Report Overview

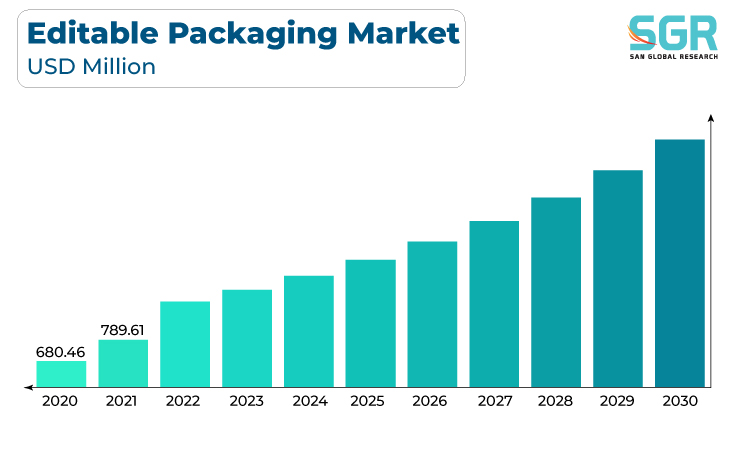

The Edible Packaging Market was valued at 969.84 million in 2022 and expected to grow at CAGR of 5.14% over forecast period. Edible packaging is a more environmentally friendly option because it is typically made from natural and edible materials such as seaweed, rice, or potatoes, which are biodegradable and compostable. Growing consumer awareness of environmental concerns, as well as a desire for more environmentally friendly packaging options, is driving the adoption of edible packaging in a variety of industries, including food and beverage. Furthermore, the convenience factor is important, as edible packaging eliminates the need for separate disposal and reduces packaging waste.

Innovative developments in edible packaging materials and technologies are also stimulating the market, reflecting a broader shift toward more sustainable and environmentally conscious packaging solutions.

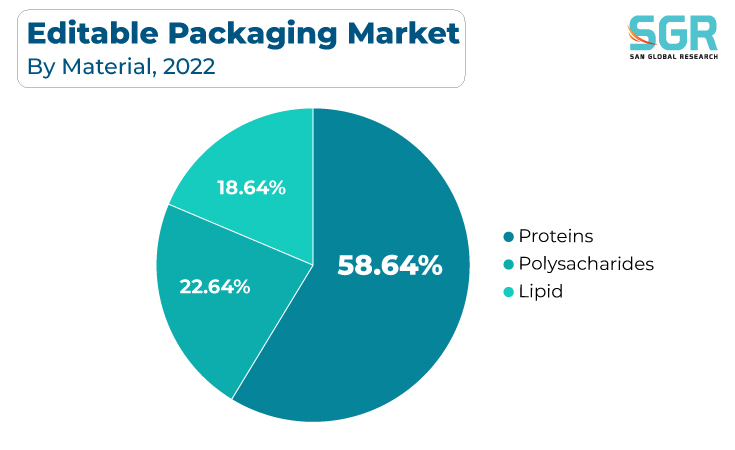

Material Outlook

Based on Material, the Edible Packaging Market is segmented Proteins, Polysaccharides, Lipid. Flexible segment accounted for largest share in 2022. The growing demand for environmentally friendly and sustainable packaging solutions, as well as the growing interest in protein consumption for health and nutrition. By offering biodegradability and reduced plastic waste, edible packaging, which is frequently made from protein-based materials such as gelatin or plant proteins, aligns with consumer preferences for eco-friendly options. Furthermore, as consumers seek to incorporate more protein into their diets, edible packaging offers a novel and convenient way to do so, adding to its popularity.

Polysaccharide-based edible packaging materials derived from sources such as starch, cellulose, or alginate are biodegradable and compostable, aligning with consumer preferences for reducing plastic waste and environmental impact. Regulatory initiatives aimed at reducing the use of single-use plastics encourage the use of these materials even more. Furthermore, the food and beverage industry's desire to improve product freshness and shelf life through edible packaging while minimizing the use of synthetic additives and preservatives drives innovation in this sector. Overall, the Polysaccharides Edible Packaging Market is shaped by the intersection of sustainability, regulatory pressures, and the need for extended product shelf life, making it a promising and environmentally conscious segment of the packaging industry.

Source Outlook

Based on Source, Edible Packaging Market is segmented into plant and animal based sources. Plant-based accounted for largest share in 2022. Plant-based edible packaging materials, derived from sources such as seaweed, potato starch, or corn, provide a biodegradable and eco-friendly alternative to traditional plastic packaging, aligning with consumer preferences for environmentally conscious choices. Regulatory initiatives aimed at reducing single-use plastics and promoting sustainable packaging speed up the adoption of plant-based edible packaging.

