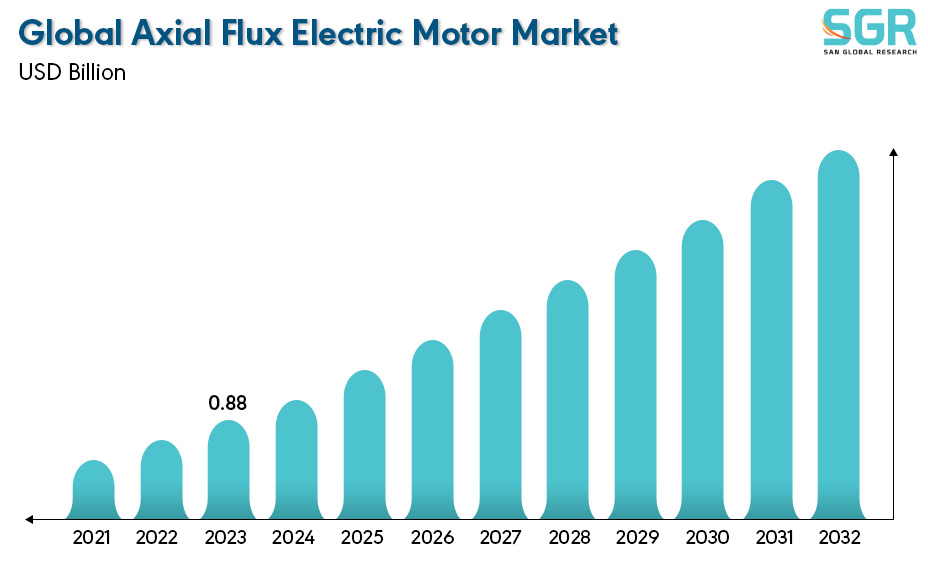

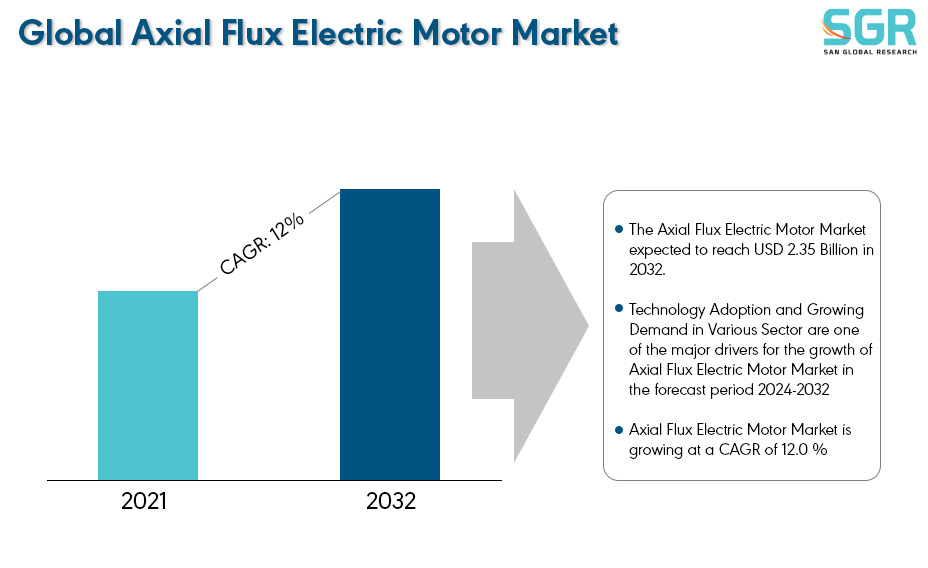

Axial Flux Electric Motor Market is estimated to be worth USD 0.88 Billion in 2023 and is projected to grow at a CAGR of 12.0 % between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of market and the forecast period is 2024 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Type, by Application, and by region/country.

Electric vehicles (EVs) have seen remarkable growth in the commercial market, driven by a dual commitment to reducing pollution and enhancing the overall driving experience. While the first modern vehicles in the last century initially ran on electric motors instead of combustion engines, the automotive landscape shifted towards combustion engine vehicles due to poor battery performance and the low cost of gasoline at that time.

However, a renewed focus on environmental concerns, global warming, and the depletion of fossil fuels, coupled with substantial improvements in battery technology, has catapulted EVs back into the spotlight. Electric motors, in contrast to traditional combustion engines, bring advantages such as increased power, improved energy efficiency, and a more compact design. In the pursuit of even greater energy utilization efficiency for EVs, the demand has risen for high-performance motors designed to be lighter and more efficient. Various motor types, including the switched reluctance motor (SRM), interior permanent magnet synchronous motor (IPM), induction motor (IM), and switched flux motor (SFM), have been employed in EV applications. Among these options, the axial flux induction motor (AFIM) stands out, drawing attention for its distinct advantages over conventional motors when integrated into EV systems. The AFIM boasts superior power-to-weight and diameter-to-length ratios, compact construction, high efficiency (especially notable in machines with a large number of poles), optimal utilization of active materials, and enhanced ventilation and cooling. These unique features position the axial flux induction motor as a promising and strategic choice, contributing to the ongoing evolution and improvement of electric vehicle technology.

