Report Overview

The Blister Packaging Market was valued at 28.14 billion in 2022 and expected to grow at CAGR of 7.65% over forecast period. Key factors driving the Blister Packaging Market, including the need for tamper-evident and child-resistant packaging solutions, particularly in the pharmaceutical and healthcare sectors, to ensure product safety and compliance with stringent regulations. The ability of blister packaging to provide excellent protection against moisture, light, and other external factors is critical for the preservation of pharmaceuticals and sensitive medical devices.

The consumer goods industry values blister packaging for its transparency and product visibility, which improves branding and consumer appeal, particularly in segments such as electronics and personal care. Sustainability is also having an impact on the market, with a growing demand for eco-friendly and recyclable blister materials and designs. Overall, regulatory requirements, product protection needs, marketing advantages, and environmental concerns drive the Blister Packaging Market, making it a dynamic and evolving sector.

Material Outlook

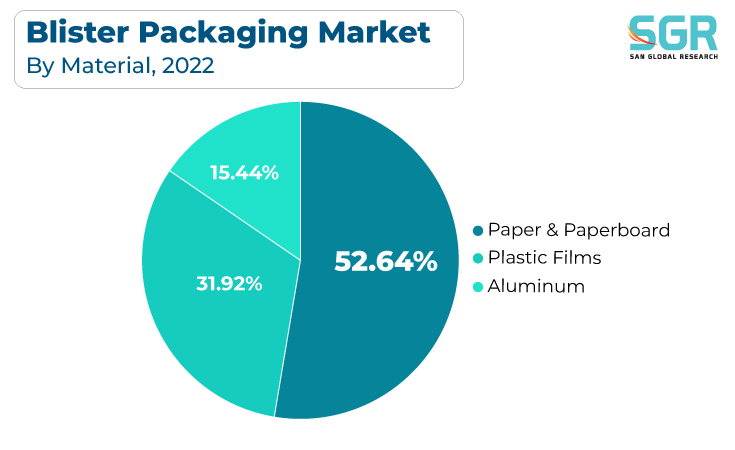

Based on Material, the Blister Packaging Market is segmented Paper & Paperboard, Plastic Films, and Aluminum. Plastic Films segment accounted for largest share in 2022. The Plastic Films Blister Packaging Market is primarily driven by a number of factors, including its versatility and cost-effectiveness in providing a transparent and protective barrier for a wide range of consumer goods, pharmaceuticals, and medical devices. Blister packaging is in high demand in the pharmaceutical and healthcare industries due to its ability to provide tamper-evident and child-resistant features that ensure product safety and regulatory compliance. Plastic films have excellent moisture and oxygen barrier properties, extending perishable goods' shelf life and improving product quality.

The Paper and Paperboard Blister Packaging Market is accounted for second largest market share in 2022 owing to the presence combination of factors, including increasing consumer and regulatory focus on environmental concerns, as paper and paperboard materials are renewable, recyclable, and biodegradable. Paper and paperboard blister options are becoming more popular in the pharmaceutical and healthcare sectors, which require tamper-evident, child-resistant, and protective packaging due to advancements in paperboard's barrier properties and ability to meet stringent packaging standards.

Type Outlook

Based on Type, Blister Packaging Market is segmented into Carded, Clamshell. Carded accounted for largest share in 2022. Carded blister packaging is essential in pharmaceuticals and healthcare for ensuring product safety and regulatory compliance, with tamper-evident features and clear product information. Carded blisters are valued in the consumer goods industry for their marketing benefits, which include product visibility, branding, and consumer access. Furthermore, this packaging format meets the demand for compact and single-serving packaging, which aligns with modern consumer convenience preferences.

Clamshell packaging improves product visibility, reduces theft, and allows consumers easy access, all of which contribute to increased sales and brand recognition in retail. Clamshell blister packaging is valued in the pharmaceutical and healthcare industries for its tamper-evident features, which ensure product safety and regulatory compliance. Furthermore, the food industry is increasingly using clamshell packaging for takeout and ready-to-eat meals, in response to the growing demand for on-the-go and convenient food options. While sustainability concerns are becoming more prominent, the development of eco-friendly materials and recyclable clamshell designs addresses these concerns, ensuring the Clamshell Blister Packaging Market's continued growth.

