Report Overview

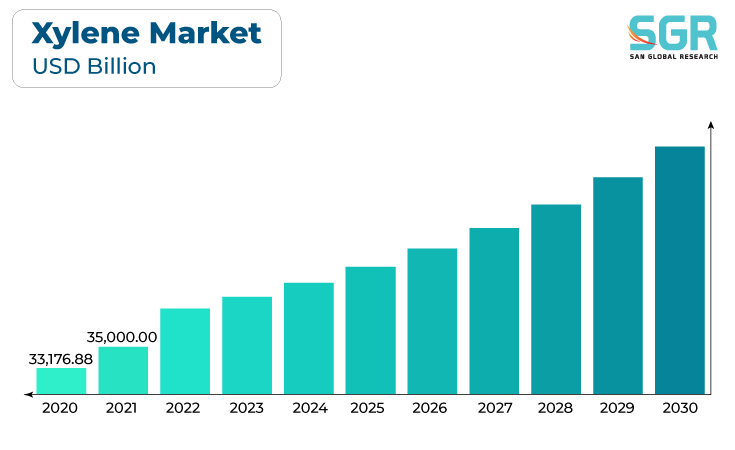

The xylene market was valued at 48.34 billion in 2022 and expected to grow at CAGR of 3.2% over forecast period.

Xylene is used in the production of various plastics and polymers, including polyethylene terephthalate (PET) and polyester fibers. The increasing demand for plastics in packaging, textiles, and automotive applications drives the xylene market. Additionally, Xylene is a common solvent in the paints and coatings industry, used in the formulation of paints, varnishes, and adhesives. The growth of construction and manufacturing sectors fuels the demand for paints and coatings, consequently boosting xylene consumption.

Furthermore, xylene is used in pharmaceutical manufacturing and healthcare applications, such as cryopreservation and medical equipment. The growth of the pharmaceutical and healthcare sectors contributes to increased xylene demand.

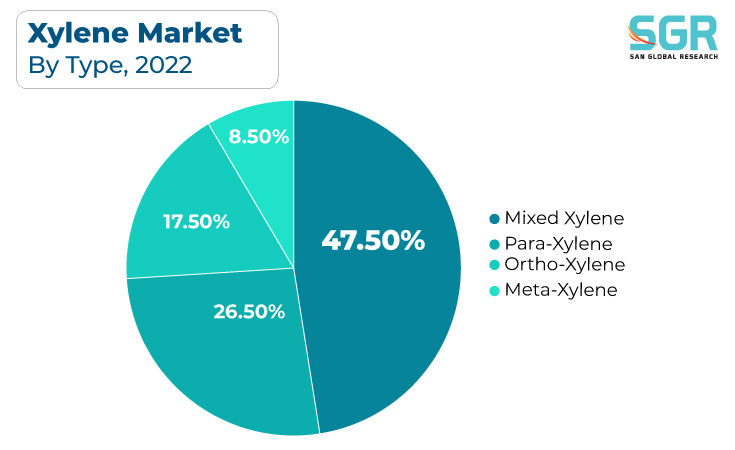

Type Outlook

Based on type, the xylene market is segmented into Ortho-Xylene, Meta-Xylene, Para-Xylene and Mixed Xylene. Mixed Xylene segment accounted for largest share in 2022. One of the primary drivers of the xylene market is its role as a feedstock for the production of para-xylene (p-xylene). P-xylene is a key raw material in the manufacture of purified terephthalic acid (PTA), which is used in the production of polyester fibers and polyethylene terephthalate (PET) resins. PET is widely used in the packaging industry for bottles, containers, and textiles. As the demand for PET and polyester fibers increases due to the growing packaging and textile industries, so does the demand for mixed xylene as a feedstock.

Thus, Mixed xylene is used as a solvent in the production of adhesives and sealants. These products find applications in the construction, automotive, and aerospace industries. The growth of these sectors contributes to the demand for mixed xylene.

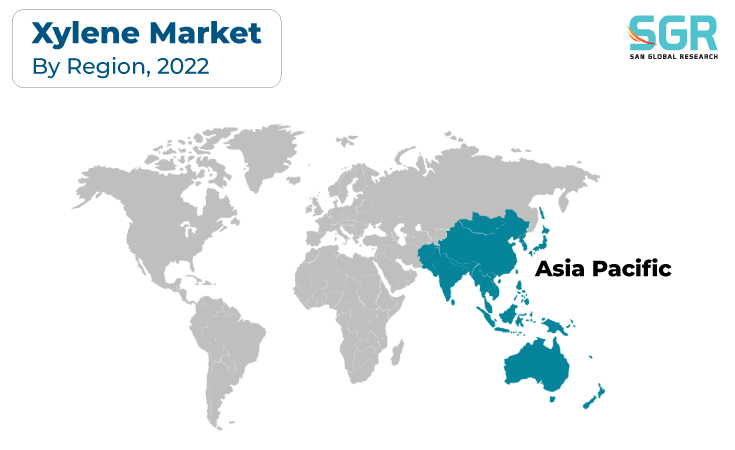

Regional Outlook

Asia-Pacific has emerged as leading market for xylene market in 2022. Several key factors are driving the Asia-Pacific xylene market such as the he Asia-Pacific region is characterized by rapid industrialization and urbanization, particularly in countries like China and India. This growth leads to increased construction activities, automotive production, and manufacturing, all of which rely on xylene-based products such as paints, coatings, adhesives, and plastics.

Furthermore, the chemical industry in the Asia-Pacific region has been experiencing significant growth. This sector utilizes xylene for the production of a wide range of chemicals, including petrochemicals, resins, and specialty chemicals. As the chemical industry expands to meet the demands of various end-user industries, the demand for xylene rises.

Hence, the Asia-Pacific region's economic growth, industrialization, and consumer demand for various products are key drivers of the xylene market's growth. As the region continues to develop and diversify its industrial and commercial activities, the demand for xylene and its derivatives is expected to remain strong.

Xylene Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 48.34 Billion |

| Forecast in 2030 | USD 62.09 Billion |

| CAGR | CAGR of 3.2% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Additives, By Type |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | Exxon Mobil Corporation, TotalEnergies, China Petroleum & Chemical Corporation, Shell chemicals, Reliance Industries Limited, INEOS Group, PetroChina Sichuan, Formosa Plastics Group, BASF SE, Honeywell International Inc. among others |

Global Xylene Market, Report Segmentation

Xylene Market, By Additives

- Solvents

- Monomers

Xylene Market, By Type

- Ortho-Xylene

- Meta-Xylene

- Para-Xylene

- Mixed Xylene

Xylene Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355