After reviewing the data shown below, it can be determined that the Asia Pacific region dominates the Axial Flux Electric Motor Market for the following reasons.

The North American market for Axial Flux Electric Motors reflects a growing interest in technology adoption and as well as growing demand in various sector, particularly in the context of wind energy recognized as the cleanest renewable energy source in solar energy conversion. Countries abundant in global wind resources, like North America, are placing significant importance on the development of wind power generation. The adoption of Axial Flux Electric Motors in wind turbines has surged, exceeding 50%. This choice is well-founded as axial flux motors prove to be ideal for wind turbines, significantly enhancing the electricity generation capacity through wind power. Their design facilitates increased power density, making them more efficient in capturing wind energy compared to radial flux motors. Beyond wind turbines, axial flux motors are gaining appeal across various sectors, including automotive, hydroelectric power plants, HVAC systems, and industrial machines. This surge in popularity is attributed to their efficiency, power density, and compact size. As a result, the market for Axial Flux Electric Motors is experiencing rapid expansion.

As European market being one of the largest investors in the sector in 2021, the investment was around $215 Billion. Due to its proactive adoption of sustainable and green technologies, emphasizing the reduction of carbon emissions and the promotion of clean energy sources.

The Asia Pacific region stands out as the primary user of renewable resources, with China leading the way and contributing to approximately 43% of the global growth. This substantial utilization has propelled a significant surge in the Axial Flux Electric Motors Market. Meanwhile, India is actively transitioning its energy mix, moving away from conventional sources towards renewable alternatives. In the financial year 2021-22, there has been a remarkable 16.4% increase in the installed capacity of Renewable Energy Sources (RES) compared to the previous year. This surge is a key driver behind the booming market for Axial Flux Electric Motors, indicating a growing reliance on sustainable energy solutions. As the demand for renewable energy continues to rise in the Asia Pacific region, particularly in countries like China and India, the Axial Flux Electric Motors market is poised to play a pivotal role in meeting these evolving energy needs.

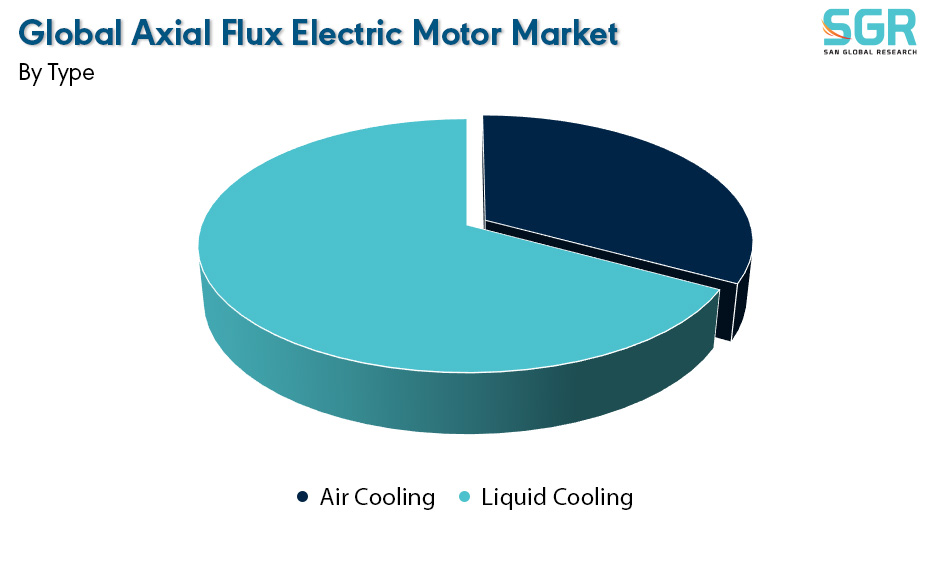

By Type

Based on the Type, the Axial Flux Electric Motor Market is bifurcated into Air Cooling and Liquid Cooling – where Liquid Cooling is dominating and ahead in terms of share.

The Axial Flux Electric Motor market is predominantly led by the liquid cooling segment, owing to its superior thermal efficiency and capacity to handle elevated heat loads compared to air cooling systems. Liquid cooling entails the circulation of a coolant, such as water, through the motor to effectively dissipate heat, making it well-suited for high-performance electric vehicles and industrial machinery where maintaining consistent motor temperatures is paramount. This method delivers enhanced thermal performance, contributing to its market dominance over air cooling systems. Liquid cooling is renowned for its efficient management of higher heat loads, establishing it as the preferred choice in demanding applications where the maintenance of consistent motor temperatures is essential.

