Report Overview

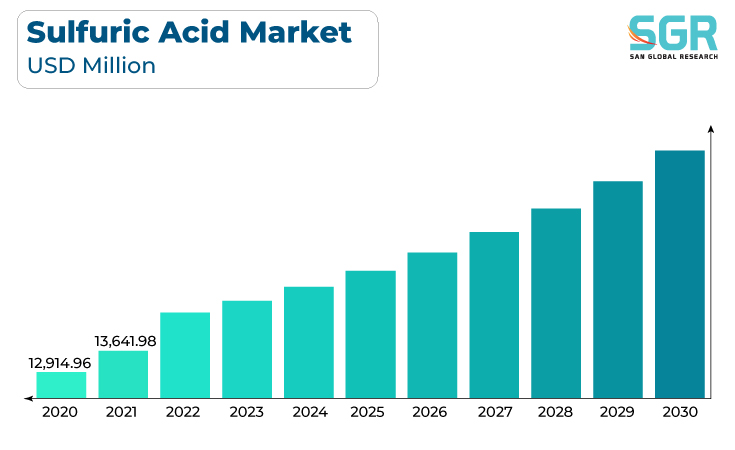

The sulfuric acid market was valued at 14,414.40 million in 2022 and expected to grow at CAGR of 5.5% over forecast period.

Sulfuric acid is a crucial component in the production of various chemicals, such as fertilizers (phosphoric acid and ammonium sulfate), detergents, dyes, and pigments. The growth of the chemical manufacturing industry directly affects the demand for sulfuric acid. Additionally, extensively in the mining and metallurgical processes, particularly in the extraction of metals like copper, nickel, and uranium. The expansion of mining and metal production activities drives the demand for sulfuric acid.

Furthermore, the automotive industry uses sulfuric acid in lead-acid batteries, which are still prevalent in many vehicles. As the automotive industry grows and as demand for electric vehicles with lithium-ion batteries continues to increase, the sulfuric acid market can see growth due to battery production.

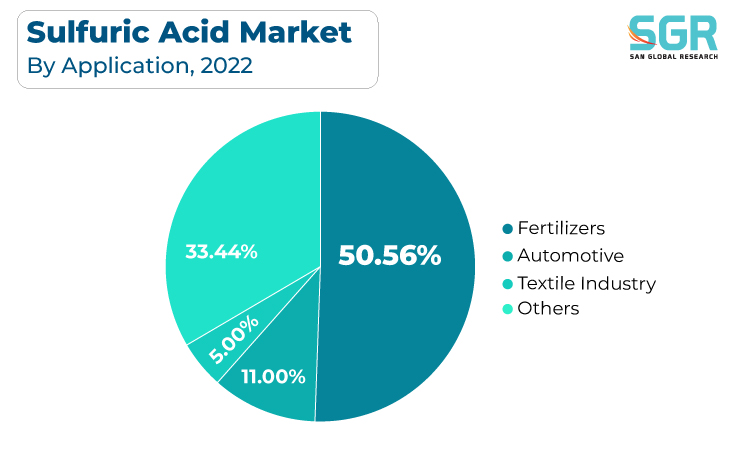

Application Outlook

Based on application, the sulfuric acid market has segmented into fertilizers, automotive, textile industry, and others. Fertilizers segment accounted for largest share in 2022. Sulfuric acid is used to manufacture phosphate fertilizers like superphosphate (single superphosphate and triple superphosphate) and ammonium phosphate. These fertilizers are essential for providing plants with the necessary phosphorus, a vital nutrient for plant growth. As global agricultural practices intensify to meet the rising demand for food and feed crops, the demand for phosphate fertilizers increases, consequently driving the demand for sulfuric acid.

Thus, the growth of the sulfuric acid market is closely tied to the demand for fertilizers, which are essential for modern agriculture. As the global population increases, and as agriculture strives to become more efficient and sustainable, the demand for fertilizers and, by extension, sulfuric acid, is expected to continue growing.

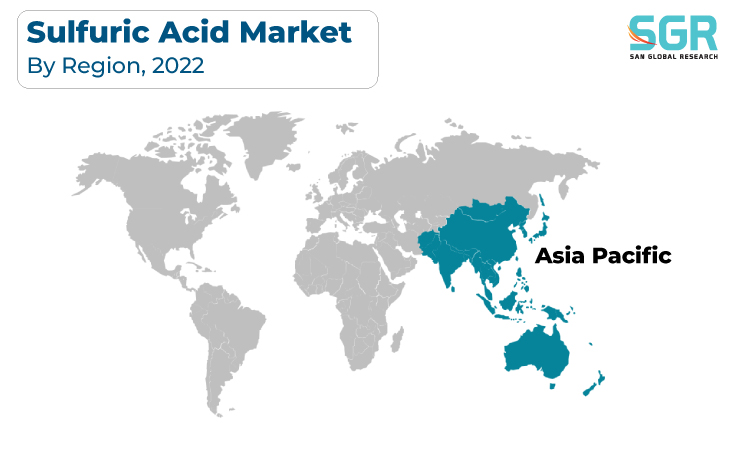

Regional Outlook

Asia-Pacific has emerged as leading market for sulfuric acid market in 2022. The Asia-Pacific region is home to some of the world's most populous countries, such as China and India, where agriculture is a primary sector of the economy. These countries have substantial agricultural activities that rely heavily on sulfuric acid for the production of fertilizers, especially phosphate-based fertilizers. As these nations seek to increase agricultural productivity to feed their growing populations, the demand for sulfuric acid for fertilizer manufacturing continues to rise.

Furthermore, major countries in the Asia-Pacific region are experiencing rapid industrialization and urbanization. This industrial growth fuels demand for sulfuric acid in various applications, including chemicals, mining, metallurgy, and wastewater treatment. Industries that require sulfuric acid are expanding to meet the needs of a burgeoning middle class and growing manufacturing sectors.

Hence, Asia-Pacific region's robust economic growth, industrialization, agricultural activities, and commitment to environmental sustainability are key drivers of the sulfuric acid market's growth. The diverse range of industries and applications that rely on sulfuric acid in the region ensures a steady and increasing demand for this essential chemical.

Sulfuric Acid Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 14,414.40 Million |

| Forecast in 2030 | USD 22,110.74 Million |

| CAGR | CAGR of 5.5% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Application, By Raw Material |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | Trident Limited, India, Boliden Group, Pursuit Industries Pvt., kakdiya chemicals, Avantor, INEOS, Bodal Chemicals Ltd., TIB Chemicals AG and Aarti Industries Ltd., among others |

Global Sulfuric Acid Market, Report Segmentation

Sulfuric Acid Market, By Raw Material

- Elemental Sulfur

- Pyrite Ore

- Base Metal Smelters

Sulfuric Acid Market, By Application

- Fertilizers

- Automotive

- Textile Industry

- Others

Sulfuric Acid Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355