Report Overview

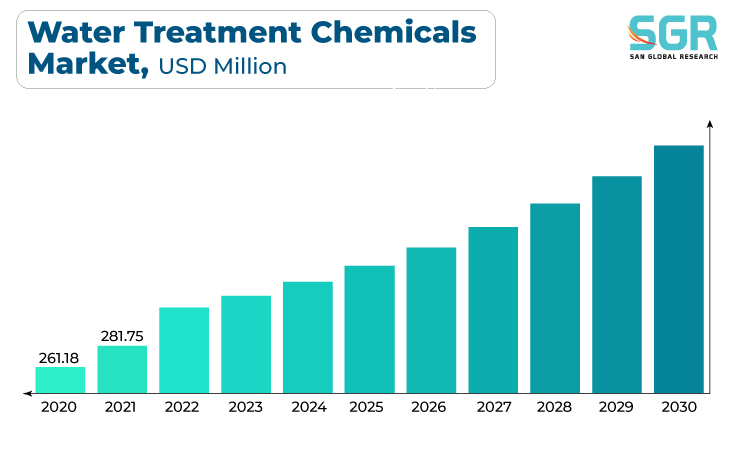

The water treatment chemicals Market was valued at 302.88 billion in 2022 and expected to grow at CAGR of 9.0% over forecast period.

The increase in global population and urbanization leads to higher water consumption and wastewater generation. As a result, there is a growing need for effective water treatment to ensure the availability of clean and safe water. Furthermore, the expansion of industrial activities across sectors such as power generation, chemical manufacturing, and food and beverage processing increases the demand for water treatment chemicals. Industries require water treatment to meet quality standards and comply with environmental regulations.

In addition, Governments worldwide are imposing stricter regulations to address water pollution and ensure the discharge of treated water within acceptable limits. Compliance with these regulations drives the demand for water treatment chemicals. Increased awareness of water scarcity and the importance of water conservation has prompted industries and municipalities to invest in water treatment technologies and chemicals to optimize water use and reduce wastage.

With a growing emphasis on sustainable water management, there is an increasing focus on water reuse and recycling. Water treatment chemicals play a crucial role in treating and purifying water for reuse in various industries and applications.

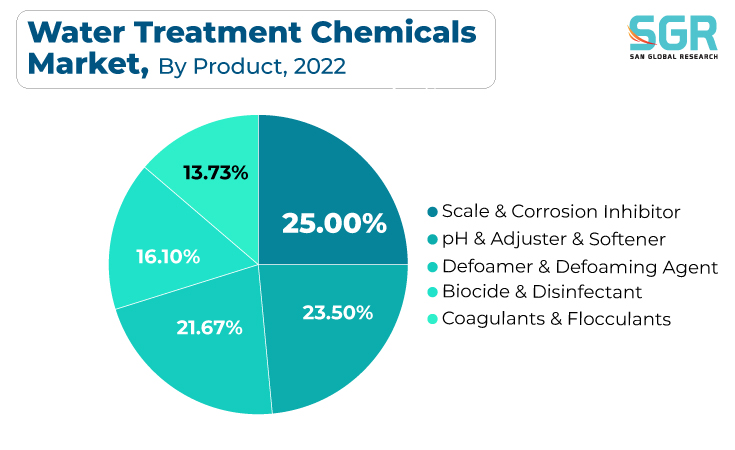

Product Outlook

Based on product, the water treatment chemicals market is segmented into scale & corrosion inhibitor, pH & adjuster & softener, defoamer & defoaming agent, biocide & disinfectant and coagulants & flocculants. scale & corrosion inhibitor segment accounted for largest share in 2022. The ongoing expansion of industrial infrastructure worldwide, particularly in sectors such as power generation, manufacturing, and oil and gas, has significantly increased the need for effective water treatment. Scale and corrosion inhibitors are essential components in water treatment formulations used to protect critical equipment and infrastructure from scaling and corrosion. As industries expand, the demand for reliable water treatment chemicals, including inhibitors, continues to rise.

Moreover, Scale and corrosion pose serious threats to the longevity and efficiency of industrial equipment, such as boilers, heat exchangers, and pipelines. The use of inhibitors helps prevent the accumulation of scale and the corrosive degradation of equipment surfaces. By extending the lifespan of industrial assets, these inhibitors contribute to cost savings for industries, driving the adoption of water treatment solutions.

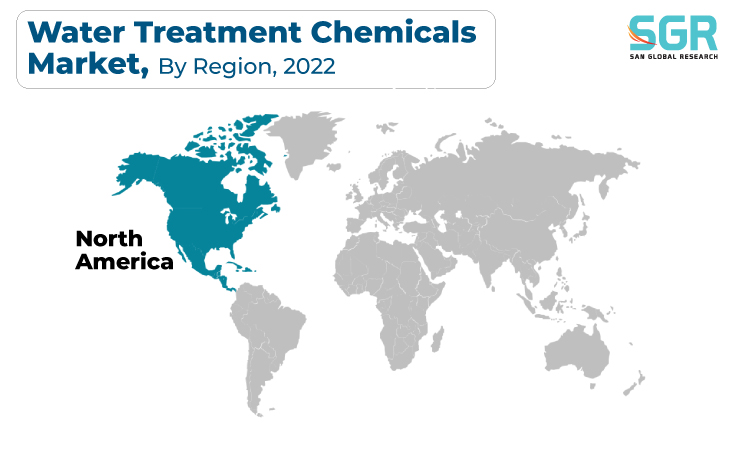

Regional Outlook

North America has emerged as leading market for water treatment chemicals market in 2022. Several key factors are driving the North America water treatment chemicals market such as North America, particularly the United States and Canada, has well-established and stringent environmental regulations governing water quality. Regulatory bodies such as the Environmental Protection Agency (EPA) in the U.S. set standards for water treatment, pushing industries to invest in advanced water treatment chemicals. Compliance with these regulations is a primary driver for the increased adoption of water treatment solutions.

The region hosts a diverse range of industries, including manufacturing, energy, and petrochemicals, which are inherently water-intensive. As these industries expand, the demand for water treatment chemicals, including corrosion inhibitors, scale inhibitors, and biocides, is on the rise. Protection of critical infrastructure and compliance with environmental standards are driving the need for advanced water treatment solutions.

Thus, the growth of the water treatment chemicals market in North America is fueled by a combination of regulatory pressures, industrial expansion, a focus on sustainability, and advancements in water treatment technologies. As the region continues to address water quality challenges and invest in infrastructure, the demand for water treatment chemicals is expected to remain robust.

Water Treatment Chemicals Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 302.88 Billion |

| Forecast in 2030 | USD 596.67 Billion |

| CAGR | CAGR of 9.0% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product, By End Use, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | BASF SE, Schlumberger Limited, Halliburton, Nalco Champion, Clariant, Dow Inc., Baker Hughes, Chevron Phillips Chemical Company, AkzoNobel and Kemira Oyj among Others |

Global Water Treatment Chemicals Market, Report Segmentation

Water Treatment Chemicals Market, By Product

- Scale & Corrosion Inhibitor

- pH & Adjuster & Softener,

- Defoamer & Defoaming Agent

- Biocide & Disinfectant

- Coagulants & Flocculants

Water Treatment Chemicals Market, By End Use

- Pulp & Paper

- Food & Beverage,

- Municipal

- Mining & Mineral Processing

- Chemical Manufacturing

- Oil & Gas

- Power

Water Treatment Chemicals Market, By Application

- Effluent Water Treatment

- Boiler

- Cooling

- Water Desalination,

- Raw Water Treatment

Water Treatment Chemicals Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355