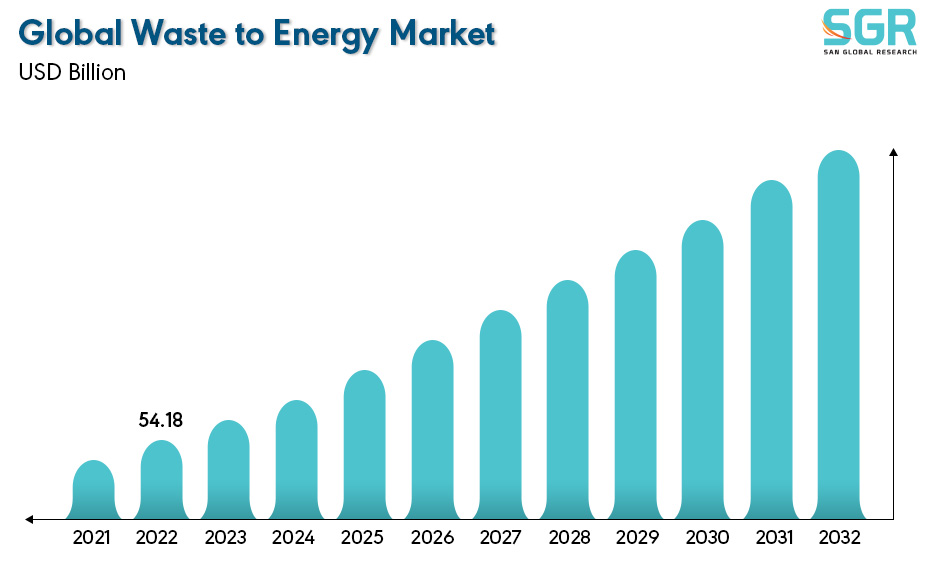

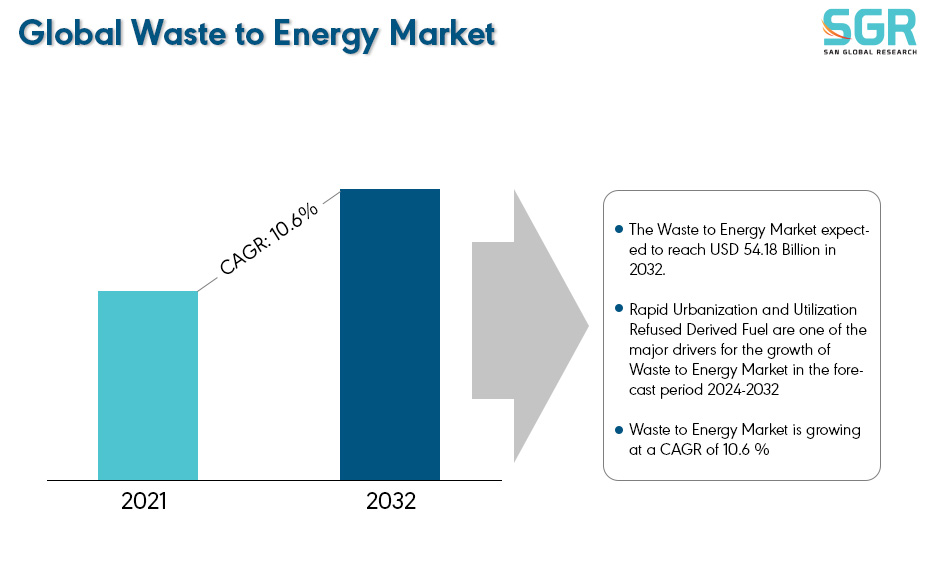

Waste to Energy Market is estimated to be worth USD 54.18 Billion in 2022 and is projected to grow at a CAGR of 10.6 % between 2024 to 2032.

The study has considered the base year as 2023, which estimates the market size of market and the forecast period is 2024 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Enterprise Type, by Insurance Type, by End User and by region/country.

- The Waste to Energy Market expected to reach USD 54.18 Billion in 2032.

- Rapid Urbanization and Utilization Refused Derived Fuel are one of the major drivers for the growth of Waste to Energy Market in the forecast period 2024-2032

- Waste to Energy Market is growing at a CAGR of 10.6 %

Region wise Comparison:

After reviewing the data shown below, it can be determined that the North American region dominates the Online Insurance Market for the following reasons.

