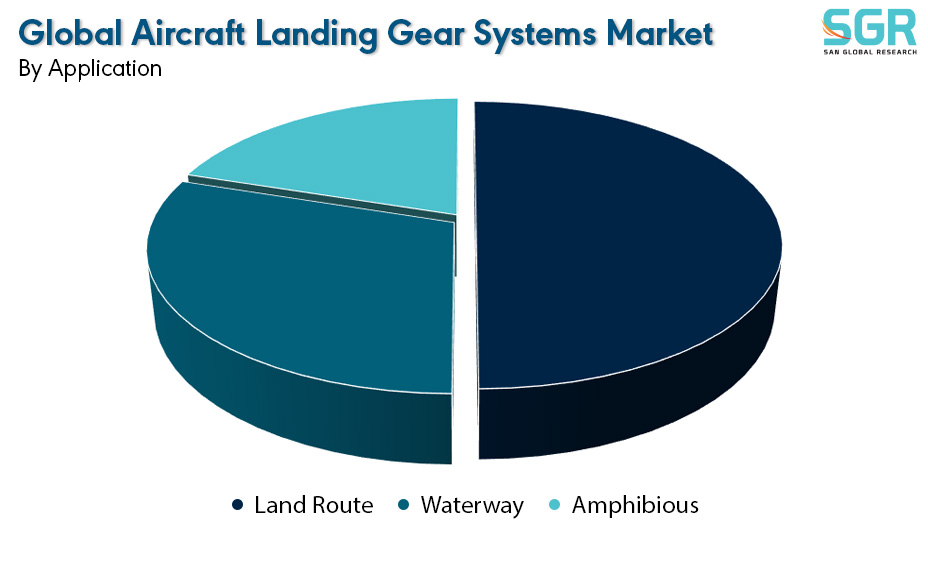

By Application:

Based on the Application, the Aircraft Landing Gear Systems Market is bifurcated into Land Route, Waterway & Amphibious – where Land Route is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the Aircraft Landing Gear Systems Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Aircraft Landing Gear Systems Market include

• Raytheon Technologies

• Heroux-Devtek

• Safran

• Liebherr

• Circor

• Magellan Aerospace

• Triumph

• GKN Aerospace

• Albany International Corp

• Swire

• AAR CORP

• SPP Canada Aircraft

Drivers:

Aftermarket Services

Aftermarket services in the Aircraft Landing Gear Systems Market refer to the range of maintenance, repair, and overhaul (MRO) activities provided for landing gear components and systems after an aircraft has been delivered to the customer. The aftermarket services play a crucial role in ensuring the continued airworthiness, safety, and performance of landing gear systems throughout their operational life. Aftermarket services are essential for extending the lifespan of landing gear systems, reducing operational costs, and ensuring the safety and reliability of aircraft throughout their service life. MRO providers, as well as the original equipment manufacturers (OEMs) of landing gear components, play significant roles in delivering these services to operators and airlines. The aftermarket for landing gear systems, including maintenance, repair, and overhaul (MRO) services, provides a steady stream of revenue. Airlines and operators regularly invest in the maintenance and upgrading of their existing landing gear components.

Opportunity:

Technological Innovations

Technological innovations in the Aircraft Landing Gear Systems Market contribute to advancements in safety, efficiency, and performance. These innovations are driven by the continuous pursuit of improved aircraft capabilities and the need to meet evolving industry standards. Technological innovations include Advanced Materials, Electric Actuation, Health Monitoring and Predictive Maintenance, Smart Landing Gear Systems, Advanced Shock Absorption etc. These technological innovations contribute to the overall efficiency, safety, and performance of modern aircraft landing gear systems, aligning with the aviation industry's goals of sustainability and operational excellence. Technologically advanced landing gear systems provide a unique selling proposition for manufacturers. The ability to offer innovative features, improved performance, and enhanced efficiency can attract customers seeking the latest advancements. Technological innovations, such as the use of lightweight materials and advanced aerodynamics, contribute to increased fuel efficiency and overall performance. This aligns with industry demands for more efficient and environmentally friendly aircraft.

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355