End-Use Outlook

Based on End-Use, Blister Packaging Market is segmented into healthcare, consumer goods, industrial goods, and food. Healthcare accounted for largest share in 2022. Tamper-evident and child-resistant packaging is required by stringent regulations, and blister packaging is adept at meeting these requirements, ensuring the integrity of healthcare products. As the world's population ages and healthcare needs grow, so does the demand for blister packaging in medications, medical equipment, and healthcare supplies. The need for longer shelf life and contamination protection is driving advancements in barrier properties and materials. Furthermore, patient-centric packaging solutions, such as unit-dose blister packs, are becoming more popular, contributing to the market's expansion. The development of recyclable and eco-friendly blister materials to address environmental concerns while maintaining product safety is also gaining importance. Overall, healthcare industry dynamics, stringent regulations, patient-centered requirements, and sustainability considerations shape the Healthcare Blister Packaging Market.

Blister packaging increases product shelf appeal, reduces theft, and allows consumers to easily inspect the quality and features of items, significantly influencing purchasing decisions in the retail sector. Blister packaging is valued in industries such as electronics and hardware because it protects delicate products during transportation and on store shelves. Furthermore, the demand for compact, single-serving, and portion-controlled packaging aligns with modern consumer convenience preferences, making blister packaging a preferred option. While sustainability concerns are growing in importance, the development of recyclable materials and eco-friendly blister designs is addressing these issues, ensuring the Consumer Goods Blister Packaging Market's continued growth. Overall, the market's drivers include concerns about product visibility, security, convenience, and sustainability.

Regional Outlook

North America is emerged as leading market for Blister Packaging Market in 2022. The North America Blister Packaging Market is primarily driven by a mix of factors reflecting the region's robust industrial landscape and consumer preferences. Tamper-evident and child-resistant features are required in the pharmaceutical and healthcare sectors due to strict regulatory requirements, ensuring product safety and compliance. Blister packaging is valued in the region's highly competitive consumer goods market for its ability to improve product visibility, reduce theft, and cater to modern consumer preferences for convenience and portion control. E-commerce and online retailing are driving up demand for secure and visually appealing packaging solutions. Concerns about sustainability are also gaining traction, prompting the development of recyclable and eco-friendly blister materials in response to North American consumers' growing environmental consciousness. Overall, the North America Blister Packaging Market is shaped by a combination of regulatory compliance, product protection requirements, marketing benefits, and sustainability considerations, making it a dynamic and evolving industry.

Asia Pacific accounted for second largest share in the market in 2022. Stringent regulatory requirements in the pharmaceutical and healthcare sectors necessitate blister packaging for tamper-evident and child-resistant features, ensuring product safety and adherence to compliance standards. The growing purchasing power of the middle-class population drives demand for consumer goods, electronics, and hardware, all of which rely on blister packaging for product protection and visibility. The growth of e-commerce and online shopping platforms in the region increases the demand for secure and appealing packaging solutions. Furthermore, the market is influenced by environmental concerns, with a growing demand for recyclable and eco-friendly blister materials to address consumer environmental consciousness and regulatory initiatives. Overall, regulatory compliance, diverse industry demands, evolving consumer preferences, and sustainability considerations drive the Asia Pacific Blister Packaging Market, making it a rapidly growing and lucrative market.

Blister Packaging Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 28.14 Billion |

| Forecast in 2030 | USD 50.67 Billion |

| CAGR | CAGR of 17.65% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Material, By End-Use |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | WestRock Company; SteriPackGroup; Honeywell International Inc; Klöckner Pentaplast; ACG; SÜDPACK; Tekni Plex; Blisterpack Inc.; Abhinav Enterprises; YuanPeng Plastic Products Co., Ltd |

Global Blister Packaging Market, Report Segmentation

Blister Packaging Market, By Material

- Paper & Paperboard

- Plastic Films

- Aluminum

Blister Packaging Market, By Type

- Carded

- Clamshell

Blister Packaging Market, By End-use

- Healthcare

- Consumer Goods

- Industrial Goods

- Food

Blister Packaging Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355