The North American Waste-to-Energy market mirrors the impact of urbanization, which correlates with a surge in waste generation due to heightened population density and consumption patterns. As cities expand and populations concentrate in urban areas, there is a notable increase in the volume of generated waste. This underscores the imperative for robust waste management systems to ensure cleanliness and public health. At the same time, the increased interest in technological developments in the waste-to-energy sector creates considerable prospects for plant holders. These advancements contribute to enhancing efficiency and sustainability in energy production. In particular, thermal-based waste-to-energy conversion is anticipated to dominate the market, propelled by advancements in incineration technologies that concurrently improve environmental sustainability and energy production efficiency.

The European region plays a dynamic and crucial role in the waste-to-energy project in Belgrade. This project is a key contributor to the waste-to-energy market, offering sustainable waste management solutions. It focuses on recovering energy from non-recyclable waste through processes like incineration, simultaneously reducing greenhouse gas emissions by substituting fossil fuels with renewable energy sources. This initiative is instrumental in treating residual waste, preventing illegal dumping, and addressing the climate impact of waste in accordance with strict emission regulations set by the EU. The incorporation of technological advancements in waste-to-energy facilities ensures clean and safe operations. The energy output generated contributes to the supply of electricity and heat to millions of inhabitants, underscoring the project's vital role in advancing environmental sustainability and ensuring energy security in the region.

The rapid development of cities and industrialization in the Asia-Pacific area have led to a significant increase in municipal solid waste (MSW) generation. Globally, cities generate around 1.3 billion tons of solid garbage each year, with that figure expected to climb to 2.2 billion tons by 2025. Many cities' waste management practices include disposing of MSW in open dumps and overloaded landfills, which endangers public health and the environment. However, this garbage situation provides an opportunity for electricity generation using garbage to electricity (WtE) technology.

Latin America is experiencing significant expansion due to the closure of obsolete landfills. The implementation of contemporary waste management systems, such as recycling facilities and sanitary landfills, is critical in addressing environmental concerns and improving public health. The Monterrey landfill project in Mexico serves as an example of a successful waste-to-energy operation in the region. This project received support from the Kyoto Protocol's Clean Development Mechanism (CDM), resulting in private sector investment and significant revenue from carbon credit sales. The project's success highlights waste-to-energy projects' ability to address waste management concerns and create income through carbon credits and other revenue streams.

The growing awareness of the circular economy in Africa is positively influencing the expansion of the waste-to-energy market in the region. Embracing the circular economy as a development strategy can empower African nations to foster economic growth within the boundaries of environmental sustainability. Currently, the waste sector stands out as a primary focus for circular practices in African countries. However, it represents just one facet of the broader circular economy spectrum. The circular economy has the potential to address the needs of a burgeoning urban population through climate-smart agriculture, ensuring enhanced food security. It also promotes the development of resilient and environmentally friendly infrastructure to bridge the housing gap, provides low-carbon and efficient energy solutions to combat energy poverty, encourages resource-efficient industries for sustainable and low-carbon industrialization, and creates more robust livelihood opportunities.

Australia is emerging as a promising region for the waste to energy market. Refuse-Derived Fuel (RDF), sourced from a blend of commercial and household waste, stands as a viable substitute for conventional fossil fuels such as coal and oil in power plants. This enables the generation of electricity, heat, and various other forms of energy. The utilization of RDF as a renewable energy source plays a pivotal role in mitigating global carbon emissions and facilitating the shift towards a more sustainable energy future.