The increasing emphasis on reducing plastic waste, and the pursuit of innovative solutions. Biodegradable edible packaging materials derived from animal sources, such as gelatin or collagen, align with growing consumer preferences for environmentally conscious choices. Regulatory efforts to reduce single-use plastics and promote sustainable packaging boost the use of animal-based edible packaging even more. Furthermore, the market benefits from advances in food technology, where animal-based ingredients are being investigated as a valuable resource for creating edible packaging materials. While the market appears to be promising, it also faces animal welfare and ethical concerns, which necessitate responsible sourcing and production practices within the industry. Overall, the Animal-based Edible Packaging Market is a dynamic and evolving segment of the packaging industry because it combines sustainability, innovation, regulatory compliance, and ethical considerations.

Packaging Type Outlook

Based on Packaging Type, Edible Packaging Market is segmented into films, coatings, and others. Films accounted for largest share in 2022. The regulatory push to reduce single-use plastics and promote environmentally friendly packaging is hastening the adoption of edible films. The convenience factor also plays a role, as these films can be used as edible wrappers, coatings, or even edible utensils, reducing waste and improving the consumer experience. The Films Edible Packaging Market is a dynamic and rapidly evolving sector with significant growth potential due to the convergence of sustainability, regulatory compliance, and innovative packaging materials.

Edible coatings, which are frequently made from natural ingredients such as beeswax, proteins, or plant-based materials, provide a biodegradable and environmentally friendly alternative to traditional packaging materials, aligning with consumer preferences for reducing plastic waste and environmental impact. Regulations aimed at reducing single-use plastics and promoting sustainability are also driving the use of edible coatings. Furthermore, these coatings can extend the shelf life of products, reduce food waste, and provide an additional layer of protection, all of which contribute to their popularity in the food and beverage industry.

End-use Outlook

Based on End-use, Edible Packaging Market is segmented into Food & Beverages, Pharmaceuticals.Food & Beverages accounted for largest share in 2022. Edible packaging, which is typically made from natural and edible materials such as starch, proteins, or seaweed, aligns with consumer preferences for environmentally friendly options by providing biodegradability and compostability. Regulatory initiatives aimed at reducing single-use plastics and promoting sustainable packaging drive edible packaging adoption in the food and beverage industry even further. Furthermore, the convenience factor is important, as edible packaging can provide a novel and environmentally friendly way to consume or unwrap food and beverages, which contributes to its popularity. Innovations in edible packaging materials and technologies are also driving market growth, reflecting a broader shift in the food and beverage industry toward more sustainable and environmentally conscious packaging solutions.

Tamper-evident and child-resistant packaging is frequently required by regulatory authorities, creating a strong demand for innovative edible packaging solutions that meet these criteria. Furthermore, as consumer awareness of sustainability and the need to reduce plastic waste grows, pharmaceutical companies are being pushed toward eco-friendly alternatives. Overall, patient-centricity, regulatory compliance, sustainability considerations, and advancements in edible packaging technologies shape the Pharmaceuticals Edible Packaging Market, making it an evolving and promising segment of the pharmaceutical packaging industry.

Regional Outlook

North America is emerged as leading market for Edible Packaging Market in 2022. The North America Edible Packaging Market experiences significant momentum due to the region's increasing commitment to sustainability and environmentally friendly packaging solutions. As consumers become more environmentally aware, there is a growing demand for edible packaging materials that reduce plastic waste and align with sustainable practices. Concurrently, regulatory initiatives aimed at reducing single-use plastics and encouraging the use of eco-friendly alternatives further accelerate the adoption of edible packaging.

Asia Pacific accounted for second largest market share in 2022. With a growing emphasis on environmental consciousness, Asia Pacific consumers are driving demand for edible packaging materials that are biodegradable and reduce plastic waste. Furthermore, stringent regulations aimed at reducing the use of single-use plastics are encouraging the use of edible packaging solutions. Furthermore, the convenience factor is important, especially in catering to modern consumer preferences for on-the-go consumption and portion control. Edible packaging materials and technologies, as well as their applications in the food and beverage industries, are driving market growth. Overall, sustainability considerations, regulatory compliance, convenience, and technological advancements shape the Asia Pacific Edible Packaging Market, making it a promising and rapidly growing segment within the region's packaging industry.

Edible Packaging Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 969.84 Million |

| Forecast in 2030 | USD 13,478 Million |

| CAGR | CAGR of 5.14% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Source, By Material, By Packaging type, By End-use |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Notpla Ltd; Devro Plc; Amtrex Nature Care Pvt Ltd; Ingredion; Glanbia plc; Skipping Rocks Labs; Coolhaus; Apeel Sciences; Mantrose UK Ltd; Do eat; TSUKIOKA FILM PHARMA CO., LTD. |

Global Edible Packaging Market, Report Segmentation

Edible Packaging Market, By Source

- Plant

- Animal

Edible Packaging Market, By Material

- Protein

- Polysaccharides

- Lipid

- Others

Edible Packaging Market, By Packaging Type

- Films

- Coatings

- Others

Edible Packaging Market, By End-Use

- Food & Beverages

- Pharmaceutical

Edible Packaging Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355