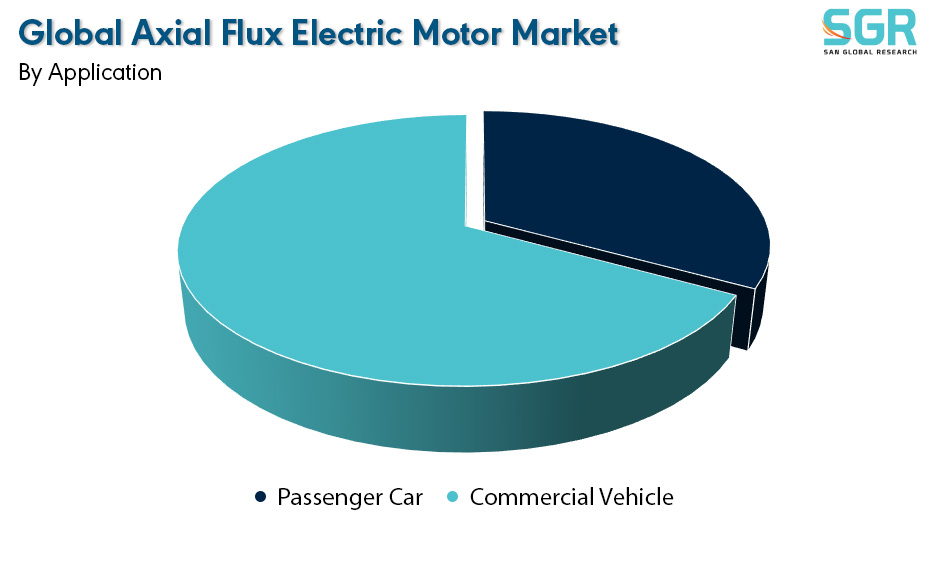

By Application

Based on the Application, the Axial Flux Electric Motor Market is bifurcated into Electric Passenger Car and Commercial Vehicle – where Passenger Car is dominating and ahead in terms of share.

The Passenger Car segment holds a prominent position in the Axial Flux Electric Motor market, driven by the rising consumer demand for electric vehicles. This surge in popularity for electric cars is a result of growing environmental awareness and the search for alternatives to internal combustion engine vehicles. Electric cars have garnered substantial traction in the market, with axial flux motors playing a pivotal role in the electrification of passenger cars. These motors contribute to greater energy efficiency, enhanced performance, and an overall improved driving experience. Global automakers are making substantial investments in the development of electric vehicles, further solidifying the dominance of the Passenger Car segment in the Axial Flux Electric Motor market. The ongoing trend of increasing electric vehicle adoption is expected to fuel the demand for axial flux motors as automakers strive to align with evolving market demands and customer preferences.

Key Players

• Mettler Toledo

• Emerson

• DKK-TOA Corporation

• Hach Company

• ProMinent

• PCE Instruments

• BMT Messtechnik GMBH

Drivers

Technological Adaptations and Rising Demand in Various Sector

The substantial growth of the Axial Flux Electric Motor market is propelled by technological adoptions and rising demands in various sectors. The increasing need for electric vehicles, renewable energy systems, and other applications serves as a key driver for the market's expansion, with the automotive sector taking the lead. This is primarily due to the requirement for efficient and compact motors such as Axial Flux Electric Motors (AFEMs). Furthermore, factors like the depletion of fossil fuel supplies, a push for advanced fuel-efficient technologies, and a surge in demand for electric-powered travel vehicles contribute to the market's growth across diverse sectors. Government initiatives worldwide that promote electric vehicle adoption, investments in e-scooter start-ups, and advancements in robotics technology utilizing axial flux motors are additional factors shaping the market's trajectory. In summary, these collective influences drive the increasing adoption of axial flux motors in various sectors and geographical regions, positioning them for sustained growth in the future.

Opportunity

Efficiency and Compact Motor

Significant and diverse market growth opportunities exist for the Axial Flux Electric Motor market. The expansion is primarily driven by the growing demand for electric vehicles, renewable energy systems, and various applications. The automotive sector is at the forefront, propelling market growth due to the imperative for efficient and compact motors like Axial Flux Electric Motors. The rising demand for electric transportation and renewable energy sources is anticipated to contribute substantially to the market's expansion, as axial flux motors become increasingly affordable and find applications across various industries.

| Report Attribute | Details |

| Market Value in 2023 | 0.486 Billion |

| Forecast in 2032 | 1.164 Billion |

| CAGR | CAGR of 12% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | By Type, By Application |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • BMT Messtechnik GMBH • PCE Instruments • ProMinent • Hach Company • DKK-TOA Corporation • Emerson • Mettler Toledo |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355