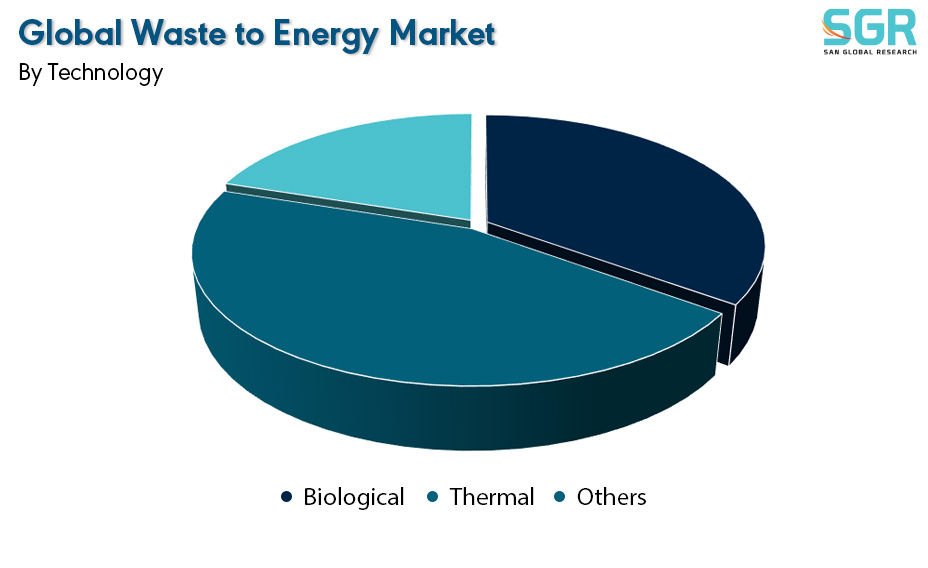

By Technology

Based on the Technology, the Waste to Energy Market is bifurcated into Biological, Thermal and Others– where Thermal based technology is dominating and ahead in terms of share.

The technology-based segment is at the forefront of the waste-to-energy market, primarily owing to its efficiency in energy generation, support from regulations that promote sustainable practices, increasing market demand for cleaner energy solutions, and ongoing technological advancements. Waste-to-energy technologies not only enhance process efficiency but also align with regulatory policies that encourage proper waste disposal and energy production, meeting the rising global demand for sustainable energy sources. Furthermore, continuous research and development efforts are dedicated to reducing costs and improving the effectiveness of waste-to-energy processes, fostering innovation within the industry. Overall, the technology-based segment distinguishes itself in the waste-to-energy market by effectively addressing environmental concerns, adhering to regulatory requirements, and meeting the growing need for efficient and eco-friendly energy solutions.

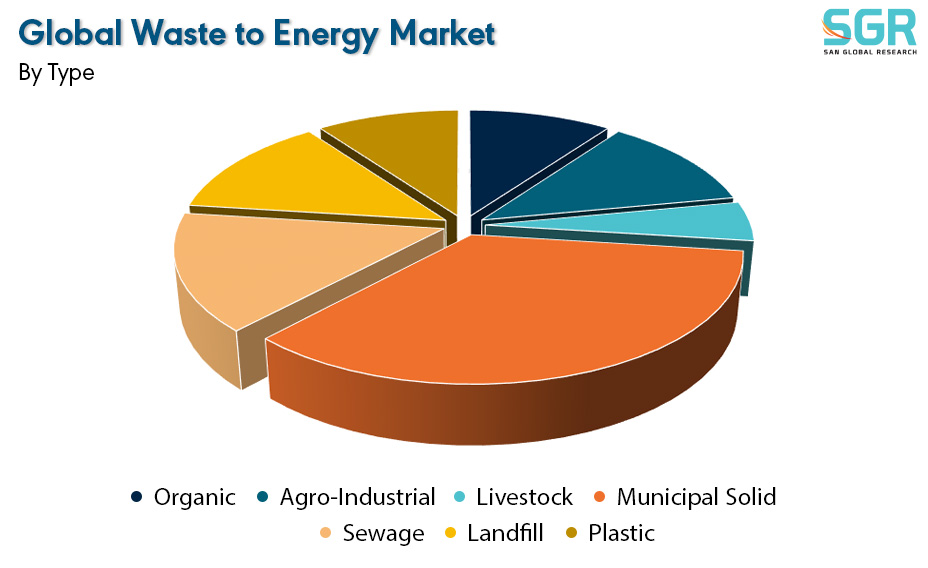

By Type

Based on the Type, the Waste to Energy Market is bifurcated into Organic, Agro-Industrial, Livestock, Municipal Solid, Sewage, Landfill and Plastic– where Municipal Solids based type is dominating and ahead in terms of share.

