Report Overview

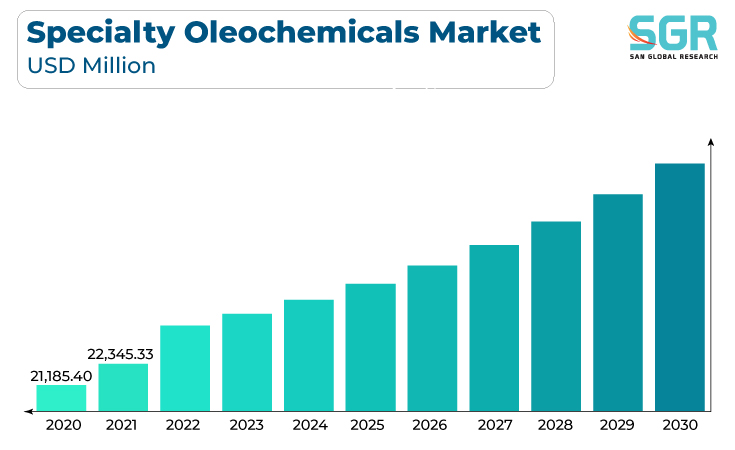

The specialty oleochemicals market was valued at 23,585.78 million in 2022 and expected to grow at CAGR of 6.0% over forecast period.

Increasing awareness and demand for environmentally friendly and sustainable products drive the use of specialty oleochemicals, which are derived from renewable resources and often offer eco-friendly alternatives to petrochemical-based products. Moreover, specialty oleochemicals, such as fatty acids and glycerol, are essential ingredients in the formulation of personal care and cosmetic products. The expanding beauty and personal care industry globally contribute to the demand for these oleochemicals.

In addition, the shift toward bio-based polymers and materials, driven by sustainability goals and regulatory pressures, fuels the demand for specialty oleochemicals as key feedstocks in the production of bioplastics and bio-based polymers.Specialty oleochemicals are integral to the production of biodegradable surfactants, which find applications in detergents and cleaning products. Increasing consumer awareness regarding the environmental impact of chemicals drives the demand for biodegradable alternatives.

Oleochemicals play a role in food processing and manufacturing, serving as emulsifiers, stabilizers, and texturizing agents. With the continuous growth of the food industry, the demand for specialty oleochemicals is on the rise.

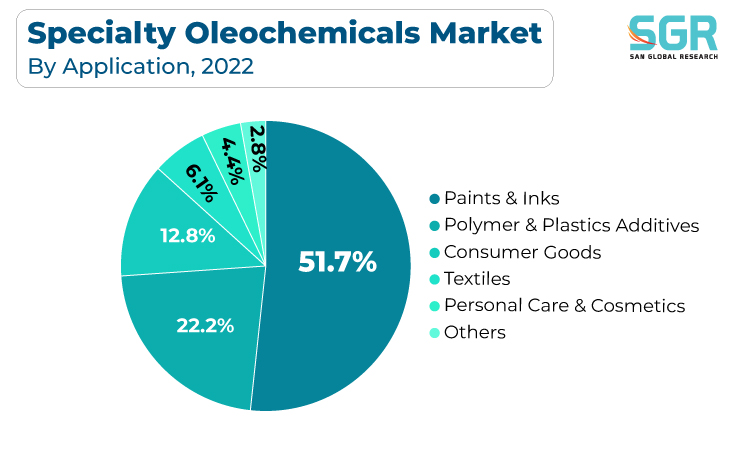

Application Outlook

Based on application, the specialty oleochemicalsmarketis segmented into paints & inks, polymer & plastics additives, consumer goods, textiles, personal care & cosmetics, others.Paints & inks segmentaccounted for largest share in 2022.As urbanization and infrastructure projects continue to rise globally, there is a growing demand for paints and coatings in construction. Specialty chemicals, such as high-performance polymers and additives, are crucial for formulating paints that offer durability, weather resistance, and aesthetic appeal, thereby driving growth in the specialty chemicals market.

Moreover, the automotive industry is a major consumer of specialty chemicals. High-performance coatings, adhesives, and sealants are essential for automotive manufacturing. The increasing production of vehicles globally contributes significantly to the demand for specialty chemicals.

Thus, the paints and inks industry's growth are closely tied to advancements in specialty chemicals, which enable the formulation of coatings that meet evolving performance, environmental, and aesthetic requirements.

Regional Outlook

Asia-Pacifichas emerged as leading market for specialty oleochemicals market in 2022. Several key factors are driving the Asia-Pacific Specialty oleochemicals market such as urbanization and infrastructure projects continue to rise globally, there is a growing demand for paints and coatings in construction. Specialty chemicals, such as high-performance polymers and additives, are crucial for formulating paints that offer durability, weather resistance, and aesthetic appeal, thereby driving growth in the specialty chemicals market.

In addition, the automotive sector is a major consumer of specialty oleochemicals, and the Asia-Pacific region has witnessed substantial growth in automotive production and sales. The demand for coatings that provide corrosion resistance, durability, and aesthetic appeal has surged in tandem with the expansion of the automotive industry.

The rise of digital printing technology in the packaging, textile, and signage industries has led to an increased demand for specialty inks. Specialty chemicals are crucial for formulating digital inks that provide vibrant colors, adhesion, and durability.

Specialty Oleochemicals Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD23,585.78 Million |

| Forecast in 2030 | USD37,337.96 Million |

| CAGR | CAGR of 6.0% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Wilmar International Limited, IOI Corporation Berhad, KLK Oleo, Emery Oleochemicals, Croda International plc, Evonik Industries AG, BASF SE, Cargill, Incorporated, P&G Chemicals, Oleon NV, Musim Mas Group, Godrej Industries Limitedamong Others |

Specialty Oleochemicals Market, Report Segmentation

Specialty Oleochemicals Market, By Product

- Specialty Esters

- Fatty Acid Methyl Esters

Specialty Oleochemicals Market, By Application

- Paints & Inks

- Polymer & Plastics Additives

Specialty Oleochemicals Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355