The segment based on technology types is at the forefront of the waste-to-energy market for several compelling reasons. Primarily, the market's segmentation, which categorizes technologies into types such as thermal technologies, biological technologies, and others, reveals that thermal technology has consistently held the largest market share, contributing significantly to overall revenue. The prevalent dominance of thermal technology in waste-to-energy processes establishes the type-based segment as a leader. Furthermore, the emphasis on thermal technology aligns with the escalating demand for energy-efficient solutions and cleaner energy sources, thereby propelling the growth of this segment within the waste-to-energy market.

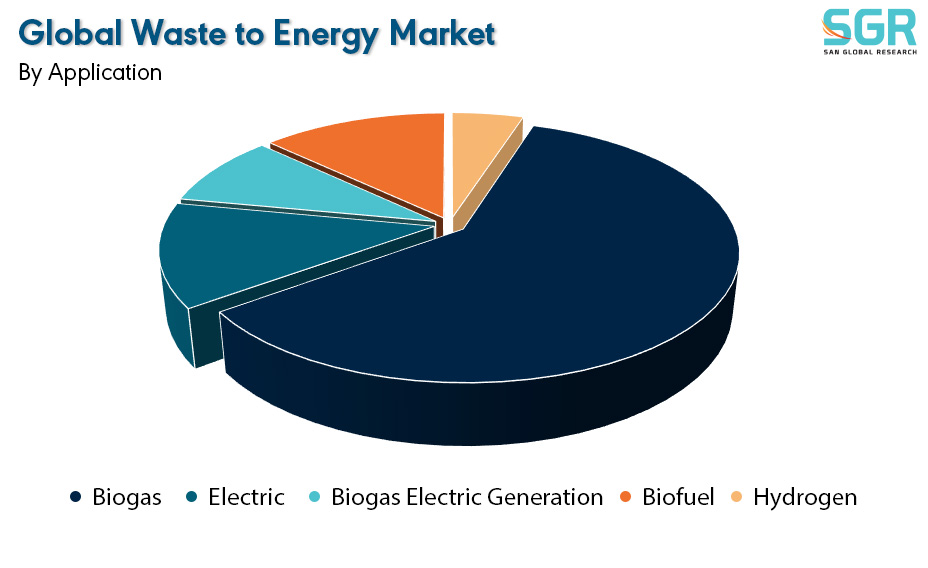

By Application

Based on the Application, the Waste to Energy Market is bifurcated into Biogas, Electric, Biogas Electric Generation, Biofuel, Hydrogen and Others– where Electric based type is dominating and ahead in terms of share.

The segment focusing on electricity generation holds a leading position in the waste-to-energy market, driven by several key factors. Within the waste-to-energy market, electricity generation has emerged as the dominant application, commanding a significant share and propelling overall market growth. This particular application contributes to nearly 60% of the market's total value, efficiently utilizing waste for electricity production. The increasing demand for applications related to electricity generation aligns with the global shift towards sustainable energy sources and the adoption of efficient waste management practices.

Key Players

• Suez

• Covanta Holding Corporation

• Veolia

• Xcel Energy Inc.

• China Everbright International Limited

Drivers

Rapid Urbanization

The waste-to-energy market experiences substantial growth propelled by rapid urbanization, driven by various key factors. Initially, the considerable surge in power consumption resulting from swift urbanization and industrialization places a strong focus on sourcing energy from renewable outlets such as waste. With the expansion of urban populations, there is a simultaneous rise in waste production, necessitating efficient waste management approaches. Waste-to-energy technologies emerge as a sustainable solution, transforming waste into energy, thereby diminishing the volume of waste destined for landfills and concurrently generating valuable energy resources.

Opportunity

Utilization of Refused Derived Fuel

The use of Refuse Derived Fuel (RDF) is a substantial growth opportunity for the waste-to-energy sector, driven by several key factors. RDF, derived from Municipal Solid Wastes (MSWs), proves to be an efficient energy source, especially in industries such as cement production, demonstrating its versatility and practicality. The transformation of RDF into pellets for diverse applications, including the power industry, underscores its potential in energy generation and supports sustainable waste management practices.

| Report Attribute | Details |

| Market Value in 2022 | 54.18 Billion |

| Forecast in 2032 | 149.0 Billion |

| CAGR | CAGR of 10.6% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Technology, By Type, By Application |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Suez • Covanta Holding Corporation • Veolia • Xcel Energy Inc. • China Everbright International Limited |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355